Soros Fund Management: Creating an Open Society

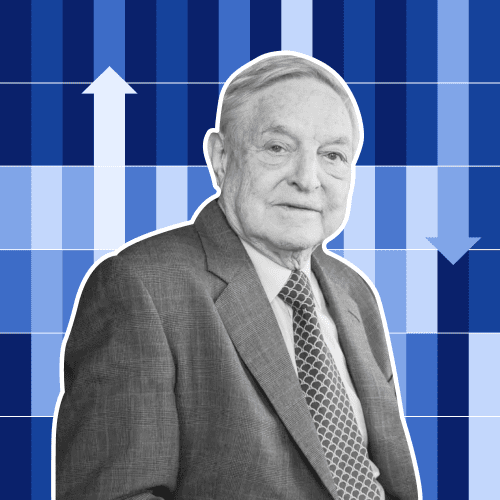

Endeavouring to change the world can draw much criticism and conspiracy theorists. George Soros, whose hedge fund netted $1B profit in one day, openly admits that improving the world is more difficult than making money. This insight explores his humble beginnings, the transition of Soros Fund Management into a family office, and philanthropic feats.

Soros Fund Management, founded in 1970 by George Soros, manages over $30 billion in assets. It is headquartered in New York City and is the primary advisor for the Quantum Group of Funds, a set of privately owned hedge funds based in London.

About the Company

Soros Fund Management

- Location United States

- Type Family business

- Founded 1970

Becoming George Soros

Born in Hungary in 1930, George Soros survived the Nazi invasion of 1944. But his life was forever marked by the injustices of ethnic and political discrimination in his teens. Being Jewish, his family managed to escape by securing fake identity documents and changing their surname to Soros from Schwartz.

Soros moved to the UK to study at the London School of Economics in 1947. He took up economics, though his greatest ambition was to become a famous philosopher. The work of Karl Popper greatly influenced his thinking, which later on helped him develop the theory of reflexivity, and inspired him to write over 15 books on his investment philosophy and politics.

The man who broke the Bank of England

After graduating in 1952 with a Bachelor of Science in Philosophy, he worked various jobs in the financial industry. He moved to the United States four years later, where he would eventually amass his fortune. In 1969, he started his own hedge fund, Soros Fund Management. But his rise to success began when he partnered with Jim Rogers to co-found the Quantum Fund in 1973.

At a time when traditional investing methods concentrated on individual stocks or bonds, the Quantum Fund employed a revolutionary way of investing. Using Soros’ investment philosophy centred on reflexivity, the fund took a global macro strategy that concentrated on predicting changes in global financial markets.

This approach paid off. Soros and Rogers achieved great success, but not without controversy. In 1992, Soros earned the title of “the Man who broke the Bank of England” when they took a massive bet against the British pound, which earned a profit of over $1 billion in one day.

Transition to family office

Today, his Soros Fund Management oversees The Quantum Group of Funds investments, with offices in London, New York, Curaçao and the Cayman Islands. In 2011, the firm transitioned to become a family office to avoid registering with the SEC and comply with the reporting requirements under the Dodd-Frank Reform Act. In the same year, they returned all external funds to investors.

Currently, the fund oversees the Soros family’s wealth. It also serves as the primary asset manager for the Open Society Foundations – the largest private funder of independent organisations that promote justice, democratic governance, and human rights. In addition to his accomplishments in the financial sector, George Soros is well-known for his philanthropic efforts.

Work in philanthropy

Soros started his philanthropic work in 1979 when he founded the Open Society Foundations. One of his first acts was providing scholarships to Black South Africans who were struggling under an apartheid regime. In the 80s, following the fall of the Berlin Wall, he established the Central European University as a hub to nurture critical thinking, which was an unfamiliar concept for most universities in the former Communist bloc. To date, Soros has already given $32 billion through Open Society and has indicated that his fortune will go to his family’s philanthropic efforts.

Succession

Earlier this year, Soros handed over the reins of the $25 Billion foundation to his son, Alex Soros. Alex is the second-youngest of George’s five children and is the only family member on the investment committee for Soros Fund Management. A true millennial, the 37-year-old keeps a Twitter account and updates it occasionally. Like his father, Alex leans left and does not shy away from expressing his political views and opinions.

Picking up where his father left off, Alex takes the criticism for their political and philanthropic activities in stride. The Open Society Foundation recently closed its offices in Hungary due to pressure from the country’s prime minister, Viktor Orban. However, on his Twitter profile, Alex clarifies that the foundation is not leaving Europe. In his latest opinion piece for POLICOEurope, he admits that “looking at the current state of Europe, however, it’s clear that our foundation needs to change — just as it did after the fall of the Berlin Wall.”