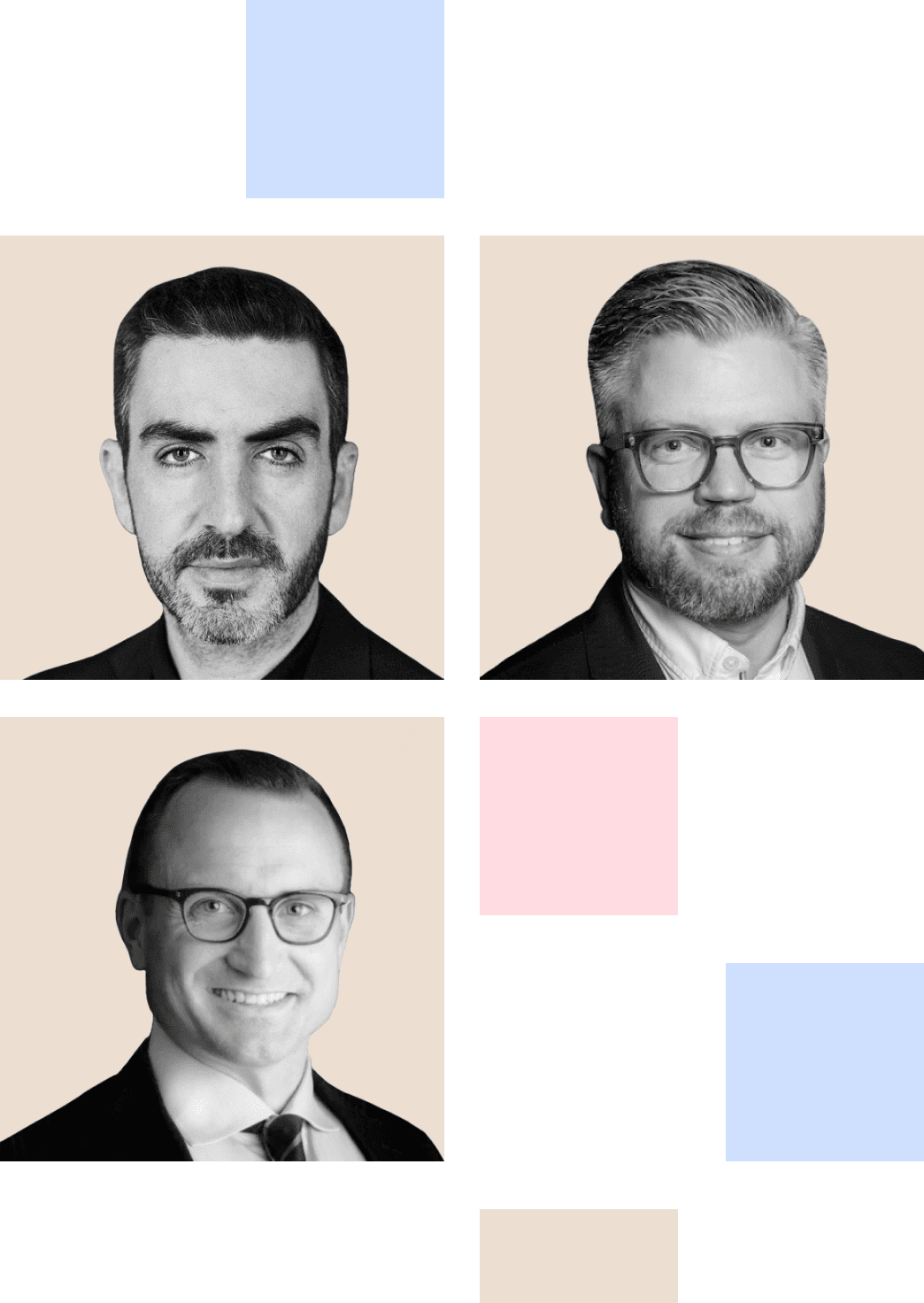

Today, Masttro is one of the leading WealthTech service providers worldwide. Founded in 2010, the company operates in 30 countries and has global headquarters in New York, Zurich and Monterey. Their success is closely aligned to the founders’ experience working within a family office. Sitting down with Simple, Domingo and Javier demonstrated an unwavering passion for their company and walked us through their innovative and evolving long-term solution.

Understanding the origins

Javier M Gutierrez’s work at a family enterprise in Monterrey, Mexico, had him realise the need to introduce automation into the firm’s workflow. As an expanding global business, the time and energy to collect and aggregate numerous reports from multiple entities needed greater efficiencies as the company expanded. As the family enterprise grew, Domingo Viesca joined, and the two were constantly faced with the challenge of aggregating complex information from banks and service providers.

With Gutierrez on the financial management side and Viesca bringing his engineering perspective, the family business further expanded, and with there being no viable alternative to their data aggregation problem, they started to develop their own proprietary system.

It was in 2008 that, while visiting a family office in Geneva, the two discovered that what they were working on was more advanced than what some of the world’s leading family offices and financial institutions at the time were using. The idea sparked to create a business: they already had a concept and their own experience was already the benchmark.

The approach

From the get-go, the two set out to build a global platform that put the user first. Having worked and collaborated with top family offices around the world, they realised this was essential. “We take care of the wealth owner first, so we started with their needs rather than the product,” says Gutierrez, expanding to add, “Reporting is just a commodity. We don’t do that, we provide data and information.”

And taking a global approach meant ensuring their solution could adapt to institutional protocols, a customized route that engaged directly with banks rather than sourcing from available data aggregators at the time.

“We take care of the wealth owner first, so we started with their needs rather than the product.” – Javier M Gutierrez

The solution

Back in 2010, WealthTech wasn’t a buzzword and most wealth managers used Microsoft Office, purchased and installed from a disc, so the Masttro approach was unusual. “Building a SaaS platform in 2012 was challenging,” says Gutierrez, “It didn’t exist, so it was very hard to convince clients because they wanted to own the software on their computer and get updates.”

Despite this challenge, the company continued to build, focusing its core solution around three tenets: top-level security, a global approach, and being adaptable for all parties. Security was naturally a critical element to ensure trust, and from day one they included 2-factor authentication. Developing multiple APIs to connect with institutional protocols globally was also enormous work, but necessary to deliver on their need to serve wealth owners worldwide.

Throughout their early development, a guiding principle was finding the shortest route from transaction to dashboard, removing any friction or delay caused by human interaction. While this is now a common practice and the number of WealthTech platform startups has exploded in recent years, back then this idea was a novelty, which is why after landing their first institutional client in Credit Suisse, word spread fast and the business quickly expanded.

Throughout their early development, a guiding principle was finding the shortest route from transaction to dashboard, removing any friction or delay caused by human interaction.

Usability as a USP

For family office users, selecting a platform to assist with data aggregation, reporting or document management means dealing with vast amounts of data. Translating this into usable displays from a user perspective is a key component for any WealthTech platform, though something that is often overlooked and can result in interfaces little different to standard spreadsheets.

“Design and UX were a priority from the start at Masttro,” notes Viesca, who had early inspiration from his parents who worked in architecture and design. He succinctly sums it up their initial approach as, “We wanted to build technology that works for you, not you working for your technology.”

People make a company

For any service provider in the WealthTech space, providing a holistic solution to clients goes beyond the platform itself. “From the beginning, we didn’t want to be a product but a partner to our clients,” says Viesca. Aligning with this meant building a team that matched their enthusiasm and could deliver on the complex needs of wealth owners, which is what Masttro’s tailored local service offering delivers.

While technology is the facilitator of a global solution, at the heart is a team that enables the last mile service, and is something they’ve invested in intensely from the beginning. Masttro has over 120 employees, whom Gutierrez proudly says are “all treated as family,” and both founders are active in finding talent that is not only suited to the business but where the business is suited to them in terms of commitment and belief.

Masttro solution today

Today, the company offers family offices a comprehensive view of their wealth, allowing them to capture total net worth and consolidate all financial data in one place. It’s not about bells and whistles but rather about providing real value, which the company highlights in its marketing. “Walk away from features – we want to sell value,” says Viesca.

That being said, aside from powerful data aggregation and reporting capabilities, their latest product roll-out also includes an AI-powered module called Doc AI, which automates repetitive, manual tasks, such as pulling reports from fund portals for capital calls and distributions. In addition, the custom model trains continuously and plugs directly into Masttro to save time and improve security.

“We wanted to build technology that works for you, not you working for your technology.” – Domingo Viesca

Looking ahead

Artificial intelligence is not something many companies would have been planning for 14 years ago, but when asked about what unexpected turns might challenge them as a Wealthtech provider over the next decade and beyond, both founders effectively disregard any concern by suggesting anything can be overcome through their maintained focus on what matters most: taking care of wealth owners’ needs.

About Masttro:

Masttro is a SaaS solution for single- and multi-family offices, wealth professionals serving wealth owners, and larger institutions. We believe modern technology and direct data feeds are critical to unlocking solutions to managing wealth data across structure, asset classes, and a move to unstructured data.