A Simple guide to family office services

Family governance Updated on September 9, 2025Table of Contents

- What are family office services?

- Wealth management and advisory services

- Estate and succession planning

- Global structuring and jurisdiction choices

- Philanthropy and impact investing

- Lifestyle and concierge services

- Family governance and education

- Outsourced and virtual family offices

- Family office trends and future outlook

- Four steps to adding a service (using design thinking principles)

- Conclusion

Every family office is a little different, tailored to its own unique needs and goals. That said, family office services aren’t a one-size-fits-all solution. But what we do know is that almost every family office shares a common goal: to “grow and preserve” generational wealth. And that means there are certain basic services that tend to be essential for most family offices.

In this guide, we’ll dive into what family office services actually mean and highlight the top five core services you’ll usually find in them. Plus, we’ll take a look at some emerging trends that are shaping the future of family offices. Then finally, whether you’re starting or considering adding a new service to refine your family office, we walk you through a four-step process using service design principles.

What are family office services?

Family office services encompass a broad range of professional support, dedicated to meeting ultra-high-net-worth families’ financial and personal needs. At the heart of these services is a focus on wealth preservation, which involves protecting family assets and ensuring that they continue accumulating over generations. This is accomplished through wealth management, effective risk management, and strategic tax solutions.

In addition to managing financial matters, family offices may also handle investment strategies that align with the family’s unique goals, risk appetite, and investment timelines. They also play a significant role in legacy planning, ensuring wealth transfer across generations, and engaging in philanthropy that reflects their values.

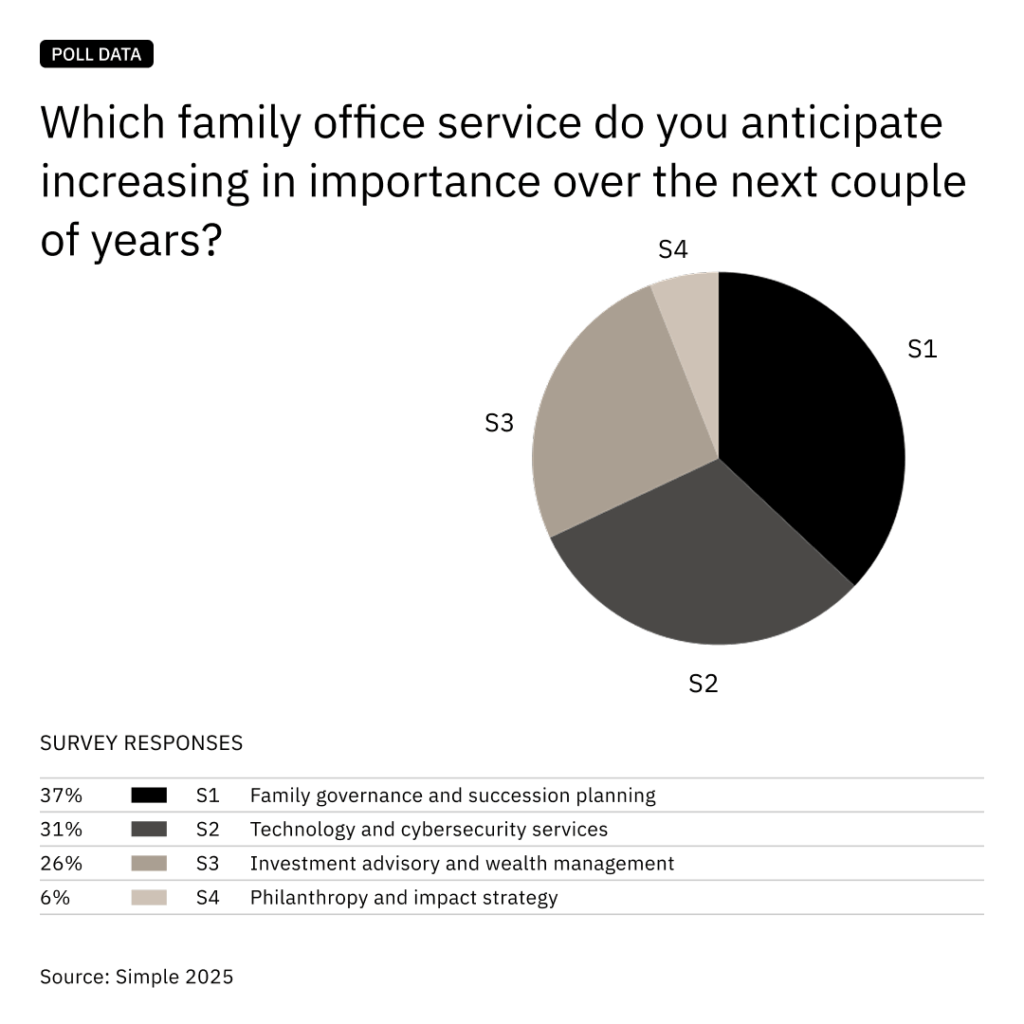

In fact, a recent Simple poll asked family offices which services they anticipate will increase in importance over the next couple of years. The results were as follows:

Wealth management and advisory services

If the goal is preserving and growing family wealth, then wealth management and investment services are at the top of the family office services’ list. How these services manifest depends on the individual family office. For instance, some families’ wealth may be tied up in a family business, while others are managing wealth passed down by previous generations.

A family office itself may be in charge of managing the family’s assets, or it could outsource the task to an investment advisor or other financial institution. Either way, where there’s a family office, a designated lead or team exists to help manage the family’s private wealth.

Estate and succession planning

The end goal of “preserving and growing” wealth is to ensure it reaches future generations. While not at the top of the list of services and quite often neglected until forced to undertake the planning due to unforeseen circumstances, handling estate planning and succession planning services presents an opportunity for family offices to shine.

If you’ve watched the series Succession, you will understand the value of having professional and impartial outsiders handle the intricacies of distributing wealth and passing down assets to family members. Whether handled in-house or outsourced to external advisors, the impact of estate and succession planning will affect the longevity of any family office.

Global structuring and jurisdiction choices

Where a family office is established can be just as important as how it is structured. Jurisdictional choices affect tax efficiency, privacy, access to financial expertise, and even succession outcomes. Families often weigh several factors, from regulatory requirements and political stability to lifestyle considerations and ease of doing business.

Some of the most established hubs include:

Singapore – attractive tax incentives such as 13O and 13U schemes, strong financial regulation, and a growing ecosystem of global family offices.

United Arab Emirates – residency pathways like the Golden Visa, progressive policies on digital assets, and a cosmopolitan lifestyle.

Switzerland – renowned for its discretion, heritage, and robust financial services sector, with proximity to European markets.

United States – Delaware and Wyoming remain popular for trust and LLC structures, offering flexibility and strong legal frameworks.

Choosing the right jurisdiction depends on the family’s priorities, whether that is optimising for tax, securing confidentiality, or tapping into a particular regional network. In practice, many families use a hybrid approach, combining entities across jurisdictions to balance efficiency with diversification of risk.

Philanthropy and impact investing

Doing good just feels good, and philanthropy or impact investing is one area where a family office can actually extend its family values to the greater society. Now, how that takes shape depends on the family’s values.

Some families are content to form an outside foundation to tackle all work on the ground – think the Gates Foundation. Others focus their entire family office operations on their philanthropic endeavours – think The Ballmer Group. While charitable giving can take many forms, experts agree that it’s an undeniable way to get the next generation involved.

Lifestyle and concierge services

For the non-financial, or rather, let’s say, the “preserving” side of family office wealth management, looking after the well-being of the principal and other family members can inadvertently fall on the family office staff. Lifestyle and concierge services, whether offered by individuals or companies, play a crucial role in supporting various facets of personal life, such as lifestyle choices, household management, and travel planning.

This family office service encompasses a range of services where family offices are tasked with meeting their clients’ lifestyle needs. These can include anything from booking family vacations, managing travel arrangements and handling personal security.

Family governance and education

Governance involves creating structures, like family councils or charters, to guide decision-making, resolve conflicts, and align family members on shared goals and values. It’s all about developing frameworks that promote transparency and accountability and, perhaps most importantly, prevent family disputes that could fracture wealth or relationships.

A well-structured governance model often includes a family constitution (outlining values and principles), regular family assemblies for alignment, and a family council to handle ongoing communication. These measures not only preserve wealth but also strengthen relationships by providing clarity around roles and expectations.

Education, meanwhile, equips the next generation with the skills to manage the family wealth responsibly. This can include financial literacy programs, mentorship on investment strategies, or training in philanthropy and leadership. By involving younger members early – through family meetings or internships within the family office – families build a sense of stewardship. Tailored to each family’s dynamics, these efforts ensure wealth isn’t just preserved but thrives across generations, balancing individual aspirations with collective goals.

Outsourced and virtual family offices

Not every family requires or wants the overhead of a dedicated office. Increasingly, families are opting to outsource specific functions – such as tax structuring, legal services, cybersecurity, or investment management – to trusted external providers. Some even use virtual family office models, combining technology platforms with a network of specialist advisors.

This approach can deliver flexibility and efficiency, particularly for families below the threshold for a single-family office, while still maintaining control over strategic decisions.

Family office trends and future outlook

AI & technology

Artificial intelligence and digital tools are reshaping family office operations. AI-driven platforms can analyse vast datasets, highlight risks, and stress-test portfolios more effectively than human teams. Automation tools and robo-advisors streamline allocation, freeing staff to focus on strategy.

Beyond investments, reporting dashboards and predictive analytics improve transparency, while AI-powered cybersecurity tools strengthen privacy. Used wisely, AI equips family offices with sharper insight, stronger defences, and the ability to scale without losing discretion.

Growth of multi-family offices

Multi-family offices (MFOs) are gaining traction as cost-effective alternatives to stand-alone offices, pooling resources to deliver economies of scale and access to top-tier expertise.

Alongside larger MFOs, boutique firms offer targeted solutions, often in areas like governance, impact, or cross-border structuring, without the overhead of a dedicated office. This reflects a broader shift towards collaboration, efficiency, and specialist access, while keeping services aligned with family values.

Increase of outsourced services

More families are outsourcing to specialist providers for investment management, tax, legal structuring, and cybersecurity instead of building in-house teams. This approach lowers costs while tapping into innovation and expertise.

Outsourcing has also fuelled hybrid and virtual models, where technology integrates external advisors into a seamless framework. Done well, this offers agility and scalability without sacrificing privacy or control.

Four steps to adding a service (using design thinking principles)

1. Empathise

This phase involves deeply understanding the client’s needs, desires, and pain points. For family offices, this could mean conducting interviews with principals, family members, and key stakeholders to gather insights into their experiences and expectations. Techniques like empathy maps can be used to capture these insights visually.

Moreover, key stakeholders, such as existing advisors (legal, tax, investment), administrative staff, and even beneficiaries, should be included in this discovery phase. Their insights are invaluable, as they often have a direct pulse on operational efficiencies.

2. Ideate

The next stage of developing services focuses on generating a wide range of ideas and possible solutions. For family offices, it’s essential to organise lively brainstorming sessions that encourage participation and the exchange of thoughts.

Involving both internal team members and external stakeholders can present new perspectives aas well as benchemark ideas with industry standards. The main aim is to go past traditional offerings and uncover genuinely innovative and comprehensive service ideas that that increase value and satisfaction for everyone involved.

3. Prototype

Once a robust set of ideas has been generated, the next step is to translate these abstract concepts into tangible prototypes of the proposed service solutions. Service prototypes for family offices could mean anything from outlining the “how-to” plan of a user journey, to even acting out physical role-playing scenarios.

The key objective is not to create a fully polished, final product, but rather a representation that is sufficient to test assumptions, gather feedback, and identify areas for improvement. Approach this process with culture of experimentational learning.

4. Test

The final stage is the testing phase. The idea is to deploy the service to “what-would-be” the real end-users. That means extending beyond internal and external teams to include even a small group of target demographic representatives.

This phase is all about gathering authentic, unbiased feedback on the overall user experience. It’s then advisable to use this feedback to pinpoint the areas for improvement. Establishing a short and efficient feedback loop is vital for making the necessary adjustments to refine the fundamental offering so that it truly meets the user’s needs and expectations.

Conclusion

Imagine a family, generations strong, whose legacy is not just measured by wealth but by shared values and purpose. This is what should sit at the heart of every family office service—a unique blend of financial mastery and personal care, crafted to preserve and grow what matters most. From wealth management to succession planning, philanthropy to lifestyle services, each family office service should support and contribute to ensuring future prosperity.

Family governance and education ensure the next generation carries the torch, while trends like AI-driven tools and outsourcing present new opportunities for upgrading and scaling services. Whether you’re starting fresh or refining your family office services, this guide should provide you with some practical steps and considerations you can take to ensure that your family’s story continues to unfold for generations to come.

What are the key differences between family office services and traditional wealth management services?

Family office services differ from traditional wealth management by offering a holistic, bespoke model tailored to ultra-high-net-worth families. While wealth managers focus primarily on investments and financial planning, family offices extend into governance, tax, succession, philanthropy, and even lifestyle support. They are designed for long-term, multi-generational wealth preservation and control, with greater privacy, customisation, and integration into family decision-making than standardised wealth management offerings.

How do family office services support succession and estate planning?

Family offices manage succession planning by creating structures that ensure wealth transfer across generations. They handle wills, trusts, governance frameworks, and family charters, helping avoid disputes and securing continuity. This focus makes them more comprehensive than standard advisory firms.

What role do family offices play in philanthropy and impact investing?

Many family offices coordinate charitable giving and impact strategies, either by setting up foundations or by directly managing impact-driven portfolios. This allows families to align their wealth with their values while involving the next generation in decision-making.

What lifestyle and concierge services can a family office provide?

Beyond financial management, family offices may oversee travel planning, household staff, education arrangements, security, and healthcare coordination. These services ensure seamless day-to-day living while maintaining privacy and discretion.

How are technology and AI changing family office services?

From AI-powered investment tools to digital reporting dashboards and cybersecurity solutions, technology is reshaping how family offices operate. It helps streamline decision-making, enhance risk management, and improve transparency across generations.

Should I choose a single-family office or a multi-family office?

A single-family office serves one family exclusively, offering maximum privacy and customisation but at higher cost. Multi-family offices (MFOs) pool resources across several families, giving access to top expertise and economies of scale. The right choice depends on wealth level, goals, and preference for control versus efficiency.

Further Reading

AI for family offices: Strategy & governance

GovernanceComprehensive guide to AI strategy and governance for family offices, with insights, practical steps, and safeguards for responsible adoption.

A Simple Guide to Risk & Resilience

Risk managementExpert-led guide to family office risk and resilience in 2025, with practical steps, quick wins, and strategies to protect assets and reputation.

AI for family offices: 101

TechnologyThis guide aims to help family offices take their first steps toward AI adoption. It includes simple suggestions for decision makers and maps out three low-risk, practical steps that any family office can use to get started.