Fortress Thinking: What Family Offices Can Learn from Jamie Dimon

Jamie Dimon’s stature as one of the most disciplined voices in global finance is no accident. It’s the result of decades of deliberate leadership, a firm grip on risk, and an unshakable belief in long-term resilience. From his annual letters to JPMorgan’s fortress balance sheet, Dimon has built a worldview defined by clarity, strength, and stewardship. His thinking continues to shape how institutions interpret risk, offering a valuable lens for family offices navigating their own capital, governance, and global exposure.

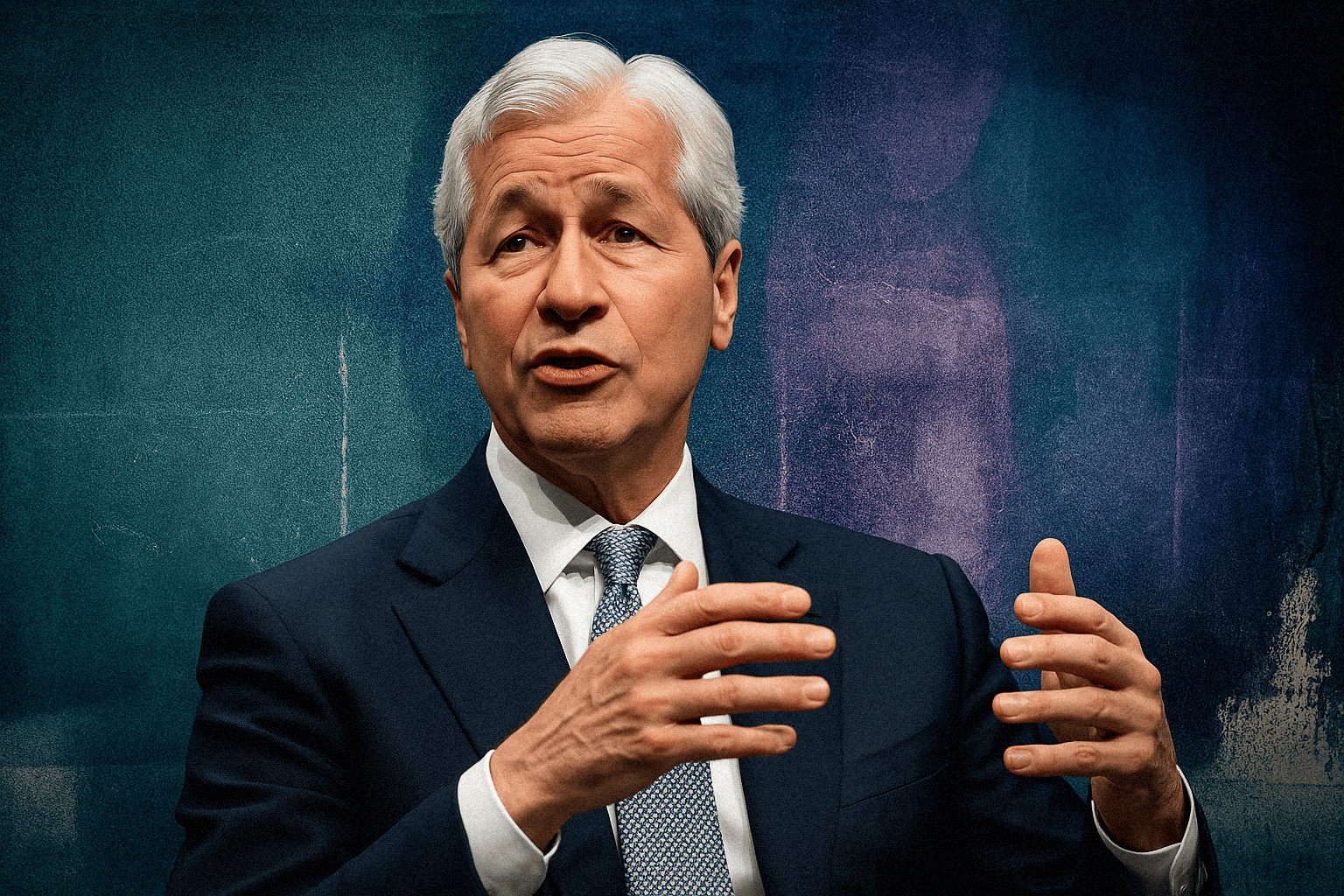

Jamie Dimon has led JPMorgan Chase through crisis, consolidation, and transformation. His disciplined worldview offers a model of clarity that many family offices now reference in times of uncertainty.

About the Company

J.P. Morgan

- Location New York, New York, United States

- Type Financial Institution / Global Bank

- Founded 1799 (as The Manhattan Company; became J.P. Morgan & Co. in 1871)

- Services Investment banking, asset management, private banking, commercial banking, treasury services, wealth management

Why Jamie Dimon Still Matters

Jamie Dimon does not run a family office, but many who do still pay close attention.

As CEO of JPMorgan Chase, Dimon has become a rare constant in a financial world defined by change. Over decades, he has navigated crises, managed through cycles, and communicated with unusual clarity. His influence extends beyond banks and markets. For wealth stewards, he represents a kind of institutional fluency, rooted in risk discipline, leadership continuity, and long-term thinking.

For family offices, the parallels are subtle but significant. While the scale and structure may differ, the underlying challenges – how to allocate capital, govern with resilience, and stay aligned through uncertainty – are often shared. Dimon offers not a blueprint, but a useful benchmark.

The Dimon Doctrine: Leadership in Complexity

Dimon is often described as the last of the old-school Wall Street CEOs, but that understates his range. He is a communicator, strategist, and systems thinker. His annual letters are widely read not because they predict the future, but because they lay out how one of the world’s largest institutions interprets risk and prepares for what may come.

He speaks plainly but precisely: on inflation, interest rates, war, AI, climate risk, and regulatory gaps. He does not merely analyse markets. He articulates how J.P. Morgan is positioning itself in response. For family offices, this kind of transparency offers something rare: a high-level view of how complexity is interpreted at scale.

“Uncertainty is not new. What matters is how you manage through it, calmly, decisively, and with your eyes wide open.”

Many family offices track Dimon not for tactical insight, but for strategic cues. His views on cohesion, accountability, and leadership continuity are relevant for principal-led offices and next-generation stewards alike. Even contentious views, such as his stance on remote work, serve as reference points in internal conversations about culture, team structure, and long-term engagement.

In an environment where the temptation is to chase novelty, Dimon represents something more enduring: a leadership style built on conviction, clarity, and preparedness.

Fortress Thinking: Capital, Liquidity and Readiness

Dimon’s most enduring contribution to institutional thinking is his “fortress balance sheet” philosophy. First coined during the global financial crisis, the idea has matured into a full framework for capital stewardship: build in buffers, maintain flexibility, and always be ready to act when others cannot.

This mindset maps neatly onto family office strategy in 2025. Many offices are sitting on elevated levels of cash and short-duration assets, not from fear, but as a deliberate posture. The fortress model reframes liquidity not as inertia, but as strategic patience.

More broadly, Dimon’s approach reinforces the importance of internal readiness. Resilience is not only about market exposure or asset class diversification. It is also about governance, continuity planning, and decision-making structure. Family offices benefit from asking themselves the same kind of questions: What happens if rates rise again? Are we prepared for sudden shifts in leadership? Can we respond to opportunity without delay?

“Having a fortress balance sheet means being prepared for the unknown. You don’t know what’s coming, but you know it’s coming.”

That said, family offices are not global banks, and they should not behave like them. Dimon’s world is one of regulatory oversight, public markets, and systemic exposure. Family offices operate with greater privacy, more agility, and less institutional drag. Their advantage lies in not needing a fortress the size of JPMorgan’s, but in learning how to build their own version with intent.

The Dimon Filter: Translating Institutional Wisdom

What Dimon offers family offices is not a model to follow, but a filter to apply.

This filter prioritises structural strength, clarity of mandate, and consistency of communication. It’s a mindset that values internal alignment as much as external performance. For family offices, applying the Dimon filter might mean tightening portfolio review rhythms, clarifying investment governance, or giving more intentional shape to succession and legacy planning.

It can also mean resisting unnecessary complexity. Many family offices fall into the trap of over-institutionalising, creating structures that mimic funds or banks, even when they do not serve the underlying mission. Dimon’s success offers a reminder: structure exists to support clarity, not to replace it.

Even in areas like philanthropy, private markets, or brand building, Dimon’s example applies. His alignment between public messaging and institutional action reinforces the value of consistency. For family offices aiming to integrate values and purpose into capital decisions, that lesson is worth carrying forward.

Ultimately, the Dimon filter is not about formality, it is about fidelity. It helps family offices stay true to their own vision while borrowing the best of institutional discipline.

What Family Offices Can Take from Jamie Dimon

Build your own fortress: Liquidity is not about waiting, it’s about readiness. Adopt a structure that allows you to act decisively when others cannot.

Track signals, not noise: You do not need to follow big-bank strategy, but understanding how institutions interpret risk can sharpen your own macro awareness.

Prioritise clarity over complexity: Dimon’s communication style is a reminder that long-term success often depends on clear thinking, not layered process.

Filter, don’t mimic: Use institutional wisdom to reinforce your own structure, but avoid importing bureaucracy or external timelines that do not serve your mission.

Align leadership with purpose: Dimon’s consistency between values, action, and messaging offers a quiet but powerful model for family offices managing legacy across generations.

Institutional Wisdom, Family Agility

Jamie Dimon’s relevance to family offices lies not in his job title, but in his posture. He leads with clarity, absorbs complexity, and communicates risk in human terms. That is a skill family offices increasingly need, not just at the principal level, but across the organisation.

In a world that prizes speed and novelty, Dimon reminds us of the value of composure. For family offices building for decades, not quarters, that is a signal worth tracking.

Further Reading

Peter Thiel’s capital stack: A contrarian view for family offices

InvestmentsPeter Thiel is one of Silicon Valley’s most influential and polarising figures. A billionaire investor, PayPal co-founder, and early Facebook backer, he is also the driving force behind Palantir and Founders Fund. Known for his contrarian worldview and libertarian ideology, Thiel has built a layered approach to managing his wealth. His method blends operating companies, […]

From fragmentation to focus: A $200M portfolio transformation

Technology StacksA UK-based multi-generational single-family office managing over $200 million faced challenges managing its complex portfolio spread across multiple continents and assets. As their sophisticated investments exceeded the limits of their operational infrastructure, they partnered with IQ-EQ to develop a tailored solution. This case study outlines how IQ-EQ helped them shift from a reactive to a […]

The hidden drains on family office portfolios and how to stop them

Listed Stocks & BondsWhen Greenlock started working with funds, a single-family office client asked them to audit their structure. At first, everything looked standard — until they stumbled upon a curious share class. The minimum investment was just $10k, designed for plain-vanilla retail investors with the highest regulatory protection and enormous embedded retrocessions. Clearly, it was not a […]

Larry Ellison: The unconventional billionaire and his family office

LeadershipLawrence Joseph Ellison is one of the world’s most enigmatic billionaires. As a two-time college dropout and a personal friend of the late Steve Jobs and Elon Musk, he has built a reputation for his bold, unconventional approaches to business and lifestyle. As the founder and former CEO of Oracle Corporation, he has chartered a […]