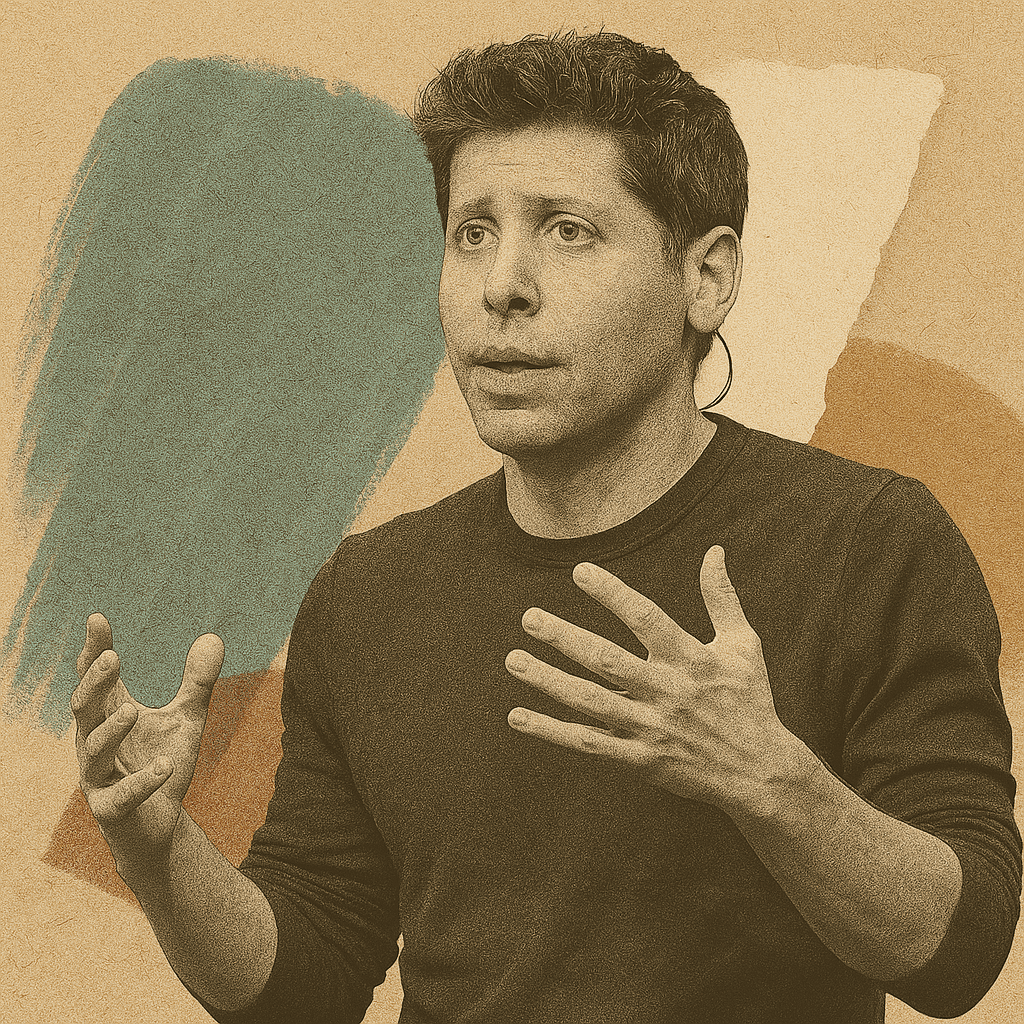

The Altman Algorithm: Lessons from Sam Altman for the Next-Gen Family Office

Sam Altman’s name is synonymous with artificial intelligence. But for family offices thinking about relevance in a world being rewritten by technology, Altman’s influence stretches far beyond AI. His approach to capital, governance, and long-term risk makes him one of the most important operators of this era, not just for Silicon Valley, but for anyone stewarding generational influence.

Altman doesn’t run a family office. Yet his decisions model the kind of clarity, intentionality, and structural creativity that family offices can learn from. This case study unpacks his trajectory – past, present, and future – and reframes it through a family office lens.

Altman doesn’t manage a family office, but he might be building something more ambitious. As CEO of OpenAI and a backer of frontier technologies, he directs capital toward what others consider speculative: nuclear fusion, longevity science, global compute infrastructure. He’s chosen not to accumulate wealth in the traditional sense, famously declining equity in OpenAI, and instead channels influence through mission, structure, and scale. For anyone thinking about how capital can shape the future, Altman’s strategy is a study in purpose over preservation.

About the Company

OpenAI

- Location San Francisco, California, United States

- Type AI Research and Deployment Company (Hybrid Nonprofit–For-Profit)

- Founded 2015

Past: Rewriting the Rules of Ownership

Altman first entered the spotlight in 2005 as the 19-year-old founder of Loopt, a location-based social app. The company was part of Y Combinator’s inaugural batch, and although it was eventually sold to Green Dot for $43 million, it wasn’t the financial outcome that mattered; it was the entry point into Silicon Valley’s inner circle.

Altman quickly transitioned from builder to kingmaker. At Y Combinator, he became president in 2014 and helped scale it into one of the most powerful startup accelerators in the world, nurturing companies like Airbnb, Stripe, and Reddit. But his ambitions extended beyond startups. He began personally investing in “hard tech” ventures like Helion Energy, Retro Biosciences, and AI safety, years before these sectors were mainstream.

The turning point came in 2015, when Altman co-founded OpenAI alongside Elon Musk and others. While the nonprofit AI lab was conceived as a safeguard against runaway artificial general intelligence (AGI), Altman’s decision to take no equity in the venture shocked Silicon Valley. He was focused on long-term impact, not personal wealth.

His early writings offer a blueprint for how he sees the world. In blog posts like “Hard Tech is Back” and “The Merge”, he outlines a vision that merges progress, risk, and purpose. It’s clear Altman never wanted to simply participate in the future; he wanted to architect it.

While Altman has avoided traditional equity paths, his influence and investments have still translated into significant personal wealth. According to Forbes, his estimated net worth sits around $2 billion, largely tied to early investments and involvement in high-growth companies like Stripe, Airbnb, and Reddit.

Lesson for family offices: Capital is only as powerful as the conviction behind it. Altman’s early career shows how mission-aligned investing and long-view ownership structures can compound influence far more meaningfully than short-term returns.

Present: The Architect of an Unfolding Future

Today, Altman sits at the helm of a company that may be defining the 21st century. As CEO of OpenAI, he leads the team behind ChatGPT, DALL·E, and GPT-4, tools that have transformed how humans interact with machines. The public release of ChatGPT in late 2022 triggered a global AI arms race, positioning OpenAI as a leader and Altman as its philosophical spokesperson.

But OpenAI is more than a tech company. It is a structural experiment. In 2019, Altman introduced a “capped-profit” model that converted the original nonprofit into a hybrid structure. Under this model, investors can receive a limited return (currently capped at 100x), while excess gains are redirected toward the organization’s long-term mission. This unusual architecture balances scale with ethical alignment, something traditional governance models rarely allow.

Altman’s reach now extends into global geopolitics. In 2023, he embarked on a world tour, meeting with heads of state and regulators to shape the narrative around AI safety, privacy, and sovereignty. His remarks at the World Economic Forum and testimony before the U.S. Senate weren’t about quarterly earnings, they were about existential risk, democratic values, and global coordination.

Simultaneously, he is attempting one of the most ambitious capital formation projects of all time. In early 2024, reports emerged that Altman was seeking to raise up to $7 trillion for a global semiconductor and AI infrastructure initiative, spanning chip fabs, energy, and compute resources. This isn’t venture capital. It’s systems capital.

Lesson for family offices: Altman’s hybrid approach, where governance models match mission complexity, invites family offices to go beyond traditional fund structures. In a world of compressed timelines and blurred public-private boundaries, long-term capital needs long-term vision and creative scaffolding.

Future: The Family Office as World-Builder

Altman isn’t just forecasting the future; he’s building for it. His portfolio now touches on nearly every system critical to civilisation: energy, education, security, information, labor. His view of AGI isn’t just technical, it’s civilisational. He’s publicly speculated on universal basic income, the end of traditional employment, and even humanity’s merger with machines.

That kind of macro-level framing is rare. It’s also essential for family offices thinking about relevance in 2040 or 2050.

Most family offices today focus on asset allocation, intergenerational governance, or philanthropic alignment. Altman suggests another layer: systemic participation. Not in politics per se, but in infrastructure. In durable, society-shaping ventures. In climate-resilient cities, energy independence, and identity frameworks. It’s no coincidence that many of Altman’s bets feel like institutional replacements, offering redundancy and resilience for a world in flux.

For families managing generational wealth, the implications are clear. There’s an opportunity, perhaps a responsibility, to engage in deeper questions: How do we contribute to the world we’ll inherit? What risks aren’t priced into the current system? Where can we create value that outlives us?

Lesson for family offices: To move from asset managers to world-builders, families must adopt some of Altman’s core principles: radical optionality, risk-aware conviction, and structural innovation. Legacy isn’t just about continuity – it’s about creativity.

Why the Altman Algorithm Matters

Sam Altman isn’t managing a family office, but he’s operating with the mindset that every family office should aspire to: mission-aligned capital, flexible governance, and a relentless focus on long-term, systemic relevance.

The Altman Algorithm is not about AI. It’s about how to think in decades. It’s about using capital not just to preserve wealth, but to reshape what’s possible. For the next generation of family offices, especially those ready to move from passive allocation to active participation, his playbook offers not just inspiration, but instruction.

Further Reading

Peter Thiel’s capital stack: A contrarian view for family offices

InvestmentsPeter Thiel is one of Silicon Valley’s most influential and polarising figures. A billionaire investor, PayPal co-founder, and early Facebook backer, he is also the driving force behind Palantir and Founders Fund. Known for his contrarian worldview and libertarian ideology, Thiel has built a layered approach to managing his wealth. His method blends operating companies, […]

From fragmentation to focus: A $200M portfolio transformation

Technology StacksA UK-based multi-generational single-family office managing over $200 million faced challenges managing its complex portfolio spread across multiple continents and assets. As their sophisticated investments exceeded the limits of their operational infrastructure, they partnered with IQ-EQ to develop a tailored solution. This case study outlines how IQ-EQ helped them shift from a reactive to a […]

The hidden drains on family office portfolios and how to stop them

Listed Stocks & BondsWhen Greenlock started working with funds, a single-family office client asked them to audit their structure. At first, everything looked standard — until they stumbled upon a curious share class. The minimum investment was just $10k, designed for plain-vanilla retail investors with the highest regulatory protection and enormous embedded retrocessions. Clearly, it was not a […]

Larry Ellison: The unconventional billionaire and his family office

LeadershipLawrence Joseph Ellison is one of the world’s most enigmatic billionaires. As a two-time college dropout and a personal friend of the late Steve Jobs and Elon Musk, he has built a reputation for his bold, unconventional approaches to business and lifestyle. As the founder and former CEO of Oracle Corporation, he has chartered a […]