A Guide to Philanthropy for Family Offices

Philanthropy Updated on April 9, 2025Table of Contents

For the modern family office, philanthropy is no longer an afterthought. Instead, it is becoming increasingly integrated into how they support families and is crucial to leaving a lasting legacy. By incorporating philanthropy into a family office, wealthy families can leverage corporate governance structure and manage resources to create meaningful social impact.

Mission and strategy

Getting to the bottom of the motivation for giving is one of the most fundamental steps to take in the philanthropy journey. Family offices must establish a philanthropic purpose aligned with the family’s beliefs, objectives, and resources. That may necessitate a conversation across generations to include every family member’s values and goals.

After determining the values and goals of the family, deciding on the target areas and issues is vital. For example, wanting to dedicate resources towards eradicating world poverty is too general. However, targeted donations to a child feeding program or another non-profit organisation in your region are more focused and may have a measurable impact.

Considering legacy

When considering your philanthropic efforts, it is good to consider the future and legacy that the family wants to leave behind. Philanthropy can play a pivotal role in succession planning and is the perfect place for the next generation to learn about shared values and the responsibility of stewarding the family’s wealth. While it is not the cure for all family ailments, philanthropic activity can bring cohesion and a sense of unity to the family.

A well-structured family foundation is an ideal place to involve family members working outside of the family business to embrace the same values and work towards a common goal.

The 4 Ts of philanthropy

While financial contributions are tremendously valuable, there are numerous ways for wealthy families to give back. Applying the 4 Ts of philanthropy can give family offices a more holistic approach to managing their philanthropic activities effectively.

Time

Family members can contribute their time and expertise to support charitable causes. Family offices can facilitate this by identifying opportunities for volunteering and providing resources and support for family members who wish to get involved in philanthropic activities.

Talent

If time is limited, contributing unique skills, knowledge, and abilities can sometimes have a more positive impact than a financial donation. Family offices can employ family members’ particular skills, expertise, and experience to help philanthropic causes. That might include finding areas where family members can support charitable organisations with their skills in financial management, legal services, or marketing and communications.

Treasure

Treasure refers to the financial resources donated to support charitable causes. That can include making one-time or recurring donations. Family offices can facilitate giving to charitable organisations that align with their values and engage in planned giving through wills, trusts, or other estate-planning vehicles.

Ties

Family offices might use their connections and networks to help philanthropic organisations. For example, they could collaborate on projects with other charitable groups and contributors. Or they can use their influence to promote issues that are important to them.

The last T, which stands for Testimony or “truth-telling,” is often left unmentioned. But it refers to honouring the lived experiences of those facing hardships and bearing witness to their story. For example, if a family member suffered from a mental illness or battled substance abuse, sharing those experiences can help to raise awareness and inspire action for a cause. Shared experiences can be a powerful building block for establishing a family office’s philanthropic endeavours.

Strategic tools for modern philanthropy

Family offices have several options when it comes to using modern tools for philanthropy. Two Simple Experts weighed in on the latest technological and current trends for making an impact.

AI: The family office’s new ally

From legal document analysis to expense management, AI can automate various administrative tasks, saving time and minimising errors. This allows family offices to operate more efficiently and cost-effectively, freeing up resources for strategic initiatives.

“While automation is a significant benefit, AI’s true potential lies in its ability to augment human decision-making, not replace it.”–Toby Usnik, Social Impact Advisor.

By providing data-driven insights and identifying hidden patterns, AI empowers family office professionals to make more informed and nuanced decisions, ultimately leading to better outcomes.

DAFs: Empowering impact

Donor-advised funds (DAFs) are an attractive funding vehicle in today’s modern philanthropy, with benefits including donor curation of gift structure (e.g. loans vs grants), flexibility in terms of assets, tax advantages, and opportunities for strategic and beneficial influence on society and the planet.

Here are some strategic tools and approaches specifically tailored for DAFs:

- Impact investing platforms: DAFs can utilise impact investing platforms to invest their funds in socially responsible enterprises or projects. Additionally, philanthropists can leverage data analytics and metrics to track the effectiveness of their giving.

- Strategic partnerships: Collaborating with other philanthropic organisations, NGOs, government agencies, and corporate partners can amplify the impact of DAFs. By pooling resources and expertise, philanthropists can tackle complex social issues more effectively.

- Education and advocacy: DAFs can fund research and policy advocacy to help raise awareness about important social issues and drive systemic change. Additionally, DAFs can support initiatives focused on promoting diversity, equity, and inclusion within the organisations they fund.

“By leveraging DAFs, family offices can maximise their impact and contribute to positive social change in a meaningful and sustainable way,”–Maggie Spicer, Philanthropic Investment Advisor.

Vehicles for philanthropy

There are several options for family offices depending on philanthropic goals, the amount of control over a charity, and the tax implications.

Some of the vehicles that family offices can use for philanthropy include:

Private Foundations

Private foundations are another popular vehicle for family offices, particularly for those who want to have a high degree of control over their charitable giving. Private foundations are typically non-profit entities funded by the family business. The family retains control over the foundation and reserves the authority to make grants to charities.

Charitable Trusts

Charitable trusts are another option for family offices that want to make a significant philanthropic impact. Charitable trusts are tax efficient and are transferable to family members. Family offices can invest assets and potentially generate income for charitable purposes.

Direct Giving

Direct giving involves making charitable donations directly to non-profit organisations. This approach offers flexibility and can be particularly effective for family offices that want to support a particular cause.

Actionable steps

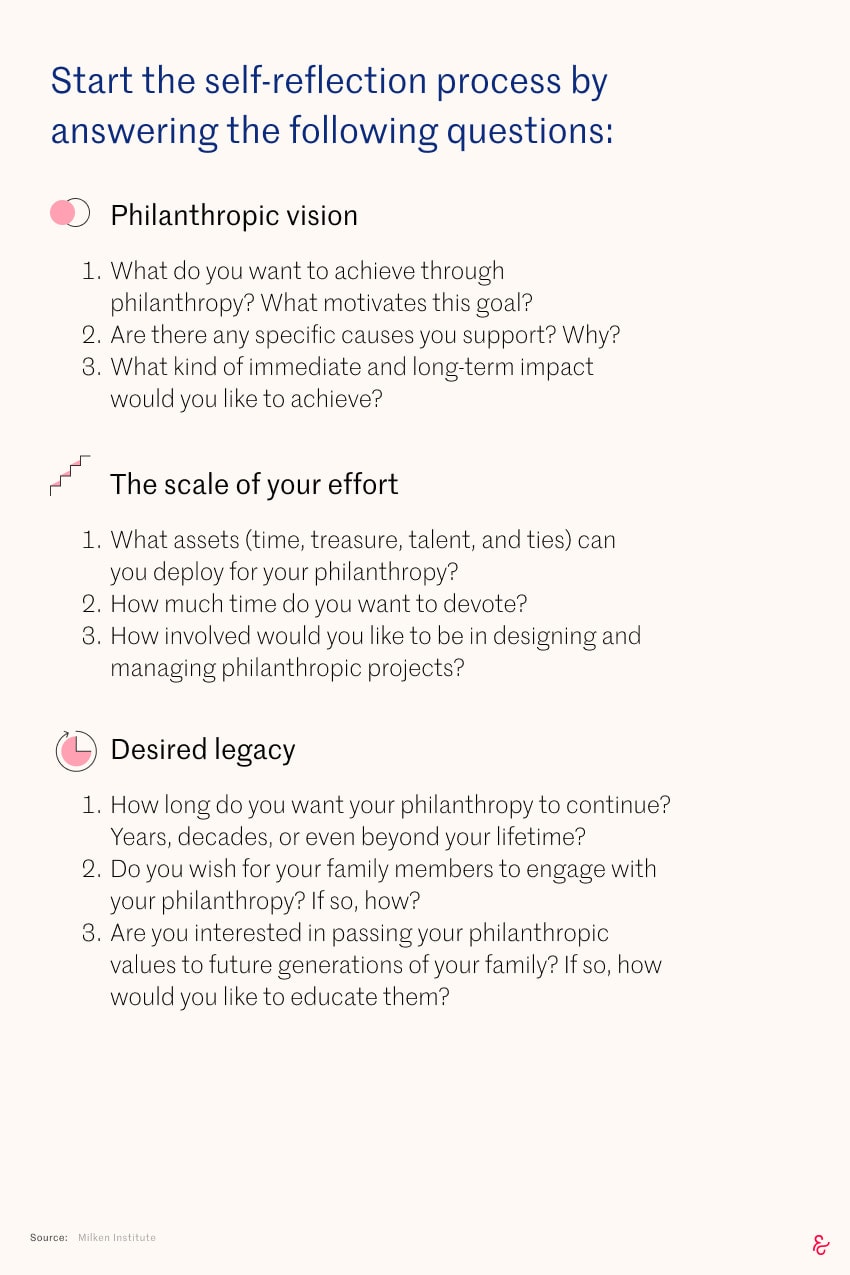

1. Reflect

Self-reflection is the first step toward more meaningful philanthropy. Asking honest, probing questions about your motivation, engagement preferences, and desired outcomes can help clarify goals and priorities and give guidance toward the appropriate philanthropic vehicle.

Don’t forget to consider the following:

1. How much are you willing to spend to support your philanthropy?

2. Would you prefer publicity or privacy?

2. Record

Once you have completed reflection, your thoughts, identify, and priorities should be crystallised. Capture them in writing as soon as possible. Documenting your intentions is a powerful motivator to help you set actionable goals, maintain your focus, and ultimately achieve your philanthropic vision.

3. Refine

Once you have documented your philanthropic goals and priorities, it may be necessary to refine your plan further. This process can necessitate the help of a trusted philanthropic advisor.

Multitasking is not usually the most effective approach. You are more likely to make a meaningful impact when you channel your energy and resources into one or two projects at a time. Later on, you can always apply your learnings to additional charitable endeavours.

How often should you go through these exercises?

If new to philanthropy, the family office should review these three exercises every year to adjust their goals and objectives according to their experience. If more established in philanthropy and do not anticipate drastic shifts in your goals and objectives, a family office can go through these philanthropy guide exercises every three years.

Milken Institute

This guide originally appeared in The Milken Institute and was written by Hilary McConnaughey and Melissa Stevens. The Milken Institute is a non-profit think tank that promotes economic and social policy solutions through research and analysis. One of the areas of focus for the Milken Institute is philanthropy, and they offer a range of resources and programs to help family offices with their philanthropic activities.

The Milken Institute can be a valuable resource for family offices looking to enhance their philanthropic activities. Through their research, convenings, advisory services, and educational resources, the Milken Institute can help family offices stay informed about the latest trends and best practices in philanthropy and develop effective strategies for achieving their philanthropic goals.

Further Reading

A Simple guide to family office service design

OperationsThis guide to family office service design explores the essential elements of design thinking for family offices, offering a comprehensive approach to enhancing their efficiency and impact.

A Simple guide to family office recruitment

RecruitmentThis guide provides a deep dive into the unique aspects of recruiting for family offices. Drawing on insights from Simple’s experts and online research surveys, it suggests actionable tips and proven methods to navigate the recruitment process. With the purpose of providing an overview of the landscape, it covers all the basics, starting from identifying specific talent needs to implementing effective onboarding and retention strategies.

A Simple guide to asset allocation for family offices

InvestmentsAsset allocation is crucial for family offices to manage their investments effectively and balance risk and reward. Our comprehensive guide on asset allocation for family offices covers key factors to consider, common strategies, and best practices.

How to select the best accounting software for your family office

OperationsAccounting, though it may be less thrilling and cutting-edge than AI or alternative investments, plays an essential role in the smooth functioning of family office operations. It is the backbone on which all other activities and processes are built. This guide explores family office accounting, how it works, its features and how to select the best accounting software provider for your organisation.