AI for family offices: Strategy & governance

Governance Updated on September 29, 2025Table of Contents

- Why AI governance matters now

- The governance challenge: adoption outpacing oversight

- Build vs Buy vs Partner

- Data governance & ownership

- Ethical guardrails

- Regulation & compliance

- Culture & change management

- What your family office can do now

- Potential quick wins

- Looking ahead: Governance as stewardship

AI is moving from pilot projects to embedded infrastructure across finance. Reporting systems, custodians, and service providers are already weaving machine learning into their platforms, often before family offices notice. This creates a shift: build vs buy decisions, vendor oversight, and data ownership are no longer technical matters, but governance priorities that shape risk and continuity.

This guide helps family office leaders turn AI from a source of uncertainty into a strategic advantage. Drawing on global benchmarks and Simple’s proprietary polls, it translates complex issues into practical frameworks, quick wins, and role-based steps, so adoption is deliberate, secure, and aligned with long-term stewardship.

Why AI governance matters now

AI has moved from hype to infrastructure. For family offices, the question is no longer whether to adopt AI, but how to do so responsibly. In wealth management, 91% of asset managers now use or plan to use AI, up from just 55% in 2023. This rapid acceleration reflects finance’s appetite for efficiency and insight, but also reveals a governance blind spot.

Family offices are not immune. Many already fund AI ventures in longevity, climate, and biotech. Yet when it comes to internal operations, adoption is uneven. Some offices are piloting new tools, others remain hesitant, citing privacy, regulatory uncertainty, and lack of in-house expertise. This creates a paradox: families driving the AI revolution externally while lagging internally. Governance, not technology, is the bridge.

A Simple poll from this year found that one-third of family offices were exploring AI but hadn’t committed, while just over a quarter were actively using tools. Another 21% described themselves as interested but cautious. This fragmented adoption confirms that while institutional finance treats AI as infrastructure, family offices are still experimenting, often without governance frameworks in place.

The governance challenge: adoption outpacing oversight

Adoption is not the same as successful integration. A Deloitte study shows that only 38% of AI projects in finance deliver expected ROI, with more than 60% delayed by shortages in talent. For family offices, where resources are leaner, the risks of wasted time, reputational fallout, or even regulatory exposure are higher.

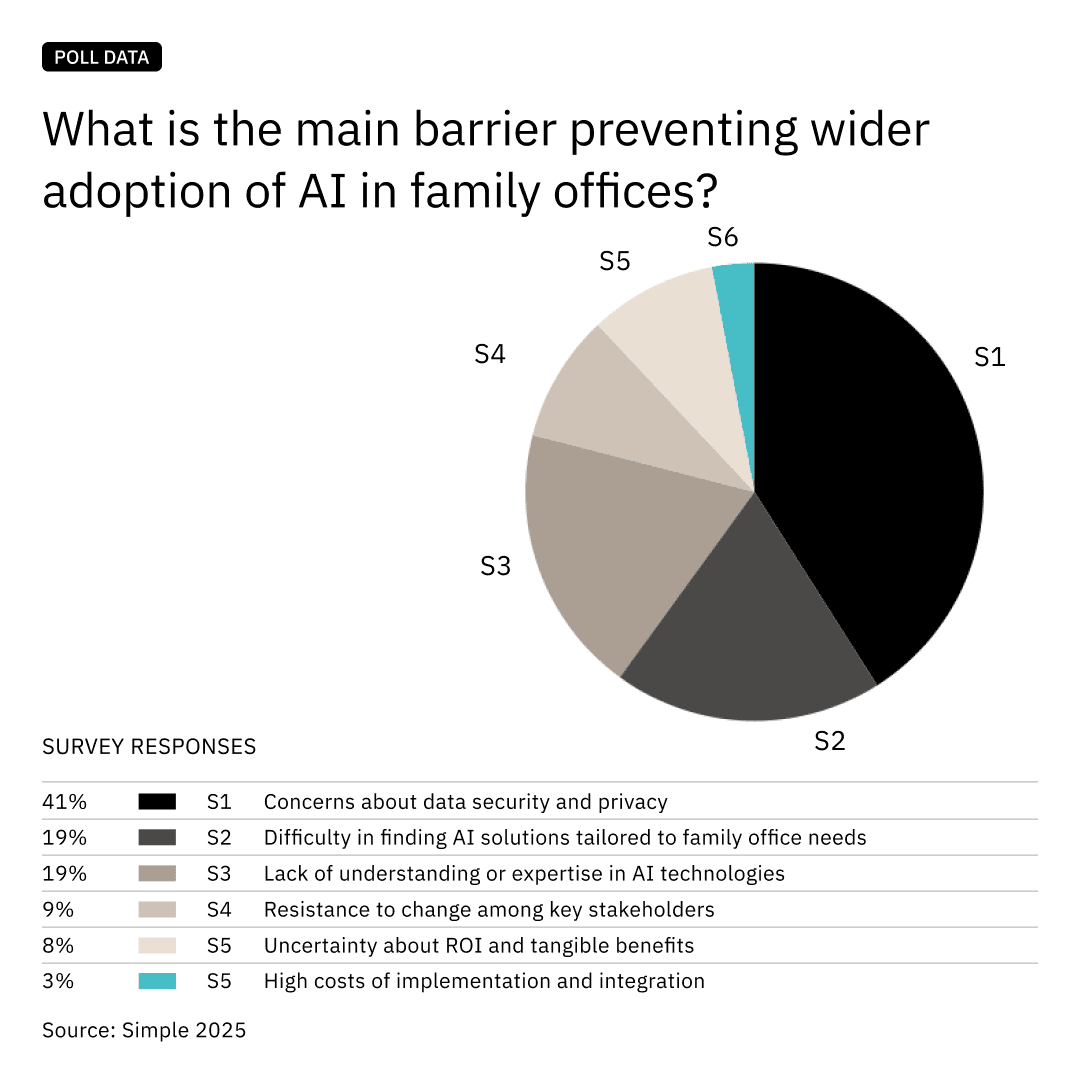

A Simple poll at the backend of 2024 underscores this point: 41% of family offices cited security and privacy as the main barrier to AI adoption. Another 19% pointed to the lack of tailored solutions for family office needs, while 19% admitted a lack of in-house expertise. These are not just technical obstacles; they reveal gaps in governance, operational readiness, and culture.

What often gets overlooked is the role of data strategy. AI systems are only as effective as the data they are built on: messy, siloed, or incomplete data will undermine results. For family offices, where information spans portfolios, trusts, and personal records, refining data pipelines is as important as choosing the right tool. Without that foundation, pilots stall, ROI is missed, and risks multiply.

A practical first step is to run a lightweight data audit before any AI pilot, mapping where data lives, who owns it, and whether it’s fit for machine learning. This turns governance from theory into tangible preparation.

The lesson: Without structured oversight, adoption risks creating exposure rather than efficiency.

Build vs Buy vs Partner

One of the most strategic choices family offices face is whether to build proprietary AI tools, buy off-the-shelf solutions, or partner with vendors.

-

Build: Maximum control over data and functionality but high cost ($100K–$500K+), long timelines (6–18 months), and ongoing maintenance demands.

-

Buy: Quicker deployment (3–9 months), lower upfront costs, but raises questions about vendor resilience, integration, and data privacy.

-

Partner: A hybrid, increasingly popular model where sensitive functions are developed internally while standard capabilities are outsourced.

Globally, 94% of financial services firms expect third-party AI use to increase. Family offices must apply disciplined evaluation frameworks, not convenience, when making these decisions.

For example, some family offices have already experimented with building custom reporting dashboards to protect sensitive data, while others lean on custodians’ embedded AI for faster implementation. Each route carries risks: building strains lean teams, buying risks lock-in, and partnerships demand careful vetting of vendor resilience. For most family offices, the pragmatic path will be hybrid – retaining control of core functions while outsourcing commodity features.

Data governance & ownership

Data is both the fuel and the fault line of AI. The IBM Cost of a Data Breach Report (2025) found that 97% of organisations reporting AI-related breaches lacked proper access controls. GDPR fines reached €1.2 billion in 2024, increasingly targeting financial institutions with weak safeguards.

Family offices, given their exposure to deeply personal and financial data, are especially vulnerable. Breaches can damage both reputation and continuity.

A Simple poll (Nov 2024) found that 47% of family offices were interested in AI but had not yet implemented it, while only 8% had reached core integration. This early-stage reality makes embedding governance now essential. Without it, experimentation risks becoming “shadow AI,” where staff use public tools informally, exposing sensitive family information.

One real-world parallel comes from financial services: several firms have already had to ban employees from pasting client data into public AI tools after discovering sensitive documents circulating outside controlled systems. For family offices, a single lapse like this could expose succession plans or personal financial data, damage that is almost impossible to contain once leaked.

Ethical guardrails

AI governance is not just about compliance. It also involves ethical guardrails: ensuring transparency, explainability, and fairness.

For family offices, the reputational consequences of biased outputs or opaque decision-making are amplified. Unlike large banks, which may absorb reputational shocks, family offices operate in high-trust ecosystems where perception directly affects influence and partnerships.

Ethical frameworks, lightweight but explicit, can reduce risks. These might include rules on human-in-the-loop oversight, requirements for explainability in investment decision support tools, and codes of conduct for AI-assisted communications.

One risk example: an AI-driven investment tool that inadvertently down-weights female or minority-led businesses due to biased training data. Even if unintended, such an outcome could undermine both returns and reputation. For family offices, embedding principles of explainability and fairness is a way to align technology adoption with family values. A simple first step is to adopt an internal “AI code of conduct” — a lightweight policy that commits to transparency, requires human review of critical decisions, and bans the use of sensitive family data in public models.

Regulation & compliance

The regulatory landscape is moving quickly, and in different directions across jurisdictions.

-

EU: The AI Act (2024) introduced a tiered approach, with high-risk systems facing obligations around explainability, oversight, and human control. Compliance deadlines run up to 36 months.

-

US: Federal deregulation dominates, but 38 states introduced AI-related laws in 2025, creating patchwork compliance.

-

UK: The FCA has taken a “sandbox” approach, embedding oversight in existing financial regulations.

For cross-border families, this “compliance complexity” means systems must either be designed to the strictest jurisdiction or adapted region by region.

In a Simple poll, 29% of family offices said their biggest continuity risk was a lack of shared long-term vision. Another 15% cited outdated systems and weak governance. This suggests that external regulations are only one part of the challenge: internal governance weaknesses can undermine continuity just as much.

Many family offices already face complexity in tax, reporting, and succession planning that spans multiple jurisdictions. AI regulation adds another layer: a portfolio reporting tool compliant with US standards might breach EU transparency rules if used in Europe. For globally dispersed families, this makes “compliance by design” essential — building or selecting tools that can meet the toughest standards from the outset rather than patching compliance later.

The takeaway for family offices is simple: treat compliance as a front-end design choice, not a back-end repair. The cost of over-engineering governance is far lower than the cost of retrofitting it under regulatory pressure.

Culture & change management

AI adoption is as much cultural as technical. Globally, 41% of employees expect AI to improve their jobs, while 20% expect negative effects. Yet 75% of CFOs still cite security and privacy as their top AI concern, highlighting a trust gap between leadership and staff.

For family offices, culture is just as critical. In the same Simple poll on adoption barriers, nearly 20% admitted that lack of expertise was holding them back. This shows that leadership concerns and workforce readiness are intertwined.

Left unaddressed, this gap leads to “shadow AI,” where staff use public models without approval. The solution is transparency from leadership, role-specific training, and framing AI as augmentation, not replacement.

In practice, generational dynamics often shape adoption. Next-gen family members and younger staff may push for experimentation, while older leaders hesitate. This can create fragmentation unless pilots are structured to include all stakeholders. For example, training workshops combined with a 90-day AI pilot can demonstrate benefits while addressing security fears. At the same time, leaders should openly explain the risks of “shadow AI” — such as uploading sensitive trust documents into public chatbots — to make clear why governance matters.

Ultimately, cultural readiness is what makes governance frameworks stick. Without trust and shared understanding, even the most sophisticated policies risk becoming box-ticking exercises rather than living safeguards.

What your family office can do now

AI adoption doesn’t have to be overwhelming. The challenge for family offices is not to do everything at once, but to embed governance into small, manageable steps. Starting with clear responsibilities across leadership roles ensures momentum without losing control. Here’s how principals, CIOs, and COOs can each play their part:

The Principal (and CEO)

Principals set the cultural tone. By framing AI adoption as a fiduciary duty rather than a technology experiment, they legitimise initiatives across the organisation. This means asking the right questions: Does this tool align with our family’s values? Does it protect our reputation? Principals can also sponsor pilot projects, signalling that innovation is encouraged, but must be guided by guardrails. Their role is to balance vision with discipline, keeping stewardship at the centre of AI adoption.

The CIO

CIOs are best positioned to translate AI into strategy. Their first step should be running a governance and risk audit: mapping where AI already touches the office (through vendors or staff use), evaluating data quality, and identifying gaps in oversight. From there, CIOs can apply structured framework, such as build vs buy vs partner matrices, to new proposals. They should also maintain dialogue with regulators and peers, ensuring the office isn’t blindsided by compliance shifts. In short, the CIO operationalises the guardrails principals set.

The COO

The COO turns governance into daily practice. That starts with appointing an “AI steward”, a point person to monitor adoption and feedback. Next, the COO should run controlled 90-day pilots of AI tools, with clear success metrics and staff training built in. Mapping workflows is equally important: by identifying where AI can reduce manual load, the COO ensures adoption improves efficiency without fragmenting processes. The COO’s role is about discipline in execution, keeping pilots contained, measuring impact, and scaling only when governance and culture are ready.

Potential quick wins

1. Run a governance audit

Before adding new tools, evaluate how AI already enters your office. Many family offices are surprised to discover exposure through custodians, portfolio managers, or even staff experimenting with public tools. A governance audit maps these touchpoints, identifies gaps in oversight, and clarifies who is responsible for decisions.

Start small: review vendor contracts for AI clauses, check whether your reporting platforms embed AI, and ask staff about unofficial use. The benefit is visibility. With an audit in place, you can spot risks early, create simple approval processes, and set policies that scale as adoption grows.

2. Apply a build vs buy vs partner framework

Choosing how to access AI is one of the most strategic calls a family office will make. Building custom systems offers control but demands significant resources. Buying off-the-shelf software is fast but can create vendor lock-in or data risks. Partnerships balance speed with flexibility.

Applying a structured framework forces clarity: define objectives, weigh costs, assess vendor stability, and consider data ownership. Even testing this framework on one decision; say, evaluating a portfolio reporting vendor, builds muscle for future choices. It helps prevent rushed adoption and ensures AI strategy aligns with the office’s risk appetite and governance priorities.

3. Pilot an ethical code of AI use

Family offices don’t need to wait for regulators to act. Drafting a simple code of conduct for AI can set the tone and reduce risks immediately. This could cover principles like transparency, requiring human-in-the-loop oversight, and prohibiting sensitive data from being entered into public models.

The key is to trial the code on one project or tool. For example, apply it to a 90-day pilot of an AI-driven document review platform. Gather feedback from staff, refine the code, and expand it gradually. The benefit is twofold: it reduces exposure today and builds a culture of responsible AI that will stand up to future regulations.

Looking ahead: Governance as stewardship

Global AI spending is projected to hit $480 billion by 2026. AI-driven systems will become standard across accounting, compliance, and client platforms. Family offices will be surrounded by AI – not just through their own adoption, but through every vendor and partner they rely on. The question is no longer whether AI will touch their operations, but how responsibly it will be integrated.

For family offices, the advantage lies in treating AI adoption as an extension of stewardship. Just as wealth is managed with a long-term lens, AI governance must be approached with continuity and resilience in mind. Embedding guardrails today helps prevent costly mistakes tomorrow, but it also secures reputational credibility and operational advantages that compound over time.

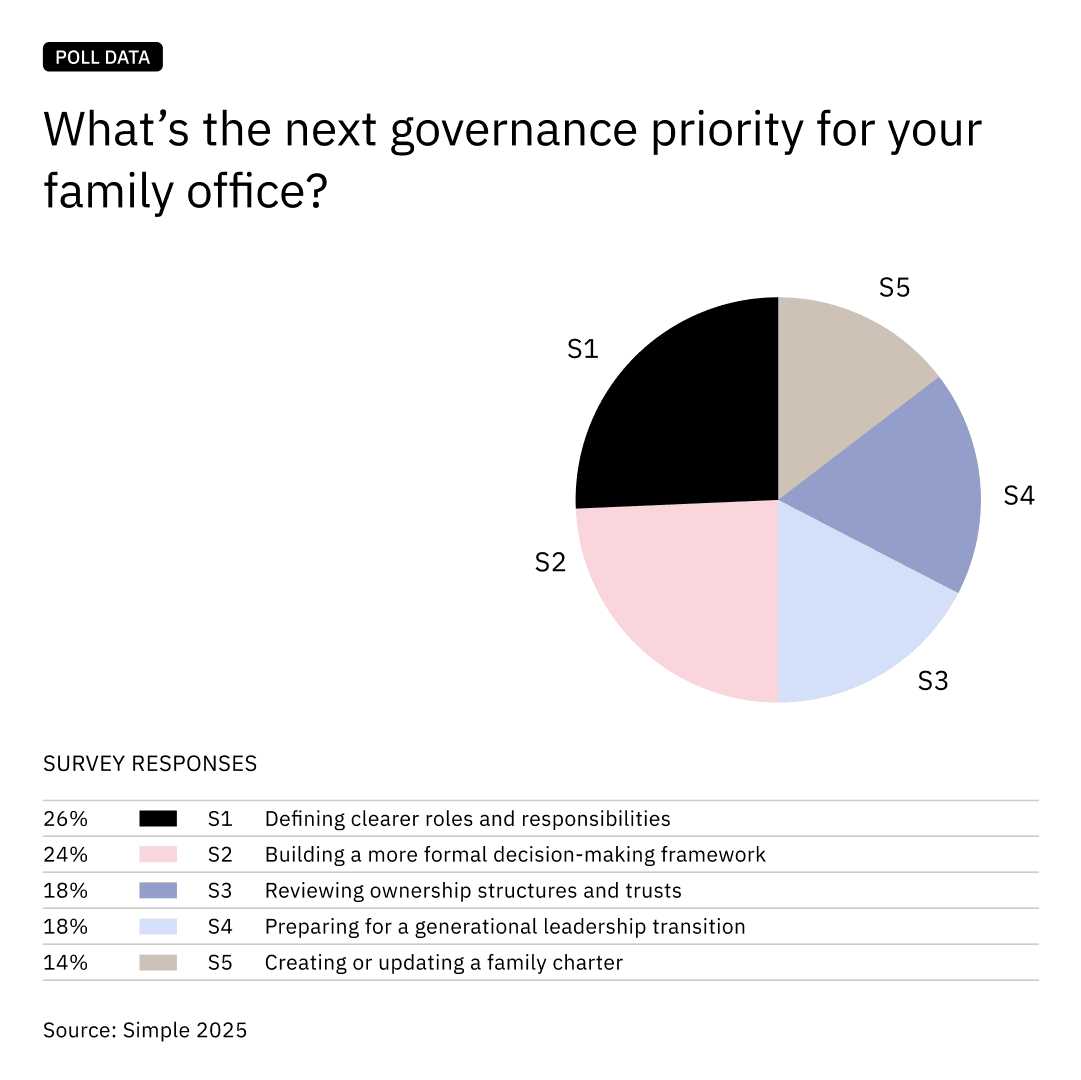

A Simple poll found that 37% of family offices named building a more formal decision-making framework as their next governance priority. Another 21% pointed to clearer roles and responsibilities, and 21% to ownership reviews. These priorities align directly with the needs of AI adoption: clarity, accountability, and frameworks robust enough to guide complex technology choices.

The path forward does not require overhauling every system at once. Instead, it means starting with contained pilots, applying governance principles rigorously, and scaling with confidence. Measured adoption is not a weakness; it is how family offices turn innovation into continuity.

In the years ahead, the family offices that lead will not be the fastest adopters, but the most disciplined stewards: those who align innovation with governance, turning technology risk into a lasting advantage.

Did you miss the first guide in our AI for Family Offices series?

FAQs

How are family offices using AI today?

Most commonly in accounting consolidation, legal contract review, fraud detection, and portfolio analytics. These tools free staff for higher-value work.

What are the biggest governance risks?

Data breaches, shadow AI, algorithmic bias, and lack of oversight. All carry reputational and regulatory consequences.

How should family offices navigate regulations?

Adopt the strictest jurisdiction — for example, EU AI Act standards — as a baseline, and adapt to local variations where required.

Is it better to build or buy AI tools?

It depends on data sensitivity, cost, and speed. A hybrid approach — proprietary builds for sensitive functions, licensed tools for standard ones — often works best.

What role should principals play?

Principals set the tone. By endorsing AI as a fiduciary and governance issue, they legitimise adoption while ensuring it remains aligned with long-term stewardship.

Further Reading

A Simple guide to family office structure

StrategyFamily office structures have evolved significantly over the past few decades, becoming far more sophisticated and efficient. Changes in organisational, legal and governance structures reflect the ambition of modern families to manage their own destiny and thrive into the future, despite complex regulatory environments and emerging risks.

What is generational wealth?

Next GenerationGenerational wealth refers to the transfer of assets or businesses, passed down from one generation to the next, which safeguards the family's future wealth. However, understanding generational wealth is slightly more nuanced than this and often goes beyond simply handing over these assets.

A Family Office Guide on Governance Pitfalls

GovernanceGovernance has become the cornerstone of effective family office strategy. As complexity and expectations grow, families are moving beyond informal arrangements to adopt structured, transparent frameworks. The focus is now on accountability, adaptability, and long-term continuity—ensuring the office remains aligned with both legacy and future vision.