How Bill Gates uses Cascade Investment to manage his wealth

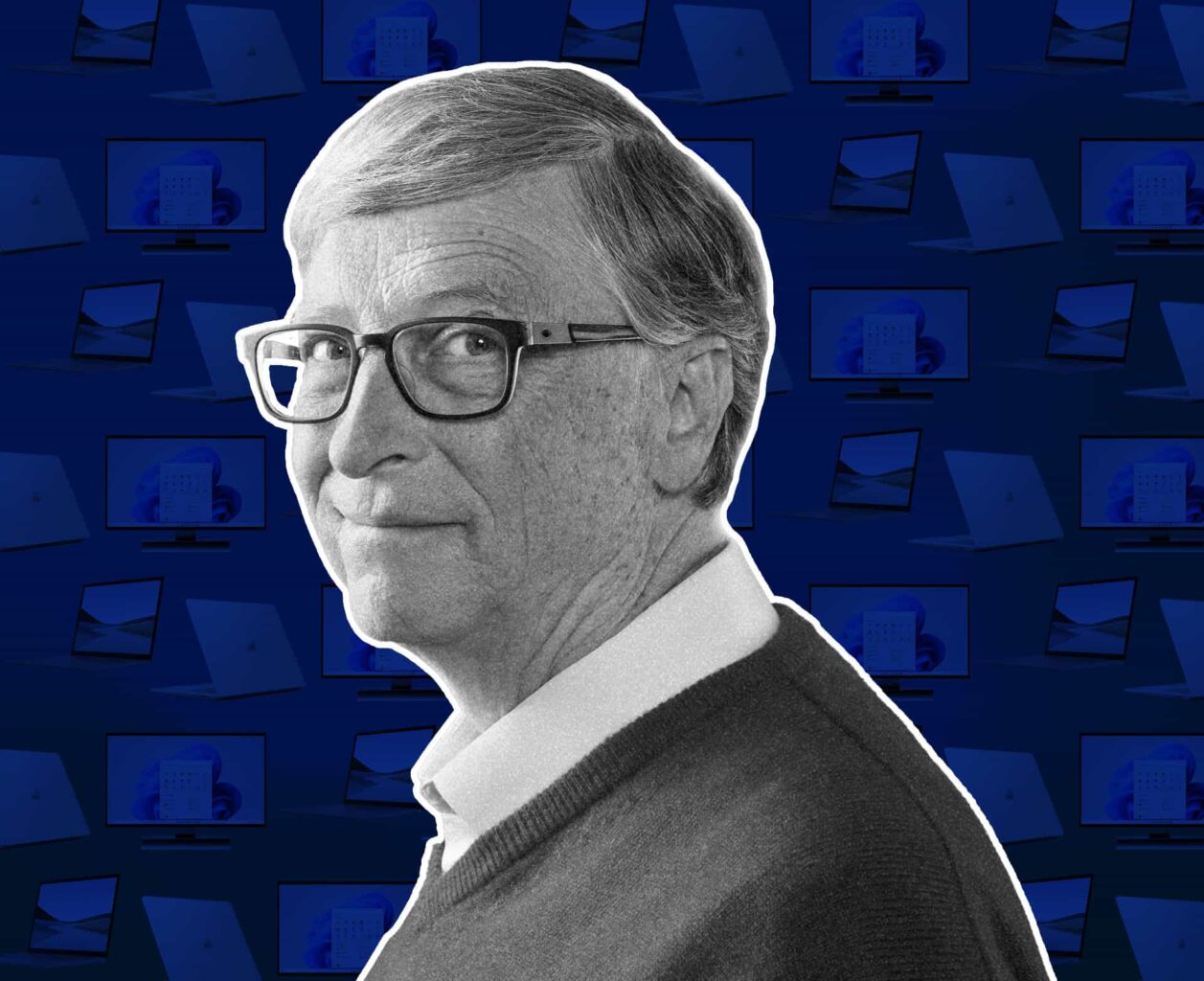

Bill Gates is one of the most recognisable figures in the technology industry, known as the co-founder and former CEO of Microsoft. Beyond his role in shaping the modern software industry, he is equally renowned for his philanthropic work. This article explores his career, the accumulation of his vast fortune, and how he manages his wealth through Cascade Investment.

Bill Gates stands apart from other billionaire founders. His deep passion for software development led him to create Microsoft, amassing immense wealth. Over the years, he has donated a significant portion of his fortune, setting a precedent for philanthropic giving among the world’s wealthiest individuals. Gates' seamless transformation of his passion for software development into the creation of Microsoft led him to become the fourth richest person globally, with a net worth of approximately $165 billion. His commitment to philanthropy, pledging to donate the majority of his wealth to improve global well-being, serves as an exemplary model for other ultra-wealthy individuals.

About the Company

Cascade Investment

- Location Washington, USA

- Type Private investment and holding company

- Founded 1995

- Services Wealth management and diversified investments

How to Build a Tech Giant 101

In 1975, while a pre-law student at Harvard, Bill Gates and his high school friend Paul Allen developed a version of the BASIC programming language for the MITS Altair 8800 microcomputer. They sold the software to MITS but retained the rights to BASIC. On April 4, 1975, Gates left Harvard to co-found Microsoft, marketing BASIC to personal computer manufacturers.

Microsoft expanded rapidly, surpassing $1 million in revenue by 1978. In 1980, after relocating to Bellevue, Gates and Allen secured a pivotal deal with IBM to develop proprietary software for its personal computers. By 1981, Microsoft’s annual revenue exceeded $16 million, and by 1985, the company’s valuation had surpassed $140 million.

Microsoft went public on March 13, 1986, with an initial share price of $21. By the end of the first day, the company had sold over 2.8 million shares, closing at $28 per share. The IPO concluded with Microsoft achieving a market capitalisation of $777 million and net revenue of $61 million. At that time, Gates owned nearly 45% of the company, valued at over $350 million.

Within a year, Gates’ net worth exceeded $1 billion, making him the youngest person to achieve that milestone at the time. By 1995, his wealth had grown to $12.9 billion, establishing him as the richest individual globally—a title he retained until being surpassed by Jeff Bezos in 2018.

In 2000, Gates transitioned the role of Microsoft’s CEO to Steve Ballmer. He stepped down as chairman in 2014 and resigned from the board in 2020 to dedicate more time to his philanthropic efforts. As of 2022, Gates retained just over 1% ownership in the company, with his shares valued at approximately $28.6 billion.

A “Cascading” Series of Personal Investments

To manage his substantial assets, Bill Gates founded Cascade Investment, LLC in 1995. Led by Chief Investment Officer Michael Larson, the Kirkland-based holding company manages over $40 billion in assets, encompassing more than half of Gates’ wealth, excluding his Microsoft shares and the Bill and Melinda Gates Foundation Trust Endowment.

As a private entity, Cascade Investment’s holdings are not fully transparent. However, based on available SEC filings, notable investments include:

- Four Seasons Hotel and Resorts – Cascade Investment initially invested in this luxury hotel company in 1997 when it was publicly traded, acquiring a 47.5% ownership stake alongside Kingdom Holding. After the company was taken private in 2007, Cascade maintained its stake. In 2021, Cascade purchased half of Prince Alwaleed bin Talal’s share for approximately $2.21 billion, increasing its ownership to 71.3% in the company, which is valued at around $10 billion.

- Republic Services – Cascade Investment holds a 34.1% stake in this waste management company, positioning it as the largest shareholder.

- Ecolab – Headquartered in Minnesota, Ecolabs has become one of the world’s leading hygiene and food safety-tech companies. Recently, Cascade bought up another $32 million worth of shares of the company, expanding Gates’ stake from 10.7% in 2012 to over 21% in 2022. He is still the largest shareholder of the company.

- Canadian National Railway – Prior to 2022, Cascade Investment was the majority shareholder of the company with a 14.28% stake. However, in May 2022, Gates sold over $940 million in shares of CN, cutting his stake down to 9%. Again, in July 2022, he gifted another $5 billion in CN stocks to Bill and Melinda Gates Foundation as part of his pledge to add $20 billion to the foundation’s endowment. The Bill and Melinda Gates Foundation is now the majority shareholder of the company.

- AutoNation – Cascade Investment and The Bill and Melinda Gates Foundation bought a consolidated 5.5% stake in this automotive retailing company in 2008. Cascade kept on increasing its stake in AutoNation and in 2018, Gates had become the majority shareholder of the company. However, in September 2021, Cascade dumped over 623k shares of AutoNation, significantly lowering Gates’ stake in the company.

- Deere & Company – Cascade has been the majority shareholder in the agri-tech company since 2011. By 2019, after the purchase of an additional 87,000 shares of the company, Cascade’s stake in the company rose to 10.06%. However, in 2021, Gates transferred $850 million worth of Deere stocks to Melinda Gates as part of their divorce agreement bringing his stake down to 9.3 %.

Gates has maintained significant stakes in companies like Strategic Hotels and Resorts, a real estate investment trust (REIT) operating in the hospitality industry, and Bunzl plc, a British multinational distribution and outsourcing company.

Gates has built an extensive real estate portfolio, combining personal acquisitions with holdings managed through Cascade Investment. His primary residence, a 66,000-square-foot estate in Medina, Washington, was purchased for $2 million in 1988 and is now valued at over $130 million. Additionally, he owns a 314-acre private island in Belize, a $43 million beachfront mansion in San Diego, and is the largest private farmland owner in the United States. As of 2024, his real estate portfolio was estimated to be worth over $160 million.

Giving It All Away

Gates stepped down from the Microsoft board to focus on his philanthropic initiatives, particularly through his commitment to The Giving Pledge. In 2000, he and Melinda Gates founded the Bill & Melinda Gates Foundation, which has become one of the largest charitable organisations in the world. The foundation primarily focuses on public health, poverty alleviation, education, and climate change. Since 1994, the Gateses have donated over $50 billion to the foundation, including more than $1.94 billion in grants for vaccine research during the COVID-19 pandemic.

The Gates Foundation has been a key financial supporter of the National Institutes of Health (NIH) for vaccine research on malaria and tuberculosis. It also played a critical role in the creation of Gavi, the Vaccine Alliance, which leads immunisation campaigns in low-income countries. As one of the largest charitable organisations globally, the Seattle-based trust continues to expand its impact. Following a $20 billion donation, Gates announced plans for the foundation to increase its annual spending by 50%, reaching $9 billion by 2026.

Further Reading

Larry Fink and what family offices can learn from BlackRock

LeadershipLaurence D. Fink, the co-founder, chairman, and CEO of BlackRock, is a well-known figure in global finance. He leads the world’s largest asset management firm, with over $11.6 trillion in Assets Under Management (AUM). His visionary leadership has positioned BlackRock at the forefront of shaping the future of capital markets. Since founding BlackRock in 1988, […]

Power, privacy, and the Palantir playbook: What family offices can learn from Alex Karp

InnovationIn a world where AI is weaponised, data is sovereign, and institutions are fragmenting, few private actors have amassed influence like Alex Karp. The Palantir CEO isn’t just building software; he’s helping reshape global intelligence infrastructure. For family offices seeking relevance in a volatile age, there’s value in studying his strategy.

The Altman Algorithm: Lessons from Sam Altman for the Next-Gen Family Office

InnovationSam Altman’s name is synonymous with artificial intelligence. But for family offices thinking about relevance in a world being rewritten by technology, Altman’s influence stretches far beyond AI. His approach to capital, governance, and long-term risk makes him one of the most important operators of this era, not just for Silicon Valley, but for anyone […]

Jensen Huang: Betting it all on AI, plus putting some NVIDIA chips into philanthropy

InvestmentsJensen Huang, co-founder and CEO of NVIDIA, is one of a handful of people who can realistically tell us where AI will be in the next ten years. That’s because NVIDIA, now in the trillion-dollar club, is heavily invested. Haung, the company’s CEO since its inception, is the man of the hour, making headlines as […]