Newest Insights about Ownership

While operational involvement in a family business has declined in some cases, there's been an increase in active ownership roles collaborating with external executives. For a family business to continue to be its best, the owners must also be at their best. Developing a owner strategy routine can help foster the best of a business legacy from generation to generation.

All Insights about Ownership

The ownership advantage

OperationsWhile operational involvement in a family business has declined in some cases, there's been an...

Why conscious ownership is critical for future-focused family enterprises.

OwnershipIn order to transition their enterprises beyond generations, family businesses must embrace what is...

The unique governance challenge of mixed culture families

GovernanceGlobalisation has seen the world become a global village. In this global village, a new complexity...

Successful on and off the stock exchange – governance practices in family firms

GovernanceThe stock exchange and family firms – two irreconcilable terms upon first glance. Going public...

Made in Germany: five best practices of German family offices

JurisdictionsWhat made family offices in Germany successful and how are they resetting for the new normal? We...

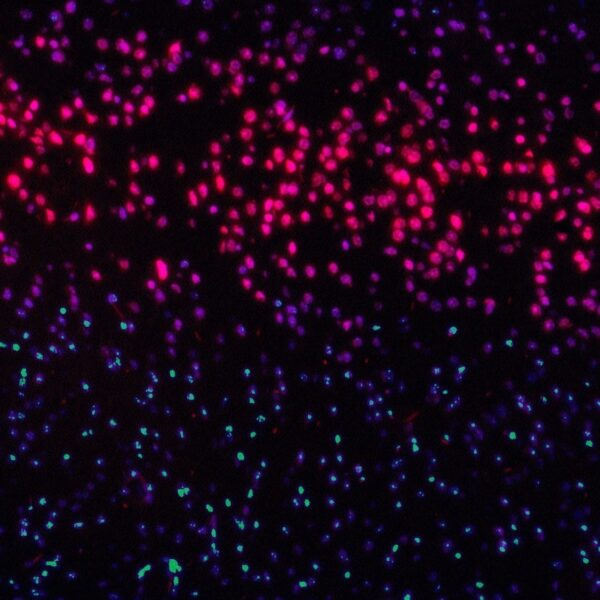

Genomics and epigenetics: new tools for promoting family legacy

GenomicsImagine a seemingly healthy 35-year-old family member assumes the CEO position of a core global...

Women on board: enhancing leadership in family firms

OwnershipOver the past 5-10 years, there has been an increasing focus on the importance of women in...

How psychodynamics can drive better decision making in family businesses

OwnershipA changing set of realities, norms and values are underway in the face of an accelerating climate...

Why emotional intelligence is the key to intergenerational succession

Next GenerationIntergenerational succession represents a significant challenge to family business. Though a common...

Using life stages to professionalise the family business

OwnershipMany businesses with humble beginnings have been able to weather change and grow into empires....

How Asian family businesses respond to four global challenges

JurisdictionsAlthough certain business challenges are universal to family offices across the globe, the way in...

5 lessons for family offices from HBO's Succession

CommunicationHBO’s mega-series Succession follows the decaying empire of a dysfunctional media family - a...

Legacy and succession planning trends and advice

Next GenerationOnly 3% of family-owned businesses survive until the fourth generation and beyond. There appears to...