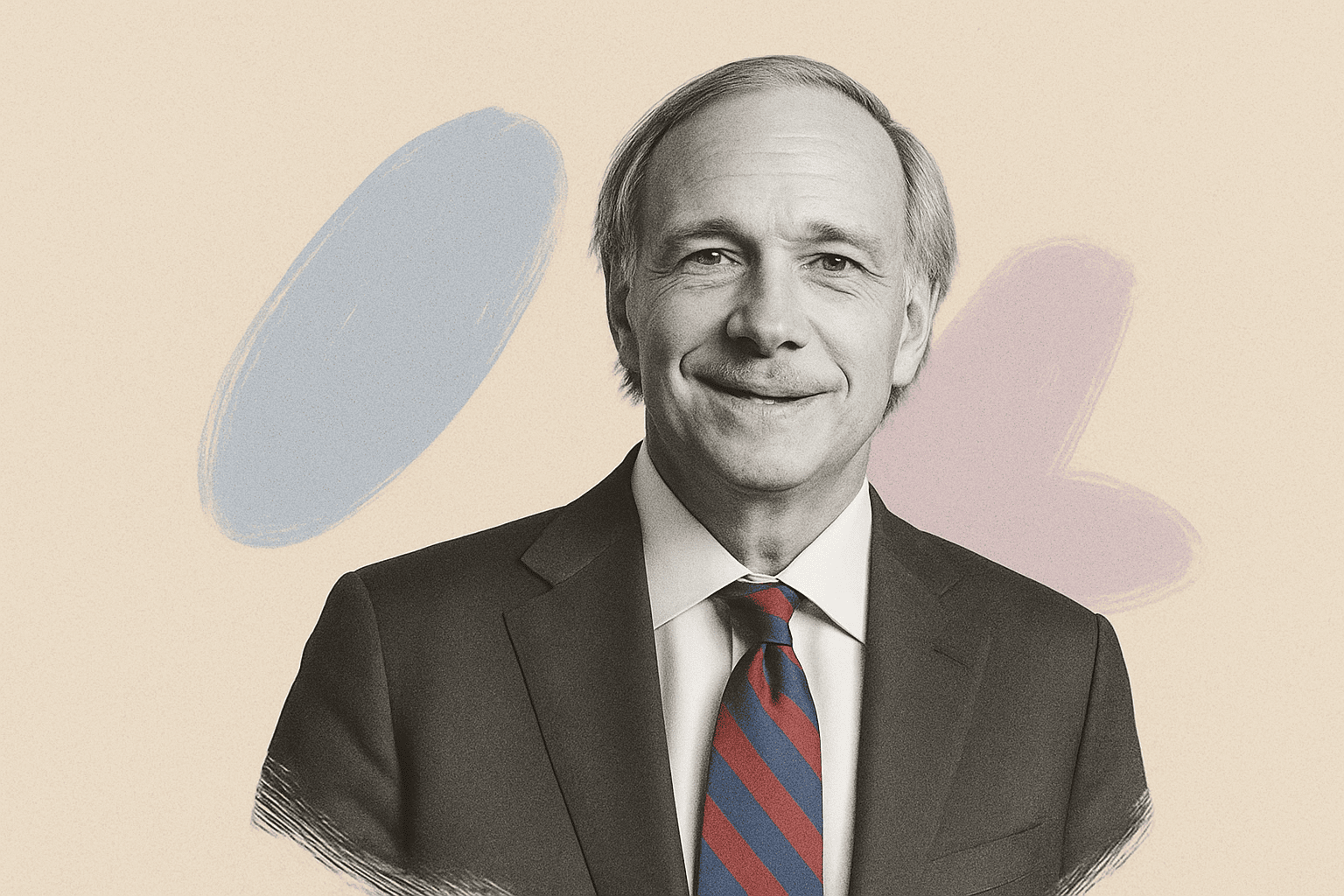

Operating from principles: The Dalio Family Office

Ray Dalio, the influential founder of Bridgewater Associates, a leading U.S. hedge fund, is frequently sought out for his insights during periods of geopolitical uncertainty and potential market downturns. His firm, now celebrating its 50th anniversary, has withstood over five market crashes and numerous economic downturns. Dalio, also the author of the acclaimed book Principles: Life and Work, is recognised by Time magazine as one of the world’s 100 most influential individuals. This case study delves into Ray Dalio’s private wealth management arm, the Dalio Family Office (DFO).

The Dalio Family Office (DFO) is a private investment office responsible for managing the wealth, investments, and ventures of Ray Dalio, his wife Barbara, and their family. It also supports their extensive philanthropic efforts through Dalio Philanthropies. Headquartered in Westport, Connecticut, with offices in New York City, Singapore, and Abu Dhabi, the DFO operates with a culture rooted in "meaningful work and meaningful relationships."

About the Company

Dalio Family Office

- Location Westport, CT

- Type Family Office

- Founded 2011

- Services Private Wealth Management

Early life and career

Ray Dalio was born in 1949 and grew up in a middle-class Long Island neighbourhood. He was the only son of a professional jazz musician and a stay-at-home mom. A less-than-average student in high school, Dalio found his stride in higher education. Having fallen in love with trading at 12, when he could finally choose what he wanted to focus on, he earned a Bachelor’s degree in Finance at Long Island University. Later on, he would go on to Harvard Business School, where he earned an MBA.

In 1969, Ray Dalio avoided the Vietnam War draft due to a diagnosis of hypoglycemia, influenced by his father’s anti-war stance. He pursued his education and in 1973, after graduating, secured a highly desirable position as director of commodities at Dominic & Dominic LLC. This established, century-old brokerage firm offered him a starting salary of $25,000 annually, a top-tier compensation for HBS graduates at the time.

Later, Ray Dalio’s career path included several positions at Wall Street firms before his 1974 firing from Shearson Hayden Stone for punching his boss while intoxicated at a New Year’s Eve celebration. The following year, in 1975, he established Bridgewater Associates. Soon after founding his company, Dalio married Barbara, and their marriage has lasted almost fifty years. They have four sons: Devon, Paul, Matthew, and Mark.

Building Brigdewater Associates

Ray Dalio initially co-founded a small, international commodities business called Bridgewater with his buddies from HBS. Since they all lived on different continents, the name was chosen to reflect their efforts to “bridge the waters” in international trade. Unfortunately, the venture did not last. But Dalio kept the name and revived it to start his legendary hedge fund in 1975.

His early days at Bridgewater began humbly in his two-bedroom apartment. By the mid-1980s, the firm had expanded to roughly ten people, prompting a move to a large farmhouse where the firm and Dalio’s family shared the space.

Growth accelerated in the late 1990s and early 2000s, and by 2007, Bridgewater managed $50 billion in AUM. The firm performed exceptionally well during the 2008 financial crisis, when most hedge funds and markets suffered significant losses. And by 2011, it had become the world’s largest hedge fund with over $100 billion in AUM. Staffing grew significantly, reaching hundreds of employees.

Unveiling the secrets behind his success, Dalio released the book Principles: Life and Work in 2017. In it, he explains how, throughout his lifetime, he developed a set of principles and followed them to deal with the challenges that come with life. Within Bridgewater Associates in particular, not only did the fund develop trading principles from past mistakes, but it also codified them to ensure that each investment decision leads to the best possible outcome. The firm is now famous for its two flagship investment products: the Pure Alpha fund and the All Weather fund.

Establishing DFO with principles

After stepping back from day-to-day management at Bridgewater Associates in 2022, Dalio’s principles or mantra, which is summarised as having “meaningful work and meaningful relationships,” have led him to continue his legacy through his family office, out of which he has decided to give away half of his net worth.

Today, Ray Dalio’s net worth is estimated at $14 billion, with the Dalio Family Office (DFO) managing most assets. The family’s philanthropic efforts, supported by the DFO, began in 2003 with the founding of the Dalio Foundation, which later became part of Dalio Philanthropies (more on that later).

The family office uses the same investment principles as Bridgewater Associates. Janine Racanelli oversees the DFO’s operations as its chief investment officer. While the office is secretive about specific strategies, known investment areas include:

- Private equity and venture capital: The DFO invests in private equity and venture capital. A notable example is its backing of Fruitist (formerly Agrovision), a berry startup with over $400 million in annual sales that raised over $600 million in venture capital.

- Real estate: The DFO also holds real estate investments, including two heritage shophouses in Singapore purchased for $19 million, reflecting Dalio’s interest in the Asian markets.

The firm has offices in Singapore and Abu Dhabi to facilitate investments in Asia and the Middle East. The Dalio family investments philosophy draws on Ray Dalio’s Principles, emphasising systematic, quantitative approaches similar to Bridgewater’s global macro and risk management strategies.

Dalio Philanthropies

Founded in 2003 and supported by DFO, DFO Philanthropies has received over $7 billion from the Dalio family and distributed over $1 billion in charitable grants. This reflects the family’s core value of philanthropy, inspired by their son Matt’s creation of the China Care Foundation in the late 1990s to help Chinese orphans. In 2011, Ray and Barbara Dalio pledged to donate more than half of their wealth by signing the Giving Pledge.

Key initiatives of Dalio Philanthropies include Dalio Education, Oceanx, Beijing Dalio Foundation, Dalio Centre for Health, and the Justice Endless Network:

- Dalio Education: Spearheaded by his wife, Barbara, this initiative partners with public schools and nonprofits to enhance educational outcomes, especially for disadvantaged students.

- OceanX: Unlike other billionaires who choose to focus on space, Dalio believes there is more yet to be discovered in the oceans. Therefore, this initiative focuses on ocean exploration and conservation.

- Beijing Dalio Foundation: This foundation reflects the family’s long-standing connections with China, which began in 1995, when Matt, who was just 11 years old, spent a year in China, where he fell in love with the people and the culture. This foundation supports educational and social welfare initiatives within the country.

- Health and Other Causes: The Dalio Centre for Health Justice at NewYork–Presbyterian Hospital was established with a $50 million donation in 2020 to tackle healthcare inequities. Additionally, the DFO supports initiatives in microfinance, entrepreneurship, and mental health, a close topic which the family dealt with when son Paul was diagnosed with bipolar disorder.

- Endless Network: This program aims to broaden digital access and provide youth with training in 21st-century technological skills, fostering their development as technology creators.

“Whatever success I’ve had in life has been more due to my knowing how to deal with what I don’t know than anything I do know. So, how you deal with what you don’t know, I believe, is so important.” – Ray Dalio in a conversation with Tucker Carlson.

In summary, having actively applied his “Principles” to build Bridgewater, Dalio continues to use a systematic and quantitative approach to manage his family’s wealth and charitable efforts. While not predictive of the future, Dalio’s principles ensure that every decision made aligns with his philosophy of “meaningful work and meaningful relationships.”

Further Reading

Peter Thiel’s capital stack: A contrarian view for family offices

InvestmentsPeter Thiel is one of Silicon Valley’s most influential and polarising figures. A billionaire investor, PayPal co-founder, and early Facebook backer, he is also the driving force behind Palantir and Founders Fund. Known for his contrarian worldview and libertarian ideology, Thiel has built a layered approach to managing his wealth. His method blends operating companies, […]

From fragmentation to focus: A $200M portfolio transformation

Technology StacksA UK-based multi-generational single-family office managing over $200 million faced challenges managing its complex portfolio spread across multiple continents and assets. As their sophisticated investments exceeded the limits of their operational infrastructure, they partnered with IQ-EQ to develop a tailored solution. This case study outlines how IQ-EQ helped them shift from a reactive to a […]

The hidden drains on family office portfolios and how to stop them

Listed Stocks & BondsWhen Greenlock started working with funds, a single-family office client asked them to audit their structure. At first, everything looked standard — until they stumbled upon a curious share class. The minimum investment was just $10k, designed for plain-vanilla retail investors with the highest regulatory protection and enormous embedded retrocessions. Clearly, it was not a […]

Larry Ellison: The unconventional billionaire and his family office

LeadershipLawrence Joseph Ellison is one of the world’s most enigmatic billionaires. As a two-time college dropout and a personal friend of the late Steve Jobs and Elon Musk, he has built a reputation for his bold, unconventional approaches to business and lifestyle. As the founder and former CEO of Oracle Corporation, he has chartered a […]