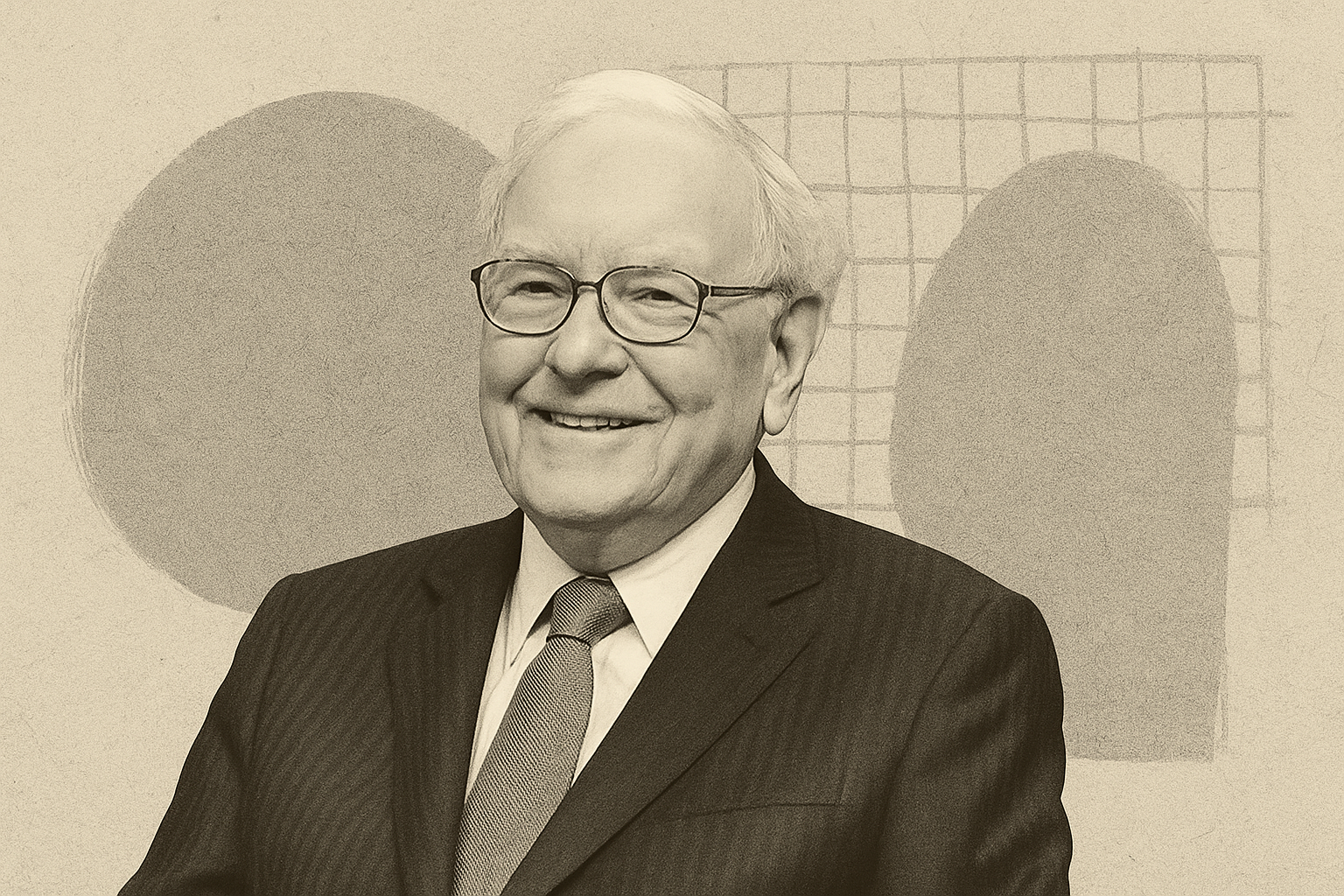

Warren Buffett, the legendary investor and longtime chairman of Berkshire Hathaway, is stepping back after decades at the helm of one of the world’s most iconic companies. Often cited as the greatest capital allocator of our time, Buffett has shaped the financial landscape through his disciplined investment philosophy, minimalist governance, and deep commitment to long-term thinking. As leadership transitions to Greg Abel, this case study explores what family offices can learn from the enduring structure behind the Berkshire model.

What would Warren do? Succession, stewardship and the family office playbook

Although Buffett never established a conventional family office, the way he built Berkshire Hathaway reflects many of the same aims: preserving wealth, codifying values, and ensuring continuity across generations. With a small headquarters in Omaha and a culture rooted in trust, clarity, and patience, Berkshire stands as a powerful example of what sustainable stewardship can look like in practice.

About the Company

Berkshire Hathaway Inc.

- Location Omaha, Nebraska

- Type Holding Company

- Founded 1839 (Buffett took control in 1965)

- Services Insurance, Utilities, Railways, Public and Private Equity Investments

Early life and career

Warren Edward Buffett was born in 1930 in Omaha, Nebraska, during the Great Depression. His father, Howard, was a stockbroker and congressman, while his mother, Leila, ran a disciplined household. Buffett showed early financial instincts, buying his first stock at eleven and filing taxes at thirteen.

After graduating from the University of Nebraska, he went on to study under Benjamin Graham at Columbia Business School. There he absorbed the core principles of value investing. At 26, he launched Buffett Partnership Ltd., which grew rapidly. In 1965, he assumed control of the declining textile company Berkshire Hathaway, a move that would define his legacy.

Building Berkshire Hathaway

Buffett did not just build a holding company. He created an ecosystem based on trust and autonomy. Rather than centralising control, he structured Berkshire as a group of decentralised businesses, led by independently minded managers. Berkshire eventually became a fortress of capital, with interests in insurance, energy, railways and global equities including Coca-Cola, Apple and American Express.

By the 2000s, Berkshire had grown into one of the most respected conglomerates in the world. Buffett resisted calls to modernise its structure, instead relying on a small headquarters team, permanent capital and a philosophy grounded in clarity and restraint.

A philosophy of continuity

Buffett never set up a formal family office. However, his approach to legacy and wealth mirrors many of the challenges family offices face. He prioritised long-term thinking, codified values and delegated authority through gradual empowerment.

With the formal naming of Greg Abel as his successor in 2021, Buffett confirmed a transition that had been in motion for over a decade. Abel, alongside Ajit Jain, Todd Combs and Ted Weschler, represents a team-based model of succession grounded in loyalty and performance.

Greg understands our culture. He’s smart. He’s the right person.

– Warren Buffett, 2021 Shareholder Meeting

What Buffett did differently

Succession as an operating rhythm

Greg Abel’s rise wasn’t a last-minute decision. It was the result of years of deliberate visibility, strategic involvement, and steady integration into the decision-making rhythm. Succession wasn’t a future plan; it was already happening in real time.

Codify the investment culture

Buffett didn’t rely on instinct alone, he wrote things down. His shareholder letters are more than updates; they’re a public operating manual. Family offices can do the same by articulating the why behind their decisions, not just the what.

Keep governance simple, and human

Berkshire doesn’t run on committees or consultants. With fewer than 30 people at headquarters, it relies on clarity and trust. That model reminds family offices that simplicity can scale — and that structure should never come at the cost of culture.

Delegate before you exit

Buffett empowered his successors years before stepping back. That kind of phased handover allowed the organisation to adapt while the founder was still there to guide it. For family offices, the lesson is clear: transition isn’t a moment, it’s a process.

Lessons for family offices

Buffett’s approach wasn’t about rigid plans or last-minute handovers. It was about building something that could endure. Here’s how family offices can translate that mindset into their own strategies.

Start with culture and make it stick.

Buffett didn’t just talk about values, he embedded them in every letter, decision, and relationship. Family offices should do the same by documenting their investment philosophy, governance model and guiding principles, then making these part of everyday life, not just a binder on a shelf.

Look beyond charisma. Choose the steady hand.

Greg Abel is not a headline-maker. He’s a steward, consistent, thoughtful, and trusted. Family offices would do well to think in the same way when appointing future leaders. It’s not about the loudest voice in the room, but the one who understands both the capital and the culture.

Talk about succession before you have to.

Buffett didn’t keep his plans a secret. Through shareholder meetings and public letters, he built trust by being open about the road ahead. Family offices can create similar clarity through structured updates, annual retreats, or even formal statements that outline what’s next and why.

Let go, and set the stage to be let go of.

Perhaps the most important lesson of all: design a system that can function without you. Buffett didn’t just prepare for the future, he built an institution that could thrive without him. That kind of foresight is what turns a founder’s vision into a family’s legacy.

Imagining a “Berkshire for Families”

What if your family office operated more like Berkshire Hathaway?

Start by thinking of your core holdings the way Buffett treats his operating companies, not as assets to be micromanaged, but as trusted entities run by capable stewards. Delegate with confidence, set clear expectations, and give them the room to grow over decades, not quarters.

Then, swap the annual letter to shareholders for a regular family office review. Keep it clear, honest and focused. Share your investment philosophy, reflect on results, and articulate the values behind key decisions. It’s not about performance alone; it’s about purpose.

Finally, take a page from the famed Berkshire shareholder meetings and reimagine your family forum. Instead of a closed-door check-in or a once-a-year reunion, use it as a platform to reinforce alignment, invite questions and cultivate long-term thinking across generations.

Because in the end, legacy isn’t built by chance. It’s built by structure, communication and trust, the same foundations that made Berkshire a blueprint, not just a business.

The Simple takeaway

Warren Buffett didn’t just plan for succession, he operationalised it. He didn’t rely on charisma or last-minute decisions, he embedded values into people, documents, and day-to-day decisions. At Berkshire Hathaway, leadership wasn’t handed over in a crisis or behind closed doors. It was rehearsed, tested, and communicated over many years. The result is a company that continues to reflect its founder’s principles without being dependent on his presence.

“If you care about what happens after you’re gone, the question isn’t just who follows you. It’s what survives you.”

Further Reading

What would Warren do? Succession, stewardship and the family office playbook

InvestmentsWarren Buffett, the legendary investor and longtime chairman of Berkshire Hathaway, is stepping back after decades at the helm of one of the world’s most iconic companies. Often cited as the greatest capital allocator of our time, Buffett has shaped the financial landscape through his disciplined investment philosophy, minimalist governance, and deep commitment to long-term […]

Operating from principles: The Dalio Family Office

InvestmentsRay Dalio, the influential founder of Bridgewater Associates, a leading U.S. hedge fund, is frequently sought out for his insights during periods of geopolitical uncertainty and potential market downturns. His firm, now celebrating its 50th anniversary, has withstood over five market crashes and numerous economic downturns. Dalio, also the author of the acclaimed book Principles: […]

Creating a world-class single-family office infrastructure with Masttro

WealthTechJefferson River Capital is a NYC single-family office with a portfolio of over $1 billion in assets across public and private markets. The family has been investing and growing a diverse portfolio for more than 30 years with a small operating team. This case study covers how Masttro helped them create a nimble, world-class portfolio […]

Alwy’s Transformation: From B2C Fintech to B2B Powerhouse for Wealth Managers

WealthTechAlwy began its journey as a B2C fintech, aiming to simplify personal finance for individuals. While the platform garnered significant user adoption, it became clear that the potential for greater impact—and opportunity—lay in empowering financial advisors who directly manage wealth for clients. In this case study, we delve into how Alwy transitioned from a B2C […]