Insights

Quick-jump to Topic category

Family Offices in Q2 2025: A Crossroads of Policy, Tech, and Global Strategy

NewsFamily offices aren’t standing still, and Q2 2025 made that clear. While headlines may focus elsewhere, beneath the surface, these firms are navigating major shifts in regulation, digital infrastructure, generational leadership, and global strategy. From AI tools moving into core workflows to wealth migration accelerating ahead of policy changes, the second quarter revealed a sector quietly but decisively repositioning itself. In this piece, we explore what’s changing, what it signals, and what forward-thinking offices are doing about it.

Family office perspectives on defencetech

Venture CapitalAs global conflicts intensify, family offices grapple with the ethical dilemma of investing in defencetech. In this article, Kjartan Rist discusses the shift driven by increased defence spending and the rise of dual-use technologies.

Integrating healthcare into security preparedness for family offices

Risk managementPrincipals within family offices often face demanding schedules. Consequently, health emergencies can pose a much bigger threat to their well-being compared to the risk of violent encounters, especially when we think about overall security. That is why the head-of-state healthcare model should be a consideration for any family office intent on protecting and preserving the […]

Hong Kong: The strategic gateway for Asian family offices

JurisdictionsIn this article, Simple Expert Marco Mesina discusses Hong Kong's recent tax updates to attract family offices. In addition, he explains how Hong Kong’s proximity to China and flexible wealth structuring make it ideal for UHNW families seeking privacy and long-term security.

Singapore: Territorial taxation and the rise of the family office

JurisdictionsIn this article, Simple Expert Marco Mesina explores how Singapore combines low-tax efficiency, legal certainty, and world-class infrastructure to offer an ideal base for international families to manage, preserve, and grow their wealth.

Quiet catalysts: How family offices are reshaping impact investing

ImpactIn this article, Simple Expert Oliver Yorke discusses the increasingly influential role that family offices are playing in impact investing.

How Interest Rate Uncertainty Is Reshaping Family Office Strategy

InvestmentsSimple explores how policy divergence, inflation shifts, and rate uncertainty are reshaping family office investment strategies in 2025, from fixed income to liquidity planning and cross-border resilience.

Stablecoins: A primer for family offices

Digital AssetsIn this article, Simple Expert Kjartan Rist discusses stablecoins, their growing role in traditional finance and how family offices can benefit.

Strategic partnerships with family offices

InvestmentsFamily offices, private wealth management advisory entities established by ultra-high-net-worth individuals or families, are reshaping the landscape of private investing. These firms manage complex portfolios, oversee intergenerational wealth, and increasingly pursue direct investments that align with specific values or long-term strategic objectives. Unlike institutional investors constrained by rigid mandates, family offices value flexibility, discretion, and […]

The silent crisis crippling private investment in family offices

InvestmentsThis article discusses the actual cost of this data bottleneck and suggests how family offices can leverage AI-powered platforms to streamline their private investment operations.

How to implement sovereign wealth fund strategies in your family office

WealthTechThis article examines why adopting sovereign wealth fund (SWF) strategies is vital for family offices and how digital platforms can help facilitate their implementation.

Building the tech stack your advisory firm actually needs

TechnologyIn this article, Christoffer Long, Alwy's CEO, breaks down why "more tech" doesn't necessarily mean better outcomes. And explains why client experience should be the focus when building an effective and efficient tech stack.

Building Smarter Private Portfolios: 6 Key Alternative Asset Classes for Family Offices

InvestmentsThis article, in collaboration with Clockwork, shares insights about six alternative investments for family offices looking to diversify their private portfolios.

Family office software: Forging successful partnerships

WealthTechTo gain valuable insights about successful partnerships between software providers and family offices, Simple interviewed Max Wattel, Managing Director of Elysys Financial Systems.

Why an ownership strategy is your family’s secret weapon

GovernanceIn this article, Simple Expert Anne-Sofie van den Born Rehfeld explains why an ownership strategy builds trust and understanding, and often, why an experienced advisor is needed to guide sensitive conversations and create a sustainable strategy.

73% of family offices demand integrated investment software

WealthTechThis article explores how emerging full-stack digital family office and accounting solutions, such as the Hatcher+ FAAST Family Office Suite, power the next generation of family office management.

Fractional CFO for family offices: Strategic financial leadership without the overhead

OperationsDiscover how a fractional CFO empowers family offices. We detail how outsourced CFOs provide flexible, strategic financial leadership without the full-time burden.

From learning to action

GovernanceIn this article, Simple Expert Lise Møller discusses why advisors play a crucial role in helping families translate their education into action.

Seamless finance: Automating integration for family offices

TechnologyWhile AI often dominates discussions, a less glamorous, but equally critical, challenge looms for family offices: data integration. Imagine spending hours manually transferring transaction data from multiple banks into spreadsheets, only to risk errors and reporting delays. This is the reality for many family offices today. In this article, Simple speaks to the PetakSys team to explore potential solutions.

Should family offices be providing philanthropy advice?

PhilanthropyShould advisers feel a moral responsibility to discuss philanthropy? In this article, Simple Expert Juliet Valdinger answers this question and discusses how philanthropy can strengthen client relationships and deepen advisers' moral standing as they provide clients with meaningful ways to engage their wealth.

AI and family offices: A new era of venture capital

Venture CapitalFamily offices are increasingly drawn to venture capital as a way to diversify their portfolios and access high-growth opportunities. However, many face operational challenges due to small teams and limited internal resources. Unlike institutional investors with dedicated analysts, family offices often rely on a few individuals to handle research, evaluation, and due diligence. Limited staff […]

Overcome succession planning challenges with a family office

Succession planningSuccession planning is one of those topics that often gets kicked down the road – until suddenly, it can’t be. Whether it’s the retirement of a founding family member, an unexpected illness, or a generational shift in business priorities, the absence of a clear succession plan can destabilise even the most successful family enterprises. With […]

Three pitfalls to avoid in managing family office households and properties

Real EstateThis article explores three common pitfalls for family offices in household and estate management—and the tools that can help avoid them.

Your clients’ values aren’t fluff. They’re important

PhilanthropyWhat are values? Values are guiding principles that influence an individual’s or group’s behaviour, decisions, sense of purpose and what they consider acceptable or important. And why do advisers who work for HNW and UHNW clients need to pay attention to their clients’ values? If they don’t already recognise why this is important and proactively […]

Female fintech founder: Simplifying wealth, one family office at a time

FinTechImagine managing billions of dollars with spreadsheets. That was the reality Simran Kang faced as an accountant at PwC Canada and at her multi-family office before deciding to create a solution tailored to the challenge. This article notes the key moments of MyFO’s genesis and how the platform is addressing long-standing operational pain points for […]

Future-proof your family office: LegalTech for succession planning

Succession planningThis article explores how LegalTech can bring clarity and continuity to succession planning. It outlines common challenges and demonstrates how the right type of technology can offer a practical, future-ready foundation for leadership transitions.

The UHNWI of 2025: more complex, more global, more connected

Next GenerationWhat does it really mean to be ultra-wealthy in 2025? It’s no longer just about having $30 million—it’s about building an ecosystem to manage complexity across borders, generations and asset classes. Here’s how the world’s wealthiest are evolving.

The role of a family office consultant

StrategyAs wealth management grows increasingly complex, the demand for specialised family office consultants has surged. These experts bridge the gap between legacy wealth preservation and modern financial challenges, offering tailored solutions for tax optimisation, generational transitions, and investment strategy.

The hidden costs of not adopting modern tech

WealthTechIn this article, Ken Gamskjaer, CEO & Co-founder of Aleta, offers valuable insights into the hidden costs of not embracing modern technology.

Key considerations for second citizenship options for US and EU HNW families

JurisdictionsHistorically, US citizens have been more inclined to pursue second citizenship due to citizenship-based taxation, which taxes US citizens worldwide, regardless of their residency. However, this concern now extends to European citizens as countries like France and Spain consider similar policies. Consequently, a portfolio consisting solely of US and EU passports offers limited diversification. So, […]

Family offices in Q1 2025: The quiet revolution you might have missed

NewsFamily offices may seem quiet from the outside, but Q1 2025 revealed a sector in transformation. From AI adoption and cybersecurity risks to the generational power shift and Asia’s regulatory chessboard, the changes are profound. In this piece, we unpack the trends shaping the future of private wealth—and why ignoring them could mean falling behind.

Single Family Offices: Are families becoming the silent partners?

Family governanceIn this article, Simple Expert Lise Moller highlights the importance of education and open communication. She offers practical steps for how families and executives can use these elements to align the single-family office with their intended purpose.

AI agents: The next frontier in family office digitization

TechnologyThe digitisation of family offices is inevitable, yet adoption has been cautious. While AI presents clear benefits—automation, efficiency, and enhanced decision-making—many family offices remain hesitant due to security risks, regulatory concerns, and cultural resistance. However, with AI-powered agents capable of autonomously managing investment analysis, risk assessments, and operational workflows, the potential to transform family office […]

Family office operations: Balancing ambitions with constraints

OperationsIn this article, Simple Expert Emmanuel de Truchis explores the challenges family offices face in balancing ambitious transformation goals with resource limitations. He also offers strategies for achieving high performance and successful execution in operations.

Should your family office allocate to venture capital?

Venture CapitalIn this article, Simple Expert Ben Ehrlich walks us through the steps family offices should consider when investing in venture capital.

Family office payments: Solving pain points and shaping the future

WealthTechThe Würms family, with deep-rooted expertise in European and Latin American private banking and multi-family office management, founded Bourgeois Bohème (BOBO) in 2018. They partnered with Gregor Anton Piëch, whose family legacy in the automotive industry instilled a relentless pursuit of innovation. Together, they assembled a team of finance and technology leaders, including CEO Hugo […]

Understanding How to Engage Family Offices as a Capital Source

CommunicationFamily offices represent a powerful yet often overlooked source of capital for mission-driven entrepreneurs. With a long-term investment horizon and a focus on alignment over urgency, they require a different approach than traditional investors.

The AI adoption paradox in family offices

TechnologyThis article explores why family offices are hesitant to adopt AI and identifies the factors that may drive greater adoption within the sector.

From founder to family office

WealthTechDiscover how first-generation a family office founder can leverage modern software to maintain control, streamline operations, and build a lasting legacy. Explore key challenges, founder traits, and the tech solutions shaping the future of wealth management.

Why family offices are seeking outside real estate resources

Real EstateIn this article, Simple Expert Seth Chadwell discusses the rise of outsourced real estate investment management, the key drivers behind the trend, and how to bridge the gap between real estate and succession planning.

Health and longevity strategies for UHNWIs and family offices

Health & LongevityThis article highlights the unique health challenges that affluent families face and suggests concierge medical solutions that family offices can adopt to support them.

Next-gen engagement: The power of brand in the Family Charter

Next GenerationIn this article, Simple Expert India Wooldridge articulates why embedding a brand strategy within the Family Charter helps to drive purpose and alignment. She also discusses how the brand creation process enables family offices to connect with and engage the next generation.

Preserving generational wealth: Four family office strategies

Next GenerationWealth often fades by the third generation, but family offices are changing that. Discover four key strategies—diversification, legal structures, education, and philanthropy—that help preserve generational wealth for the long term.

Four steps to spending down with purpose

ImpactIn this article, Simple Expert Sharon Schneider presents a four-step approach to spending down with purpose for family offices for prioritising impactful capital deployment over mere wealth preservation.

Family Office Market Size: How many family offices are there?

BenchmarkingEveryone seems to have a different number for how many family offices exist worldwide. Estimates range from 3,500 to 20,000, depending on who you ask. Deloitte’s 2024 report pegs the number at 8,030, growing at 4.8% annually to reach 10,720 by 2030. The Problem with Family Office Estimates Here’s the thing: family offices are private, […]

LegalTech for family offices

WealthTechExplore the rise of Family Office 3.0, where innovation meets tradition, cybersecurity is paramount, and legaltech plays a vital role in ensuring seamless operations.

Family offices allocate more funds as private equity rebounds

Private EquityPrivate markets have grown significantly in recent years, with family offices increasingly expanding their portfolios in the space. In this article, we discuss the shifting dynamics with Ken Gamskjaer, the CEO of Aleta, and how family offices can leverage technology to simplify the challenges of investing in private markets.

Simplifying State and Federal Reporting for Family Offices

ComplianceThis article explores the latest developments and how family offices can leverage technology to simplify compliance with BOI and Annual Report filings across all 50 American states.

Family Trusts Explained

LegalDiscover how family trusts and why they're crucial for wealth preservation and succession planning. Learn about trust structures, tax implications, and expert insights.

Wealth Management Software for Family Offices

TechnologySince launching the family office software and technology report in 2020, Simple has tracked a surge in service providers offering wealth management solutions. This article explores the background, covers the current landscape, and notes the benefits of wealth management software for family offices.

What Is Primal Branding®? Why Does It Matter To Family Offices?

Brand & designIn this introductory insight, Simple Expert Patrick Hanlon explains the seven elements of primal branding and the projected outcomes of employing it in family offices.

Portfolio management software for family offices

SoftwareThis article examines the benefits, challenges, and top portfolio management software solutions tailored for family offices.

Building a brand will give you a competitive edge in direct investing

Brand & designSimple Expert India Wooldridge explains how family offices can gain a competitive edge in direct investing by building a values-driven brand to enhance deal flow, trust, and long-term success.

Family meetings: Where to start and what to include

Family governanceSimple Expert Charles Eckhart outlines actionable strategies for initiating and sustaining family meetings gatherings, emphasising how expert facilitators can help in tackling complex topics.

Bridging the knowledge gap in venture capital

Venture CapitalIn this article, Simple Expert Kjartan Rist discusses how family offices can bridge the knowledge gaps in venture capital for future success.

Citizenship by Investment for Family Offices

InvestmentsIn this insight, we delve into why Citizen by Investment programmes are relevant to family offices, how they can be integrated into a family office strategy, and the critical considerations when engaging service providers.

Why are family offices risk magnets?

RiskSimple Expert Edward Marshall shares three actionable strategies for turning your family office from a risk magnet to a resilient organisation.

Rethinking Philanthropy: The Role of Wealth Advisors and Technology in Meeting Modern Donor Expectations

PhilanthropyPaul Lussow (TIFIN Give) shares insights on how technology is transforming philanthropy, the shifting role of trusted advisors, and how the platform is pioneering multi-generational engagement in giving.

Family Foundations Losing Their Shine

PhilanthropyLearn why family foundations often fall short of their promises. Simple Expert Sharon Schneider shares insights into shifting family dynamics, the rise of autonomy, and the evolving role of philanthropy across generations.

Proactive healthcare: Concierge medicine for family offices

Health & LongevityIn a conversation with Todd Scheuer of Private Medical, we explore how personalized healthcare can transform client relationships for family offices.

Impartial reporting and automated back-office solutions for family offices

Automative technologyIn a recent interview with Simple, Ethan Bonar of CFO Family discussed his software-agnostic, client-centric approach to delivering efficient automated reporting that adds value to family offices.

5 trends in luxury lifestyle and travel management for family offices

Concierge ServicesFrom the icy landscapes of Antarctica to sipping champagne on the edge of space, the boundaries of luxury travel are expanding. Maison Benjamin, led by Benjamin Vaschetti, explores five key trends redefining this space for family offices.

A data-driven liquidity solution for family offices

Banking ProvidersThis insight with Ray Denis from Sandbox Wealth explores how HNWIs can use their data to access liquidity using a family office software solution.

Venture Capital: A long-term game for patient investors

Venture CapitalFamily offices are increasingly attracted to venture capital due to the promise of high returns, innovation and diversification. Unlike traditional asset classes, VC offers an opportunity to support and benefit from the growth of early-stage companies, often in disruptive fields. According to InvestEurope, European venture funds have consistently delivered over 20% annual returns over the […]

EtonGPT™ and the future of AI in family offices

TechnologyThe introduction of generative AI solutions like EtonGPT™ offers many possibilities, pushing the boundaries of family office operations. In this article, we discuss the current use of AI in family offices with Eton Solutions' CIO, Murali Nadarajah, and explore the technology's impact on the industry's future.

Women controlling wealth

ImpactThere’s a great wealth transfer I don’t see anyone talking about. I know we’ve been hearing a lot about the great wealth transfer: The trillions of dollars being shifted into new hands as the baby boomer generation passes their wealth down to their children, but another great wealth transfer is taking place. This one, into […]

The future of alternative investments for family offices

InvestmentsIn this insight, Simple chats with Cory Shea and Alex Goodman, the founders of Clockwork, about the trends, the challenges and how technology is transforming the future of alternative investments for family offices.

How Masttro defines data aggregation for family offices

WealthTechThrough a series of interviews with co-founder Domingo Viesca and CEO Padman Perumal, Simple uncovers Masstro's successful strategies for data aggregation for family offices.

Four trends that will drive the family office revolution

TrendsDiscover the four key trends driving the family office evolution: women controlling wealth, a shift towards Donor-Advised Funds, declining interest in extreme wealth, and the rise of values-driven, integrated living.

Delegate or outsource: Key considerations for single family offices

OperationsIn this insight, Panchee Advisory helps single-family offices assess when to delegate in-house versus outsourcing to third parties.

Navigating venture capital communication with family offices

Venture CapitalLearn how to navigate venture capital communication with family offices to build successful, long-term partnerships. In this insight, Kjartan Rist provides actionable guidelines for effectively collaborating with family offices in the venture capital landscape, driving impactful investments and innovation.

Excel vs. Efficiency: Three challenges family offices face with private market data

WealthTechFamily offices, particularly those managing private market investments, have embraced the idea that their decisions should be driven by hard data and not just by intuition. However, using tools like Excel to manage their data often adds a significant layer of complexity. This insight highlights three challenges family offices typically face when managing private investments.

Family Office marketing: Key considerations for providers

StrategySimple's Digital Marketing Manager, Bryan Smith, explains how service providers can leverage marketing strategies and service design to engage effectively with family offices leveraging iterative strategies, trust-building approaches, and leveraging online communities to deliver value.

Family offices and the rise of generative AI

Venture CapitalGenerative AI is revolutionising industries, capturing family offices' interest as a promising investment. In this insight, Simple Expert Kjartan Rist discusses the evolution of the new technology, invest strategies, and how, with long-term capital, family offices stand to benefit greatly from this transformative technology.

Do you need a family office?

GovernanceSimple Expert Erik Solum shares insights on the importance of establishing a family office for affluent families in Australia and beyond - highlighting key benefits, including financial management, succession planning, and governance. He covers practical tips on creating a strategic plan to help preserve and grow family wealth across generations.

A path to a paperless family office

FinTechFamily offices often rely on outdated, paper-based methods. This insight discusses how transitioning to digital solutions simplifies complex wealth structures, enhances collaboration, and provides real-time data.

Bridging the gap to the next-gen for family offices

Next GenerationMillennials are set to inherit their parents' wealth and approach wealth management differently. Ken Gamskjaer, CEO and Co-founder at Aleta, shares insights with Simple on bridging generational gaps in family offices.

Simplify and scale giving for family offices

PhilanthropyThis article explores the challenges family offices face in managing philanthropy. Learn how modern philanthropy technology can reduce administrative burdens and create a holistic, fulfilling giving experience.

Tech-driven strategies for RIAs: Gaining an edge in family office services

SoftwareRegistered Investment Advisors (RIAs) play a vital role in serving HNWI and family offices. However, standing out in this competitive arena is no small feat. This article highlights how RIAs can outperform their competitors by adopting technology that caters to the unique needs of family offices.

Across generations: The family office attitude to venture capital

Venture CapitalDiscover how family offices are shifting from traditional wealth preservation to venture capital investments, driven by generational differences and a growing focus on sustainability and impact investing with Simple Expert Kjartan Rist.

The rise of family offices in Asia: A new era of wealth management

JurisdictionsThe wealth management landscape is undergoing a significant transformation in Asia, driven by the rapid rise of family offices. As ultra-high-net-worth individuals (UHNWIs) and families seek more tailored and sophisticated ways to manage their wealth, family offices are the preferred solution. This trend is reshaping the financial services industry in the region, offering a comprehensive, personalised approach to wealth management that extends beyond traditional banking and investment services.

Family office software: The build vs buy dilemma

DigitalAs family offices embrace digital transformation, the obvious switch from manual processes to a digital platform may be simple, but it’s a bit more tricky to determine which is better: to build from scratch or to buy off the shelf. In this insight, Simple sits down for a conversation with the team at PetakSys to unpack the answers.

Family vision comes before planning in wealth management

GovernanceHow can financial advisors know the vision of their clients if clients don’t know it themselves? In this insight, Simple Expert, founder and CEO of TFM, shares how to standardise and implement the family vision, benefiting advisors and enhancing client relationships and retention.

An introduction to investment opportunities in Boston’s tech and innovation ecosystem

JurisdictionsDiscover how Boston's vibrant tech ecosystem offers lucrative investment opportunities for family offices, particularly in biotech, AI, and sustainable energy sectors.

Simplifying ESG consolidation and reporting for family offices

SoftwareThis article explores the dynamics of ESG considerations for family offices, the pitfalls to avoid, and outlines a three-step process, enabled by KeeSystem's software solution KeeSense, to help them get started.

Private asset tracking with family office software

Private EquityDiscover the benefits of modern family office software for tracking private assets. Learn how technology like Asora enhances efficiency, automates data collection, consolidates information, and provides real-time insights, enabling family offices to focus on strategic investment decisions.

Are family offices really competitors to venture capital firms?

InvestmentsIn this insight, Simple Expert Kjartan Risk explains that family offices and venture capital (VC) firms are not competitors but potential partners. Kjartan emphasises that family offices can benefit from VC expertise and networks, enhancing their investment strategies and contributing to societal advancements. By recognising their complementary strengths, family offices and VC firms can achieve synergistic growth and success in the venture investment landscape.

Concierge Healthcare and Telemedicine Services for Family Offices

Health & LongevityJoin us as we delve into the dynamic world of concierge healthcare and telemedicine specialist services for family offices, exploring how this fusion is redefining the standards of care for high-net-worth families.

Middle East Family Offices: A Moment In Time

OperationsIn this insight, Simple Expert Besarta Dani shares why now is a unique time of opportunity for the Middle East and why family offices should take advantage.

3 Key Considerations for Developing an ESG Strategy for Family Office

ImpactInvest in a better tomorrow by harnessing the transformative potential of Environmental, Social, and Governance (ESG) investment strategies. Join us as we explore three key considerations for developing a family office ESG strategy: aligning with core values, integrating ESG criteria into investment processes, and establishing robust reporting for sustainable, high-impact growth.

Technology’s role in modernising family office fiduciary services

StrategyIn our latest insight, we unpack how key innovations in technology are transforming fiduciary services by enhancing transparency, accuracy, security, and efficiency.

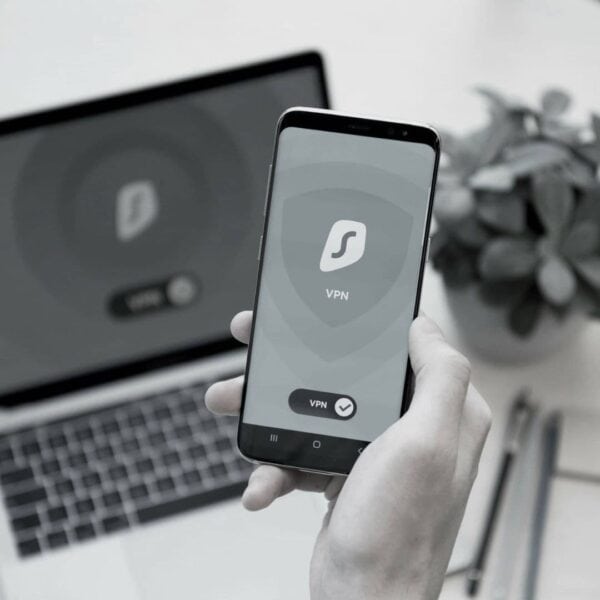

3 foundational cybersecurity recommendations for family offices

DigitalWith high stakes risks, robust cybersecurity measures are no longer optional but imperative. By understanding their unique vulnerabilities, family offices can implement effective strategies to reduce cyber-attack risk notably.

The modern approach to wealth management

FinTechTracking Altoo's journey as a Swiss-based fintech, this insight highlights the primary factors driving the change. It discusses the importance of cybersecurity and explores the concept of a paperless family office which digitisation can deliver.

Highlights from the Milken Global Conference: Passion, Purpose, and Profit

ImpactSimple’s Strategic Content Partnerships Lead, Jimmy Otterdijks, reflects on the Milken Global Conference - as well as takeaways for next-generation family offices.

Instant Insights: AI-powered Family Office Accounting and Reporting Software

DigitalThis article delves into the challenges of family office accounting and performance reporting and demonstrates how software solutions such as AV EDGE use AI and natural language processing to help family offices get instant insights and make informed financial decisions.

The benefits of modern concierge pet care and management services in family offices

Concierge ServicesAs younger generations of wealth owners are more likely to have pets, we explore how modern family office concierge services are revolutionising pet care and management using cutting-edge solutions and strategies.

Holistic security: The four pillars for family offices

RiskSimple Expert Kate Bright, the Founder and CEO of Umbra, introduces the four-pillar approach to address the security needs of modern family office clients.

The shift from direct investments to partner funds

Venture CapitalIn this article, Simple Expert, Kjartan Rist explains why family offices are moving away from direct investments to partner funds when participating in venture capital.

Wealth Management Solutions: Elevating Multi-Family Office Expectations

WealthTechSimple sits down with Crispin Rolt, the COO of Performativ, to discuss how a Multi-Family Office should expect more from their portfolio management systems.

Eternal quest: Humanity’s age-old pursuit of health and longevity

Health & LongevityA look at how ultra-high net worth families are navigating the future of healthcare through customised medical solutions, advanced health technology, and strategic investments with Simple Expert Tim Daum.

The regenerative model for family businesses

ImpactLearn how family businesses can thrive through generations by adopting a regenerative model with Simple Expert, Julien Lescs.

Family offices: The innovation challenge

InnovationThe intersection of family offices and innovation is both complex and crucial, framing a narrative of potential, challenges, and societal impact. Simple Expert Kjartan Rist explores the growing influence of family offices in the global market and their potential to shape the future of innovation across various industries.

Continuous improvement for boards: 7 best practices for family offices

GovernanceSimple Expert Christian Schiede offers insightful advice on leadership transitions in family businesses and seven best practices for family office boards to maintain operational excellence.

How Masttro’s family office origins continue to drive their vision

SoftwareWealthTech platform Masttro was established over 14 years ago, but even their family office users likely don’t know that the company’s two founders, Domingo Viesca and Javier M Gutierrez, previously worked together at a family office.

Bermuda’s approach to privacy and asset protection for family offices

InsightsDiscover the legal framework for privacy and asset protection in Bermuda. Learn how family offices can benefit from its robust laws and international compliance.

Why family offices shouldn’t fear the future

ForesightIn this insight, Simple Expert Toby Usnik discusses why family offices should embrace artificial intelligence (AI) as a strategic ally, not a threat. In the midst of their fear of the unknown, he proposes a different perspective—one of optimism, opportunity, and the potential for extraordinary growth.

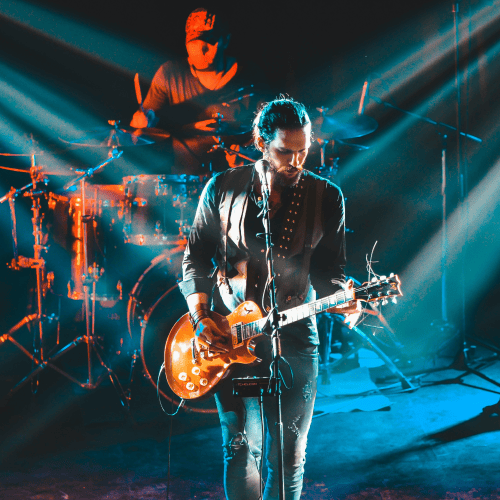

Challenges and opportunities for family offices serving musicians

InsightsFamily offices, traditionally managing wealth for high-net-worth individuals, increasingly find themselves navigating this vibrant yet complex sector, especially when serving musicians and artists. This article explores the challenges and opportunities for family offices serving musicians

The impact of Florida’s tax landscape on family offices

JurisdictionsKnown for its favourable tax regime, Florida offers significant advantages that can impact wealth preservation, growth, and succession planning. This article explores how Florida's tax environment affects family offices, highlighting key benefits and strategic considerations.

5 Emerging WealthTech innovations for family offices

WealthTechExplore the top five WealthTech innovations revolutionising wealth management for family offices. From AI-driven analytics to secure blockchain transactions, discover how these technologies can enhance your investment strategy and safeguard your assets.

A glimpse into five of India’s largest family offices

JurisdictionsExplore the dynamics of wealth management in India through an in-depth look at five of the most influential family offices, understanding their strategies, influence, and impact on the Indian and global financial landscape.

How US sporting celebrities manage their family offices

StrategyThe transition from high-earning athletes to savvy wealth managers is a critical journey, often mired in complexities unique to their career paths. This article delves into the nuances of how US sporting celebrities structure their family offices, ensuring financial growth, legal compliance, and effective brand management.

Celebrities who have embraced family offices

TrendsIn the intricate world of wealth management, the concept of a family office has become a pivotal strategy for many, including some of the most renowned celebrities. Discover how renowned celebrities like Oprah, Richard Branson, and Jay-Z are navigating the complexities of wealth management through their family offices.

Exploring digital family office solutions for UHNWIs

DigitalWhile it can be the ultimate goal, not all ultra-high net worth individuals (UHNWIs) are ready to set up a fully staffed traditional family office. This insight explores the growing number of digital family offices and the tailored solutions they offer to UHNWIs.

Health insurance considerations for family office leaders

Health & LongevityDiscover the most effective global health insurance options for ultra-high-net-worth individuals (UHNWIs) and family offices. This article provides valuable insights and best practices for family office CEOs and COOs seeking comprehensive global health insurance coverage.

Empowering impact: Channeling philanthropic capital into for-profit initiatives

PhilanthropyDonor Advised Funds (DAFs) have emerged as a strategic tool in this new philanthropic landscape, offering a flexible and innovative approach to stewarding capital for social and financial returns. In this insight, Simple Expert Maggie Spicer discusses the benefits of channelling philanthropic capital into for-profit initiatives through DAFs.

Trustee-beneficiary dynamics: How to handle the headwinds of digital assets

Digital AssetsFamily office trustees face a new challenge as the younger generations increasingly seek exposure to digital assets and cryptocurrencies. This insight shares a comprehensive checklist of ten guidelines to help them in their approach to this rapidly evolving sector.

Unleashing family office insights with Power BI

SoftwareFamily offices prepare reports on a regular basis so families can make informed decisions about their assets. The problem with traditional reporting is that it is rigid, data-heavy, and needs more context. This insight explores how Power BI reporting solutions can meet the specific needs of family offices and their clients.

How family offices can access AI through venture capital

Venture CapitalSimple Expert Kjartan Rist discusses how family offices can leverage venture capital to position themselves at the forefront of the AI revolution.

How Nordic family office WealthTech differs from the rest

WealthTechThis insight delves into conversations with four leading WealthTech providers in the Nordic region to explore what sets them apart from their competitors and what the future holds for the family office industry in the area.

Digital assets: A brief update for family offices

Digital AssetsThis insight delves into what family offices need to know about digital assets and offers valuable resources to explore.

Davos 2024: Four focus areas for family offices to consider

Impact StrategyThis insight focuses on what family offices can learn from this year's Davos discussions to position themselves for the future.

Building lasting family legacies: The role of values and social fitness

GovernanceSimple Expert, Alex Kirby breaks down social fitness, the importance of values and advises how family offices can integrate these services.

Holistic wealth management software for the modern family office

SoftwareNot so long ago, family offices could manage their investments on Excel spreadsheets. However, the complexity of assets necessitates a more holistic approach. Simple discussed this need to digitise with Radomir Mastalerz, the CEO of WealthArc.

How family offices can maximise their impact in 2024 and beyond

ImpactLearn how modern family offices can enhance their impact by integrating sustainable investments, innovative philanthropy, and intergenerational collaboration.

A synergistic future for family offices and venture capital

Venture CapitalThe investment landscape has changed due to the global economic downturn and evolving market dynamics, particularly in the way family offices and venture capital sectors interact. Simple expert, Kjartan Rist, shares his insights on the synergies between these two worlds.

Why estate management is a key aspect of holistic wealth management

Real EstateProviding estate management support can ease some of the family's most pressing frustrations and increase their overall well-being. This insight discusses holistic wealth management and effective estate management. It also suggests how family offices can bridge the gap between financial and non-financial aspects of wealth management by partnering with specialised service providers.

The benefits of global health insurance for family offices

Health & LongevityFamily offices face many challenges with traditional health insurance. This insight explores the unique challenges that family offices face with health insurance and how the right partner can help streamline the complex healthcare needs of their clients.

Family Offices in Australia

JurisdictionsAustralia's relatively secretive family offices have been experiencing significant growth over the past decade. This insight lists at some of the country's most prominent ones.

The importance of trustee succession in wealth transfer planning

Next GenerationWhether choosing individual or corporate trustees, learn how trustee succession planning with a focus on competency, continuity, and managing complexity is essential for preserving and passing on family assets across generations.

Bill pay software for family offices

SoftwareWriting, mailing, and processing paper checks can be time-consuming. Worst of all, checks can get lost in the mail or even stolen. Not only are they vulnerable to fraud, but there is also a high risk of adding an extra zero or misplacing a comma. This article explores the benefits of using bill payment software for family offices to mitigate risks and simplify accounting processes.

Corporate Transparency Act and BOI reporting for family offices

OperationsExplore the impact of the Corporate Transparency Act on family offices. Learn key definitions, historical context, and compliance requirements as this landmark legislation ushers in a new era of accountability and transparency.

An introduction to family office security

Cyber SecurityFrom cyber threats to physical asset protection, learn how family offices can mitigate risks through in-house measures and collaborations with expert service providers.

Exploring the rise of family office health insurance providers

Health & LongevityFamily offices are increasingly turning towards focused health insurance provider to better manage the health needs of their clients. This insight dives into the options available for high-net-worth individuals and families and explores the type of services available to family offices.

New family office technology: The flourishing tech ecosystem for family offices

DigitalOver the last five years, Simple's annual family office software review found that the number of service providers continues to rise. This insight explores growth drivers, legacy players, new innovators, and offers guidance on partnering with software providers for family offices.

Harmonising wealth and purpose: Why embark on an impact optimisation journey?

ImpactThere are fundamental shifts afoot in the realm of high finance. Simple Expert, Rory Tews addresses this shift and the implications for wealth owners into the future.

The largest family offices in the UAE

JurisdictionsFrom a desert landscape to a thriving metropolis in just a few decades, the UAE has transformed into a land of opportunities for family offices. Our latest insight explores the UAE's family office landscape, discusses current trends, and highlights well-established family offices in the region.

What family offices should know about alternative data aggregation

DigitalFamily offices struggle with managing assets across different locations and institutions. This article focuses on data aggregation challenges for family offices and how software can help streamline the process.

What family offices should know about portfolio management systems

InvestmentsPortfolio management is a crucial but time-consuming task for family offices. This article discusses its significance and explores how software can improve efficiency and reduce workload so family offices have more time to focus on their investment strategy and vision.

Strengthening family office cybersecurity: Key considerations for family offices looking to protect themselves against cyber threats

Cyber SecurityMany family offices tend to underinvest in cybersecurity. Yet, hackers are becoming increasingly sophisticated, posing potential financial loss and damage to their reputations. This article stresses the significance of cybersecurity for family offices and suggests ways to enhance it.

Want to try venture investing? It isn’t as easy as you might think

Venture CapitalVenture investing might seem like a straightforward way of achieving bumper returns. But there is more to it than some family offices realise, demanding the right balance of skills, experience, and resources.

CRM for family offices: The next generation of family office communication

Cyber SecurityIn family office management, the role of Customer Relationship Management (CRM) software has evolved significantly. Traditional CRM systems have paved the way for a new breed of software tailored specifically for family offices. This insight explores how next-gen CRM solutions go beyond simple contact management, transforming how family offices manage relationships, harness data, and optimise operational efficiency.

Lifestyle concierge services for family offices

Luxury & LifestyleAs the world evolves, so do the expectations of high-net-worth individuals and affluent families. To meet these changing demands, family office concierge services are elevating their game. Our insight focuses on family offices' lifestyle and concierge services and how they have expanded to keep up with the times.

Family capital and governance: Navigating wealth beyond rich lists

GovernanceWhile they might seem innocuous, 'rich lists' tend to be quite limited in gauging wealth. When it comes to good governance, family offices should rather look at the concept of family capital, a broader concept encompassing family well-being, decisions, knowledge, and health. By questioning the reliance on numbers, advisors will encourage a comprehensive view of wealth that includes family dynamics and governance in wealth management.

How family offices can evaluate their internal operations using industry benchmarked KPIs

SoftwareMany family offices struggle with their data management processes making it hard to make timely investment decisions. However, by implementing a KPI assessment tool that assists in identifying areas for improvement, family offices can stay ahead of the curve and safeguard their wealth.

Family office compensation: The complexities and considerations affecting staff salaries

OperationsAs the family office sector matures, staffing discussions continue to take centre stage. Deciding on staff compensation and salaries is complex and nuanced, amplified by a lack of industry benchmarks. Dynamics of single and multi-family setups, investment attributes, and investor roles further complicate the matter. Here, we explore the various aspects of family office compensation, breaking it down into four key sections.

Family office jobs: An introduction to key roles and career paths

OperationsGiven the private nature of the industry, there is a lack of standard job descriptions for family offices and along with managing family wealth, staff can also find themselves involved in everything from philanthropy to lifestyle and concierge services. In this insight, we explore the common roles you can find in a family office, as well as an overview of compensation and career resources.

Venture philanthropy for family offices

ImpactThis insight delves into how family offices can utilise venture philanthropy to align investments with philanthropic goals and positively impact society. By implementing traditional venture capital principles, they can invest in projects that empower communities and maximise social impact.

Family offices in Hong Kong: Understanding the factors driving growth

JurisdictionsDue to its advantageous location, robust financial infrastructure, and favourable economic policies, Hong Kong is championing the cause of the family office industry. With its continuous efforts, here is a look at how Hong Kong could quickly become a top spot for family offices looking to expand their wealth in the Asia-Pacific region.

Introduction to outsourcing for family offices

OperationsFrom accessing specialised expertise to improving efficiency and reducing costs, outsourcing offers numerous benefits to family offices. Read our latest insight to learn more about the functions they outsource, the benefits and drawbacks, and key considerations for a successful outsourcing experience.

The common IT challenges for family offices and how an IT partner can assist

Cyber SecurityAs family offices become more digitally-minded, the more vulnerable they become to digital attacks. This piece explores the ways in which family offices are exposed to cyber threats and some of the common challenges they face in the digital world, as well as how they can overcome them.

Why more family offices are going public: Examining the advantages and trends

Brand & designAs younger generations join family offices, there is a trend towards increased public presence and direct investing. Reasons include attracting clients, building credibility, networking, access to deals, and philanthropy.

Harnessing the potential of AI: Transforming family office operations for optimal efficiency

DigitalArtificial intelligence (AI) has the potential to transform family offices by automating tasks, optimising portfolio management, and enhancing risk management. While human expertise remains essential, integrating AI can propel family offices into a new era of success.

How digitalisation and automation affect family office compliance costs

InsightsEvery management company will recognise the constant pressure to comply with regulations. And while this pressure is significant, oftentimes the financial and non-financial costs associated with compliance can be underestimated. This article outlines the true cost of compliance in wealth management, the factors that contribute to compliance costs, and the role of digitalisation and automation in reducing compliance costs and improving operational efficiency.

From aristocracy to modern firms: A look at the largest family offices in Europe

JurisdictionsEuropean family offices have a fascinating history dating back to the aristocratic and Renaissance eras. Despite challenging circumstances like the Russian-Ukraine war and inflationary pressures, European family offices remain resilient, adapting and evolving to safeguard their wealth and legacy.

Outsourcing chief investment officer for family offices

OperationsFamily offices encounter distinct investment challenges, and Outsourced Chief Investment Officers (OCIOs) are emerging as the solution. This insight discusses how OCIOs streamline investment activities, provide access to specialised expertise, and tailor investment strategies.

From possessions to experiences: Trends in high-net-worth lifestyle management

Luxury & LifestyleAs the next generation of family offices takes over, lifestyle managers are becoming aware of the increased desire for more meaningful experiences, rather than possessions.

Expanding professional networks through family office networking groups

LeadershipBy joining a reputable networking group, family offices can connect with their peers, service providers, and experts worldwide. They can also access the latest industry practices and technology developments to position themselves to take advantage of emerging opportunities.

Multi-family office vs wealth managers: What is the difference?

OperationsThe world of private wealth management can be extremely complex, with a multitude of different terms, services, and providers. While multi-family offices and wealth managers can offer critical services to help preserve and grow the wealth of the world's wealthiest families, the terms are often used interchangeably, leading to confusion among clients about what each actually does and which one is the right one to choose.

Tracking the changing landscape of family offices in Canada

JurisdictionsThe family office industry in Canada is experiencing growth as younger generations switch from family enterprises to more tech-driven and sophisticated business structures for managing family wealth. This insight explores why Canada is an attractive location for family offices.

Why should venture capital be at the heart of family office impact strategies

Venture CapitalImpact investing is a top priority for family offices, yet defining an approach that will ‘do good’ and drive returns is fraught with challenges. However, if you’re committed to venture investing, there’s a strong argument you’re already making an impact in several ways.

Unpacking investment fees: A guide for family offices

OperationsFamily offices and high-net-worth individuals often face significant challenges when it comes to understanding and managing investment fees, which can be complex and opaque. However, with the right software and expertise, family offices can take steps towards navigating investment costs more efficiently.

Managing multiple entities: Strategies for family office accounting success

SoftwareFamily offices often face difficulties when accounting for multiple entities. In this insight, we explore the benefits of employing accounting software to manage these entities successfully and discuss important factors to consider when choosing the best accounting software.

Exploring art as an investment for family offices

ArtArt investment has become a viable option for diversifying portfolios, with the potential for appreciation and hedging against economic downturns. However, it requires expertise and an understanding of the art market.

Why more family offices are looking to private equity for high returns and long-term success

Private EquityPrivate equity is becoming a more attractive option for family offices as public markets face macroeconomic headwinds. Driven by more than just profiteering, factors such as the family business and industry expertise play an important role in making alternative investment decisions.

Why Singapore is becoming the destination of choice for family offices

JurisdictionsSingapore has become one of the most popular destinations to establish a family office in Asia due to its clear and non-conflicting regulatory and legal framework, as well as its reputable judiciary system.

Navigating the risks and rewards of alternative investments for family offices

InvestmentsAs the global economy becomes increasingly complex and unpredictable, more and more high-net-worth families are turning to non-traditional investments in search of higher returns and greater diversification. From private equity and venture capital to real estate and cryptocurrency, alternative investments offer the potential for significant upside and the ability to hedge against market volatility.

Family office vs hedge fund: Understanding the differences and investment strategies

InvestmentsWith an increasing number of hedge funds converting to family offices over the past decade, it is more important than ever to understand the differences between the two. This article dives into what hedge funds are, how “hybrid” funds differ from full-fledged family offices, and how they fit into family offices’ portfolios.

Navigating privacy and publicity: A new approach to family office operations

CommunicationAs the family office industry continues to grow, more family offices are shifting away from privacy with more public profiles to compete for better investment deals, clients and talent. Here's how family offices are adopting marketing strategies that leverage digital platforms to build a strong public perception among the ultra-high-net-worth community.

Direct investing for family offices: Balancing risk and reward

InvestmentsDirect investing has seen tremendous growth over the past decade as family offices seek greater control over their investments. But what have been the drivers behind this trend and what are the pros and cons that direct investing brings to the table?

How family offices can improve digital security

Cyber SecurityAs more modern family offices digitise their operations, the more apparent the lack of cybersecurity infrastructure becomes. We explore the common issues and cover some of the measures that can be taken to address them.

The evolution of family office accounting – And the innovative service providers leading the charge

FinTechAs within any business including family offices, accounting and bill payment are two of the most critical responsibilities.

Venture due diligence for family offices: Balancing thorough analysis with gut feel

Venture Capital'Gut feel' is a big part of venture investment, but that doesn’t preclude the need for thorough due diligence to assess the business fundamentals. Doing so is even more important in the current climate and particularly for those with less experience in the VC space.

How family offices can ensure successful adoption of technology changes

SoftwareAn illustration of the potential decision bottlenecks, managing the onboarding process, discuss the drivers of change in how family offices are utilising new investment technology and how to manage the current office dynamics for a new regime.

Using Human Rights and a rights-based approach for investor engagement

PsychodynamicsA rights-based approach is a conscious and systematic integration of human rights and rights principles into all aspects of activities and policies of a business. It also means considering how activities and internal policies influence the enjoyment of rights of the societies.

The role of philanthropy in family office’s investment strategy

PhilanthropyPhilanthropy is not only a means of doing good and helping others, it is also a powerful tool in a family office's investment strategy.

Family office succession: Reconciling with a family’s dirty past

PR & Reputation ManagementA shift in generational leadership can also mean rethinking what "good business" means. Today, environmental, social, and corporate governance (ESG) shapes investment mandates as well as workplace culture.

What bill pay solutions can do for family offices

SoftwareAs family offices aim to preserve family wealth and ensure its smooth transition to the next generation, cost management and risk mitigation should be at the top of their priorities. This article highlights how investing in a proper bill payment solution can help with these operational roadblocks.

Introduction to alternative investment systems for family offices

InvestmentsAlternatives have always been an elusive market for investors. Here, we explore what they are and how family offices can leverage tech use to make the most out of this very lucrative market.

How a portfolio management system can streamline family office operations

SoftwarePortfolio management is one of a family office's most crucial yet time-intensive functions. This article explores the significance of investment management in the general workflow and how software can help increase efficiency of your family office.

How family offices approach consolidated reporting

FinTechIn this insight we look into the growing importance of consolidated reporting for family offices and how software is changing the reporting landscape for the better.

How should family offices invest in impact?

ImpactAs the world needs to make significant progress to limit global heating, the role of private investors is coming under increasing scrutiny. We evaluate the investment strategies for economic growth through climate adaptation.

How private banks assist family offices with digital asset investments

CryptocurrencyAs digital assets continue to form part of many family office portfolios, the need to do this with the support of accredited parties, recognised by financial authorities has never been more vital.

What can ultra-affluent clients learn from the origins of a multi-family office?

OperationsBy understanding the origin of a multi-family office, clients can gain some unique insight into the potential strengths and weaknesses of the firm.

The history of family office regulation

LegalThe collapse of Archegos Capital Management heightened calls for regulation of an untamed industry worth billions of dollars. We take a look at the history of family office regulations and the role that the Archegos collapse had to play.

Venture philanthropy vs impact investing: How to align impact and philanthropy

ImpactImpact investing and philanthropy are not necessarily on opposite sides of the scale. However, understanding the differences can ultimately make or break the success of any particular investment.

An introduction to venture capital funds for family offices

Venture CapitalVC funds don’t always receive the same attention as their colleagues in the private equity and broader asset management space, and historically they’ve sometimes been seen as a bit mysterious. Here is an overview of everything you need to know.

Understanding ESG software for your family office

SoftwareImplementing ESG across various family office operations is an essential part of ensuring sustainable wealth management and succession planning. In this insight, we explore the key roles and capabilities of ESG software in your family office.

Family office costs

OperationsWhile family offices aim to lower their costs, it is essential to view the expenses in the context of the value provided. We take a look at how family office costs vary depending on unique office factors such as operation, investment portfolio or family office structure and size.

Jurisdiction selection for family fiduciary structures

JurisdictionsIt is not enough to choose a jurisdiction for a fiduciary structure based on black letter legal and tax considerations. One must also consider the softer requirements of the family to ensure the jurisdiction is fit for purpose.

Funds vs. Direct: what is the best approach to real estate for my family office?

Real EstateInvesting in real estate requires analytic and due diligence work and often the continued management of properties after purchase. This means family offices have to decide how best to proceed with real estate.

Real estate in the digital age: Big data, Metaverse and Blockchain

Real EstateFor forward-thinking family offices, governance and ownership in the world of Web3 and Blockchain are becoming increasingly familiar. Here is a look at how real-world applications of exciting technologies could present interesting investment opportunities.

How family offices invest in real estate

Real EstateRight up until the pandemic, many family offices around the world were investing in real estate assets due to their long-term cash flow potential. Now, it might be worth revisiting what makes it such a lucrative market to invest in and some of the ways family offices maximise their profits.

The 20 largest family offices in the world

StrategyAs family offices continued to grow steadily across the globe over the past decade, so did their investment strategies, leading them to become more successful over time. Here is a list of the 20 best-performing family office organisations, based on their assets under management.

Family offices and venture deal flow – the holy grail

Venture CapitalFor family offices looking to grow their venture portfolios, generating, and managing deal flow is a significant challenge. From building a pipeline of startups to filtering out the most promising deals, what’s the best way to approach it?

How to start family succession planning

Next GenerationSuccession planning is often a thorny obstacle for families to overcome. Sensitive as all issues of this nature are, it is often tempting to put off discussions to avoid conflict. However, smart succession planning is essential to a family empire for a number of reasons, and with the right action plan, it can be handled without undue infighting.

6 family office trends in direct and venture capital investments

Venture CapitalFamily offices have become a significant agent in global investments and innovation in the last decade. Despite recent turbulence, such as the Covid-19 pandemic and the disruptive global recession, family offices continue to remain positive regarding investments.

Single family office vs multi-family office: Could a hybrid be the future?

OperationsSingle-family offices have always been the preferred choice for affluent families as a centralised means of managing their wealth. However, this service can come at a price, along with other considerations, that might not suit the needs of every family, which is where multi-family offices come into favour.

The importance of family office advisory for the next generation

OperationsAs a new generation of ultra-high-net-worth individuals takes over, they will undoubtedly have very different approaches to wealth compared to their parents. This runs the risk of creating conflict between clients and their advisors, but here are some tips to navigate any potential turbulence.

Family office investment: Recurring and new asset classes

InvestmentsAs new asset classes emerge, the scale of family office investment is expanding and the portfolios are becoming even more uniquely diverse. Nevertheless, as they look into these innovative asset classes, family offices mustn't forget about the traditional, tried-and-trusted ones either.

Level up your operations with family office technology

SoftwareTechnology is crucial for family offices in order to automate and optimise data, which can help with transparency, better decision-making opportunities, and better data security. Not only can technology provide access to real-time data, but family offices can track overall wealth and assist with an outsourcing strategy.

Common family office technology challenges and how to resolve them

SoftwareWhen compared with multi-client organisations, family offices often face more challenges when selecting and implementing technology. And when it comes to technology to leverage their processes and operations, they need to navigate issues such as systems’ complexity, consistency or cost.

An introduction to fiduciary holding structures

OperationsFiduciary holding structures can be useful to wealthy families. Here’s a brief overview of these structures and some of the advantages of owning assets through trusts and foundations.

Family business transition: The case for transformational family businesses

StrategyFor families to thrive beyond generations, transitioning is vital. And a successful family business transition comes from transforming an enterprise through connections, collaboration and collectively gaining clarity.

Activist Philanthropy and Innovative Family Structures

PhilanthropyThere’s a new breed of activist philanthropists who are going beyond the call of duty to make meaningful change. Unlike family offices who write cheques and serve on boards, fulfilling their obligations but oftentimes not digging enough to truly solve societal challenges, individual philanthropists and specific family office go one step further–and their active participation help move society forward each and every day.

Impact: Investing in quality education

ImpactFamily offices looking to expand their impact portfolio can consider ways to contribute to the 4th SDG, which aims to provide access to a full course of free primary and secondary education for all children in the world by 2030, regardless of their gender or family income.

Luxury investments: Luxury as an Asset Class

Luxury & LifestyleBeauty, passion and value are often hard to combine but in the context of a diversified portfolio, luxury goods can be as profitable as they are enjoyable.

How family office reports can meet decision-making needs

OperationsUsing the right kind of family office report can help streamline decision-making. We’ve rounded up the annual reports we refer back to.

Family office education: 8 institutions offering executive teaching

GovernanceTo keep up with the family office industry constantly evolving, here are 7 leading institutions offering family office education.

Solving the wrong problem really well: How family offices can understand human behaviour

Health & LongevityThe power of paradox can be found in many parts of our life and the distinctions can be hard to perceive. Yet missing these nuances can be disastrous, particularly for high-net-worth clients running high-stakes operations.

Integrating human rights into impact investing

ImpactThe increasing focus on sustainability poses new challenges for investors because they're now required to show results, not just good intentions. Here's how they can do this by using a narrative of change and results-based management.

Impact: Investing in sustainable life below water

ImpactThe 14th SDG, as set out by the UN, aims to conserve and encourage the sustainable use of the oceans, seas and marine resources. Here’s an exploratory look at why marine conservation presents an interesting avenue for family offices involved in impact investing.

Understanding how VCs and family offices can work together

Venture CapitalThe story of family offices has always been closely aligned with venture capital, but VC remains an under-exploited opportunity. So how can family offices and VCs forge new partnerships and work more effectively together?

Lifestyle management: the new necessity for family offices

Luxury & LifestyleThe family office landscape is changing as new aspects of the family members’ lives come into focus. Lifestyle management is the key to managing clients’ expectations outside of their financial sphere and it is quickly going from being optional to being essential to family offices.

Cryptocurrencies as part of the family office asset mix

CryptocurrencyWhen setting long term strategic asset allocation bands, an increasingly common question is whether crypto should be part of the asset allocation. Meanwhile, according to research, 1% of the average family office portfolio is invested in cryptocurrency. For those family offices yet to commit to crypto as an asset class, here's where they can fit in.

Investing in food security: An alternative approach to impact

Impact StrategyIn response to the climate and social crisis, the UN established a set of sustainable development challenges to be addressed by 2030. We explore alternative ways to contribute to the 2nd SDG, which aims to ensure food security, improve nutrition and promote sustainable agriculture.

Making the investment case for bitcoin infrastructure

Venture CapitalBitcoin is not just a cryptocurrency – it’s a transformative technology with the potential to rearchitect the world’s monetary systems. Realising this potential requires significant investment in bitcoin infrastructure, creating a high-impact and lucrative opportunity for family offices looking to make substantive first steps into the crypto world.

Why women in impact investing can change the world

ForesightToday, women are still less inclined than men to invest. This gender inequality in finance is a global problem that limits not only women's financial opportunities but also their potential to influence a better future for the planet.

Cryptocurrency’s rise in family office investment considerations

InvestmentsThe meteoric rise of digital assets, and Bitcoin in particular, is undeniable. But what role can this cryptocurrency play in a family office portfolio?

The Great Transition and Life Expectancies

StrategyIn many high-net-worth families, the great wealth transition isn't happening quite as quickly as some expected, as it's common for founding members to enjoy a long working life in their own businesses. Despite there being two working-age generations in waiting, a shift in thinking is needed so that they are both accommodated.

How to create multi-generational wealth

OperationsCreating multi-generational wealth isn't only about finances and investments to last across lifetimes, it's about considering and utilising various forms of capital.

Are your wealth planning arrangements due for a health check?

LeadershipLike taxes, death is a certainty in life and it's important to understand that when the inevitable happens, certain legal processes will be followed. Another constant in life is change, meaning that these arrangements should be reviewed regularly to ensure they’re up to date and relevant to your current circumstances and desired outcomes.

How wealth management is adopting digital financial services

DigitalAs family offices become more comfortable with digital business transactions, advisers are utilising new technology to provide advice quicker and more profitably than ever before. Wealth platforms that were forced to upgrade allow for increased mobility for those providing advice to families, who can use this infrastructure as part of a new breed of family office services.

What you need to understand about trusts

OperationsTrusts in common law countries are commonly used as a tool for private wealth structuring and succession planning. In civil law countries, they're often regarded with scepticism. There are certain rules and tax implications for trusts that must be carefully considered from many jurisdictions as families disperse across the world.

Why family offices should consider investing in food technology

InvestmentsAs the next decade shapes up to be one of disruptive change, one sector seeing huge growth is that of food technology, where advances in technology, coupled with compelling business cases, are attracting significant private investment.

Are family offices starting to eat VCs’ lunch?

InvestmentsWith companies staying private longer and the number of listed companies decreasing, family offices are turning their interest towards venture capital, compelled by the investment opportunities in innovative technologies and new business models. So how will this increased influence from family offices affect an already shifting venture ecosystem?

A new inheritance mindset that reveals more value to heirs

ForesightSome of the greatest wealth transfers are currently happening through inheritance. By viewing the concept of inheritance out of the money-asset-property framework, inheritors are able to gain a whole new wealth landscape, revealing a wider understanding of its value potential.

The irreplaceable aspect of trust and network in the family office space

ForesightWhile the increasing presence of technology has made some things significantly easier, there are still some aspects of operations that benefit from a human element, especially when dealing with families of a more traditional background. Here's how to marry technology with the classical business model.

A family office strategy for navigating the new normal

OperationsThe second year of a pandemic has meant shifting from survival mode to re-establishing a new business strategy. By putting stronger systems in place, identifying and rectifying weak points, and confidently moving the business into the digital age, one expert shares how family offices can make the most of the turbulence of the past two years.

Next-generation transition: how to prepare to pass the family business on

GovernancePreparing the next generation to take over the family business requires some thought, but it doesn’t have to be complicated. There are a few crucial questions to answer to ensure the family is on the same page and that the next generation actually wants, and is ready for, this responsibility.

Is investing in electric vehicles really a good business decision?

InnovationWhy have combustion engines become so unpopular, and why do we all think that electric vehicles are the future? Is it possible that this trend has been created by regulators who have been pushed into a one-way street as a consequence of global warming issues?

From linear to cyclical business: how to lead in a complex post-Covid world.

ForesightTo cope with an uncertain and volatile world, visionary leadership is key to developing future-proofed businesses. Moving beyond a linear business model to a more cyclical one is a powerful tool that can lead to resilient businesses able to weather any storm.

The case for interdependence in a family business

GovernanceInterdependence, where there is mutual reliance on other family members, signifies that there is an inclusive mindset with a clear understanding of the family's shared purpose, vision and mission. It is often also what sets a family business apart from other organisations.

Late-stage venture investing: running with unicorns and tigers

InvestmentsAs many of the world’s fastest-growing companies are waiting longer to go public, late-stage venture investing is having a whirlpool effect on private markets, drawing in traditional public markets investors, private equity firms and early-stage venture capitalists. Brendan Murphy double clicks on why family offices should also be thinking about investing in late-stage ventures.

How to become an impact investor: an expert’s guide