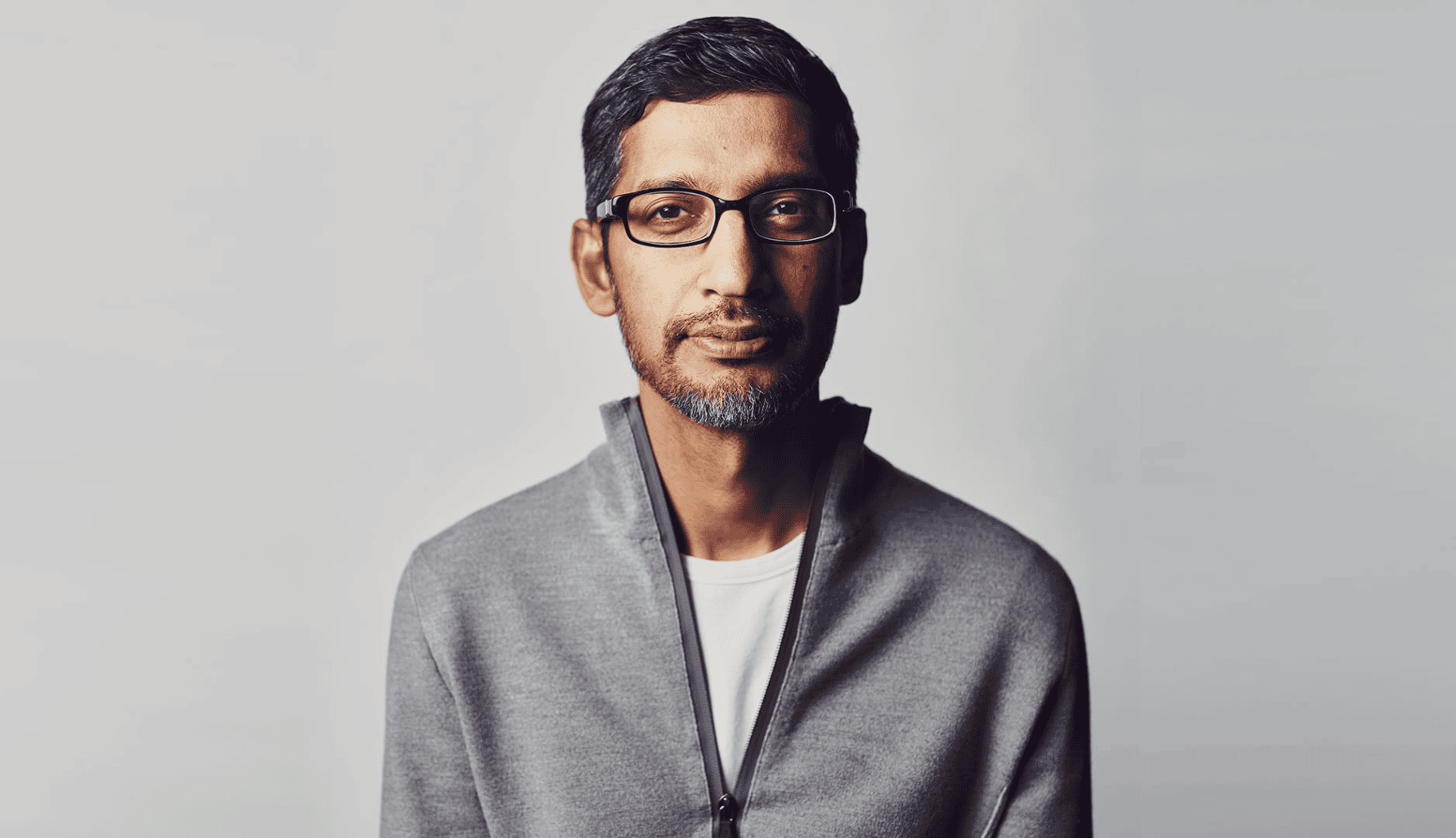

Sundar Pichai’s rise to the helm of one of the world’s most influential technology companies is no accident. It’s the product of steady leadership, disciplined execution, and a long-term vision for innovation. From guiding Google through the AI revolution to steering Alphabet’s multi-billion-dollar investments in infrastructure, Pichai has built a track record defined by patience, precision, and quiet influence. His approach offers a blueprint for family offices seeking to balance bold capital allocation with governance, resilience, and sustained relevance in a rapidly evolving global landscape.

Sundar Pichai: The steady hand behind Alphabet’s AI-fueled wealth engine

Sundar Pichai has guided Alphabet through technological shifts, regulatory challenges, and the AI revolution. His steady, long-term approach offers a blueprint for family offices seeking resilience and strategic focus.

About the Company

Alphabet Inc.

- Location Mountain View, California, United States

- Type American multinational conglomerate and technology holding company, parent of Google and its subsidiaries.

- Founded Founded on October 2, 2015, as a strategic restructuring of Google into a holding company structure

From humble roots to global leadership

Sundar Pichai’s ascent is one of quiet persistence rather than sudden disruption. Born in Madurai, India, and raised in Chennai, he grew up in a modest two-room apartment, often studying by candlelight during power cuts. After earning a degree in metallurgical engineering from IIT Kharagpur, he secured a scholarship to Stanford University, pivoting toward materials science and semiconductor design. He later added an MBA from Wharton, honing the strategic acumen that would define his corporate career.

Joining Google in 2004, Pichai quickly emerged as a product leader. He played a pivotal role in developing the Google Toolbar and spearheaded the launch of Chrome in 2008, a move that reshaped how billions access the internet. By 2015, he was appointed CEO of Google, and four years later, CEO of Alphabet. Unlike some Silicon Valley leaders known for aggressive public personas, Pichai cultivated a reputation for steady stewardship, inclusive leadership, and a deep focus on product excellence.

For family offices, his early career mirrors the careful, long-term cultivation of a portfolio: building durable positions in high-quality assets, resisting the temptation of short-term wins. As he has reflected,

“You might fail a few times, but that’s OK. You end up doing something worthwhile which you learn a great deal from.”

A billionaire by design, not by accident

As of mid-2025, Pichai’s net worth is estimated at around $1.1 billion, with some sources placing it closer to $1.3 billion. This fortune is not the product of founder equity or venture windfalls, but of consistent compensation: salary, restricted stock units (RSUs), and performance grants, paired with disciplined stock sales.

Through pre-arranged Rule 10b5-1 trading plans, Pichai has sold between $500 million and $650 million in Alphabet shares over time. These sales, timed and structured to avoid market perception risks, have allowed him to steadily unlock liquidity while retaining a strategic equity position. It’s a playbook family offices use when diversifying concentrated positions without signalling instability or eroding trust.

Pichai’s path to billionaire status, through operational excellence rather than entrepreneurial fortune, offers a relatable model for first-generation wealth creators who built scale within large institutions.

Strategic investment in AI as an asset class

Under Pichai’s leadership, Alphabet has doubled down on artificial intelligence, not as a speculative add-on, but as a core growth engine. In 2025 alone, the company committed $75 billion to AI infrastructure, spanning hyperscale data centres, custom AI chips, and full-stack product integration.

Google Cloud, now a critical profit driver, has hit an annualised run rate near $50 billion, fuelled by demand for generative AI solutions. AI capabilities have been embedded across Google Search, Workspace, YouTube, and Android, reinforcing network effects and making AI a pervasive revenue catalyst.

The approach mirrors a family office strategy of securing a multi-point presence in a growth market: infrastructure, distribution, and applications all feeding into one another. Pichai’s philosophy is clear: Google doesn’t need to be first, it needs to deliver the most trusted and enduring product. As he has advised others,

“Wear your failure as a badge of honour.”

It’s a mindset that blends calculated risk-taking with long-term resilience.

Governance and risk management: Lessons from the corner office

Alphabet’s global scale has brought regulatory challenges in antitrust, privacy, and content governance. Pichai’s response has been to build a governance architecture that adapts without derailing growth: compliance baked into operations, transparent communication with regulators, and internal checks that preserve agility.

For family offices, this is a reminder that governance is not a defensive drag, it’s an asset that safeguards continuity, reputation, and alignment across generations. Pichai’s ability to manage global complexity while keeping strategic priorities on track offers a direct parallel for multi-jurisdictional wealth structures.

If Pichai built a family office

If Pichai were to establish a family office, its DNA would likely mirror his corporate playbook:

Disciplined Liquidity Management: Structured sales and diversification to protect core positions while freeing capital for new opportunities.

Platform-Centric Investing: Building interconnected holdings where success in one strengthens the others.

Generational Bets: Allocations to transformative technologies like AI, clean energy, and quantum computing, designed for multi-decade payoffs.

Risk Segmentation: Isolating high-risk experimental ventures from long-term wealth anchors.

Quiet Influence: Leveraging deep networks and strategic partnerships without overexposure in public markets or media.

Such an office would likely blend public equity exposure with significant private investments in frontier technologies, supported by a governance framework as robust as its investment thesis.

Takeaways for family offices

Steady Compounding Beats Flashy Wins: Long-term value creation often comes from incremental, sustained growth.

Plan Your Liquidity Events: Programmed exits can provide flexibility without sending negative market signals.

Invest Across the Value Chain: Owning infrastructure, distribution, and end-user touchpoints amplifies returns.

Governance is Growth Insurance: Structure decision-making early to protect both capital and reputation.

Resilience Over Perfection: Failures, if managed well, can strengthen long-term positioning.

Final Thought

Sundar Pichai’s career is a case study in patient power. By combining disciplined capital realisation with deep reinvestment in transformative technologies, he has built wealth that is as stable as it is scalable. For family offices navigating the uncertainties of the AI era, his example shows that understated leadership, strong governance, and platform-based thinking can create enduring advantage, quietly shaping the future without needing to dominate the spotlight.

Q

What is Sundar Pichai’s net worth?

A

As of 2025, his net worth is estimated at around $1.1 billion, primarily from long-term compensation and stock sales at Alphabet.

Q

How did Sundar Pichai become CEO of Alphabet?

A

He joined Google in 2004, rose through leadership roles including leading Chrome, and was appointed Google CEO in 2015 before becoming Alphabet CEO in 2019.

Q

What is Sundar Pichai’s leadership style?

A

Known for quiet, consensus-driven leadership, he focuses on patient innovation, platform building, and balancing bold bets with strong governance.

Q

What can family offices learn from Sundar Pichai?

A

Lessons include disciplined capital allocation, investing across ecosystems, managing risk through governance, and prioritising long-term resilience over short-term wins.

Further Reading

Peter Thiel’s capital stack: A contrarian view for family offices

InvestmentsPeter Thiel is one of Silicon Valley’s most influential and polarising figures. A billionaire investor, PayPal co-founder, and early Facebook backer, he is also the driving force behind Palantir and Founders Fund. Known for his contrarian worldview and libertarian ideology, Thiel has built a layered approach to managing his wealth. His method blends operating companies, […]

From fragmentation to focus: A $200M portfolio transformation

Technology StacksA UK-based multi-generational single-family office managing over $200 million faced challenges managing its complex portfolio spread across multiple continents and assets. As their sophisticated investments exceeded the limits of their operational infrastructure, they partnered with IQ-EQ to develop a tailored solution. This case study outlines how IQ-EQ helped them shift from a reactive to a […]

The hidden drains on family office portfolios and how to stop them

Listed Stocks & BondsWhen Greenlock started working with funds, a single-family office client asked them to audit their structure. At first, everything looked standard — until they stumbled upon a curious share class. The minimum investment was just $10k, designed for plain-vanilla retail investors with the highest regulatory protection and enormous embedded retrocessions. Clearly, it was not a […]

Larry Ellison: The unconventional billionaire and his family office

LeadershipLawrence Joseph Ellison is one of the world’s most enigmatic billionaires. As a two-time college dropout and a personal friend of the late Steve Jobs and Elon Musk, he has built a reputation for his bold, unconventional approaches to business and lifestyle. As the founder and former CEO of Oracle Corporation, he has chartered a […]