A Simple guide to asset allocation for family offices

Investments Updated on May 5, 2025Table of Contents

In 2023, family offices decided to reduce their investment risks. Although they were optimistic at the end of 2021, the decline in the stock market, high inflation, and interest rate hikes in 2022 dampened their appetite for risky asset classes. As market cycles rotate, different assets yield different returns. Therefore, capital needs to be redistributed for wealth preservation and growth.

This guide discusses why asset allocation is essential for family office investments, what factors they should consider, and highlights common strategies. In addition, it outlines the best practices for guidance on their asset allocation journey.

What is asset allocation?

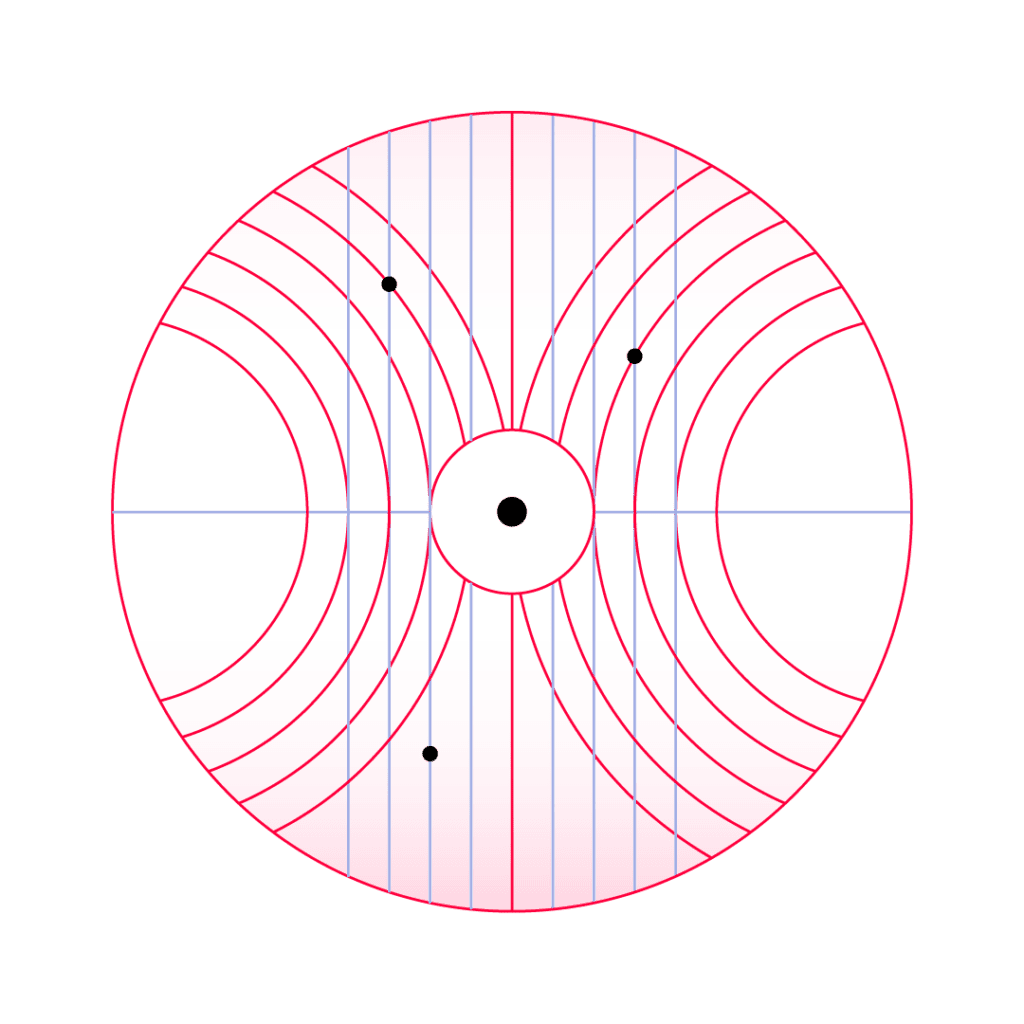

Asset allocation is an investment strategy to balance the risk and rewards of family offices‘ asset portfolios. It involves distributing capital across asset classes to minimise risk and achieve objectives. There is no right or wrong way to allocate assets. The ideal balance matches the family’s time frame and risk appetite.

According to Goldman Sachs, family offices’ asset allocation tends to have outsized exposure to alternative investments. On average, 45% combined allocation to private equity, real estate, private credit, and hedge funds. Family offices are a private wealth management sector not incumbent by benchmarks and stakeholder reporting. To preserve and grow family wealth, a family may engage in various investment activities, such as private equity, impact investing, and direct investment.

Asset allocation in family offices

Managing investments is one of the core services that family offices offer. And asset allocation can be a powerful tool in financial planning and maintaining generational wealth. Asset allocation goes hand-in-hand with portfolio ‘diversification.’ Family offices can use asset allocation to diversify their investments and limit overexposure to a particular asset class. Diversification can help protect the family’s wealth in times of uncertainty. In addition, it can optimise investment performance during times of economic expansion.

However, asset allocation is not limited to diversification only. After all, Warren Buffet sees diversification as ‘protection against ignorance’. Like the Goldman Sachs family investment report, the investment guru prefers portfolio concentration and has allocated 44% of his portfolio to Apple stocks, with outstanding results.

What factors to consider

Regardless of diversification or concentration preferences, here are key factors that all family offices should consider:

Family objectives and goals

Family offices need to consider their family’s specific financial objectives and goals. Is the family concerned about wealth preservation for future generations, or are they looking for new opportunities to grow their wealth? Is the family concerned with succession planning, and is it involved in philanthropic activities? The asset allocation structure should support and align with these objectives.

Risk tolerance and liquidity needs

Family offices must assess the family’s risk tolerance and liquidity need to achieve the best asset allocation balance. Even though most family office investments are long-term, the family’s comfort levels should take priority. For example, conservative families might be sensitive to the price fluctuations of their investment portfolios. In this case, it would be critical to steer clear of volatile asset classes. In addition, the family should always remain liquid enough to fulfil short-term commitments or unforeseen expenses.

Tax and legal considerations

Investment vehicles, jurisdictions, and tax constraints might influence a family’s after-tax profits. When distributing assets, it is critical to consider the tax implications and legal regulations. In this regard, the family office should consider collaborating with tax professionals and legal specialists to develop an asset allocation strategy that is both tax-efficient and compliant. Engaging qualified professionals can provide valuable guidance and help execute the asset allocation strategy effectively.

Four common asset allocation strategies

1. Strategic asset allocation

Strategic asset allocation is a more passive approach. It is concerned with reaching the investment goals in the long term. It involves allocating a certain percentage of total capital to various asset classes. The strategy allocates money to stocks, bonds, cash, and alternative investments based on historical returns, risk profiles, and correlations. For example, the 60/40 split gives 60% of the capital to the stock market and 40% to the bond market. Periodically, it rebalances the portfolio to maintain the desired allocation.

2. Tactical asset allocation

Tactical asset allocation is a more active management strategy. It involves making short-term adjustments to a portfolio’s asset allocation based on market conditions, economic indicators, or other factors. For example, in 2020, tactical strategies would have reduced their portfolio’s exposure to the stock market. The goal is to maximise returns and minimise losses during economic volatility.

3. Dynamic asset allocation

A dynamic asset allocation strategy balances strategic and tactical asset allocation strategies. It involves improving the portfolio’s long-term risk-return characteristics while adapting to changing market conditions. Portfolio adjustments are only in response to significant changes in the market or the portfolio’s long-term objectives.

4. Core-satellite allocation

This strategy aims to take advantage of both passive and active investment management. It splits the portfolio into two: the core and satellite portfolios. The core portfolio typically consists of diversified, low-cost investments such as index funds managed passively. The satellite portfolios are smaller, more focused investments that aim to add value through active management or specialised strategies. The idea is for the core portion to provide stability and broad market exposure while the satellite portion provides alpha or outperforms the market.

Asset allocation best practices

Regarding asset allocation, several best practices can help family offices make informed decisions and optimise their portfolios. Here are some asset allocation best practices to consider:

Define investment objectives

Clearly defining your family’s investment goals and objectives should be the foundation for a family office’s asset allocation strategy. Ideally, the family should have an investment policy statement (IPS). And it should serve as a roadmap for the family office’s investment decision-making process.

Consider risk-return profile

The family office should grasp the risk-return characteristics of various asset classes and strike a balance corresponding to the family’s risk tolerance and investment goals. Asset allocation works best when assets have low correlations with one another, as this can assist in minimising overall portfolio volatility and enhance performance. Asset correlation should influence the selection of stocks, bonds, cash, real estate, and commodities.

Review portfolio regularly

Conduct periodic reviews of your portfolio to ensure it aligns with your investment goals. Evaluate current market conditions and economic trends and rebalance the portfolio when necessary to return the asset allocation to your desired targets.

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Further Reading

ESG for family offices: How to draft an ESG statement

InvestmentsESG is no longer just a buzzword associated with impact investing. For future-thinking family offices, incorporating ESG into all financial decisions is key. Here's what you need to know about ESG and how family offices can draft an ESG statement.

How to get started with venture investments – a step-by-step guide

Venture CapitalDespite a drop in deals, now is a great moment to start investing in venture capital. To get started, family offices must ensure they understand the risk versus reward, and then set out their strategy for allocation, and where they will focus their investments. First timers are advised to start small, working with experienced fund managers, before progressing to larger allocations and direct investments. Success requires patience, but done right, the returns are worth it.

A Simple guide to NFTs

CryptocurrencyNow that you've got to grips with cryptocurrency, it's time to understand NFTs. This is a comprehensive guide to everything you ever wanted to know about NFTs but didn't want to ask. From the origin of NFTs, and their rise to prominence, as well as how to buy and sell them, we're covering all the aspects of this trending digital asset.

A Family Office Guide on Governance Pitfalls

GovernanceGovernance has become the cornerstone of effective family office strategy. As complexity and expectations grow, families are moving beyond informal arrangements to adopt structured, transparent frameworks. The focus is now on accountability, adaptability, and long-term continuity—ensuring the office remains aligned with both legacy and future vision.