Private Wealth Systems

Private Wealth Systems’ award-winning innovation has transformed consolidated investment reporting for global family offices and UHNWIs.

UHNWIs, family offices and private banks rely on Private Wealth Systems to transform how they aggregate investment data, validate data accuracy, report on multi-asset class portfolio performance and evolve complex investment portfolios over time.

Have a question regarding Private Wealth Systems?

Contact Private Wealth Systems directly, or opt for discretion with our private exploration option and take advantage of a free 20-minute consultation with the Simple team to thoroughly explore your service requirements.

Simple ("Promoter") is not a current client of a Private Wealth Systems. Promoter will receive cash compensation for referrals to Private Wealth Systems. Click here to read the full disclaimer.

Simple ("Promoter") is not a current client of a Private Wealth Systems. Promoter will receive cash compensation for referrals to Private Wealth Systems. Click here to read the full disclaimer.

What sets Private Wealth Systems apart?

"Our platform has proven to deliver a level of data accuracy, speed, and personalization that remains unmatched. We have eliminated the friction of information for complex investment portfolios."

Craig Pearson

Product

Get an overview of what this software does.

Main tasks

- Accounting

- Consolidated reporting

- Portfolio management

- Data aggregation

- Risk management

- Impact/ESG reporting

Top features

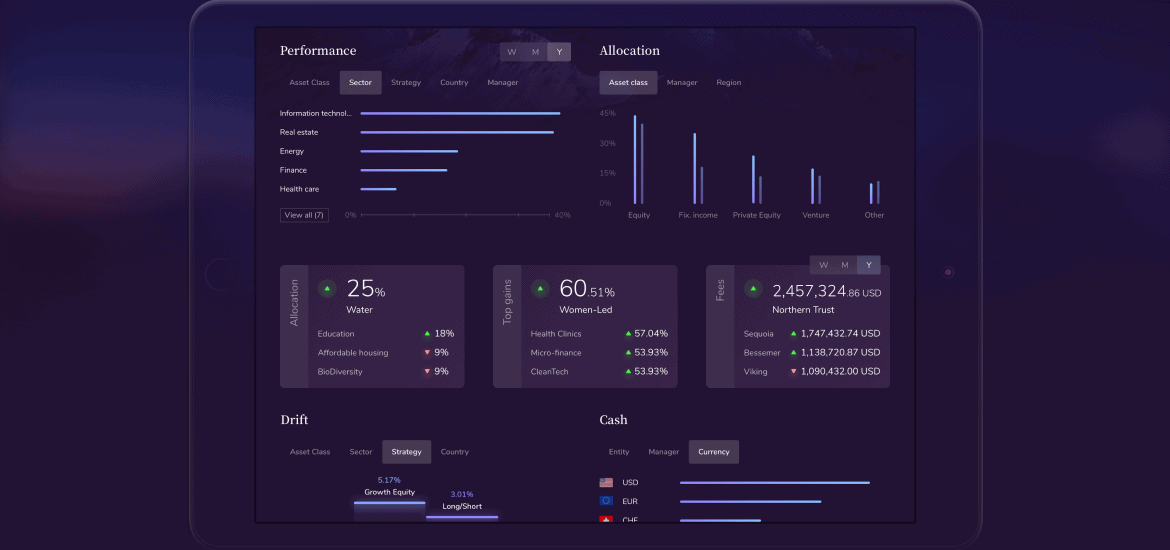

- Data aggregation – our direct bank feeds captures 3x more data than other providers.

- Data validation – we perform daily reconciliation and correct bank data errors.

- Performance calculation – in side by side comparisons with other systems we have proven double-digit accuracy in performance and analytics.

- Custom reporting – our award winning data model empowers each user to personalize their data any way they want.

- Digital portal – wealth owners can customize their own mobile dashboards to have total power over their wealth.

Assets supported

- Private equity

- Bankable assets

- Real estate

- Rare collectibles (e.g. luxury cars, boats, high-value jewellery)

Compliance

- GDPR

Whitelabel

- Yes

Type Of Software

- SaaS

- Serviced software

Security

- Multi factor authentication

- Application scanning

- Network scanning

- Encryption at-rest and in-transit

- Data leakage prevention (DLP)

- User level access controls

- Annual audits by global banks

Ecosystem

- Microsoft

Integrations

- API that can connect with any third party system including CRM, bill pay

Mobile App

- Yes

Type of data

- Transaction level data

Accuracy

- We run our transaction and position ledger in parallel to each custodian and manager daily to ensure the industry’s highest level of data accuracy.

- We correct bank errors, and enrich the data across pricing, accounting, and corporate actions.

- We have successfully passed transaction level audits by top auditing firms.

- In side by side comparisons we have shown that other systems generate double-digit errors.

Custodians

- 400+

Time to new custodian

- 4 weeks

Multi-currency

- Users can set multiple base currencies.

- We can separate holding level p&l from currency p&l based on transaction data.

Cost structure

- Flat fee

Average cost p.a.

- $60k full version

- $25k light version

Key Company Info

Have a look at the company, clients and references to learn whether this is a match for you.

Employees

- 11-50

Founded

- 2014

Ownership

- Owned by management

- Clients are also owners

Incorporated

- United States of America

Locations

- Charlotte

- New York

- Salt Lake City

Top markets

- Switzerland

- United States of America

- United Kingdom

- Saudi Arabia

- Australia

Total AUM

- $200 billion

Avg. AUM per client

- $223 million

Focus

- Single-family offices

Serves also

- Multi-family offices

- Banks

- Individual wealth owners

- Fund managers

Number

- 650+ UHNWIs and family offices

Goldman Sachs

JP Morgan

KPMG

E&Y

What client's say about Private Wealth System?

"Thank you for getting back to me so quickly. That is exactly what we received on the investor statements - our current reporting system is off by 230 bps. Good to know you can get it right."

Support & Services

Learn what support and services you can expect

Support options

General contact mail or phone

Dedicated contact.

Pricing of support

Free support

Onboarding

Client go-live ranges from 30 days to 3 months.

Customisation

Each user can customize data sets.

Grouping any combinations of entities, accounts, and holdings together.

Report structures, view, analyze, and report anyway you want.

Classifications

Bespoke development

Building new reports and calculations. For example we built partnership accounting to support the IRS Lender Rule.

Added services

Data entry

Software development

Private Wealth Systems Reviews

Sign in to read or leave reviews for Private Wealth Systems

Gain insight from real user feedback to guide your decisions or share your experiences and help shape the future of Private Wealth Systems.

Read ReviewsLeave Review

Wondering how Private Wealth Systems compares to other companies?

- Private Wealth Systems vs Orca

- Private Wealth Systems vs Etops

- Private Wealth Systems vs Copia Wealth Studios

- Private Wealth Systems vs Northern Trust Family Office Technology

- Private Wealth Systems vs Abbove

- Private Wealth Systems vs AgilLink

- Private Wealth Systems vs FundCount

- Private Wealth Systems vs Assure Wealth

- Private Wealth Systems vs SS&C Family Office Services

- Private Wealth Systems vs Global Asset+ by Lombard Odier

- Private Wealth Systems vs Sharpfin

- Private Wealth Systems vs Nasdaq for Family Offices

- Private Wealth Systems vs BILL

- Private Wealth Systems vs Asora

- Private Wealth Systems vs Ethic

- Private Wealth Systems vs Arch

- Private Wealth Systems vs Centtrip

- Private Wealth Systems vs KeeSystem

- Private Wealth Systems vs Landytech

- Private Wealth Systems vs Aleta

- Private Wealth Systems vs Venn by Two Sigma

- Private Wealth Systems vs eXeer by Point Group

- Private Wealth Systems vs Fincite

- Private Wealth Systems vs SoftLedger

- Private Wealth Systems vs Performativ

- Private Wealth Systems vs Giving Place, Inc.

- Private Wealth Systems vs WIZE by TeamWork

- Private Wealth Systems vs Masttro

- Private Wealth Systems vs Sensiba

- Private Wealth Systems vs Asset Vantage

- Private Wealth Systems vs Black Diamond Wealth Platform

- Private Wealth Systems vs SEI – Archway Platform

- Private Wealth Systems vs Altoo

- Private Wealth Systems vs Swimbird

- Private Wealth Systems vs Canopy

- Private Wealth Systems vs Hemonto

- Private Wealth Systems vs PandaConnect

- Private Wealth Systems vs Black Diamond

- Private Wealth Systems vs Addepar

- Private Wealth Systems vs Eton Solutions

We also reviewed some other Consolidated Reporting Providers

FAQs

FAQs about Private Wealth Systems