Auria

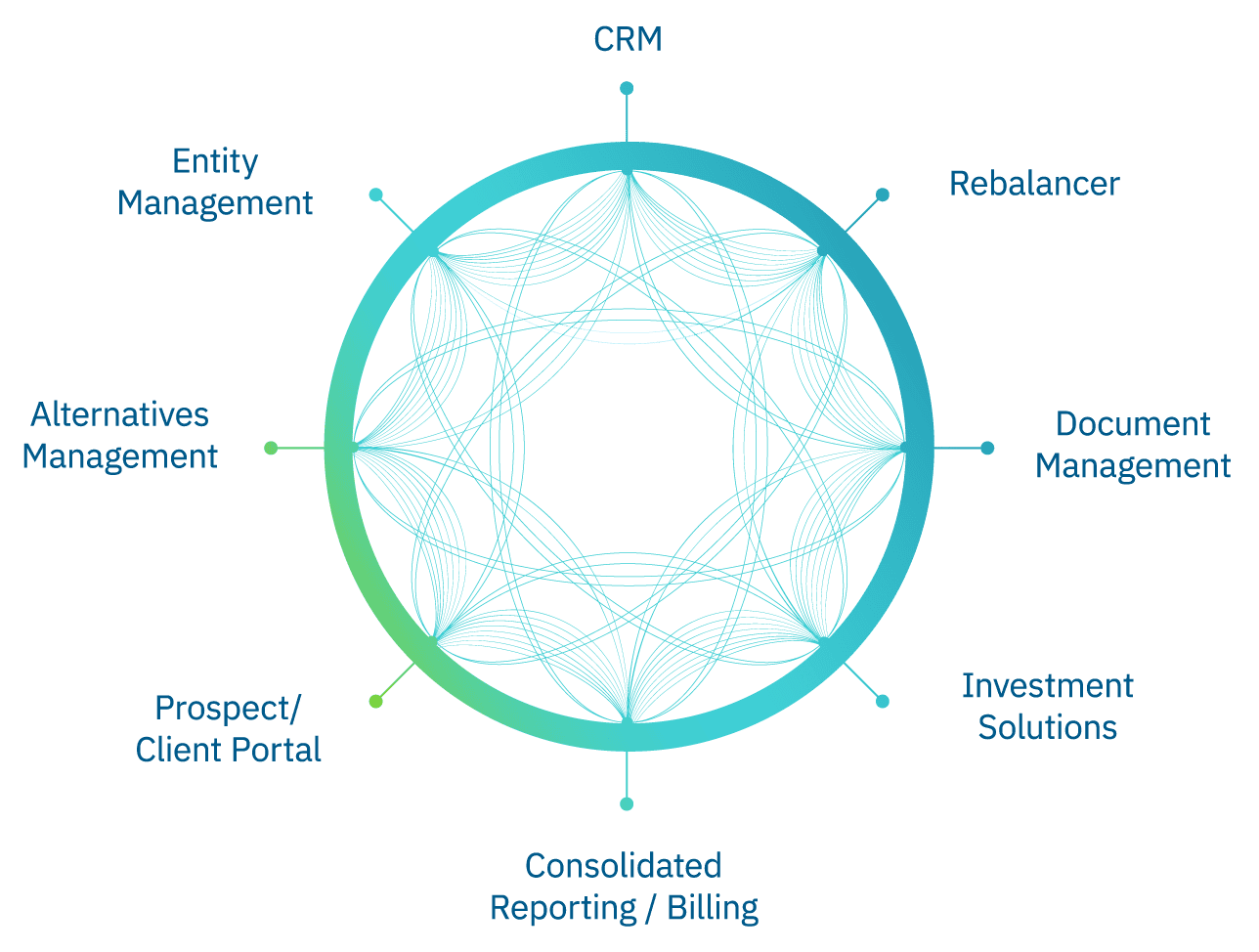

Auria is a modern technology solution that unites essential capabilities—data aggregation, performance reporting, billing, document management, CRM and client portal—into a single, seamless interface, while also empowering wealth managers to handle intricate entities, track alternative investments and more.

Have a question regarding Auria?

Contact Auria directly, or opt for discretion with our private exploration option and take advantage of a free 20-minute consultation with the Simple team to thoroughly explore your service requirements.

What sets Auria apart?

"We believe Auria’s single data model and source code, combined with an intuitive experience can transform how wealth managers serve their clients."

Kartik Srinivasan

Product

Get an overview of what Auria does.

Main Tasks

- Consolidated Reporting,

- CRM,

- Data Aggregation,

- Portfolio Management,

- Trading

Top features

- Ability to Whitelabel,

- Custom Reports,

- Full Multi-Currency Support,

- Mobile App

Assets supported

- Alternatives,

- Art & Collectables,

- Cash & Equivalents,

- Bankable or Financial Assets & Funds,

- Cryptocurrency,

- Direct Private Equity,

- Equities,

- Fixed Income,

- Hedge Funds,

- Insurance,

- Real Estate,

- REITS,

- Private Equity,

- Venture Capital

Whitelabel

- Yes

Type of software

- SAAS

Integrations

- Financial planning,

- Custodians,

- Risk,

- Compliance

Mobile App

- Yes

Type of data

- Transaction level

Accuracy

- Reconcile data with custodian info

Custodians

- 50+

Time to new custodian

- 4 weeks

Multi-currency

- Users can set multiple base currencies

Regulated

- Yes

Regulated by

- SEC

Cost structure

- AUM-based,

- Flat fee,

- Other

Rates

- Pricing depends on factors like AUM, accounts, and entities and can vary based on the type of firm (SFO, MFO, RIA).

Key Company Information

Have a look at the company, clients, and references to learn whether this is a match for you.

Employees

- 100-500

Founded

- 2012

Locations

- Chicago

Top 5 Markets

- United States of America

Ownership

- Owned by management,

- Key staff also have ownership

Focus

- Investment & Financial Advisors (RIAs/IFAs)

Secondary focus

- Individual wealth owners,

- Single-family offices,

- Multi-family offices,

- Investment & Financial Advisors (RIAs/IFAs),

- Banks

Support & Services

Learn what support and services you can expect

Support options

Dedicated contact,

General contact mail or phone

Pricing of support

Free support

Onboarding

2-8 weeks

We also reviewed some other Consolidated Reporting Providers

PandaConnect

Denmark Consolidated ReportingPandaConnect is a global full-scale investment administration solution servicing clients around the world covering all asset classes both bankable and non-bankable...

MyFO

Canada

Consolidated Reporting

The most advanced family office experience which merges efficiency and advanced AI to bring family office services to your fingertips.

Abbove

Belgium

Consolidated Reporting

Abbove helps patrimonial advisors to serve their clients with a holistic and structured approach on their global wealth.