1. Introduction & purpose

There’s been no shortage of hype and expectation around private markets going into this year, one in which family offices are looking for ways to generate growth in a highly uncertain market, one where the last year saw most asset classes underperform for another year.

Private capital still only represents a small fraction of the overall global finance markets, estimated around 5%, but its importance can’t be overstated as a means to find value, and with multiple global family office surveys reflecting an intention to increase capital allocations to this sector there is much expectation across its categories, from private equity, private credit and venture capital to infrastructure and real estate.

Outside of direct investment, the traditional route to access private markets for qualified investors relies on institutional funds, with more direct access coming through potential co-investment opportunities that often result from investors networks and connections, but technology has enabled new, highly efficient ways for family offices to engage further.

While many family offices have investment teams, some sizeable enough that they can focus on specific areas within private markets to source opportunities, even these are finding value in technology solutions that enable faster and more effective portfolio management and reporting, part of the broader move away from spreadsheet-based operations.

For family offices that are looking for more access to private markets opportunities or to have a more active control over their investments, there are a host of new technology service providers that can empower them, from platforms that allow discovery and due diligence, direct and co-investment opportunities as well as curated access to funds working with private equity, private credit and secondaries.

Then there’s the growing number of solutions that add a valuable support layer to private markets activities, providing business process automation, forecast modelling, reporting and more, driven by both the complexities of managing increased investments into private markets and the more demanding information requirements that investors have today.

Researching this report, it struck just how stark a contrast there is between the negative market performance over the last two years and the constantly increasing allocation of capital to private markets: it’s no wonder there is a sense of “now must be the time” communicated by major players across the private markets industry.

Whether this is shrewd insight or required optimism, the next three quarters should provide the answer. Regardless of the outcome, there are new opportunities emerging and areas within the private markets space, and technology is playing its part in finding new value and liquidity.

Embracing a new technology offering, whether investment or purely operational in nature, is always risky and requires a considered approach to ensure the best solution is chosen and a thorough onboarding process is completed. When done correctly though, there is no doubt they can improve efficiencies and add value, and looking at the offerings encountered in researching this report, there are already some extremely powerful solutions available, and can certainly help family offices build resilience in these challenging times.

TL;DR

- Private markets have grown consistently in size, but also created growing liquidity needs

- Private credit and secondaries are the two areas delivering notable returns

- Technology is enabling accessibility, adding new forms of value and liquidity

- An increasing number of private markets investment platforms provide new routes of access

- Process automation, analytics and reporting solutions have become essential to manage complexities

Purpose

This report puts a lens on recent shifts within private markets, how family offices are adjusting their approach and what technology solutions are enabling this, with insights based on our qualitative and quantitative research with family offices, service providers and independent advisors, together with information collected from industry reports and publications. It is not aimed as a guide, merely to provide relevant context on where the industry is now, what some of the challenges and opportunities within the space are and highlight some of the digital solutions that stand out. None of this is intended as investment advice and Simple takes an entirely neutral approach to family office portfolio allocation.

Watch our recent Private Markets webinar on demand

2. Private markets shifts

Historically it has been perceived that capital allocated to public markets was less at risk than that allocated to private markets, but the last few decades have proven this not to be the case, with both categories showing they have both safe and risky sides.

The particularly volatile public market conditions of recent years together with the increasingly anxious geopolitical state of affairs, have lead to a spike in the growth of private markets, with capital increasingly allocated to investments whose outcomes are independent of the uncertain public markets.

Last year was tough on the global financial industry, for both public and private markets, with deal value and exit values decreasing. But high interest rates have also lead companies to pursue more equity financing, growing the number of these opportunities. Amidst these conditions, the traditional private equity firms have benefitted, with investors putting their trust into the big names so much that 25 of the most successful collected over 40% of aggregate commitments to closed-end funds.

While the funds are still flowing in, it hasn’t been idyllic for all areas across private markets. Venture capital has perhaps felt this the hardest, with fundraising dropping 60% down to 2015 levels and the number of deals falling 35%, down to 2019 levels.

Real estate has certainly offered opportunities across its categories, with infrastructure presenting reliably resilient cashflows, but private debt has emerged as the biggest winner across private markets in the last year, worthy of closer exploration.

Taking a step back though, when looked at from a broader perspective over the last two decades, private markets have shown a staggering amount of growth, with assets under management reaching over $13 trillion last year.

Great expectations

This much capital means significant pressure for it to perform, and as was the theme across the many forecasts from private banks and institutions at the start of the year, there is a very bullish attitude towards 2024. Perhaps some of this is based on how poor 2023 was, and that surely this year can’t repeat the same levels.

The actual scale of decline was only comparable to that seen during the global financial crisis, and likewise, the slowdown was global, affecting Europe and Asia-Pacific as much as the United States. But despite this, private markets also showed their resilient side, generally outperforming the public sector, perhaps reflecting the perception shift and increasing willingness to allocate more capital towards it, even as the overall numbers decreased.

Much of the market expectation comes from the belief that the once-expected recession has been avoided, that the deterioration of markets will abate and interest rates are set to decrease, meaning 2024 must surely be the turning point and present economic recovery. From the venture capital world expecting large initial public offerings to private equity buyout funds anticipating a flurry of deals, expectations are at a high.

No business upfront, no party out back

A common source of concern for those in the private markets coming into 2024 was around the amount of capital committed to funds but not yet deployed, commonly referred to as dry powder. While the markets suffered, the value of these capital reserves increased for the ninth consecutive year to reach $3.7 trillion.

More than that, 26% of buyout funds’ reserves is four years old or older, which equates to significant pressure on general partners to do deals regardless of what happens with regards to the larger economic conditions of the year.

And with the slow previous year of transactions, where buyout deal count reportedly dropped 20%, private equity firms sit with large amounts in unsold investments and a situation that has left many limited partners that expect more regular flow of cash returns frustrated with the lack of distributions and anxious around when these deals will materialise.

Secondaries come first

One of the areas where private market entities are seeking value is in the form of secondaries, which involves buying and selling previously issued securities to create liquidity beyond traditional exit strategies. Buying a stake in another funds deal does provide a new source of income outside of the traditional private markets activity and can unlock value outside of the longer fund cycles.

With the market situation as it is and the exit backlog so ominous, it’s no surprise that while still small compared with the rest of the industry, the secondaries market was the fastest growing asset class within private markets last year with transaction volumes reaching $114 billion.

It’s also an area where the complexities involved are being addressed with digital platforms that help facilitate transactions, creating a new secondary marketplace for investors, allowing both general and limited partners to have the potential to manage their liquidity. It’s an immature market but one that looks set to scale.

Carbon-zero transition

The transition to a low-carbon economy is reshaping markets and impacting all asset classes, especially infrastructure. The reduction in the costs of low-carbon energy sources due to improved technology will likely result in further widespread adoption, a shift that will see a significant capital investment, estimated at around $4 trillion by 2050.

Considering this narrative aligns well with family offices looking to invest in impact-related initiatives, there looks set to be much opportunity and allocation of capital towards this area over the year ahead.

Private credit awakens

As interest rates increased, banks tightened up lending and reduced the amount of loans, leading to a surge in the private credit market, with the category now representing over $1.6 trillion, or over 10% of alternative assets under management. The economic situation has created much opportunity for distressed lending, and middle-market firms not able to access loans from banks are increasingly looking to private debt funding, as are startups that can’t currently raise equity rounds, meaning some short term and high risk deals but ones that present high yield returns.

It’s not a familiar space for many investors which does mean there is still much to be done in terms of understanding and education, but it’s also no surprise that technology platforms are leading the way, creating a marketplace for private credit, directly connecting lenders and borrowers, with some offering diversified means of exposure across asset classes to offset the risk for lenders.

“The most common challenges are around investor education, as many investors are new to the private credit space. This includes explaining what private credit is, types of private credit deals, and understanding risk-adjusted returns across different deals.”Prath Reddy, CFA, President, Percent

Digital influence

As mentioned within the rapidly growing secondaries and private credit areas, disruption through technologies is a constant. Of course artificial intelligence is grabbing all the headlines and attracting investor attention, but there is growth in other areas, such as cloud computing, particularly for storage and software as a service offerings.

While there is a lot of hype around artificial intelligence, and providers that claim to use the emerging technology as part of their core offering should be subject to proper due diligence, the digital revolution steamrolls onwards and with investors wanting accessible and intuitive presentation of information to enhance their work, there are likely to be more significant acquisitions in this space as larger entities seek to retain relevance. MSCI purchasing Burgiss and Aumni being acquired by J.P. Morgan are just two notable examples from the last year.

3. Synergies for family offices

Family offices could be considered particularly suited to private market investment. While the stereotype around family offices suggests wealth preservation is more important than growth, this has changed with recent reports showing growing assets is an overwhelming priority. This is coinciding with the emerging influence of the younger generation taking more of an active role, and at the same time as private markets evolve to be seen as no more riskier than public markets.

Family offices and their their patient capital is one good synergy, with the lower liquidity being less of a downside for them. Another strong synergy outlined in the World Economic Forum report on capital markets include their financial sophistication, based on better knowledge and greater experience and risk tolerance, particularly when compared to retail investors.

Direct control

One of the reasons family offices are increasing their allocation to private markets is the ability to have more control over the outcome of these investments. This is also closely aligned to next-generation involvement, with direct deals giving them a chance to bring new perspectives and reflect their interests in their investment choices, where they can work directly with portfolio companies.

Family run businesses are known for their success rate, with greater longevity and performance than non-family owned businesses, so the attraction to invest significantly directly and bring their years of experience, industry knowledge and guidance to companies can shift the path and be the difference between success and failure.

Taking this approach wouldn’t necessarily involve digital solutions to discover or invest, especially for family offices that have full investment teams to manage these processes, but they would find value through portfolio management, data analysis and reporting solutions.

“I think the trend of family offices becoming more sophisticated in their ability to make direct investments into private companies will continue, along with their desire to co-invest with venture funds they’ve backed.”Alex Johnson, Founder and CRO, Velvet

Diversification

Offsetting risk is another reason for family offices to pursue private markets and as covered earlier in this report, very much in tune with the need to allocate capital to investments not correlated with public markets that are more susceptible to geopolitical uncertainties of the current time.

Looking for ways to hedge against economic uncertainties and creating new protective strategies means embracing private markets and the asset classes within, where aside from the performance thereof being shown to have resilience, they present an approach to dilute risk through diversification.

Stronger returns

While diversification may be centered around offsetting risk, the delivery of strong inflation-adjusted returns by private markets represents its own significant attraction and again ties in with common approaches family offices take. Outside of their ability to have an operational influence and optimize the performance of businesses invested in directly, many of the private markets investments are in real assets such as real estate and infrastructure, where many family offices have strong connections and which appreciate in value with time to sometimes surpass interest rates.

Taking the long term approach that most family offices do, allocations to these either directly, through funds or other investment vehicles, allows them to ride out short-term economic challenges and capitalise on long-term growth benefits.

Sustainability focus

Family offices are engaged in and being called upon to engage even further through diverting capital into impact-related investments. Some of this motivation to pursue profit beyond the purely financial is from the emerging next generation that understands following this approach doesn’t necessarily mean forsaking financial returns, with sustainable investing showing it can be profitable and becoming an integrated part of investment due diligence and research.

However, regardless of where the motivation originates, investments into sectors around environmental, social and governance, with an aim to finance solutions that focus on solving global challenges, allows family offices to knowingly contribute to a more sustainable future, reflected in many global reports that show family offices plan to substantially increase their sustainable investment allocations in the next few years.

“We recently launched Impact and will be adding the profiles of over 1,200 Impact GPs across asset classes, geographies, strategies and stages. We know Impact is of strong interest to LPs, but gaining an overview is very hard for them – this is why we built Orca.”Kasper Wichmann, co-founder and CEO, Balentic

4. Finding value through technology

Larger family offices are less sensitive to things like higher fixed costs, fees that may reduce returns or hefty minimums that can affect access to private markets to smaller family offices and retail investors. Those with experienced investment teams have the capability to do their own discovery and due diligence, connect with opportunities through networks and traditional entities and institutions as well as what by our research indicates an ever-increasing amount of direct funding pitches aimed at prominent family offices.

Hence pursuing private markets deal opportunities through investment platforms may not fit within their current scope of engagement, alongside consulting companies and mergers and acquisitions specialists. But technology is proving to be useful across the full spectrum of private markets activities, bringing efficiency and automation to support in everything from due diligence, portfolio management, data aggregation and analysis and reporting.

Lower onboarding costs, decreased ticket size, better user experiences in managing investments, scaling advisory roles, quicker investor validation and improved security and eduction are just some of the areas where digital solutions are adding value, not to mention the marketplace platforms that are creating new value and finding innovative liquidity solutions.

Broader deal sourcing

There’s naturally a lot of noise for family offices when it comes to sourcing the right deals, which have relied heavily on networks and referrals and involve multiple intermediaries. It’s an area where technology looks set to add much value, allowing the processing of larger amounts of data to analyse and better identify the most well-suited opportunities, based on preferences set in advance.

This is not purely about finding deals, but about finding opportunities that match the specific objectives of the family office, but without having to manually sift through a vast number of presentations and proposals. New platforms that are collecting and curating general partners across asset classes and strategies allow family offices to explore a broad range of specific investment themes more easily, which has historically provided a challenge.

“We’ve learned that families all have such bespoke requirements, that the most valuable thing we can do is give families visibility of the hundreds of funds we speak to, and let them choose who they want to meet.”Jonny Blausten, Co-Founder and CEO, Sprout

Efficient due diligence

Private markets requires significant due diligence processes, to ensure accurate information and full transparency before any investment decision is made. Pulling the financial, operational and legal information and assessing the risks and opportunities therein is one of the most time-consuming aspects, and an area where powerful and intuitive digital solutions can make an enormous saving in both time and money whilst simultaneously ensuring greater accuracy.

Cloud-native solutions that allow shared but secure data rooms, blockchain technology that allows verification and tracking of transactions and processes, and digital platforms that aggregate and extract information and allow collaborative access all present new routes to greater efficiency in the due diligence process.

Greater transparency

As private markets have mainstreamed and increased in value to where it is today, there is an increasing need for transparency. The disconnect in flow of data between investors and fund managers is one of the areas where this is an ongoing issue, with the increasing frequency and sophistication of limited partner requests being one of the reasons highlighted as to why this isn’t going to slow down. Another motivation is the increasing push from regulators for transparency on valuations of portfolio companies, as well as the need to only connect with legitimate investors that meet compliance criteria.

For traditional funds, the need to satisfy these new reporting needs means added effort and time, and therefore risks extending their costs unnecessarily, and is where technology solutions can provide a far more efficient means to share meaningful information and communicate with stakeholders, as well as flag any issues more rapidly as they arise.

If approached correctly, platforms that enable full transparency can also address the issue of adverse selection, to ensure complete level of information is shared amongst all parties involved in transactions, and is already proving to add value in regards to measuring sustainability criteria around a common set of metrics, something that has plagued the environmental, social and governance investment sector.

Enabling liquidity

There is huge pressure to resolve the hefty exit backlog that private markets currently carries around like a weight on its shoulder, and finding new ways to unlock value and create liquidity for limited partners will be a theme that runs through the year ahead and beyond.

Technology can play a role here in several ways. Within the traditional private markets life cycle, digital solutions can assist in the efficient assessment of historical data, evaluate potential buyer profiles and model favourable exit options.

New digital platforms that enable direct access to secondaries markets are creating a need for new strategies that include portfolios with shorter term assets. Embracing secondaries provides additional exit options, opens opportunities for more investors and is an area where technology can help ease the burden of the exit backlog.

Predictive analysis & scenario modelling

Technology solutions have become adept at automating private market data processing, doing everything from collecting documents and extracting information to presenting this in intuitive displays and sharing consolidated reports with selected stakeholders.

Some of these solutions can allow forecasting of potential future performance. This goes beyond basic risk and return optimisation and can allow scenario modelling based on various investment adjustments and different cash flow projections, providing useful tools to support the decision-making process.

“With the growing confidence in the asset class, investors are ramping up internal competence to select and manage their funds investments. Family offices are investing in becoming more self-sufficient to manage their private markets portfolio”Martin Zahner, General Manager Investment Solutions, Apliqo

5. Underlying technology at work

Nothing has captured the imagination of investors quite like generative AI and the power of large language models (LLMs) in the recent year, but artificial intelligence has been integrated into private markets technology solutions since before this. There are also other technologies that may seem ubiquitous, like cloud technologies, that are still creating change as companies adopt and adapt to their potential.

Artificial Intelligence

Leaps ahead in its position as the favourite child of technology right now, it’s worth noting that artificial intelligence isn’t new, the phrase being coined all the way back in the 1950’s and financial tools using machine learning for decades now. But generative AI is created its own fervour, and its accessibility to manage coupled with it’s ability to sort through vast amounts of unstructured data and uncover targeted insights has seen an exponential rise in prominence, with estimates that leveraging it can create up to 7% productivity and 4% revenue gains for companies. Exactly how much that will increase as we understand the long-term transformative capabilities of generative AI is unknown, but the use cases across the entire financial industry are certain to increase.

Cohesive Data Ecosystems

With integration a top demand from family offices, solutions providers need to prioritise this and is where planning around a cohesive data ecosystem makes sense. Not a singular technology but rather an approach driven by increasing technology capabilities, cohesive data ecosystems are a move away from outdated silo structures and manual processes, and tools like spreadsheets and email, and instead focus on creating an interconnected network of platforms and processes that integrate seamlessly and work together to not just store data, but process it and deliver analytical insights.

Solutions that enable such data ecosystems allow secure access to data from multiple origins, across investment systems and beyond, including legal and operational data, and enables companies to model scenarios, test investment hypotheses and dive into thematic explorations such as sustainability metrics.

Blockchain technology

Looked at outside of its application within the world of digital assets as cryptocurrencies, there is new focus from family offices on investment in blockchain technology to add real world value. Within private markets, it can offer multiple benefits, from increased speed of sharing information, maintaining accurate timelines and enhancing security and verifiability of transactions.

Aside from its ability to increase transaction efficiencies, from settlements to tamper-proof smart contracts, blockchain technology is set to find further value as the tokenization of assets starts to gain momentum as digital assets continue to become more mainstream.

Cloud Technology

As common as it now is, cloud technology and its ability to enable scaling efficiently and at manageable costs are an essential piece of private markets technology solutions and their potential growth. While it may seem as every family office would be fully adopted into this, research estimates less than 40% of private companies have fully moved their operations to the cloud, which would offer an immediate advantage in their ability to access and share data securely and remotely as well as facilitate collaboration internally with their investment team and any advisory partners.

6. Solutions

The number of software and technology solutions geared specifically to private markets has ballooned recently, everything from highly focused deal sourcing platforms to AI-powered digital associates through to complete end-to-end offerings that aim to be a one-stop shop for investors.

For purposes of practicality in this report we look at two areas: solutions oriented to discover opportunities and invest in private markets, and solutions aimed at supporting private markets investments through management of data and reporting. This is by no means an complete list of offerings, but rather a snapshot of what solutions on the market offer and some of the companies that stood out within our research.

Discover and invest

It’s a recurring theme when engaged with family offices that they are concerned about access to deal flow, particularly the smaller or newer family offices that have yet to establish a reliable network. While most of the family offices we spoke to don’t rely on digital solutions to source deals, the growing number of offerings in this space provide a complementary offering.

They can facilitate deal sourcing and due diligence, provide access to direct investments, co-investments, funds and secondaries, not to mention the growing secondaries market, and can include powerful portfolio management tools within their offering.

Some undertake complete due diligence on the investments and only present a fraction of the companies to their user base, a curated offering that aims to reduce risk for limited partners. Solutions like Royc and Sprout do this, providing investors with a highly efficient and user-friendly means to source opportunities, connect with funds as well as co-investments and also track their portfolio, while EquityZen and Rondeivu do similar, with the added option of direct investment opportunities.

Enabling access to private market funds is the sole focus for some of the fastest growing companies in this sector, where names like Titanbay, Yieldstreet and Moonfare have carved out a chunk of the market through providing this access at lower minimums.

Newer entrants like Velvet marketplace and Taroko give similar access, as does Alta Exchange in Singapore but with an extended offering across alternative asset classes that is effectively a marketplace service built on blockchain technology.

There are also niche companies like Balentic that focus on improving efficiencies and providing a competitive edge for general partners, limited partners and placement agents to facilitate fund formation, and CyndX, which uses artificial intelligence and natural language processing to analyze and present actionable deal opportunities to users.

iCapital offers an end-to-end solution, from discovery and due diligence through to investment in funds, as well as direct and co-investing, and access to secondaries opportunities, while Nasdaq Private Market does similar, spun out from Nasdaq in 2021 with the aim to bring efficiency and transparency to the private markets and service the liquidity needs of employees and institutional investors.

With private credit gaining momentum within the alternative investment sector, its no surprise to see dedicated solutions aimed at providing access to deal opportunities here. Companies like Finitive present a private credit marketplace for investors and borrowers, as does Percent, offering direct investment as well as blended notes, which provides diversified exposure through a single deal. Kilde allows similar access to private credit deals in developing and emerging markets, through private bonds that are all secured by collateral.

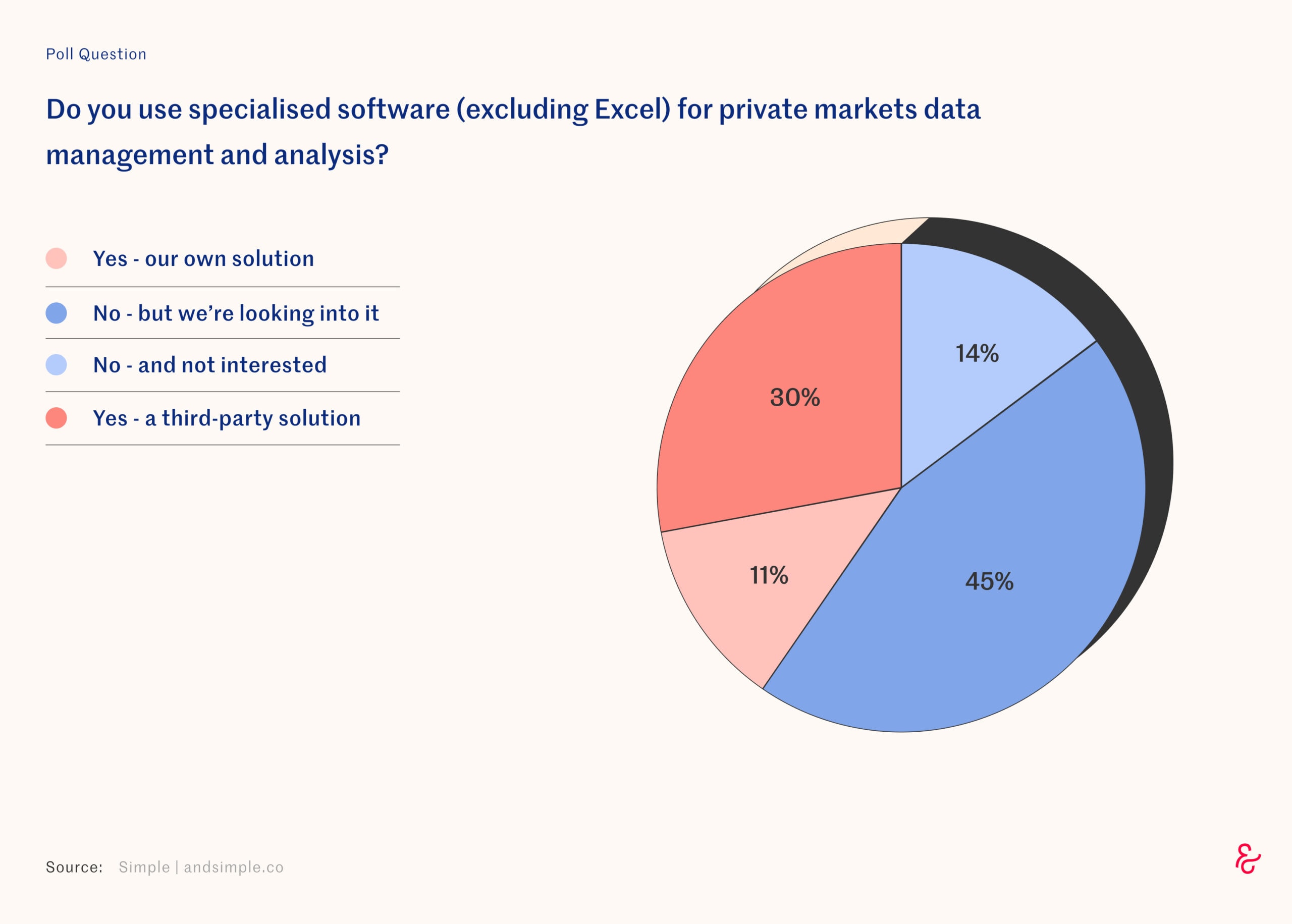

Supporting data management & analysis

With an overwhelming 70% of family offices looking to enhance their performance in private markets through better analytics, there is a growing number of private markets-focused digital solutions for them to turn to that can support their investments. These are also extremely valuable to funds that are experiencing

Offering everything from fully intelligent workflows and document data extraction, through to accounting and legal oriented business processing solutions that aim to relieve the burden of manually handling the extensive data that private markets investments and effective due diligence entail.

There is certainly cross-over in some of these solutions with the burgeoning wealth management platforms available to family offices, though these are private markets focused in their objective, often facilitating direct integration with wealth management platforms to contribute towards cohesive data ecosystems.

Canoe has solved a need through providing a powerful document collection and data extraction tool that is driven by artificial intelligence and enables investors to automate pulling of valuable insights from private markets documents received across multiple sources.

Other companies focused on streamlining investment operations include Oyste, which focused on automated algorithmic rebalancing across asset classes, and RevereVC, which offers complete portfolio management and automated workflows for investments, while Arch is focused on document management and communication that relates to tax and capital calls obligations as well as maintaining records of distributions.

Venn provides a complete due diligence, portfolio data management and construction tool to streamline analysis, forecasting and risk management, as well as a full reporting solution, while LandyTech provides family offices with a complete consolidated data, analytics and reporting solution. Apliqo offers a unique unified performance management solution that aims to save time and increase transparency across budgeting, forecasting and financial reporting processes.

Aumni, recently acquired by J.P. Morgan, utilises artificial intelligence to analyse and surface verified financial and legal insights that are pulled directly from investment agreements, as well as ensure there are no errors or missing details within deal documents, and LemonEdge provides an automated end-to-end accounting process solution built specifically for managing the accounting complexities of investing in private markets.

On the institutional side, Efront is backed by BlackRock and provides a full suite of services to support and streamline private markets investments, from increasing operational efficiency to portfolio management and performance analytics and reporting. They’ve also introduced CoPilot, their generative AI powered tool that answers questions to give instant insight and generate practical visualisations from investment data.

7. Selection process, due diligence & risk management

Inherent Risks

Investing in private equity markets invariably comes with its share of risk, largely due to their complexity, illiquidity and limited transparency. Private market investments are more intricate than those in public markets and the illiquid nature of private investments can have a disproportionate effect on investors with short-term requirements who may struggle to absorb such risk.

The limited information provided by private companies compared to their public counterparts also adds to the risk of adverse selection, and with technology facilitating a real-time exchange of information and quick access to investing, it’s essential that investors obtain all the necessary information before making investments.

Technology Risk

Ongoing adoption of new technology, from generative AI to blockchain-based solutions, will still present their own level of risk. This includes quality assurance issues with occasional inaccuracies requiring human intervention, data privacy and security concerns necessitating stringent protocols to prevent unauthorized access and breaches.

Then there is the opaque nature of generative AI which while presenting a simplification solution, can complicate understanding of investment recommendations if not verified. The implementation of such technology also requires substantial upfront investments in infrastructure, software, and talent, which can be resource-intensive and time-consuming, putting pressure on these solutions providers.

Due Diligence

With the rise in popularity of private market investments and the inherent complexities they bring, investors need efficient solutions for due diligence that go beyond manual processing. This includes collecting and analysing vast amounts of data – and brings its own challenges where investors can fall foul of collecting too much data without proper filtering, leading to more inefficiency and no risk reduction. As technology enables due diligence solutions, it doesn’t negate the value of maintaining a human element in communication with parties involved in deals.

Data Accuracy

Ensuring the accuracy of financial data used on technology platforms that enable access to private markets investments is vital. Any lapses in the validity of financial information can open platforms up to legal issues or securities fraud, something that came up as a concern with family offices in our research.

Adverse Selection

The communication of information is often where tech solutions fall short, with buyers and sellers having varying levels of information on the entity. This creates adverse selection risk, an information asymmetry that may benefit one party or lead poor investments that shouldn’t even have made it to the table. One recent example is where full information wasn’t disclosed with platform users and lead to a loan default, which in hindsight was inevitable.

Role of Advisors

As more solutions emerge, there is a need to cut through the noise, which is where the role of consultants and advisors are crucial to success and risk management. Their ability to be ongoing strategic partners can help ensure the right solution selection but also more efficient onboarding and usage, an area that in itself can cause major headaches.

8. Global market considerations

Private markets investments are witnessing a shift towards global diversification. Family offices are broadening their reach, lured by potential returns in international markets, including emerging economies. Yet, these opportunities come with unique challenges and necessitate careful strategies, whether pursued through traditional funds or new technology solutions.

Investing internationally offers diversification benefits, risk management, and growth opportunities, particularly so when in emerging economies. Given the proper due diligence required to understand and work with regional dynamics, regulatory environments, and potential risks, regional-focused private markets platforms can offer invaluable tools to provide insight and deal prospects.

However, regulatory disparities, access to capital, managerial expertise and exit environment intricacies are just some of the variables that will play a role in influencing regional performances, and motivate for gathering sufficient intelligence to ensure there is no concern around adverse selection when pursuing regional opportunities.

International private markets are in various states, and this will continue to pose challenges for family offices looking at them relation to asset allocation, liquidity considerations and the pursuit of significant returns.