A family office guide on governance pitfalls

Governance Updated on September 16, 2025Table of Contents

- Introduction: The Imperative of Strong Governance in Family Offices

- Pitfall 0: Neglecting Foundational Planning

- Startup Principles for Lean Governance

- Core Governance Pitfalls and Solutions

- Pitfall 1: Lack of Clarity in Roles and Responsibilities

- Pitfall 2: Lack of a Formal Decision-Making Framework

- Pitfall 3: Ineffective Communication and Alignment

- Pitfall 4: Project Inefficiency and Coordination Issues

- Pitfall 5: Stagnant Governance and Over-Centralisation

- Pitfall 6: Talent Management Challenges

- Pitfall 7: Weak Security and Risk Management

- Key Principles of Good Governance

- Implementation in Practice

- Looking Ahead: A Dynamic Landscape

- Building a Robust Governance Structure

- Conclusion: A Long-Term Commitment

Modern family offices have significantly evolved, showcasing increased sophistication and efficiency. This transformation in their organisational, legal, and governance structures reflects a strong ambition from families to manage their own destinies and ensure future prosperity, even amidst complex regulatory landscapes and new risks.

Introduction: The Imperative of Strong Governance in Family Offices

A family office serves as a private wealth management entity, meticulously overseeing a family’s diverse financial and administrative affairs. At its core, effective governance—the framework of rules, practices, and processes—is critical for preserving wealth across generations, ensuring family harmony, and achieving long-term objectives. Without robust governance, family offices risk inefficiency, internal conflict, and missed opportunities.

Thanks to Lise Møller, Christian Schiede and David Werdiger for their contributions to this guide.

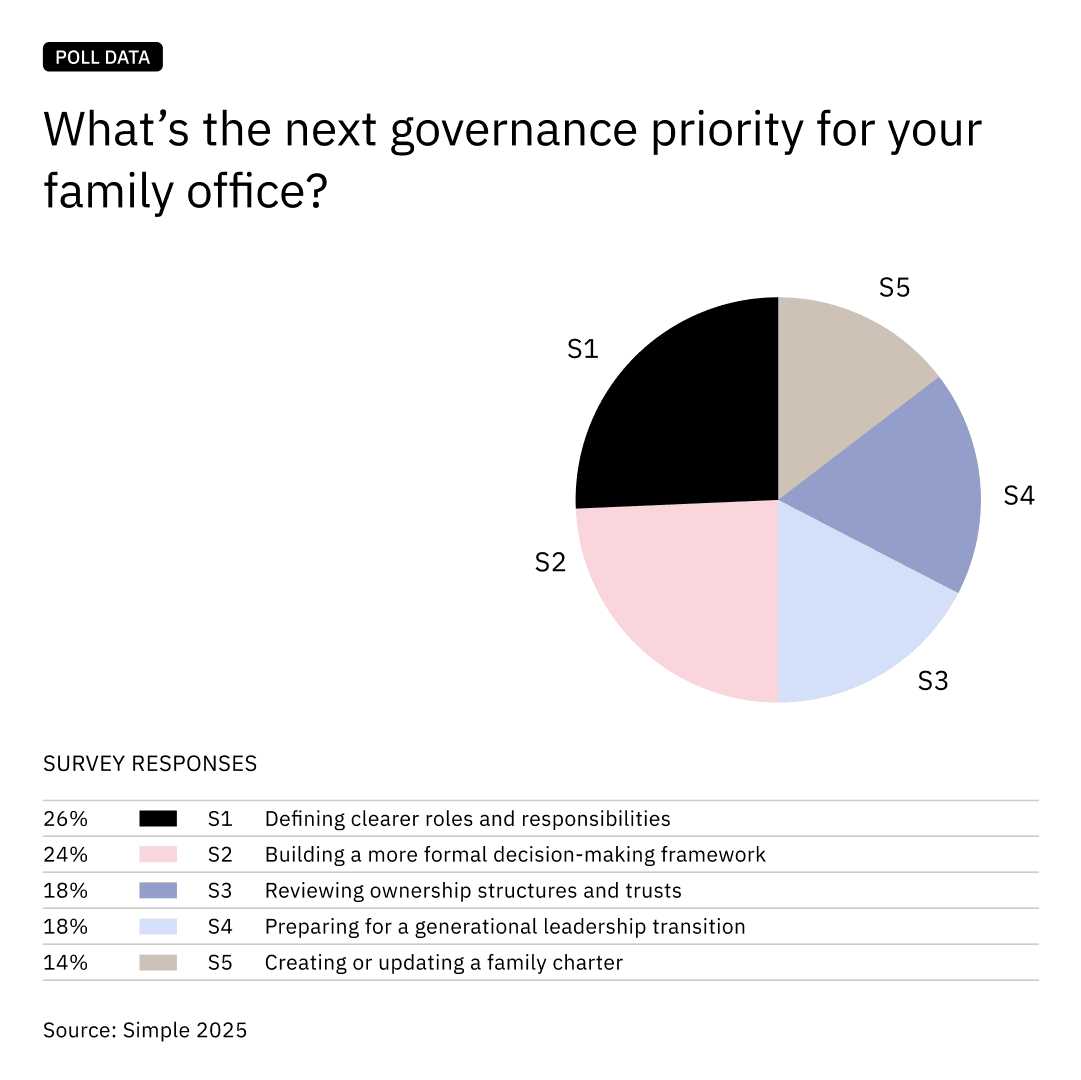

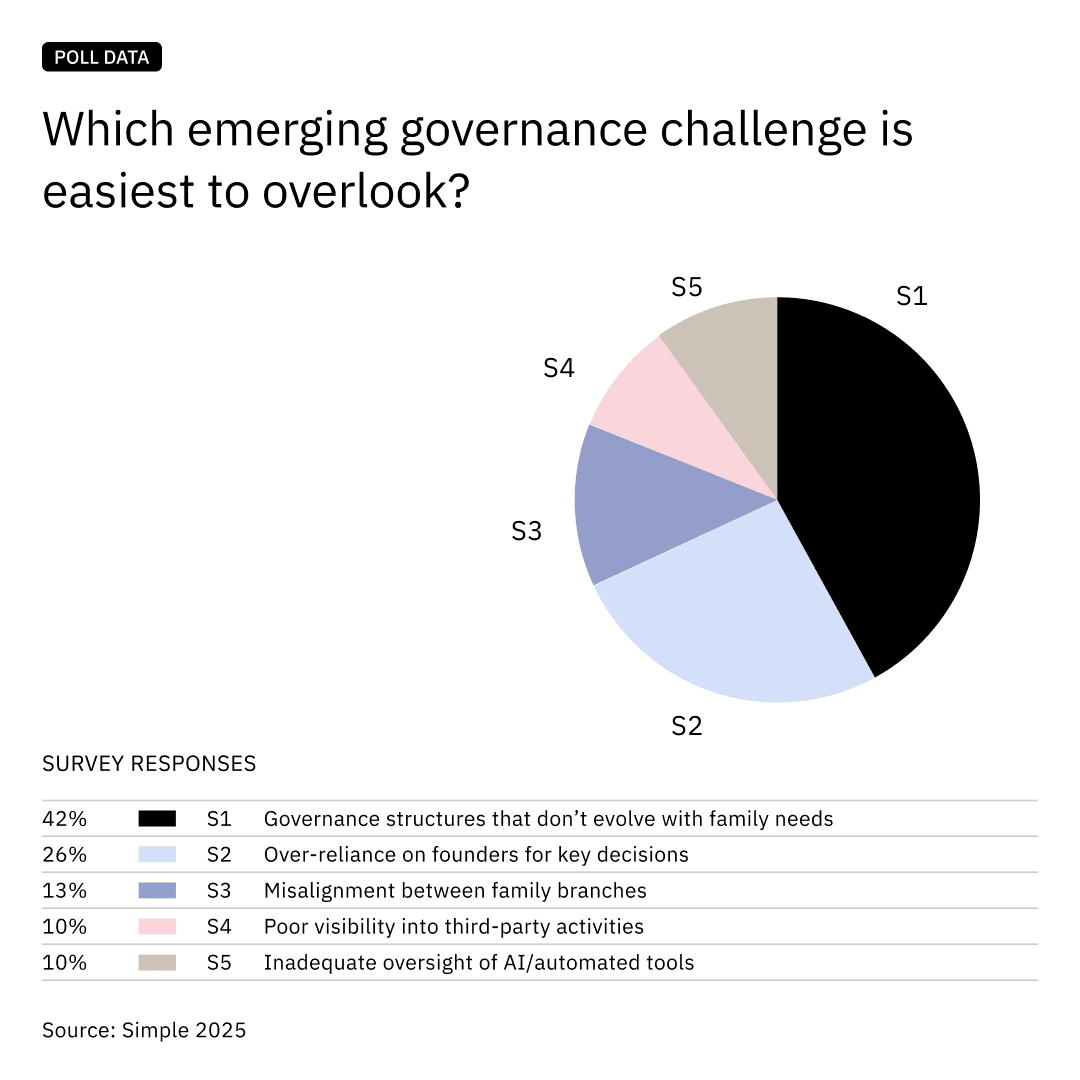

Key Governance Priorities & Challenges

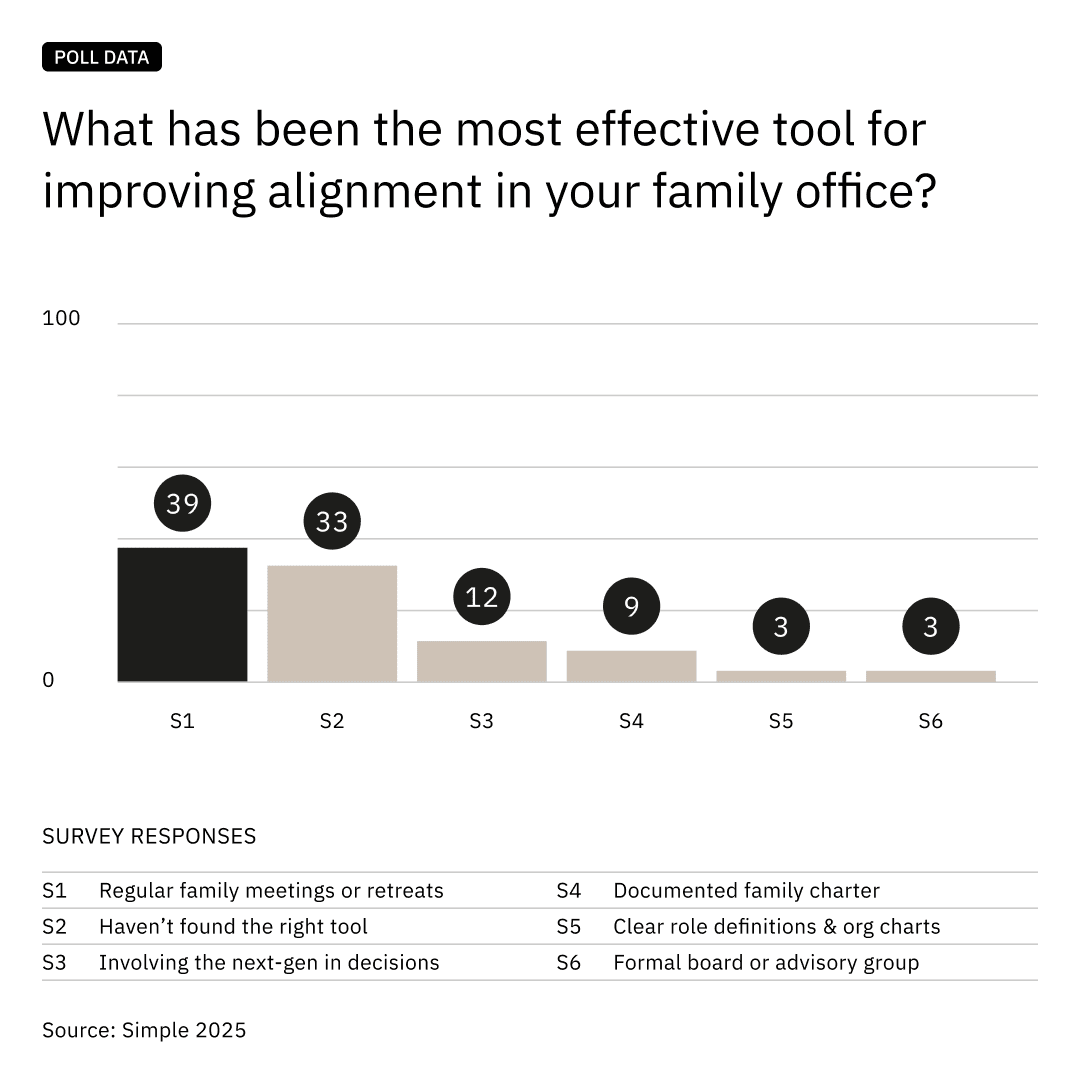

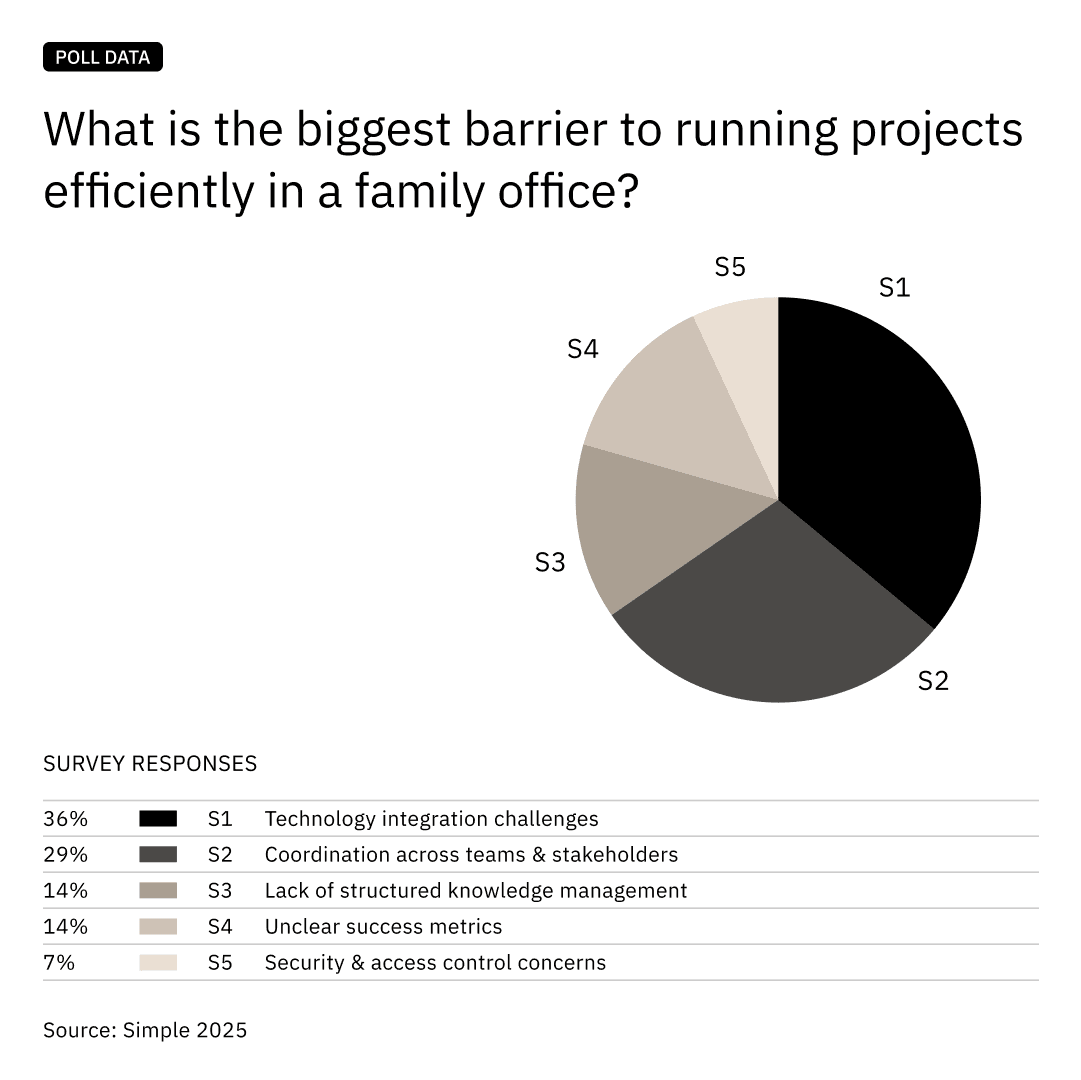

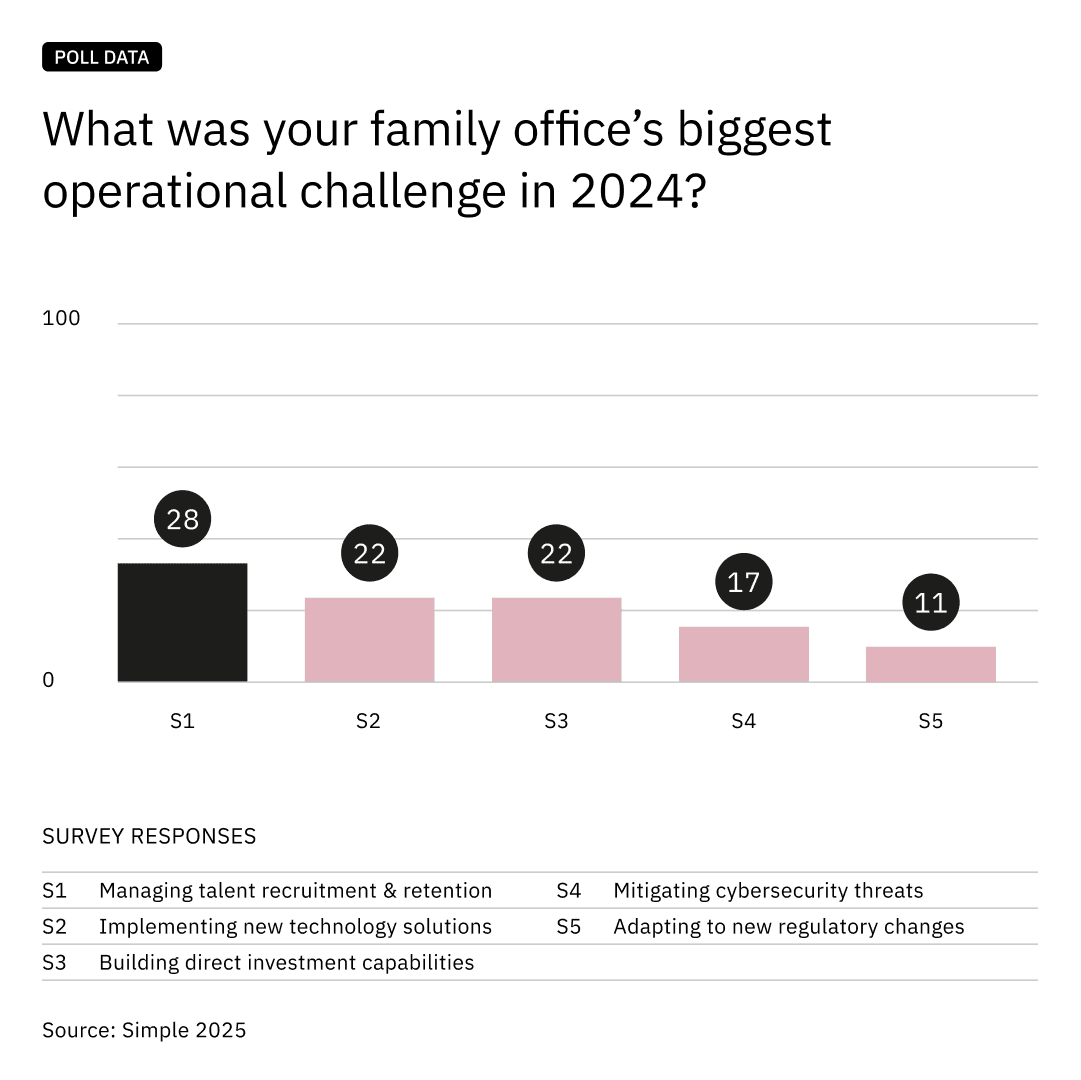

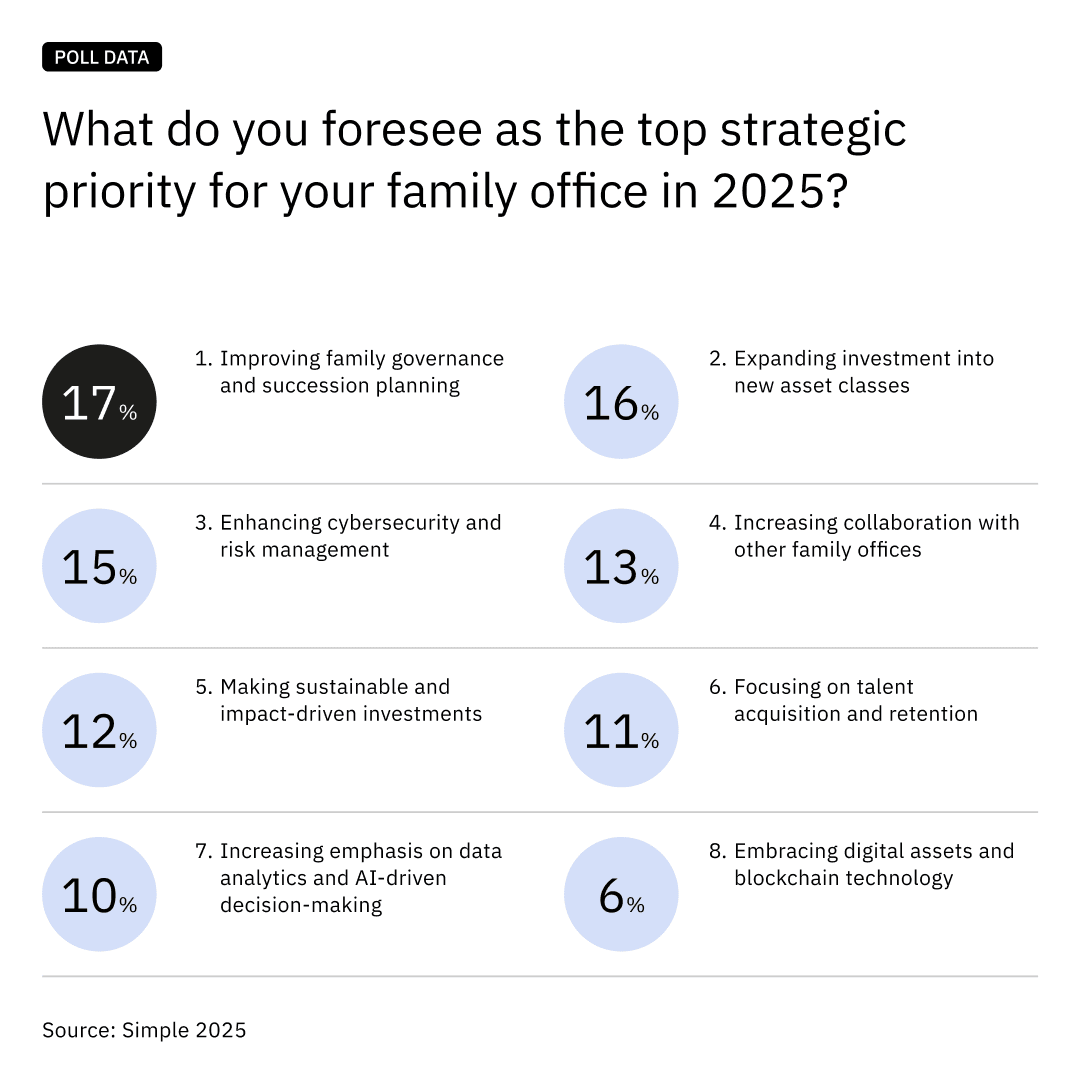

Recent poll data reveals that “defining clearer roles and responsibilities” (26%) and “building a more formal decision-making framework” (24%) are top priorities. While traditional tools like “regular family meetings” (39%) are common, many family offices (33%) still struggle to find effective alignment tools. Operational efficiency is also hampered by “technology integration challenges” (36%) and “coordination across teams” (29%).

Poll data also suggests that many governance risks remain underestimated, particularly those tied to structure and leadership transitions.

Pitfall 0: Neglecting Foundational Planning

The Challenge: Too often, families leap into launching a family office with great enthusiasm—but little strategic preparation. The desire for control or urgency to ‘professionalise’ quickly can result in costly missteps. Lise Møller summarises it well: “Setting out with a 5-person c-suite to then figure out down the road that you forgot the ‘WHY’ is not ideal.”

Why It Matters: When foundational planning is skipped, the resulting structure often lacks coherence. Services may be misaligned with actual family needs, roles become unclear, and governance risks being reactive rather than intentional. Resources are expended before the family fully understands its goals, leading to inefficiencies and potential friction.

Strategic Response: Begin with a clear mandate. Ask the essential questions: Why are we setting this up? What specific outcomes do we want? Who will this office serve—now and in the future? When is the right time to activate certain capabilities? Before any structural decisions are made, invest in deep education and benchmarking. Engage with peers, consultants, and case studies. Form a temporary working group or steering committee to draft an initial vision, clarify non-negotiables, and map out early-stage governance. Taking this approach not only improves long-term fit but builds early alignment and confidence across generations.

Startup Principles for Lean Governance

Structure Without Bureaucracy

Early governance should prioritise shared understanding and purpose over rigid committees. Questions to address: What is the family office here to do? Who decides what? How are disagreements handled? How can someone exit? Christian Schiede suggests startup-style agility works best when paired with rapid feedback and collective learning.

Use Frameworks Like a Startup Would

Borrow from tools like the Business Model Canvas. A short family charter can clarify values, roles, decision-making, and long-term goals. It need not be legal from day one. David Werdiger recommends setting a 20+ year vision to guide decisions.

Define Roles Before Titles

Prioritise functions over formal titles. Use simple tools like a RACI matrix to clarify who is responsible for what. Once roles are defined, the office structure (SFO, MFO, VFO) and staffing mix can follow. Revisit the matrix annually to reflect staff or service model changes.

Set Up Decision Flows

Define how decisions are made—who approves investments, allocates budgets, or acts independently. Create a one-page outline of key decision paths. Automate workflows early to enhance scalability. Test these flows through mock scenarios to uncover bottlenecks or gaps.

Start with an Advisory Group

Like startups use advisory boards, family offices can convene a trusted external advisor, a next-gen family member, and an operator to meet quarterly. This supports accountability, intergenerational learning, and regular review. It also creates a proving ground for future leaders without forcing early formal appointments.

Keep Documentation Lightweight

Document the essentials: meeting cadence, responsibilities, and escalation paths. Review governance structures annually to adapt to change. Maintain a living knowledge repository—an evolving playbook of decisions, lessons, and processes.

A Note on the Family Charter

A two-page memo can serve as a first step. It should answer: Why does the office exist? What are our values? Who does what? How do we stay aligned? Its power lies in the co-creation process, not its length. Revisiting the charter annually as part of family retreats ensures its relevance and reinforces shared ownership.

Core Governance Pitfalls and Solutions

Before a family office can thrive, it must avoid the structural and behavioural missteps that quietly undermine success. The following section outlines the most common governance pitfalls, drawn from patterns observed across jurisdictions and generations. Each is paired with a strategic response designed not only to solve the issue but to embed resilience, clarity, and long-term alignment into the family office model.

Pitfall 1: Lack of Clarity in Roles and Responsibilities

The Challenge: Ambiguity around who does what, causing overlaps, inefficiencies, and accountability gaps.

Why It Matters: Confusion, internal conflict, slow decisions, and low staff morale.

Strategic Response: Develop a governance charter, detailed job descriptions, RACI matrices, and an organisation chart. Review roles regularly. Consider onboarding workshops or induction guides to reinforce expectations for new staff or family members. Implement role rotation or job shadowing to deepen mutual understanding and identify grey zones. Tie responsibilities to performance reviews to institutionalise clarity.

Pitfall 2: Lack of a Formal Decision-Making Framework

The Challenge: Over-reliance on informal processes results in inconsistent decisions and no mechanism for dispute resolution.

Why It Matters: Poor decision quality, bias, delays, and potential family disputes.

Strategic Response: Create a documented framework detailing who decides what, with clear escalation paths and conflict resolution mechanisms. Supplement with a decision register to track key actions and rationales. Train key staff in decision analysis tools and build tiered approval paths. Schedule quarterly reviews of the framework.

Pitfall 3: Ineffective Communication and Alignment

The Challenge: Irregular communication and unclear alignment between the office and the family.

Why It Matters: Mistrust, disengagement, wasted resources, and strained relationships.

Strategic Response: Introduce structured meetings, transparent reporting, and alignment with family values. Use digital hubs for governance documents and updates. Rotate internal communications leads, and conduct regular feedback surveys to detect misalignment early. Incorporate family vision statements into onboarding.

Pitfall 4: Project Inefficiency and Coordination Issues

The Challenge: Poor project execution due to unclear goals, inadequate tools, and weak coordination.

Why It Matters: Missed deadlines, low morale, reputational harm.

Strategic Response: Adopt project management frameworks, invest in integrated tech, clarify goals, and assign clear roles. Run retrospectives post-project. Introduce visual planning tools and designate project sponsors for ownership. Standardise handover and reporting protocols.

Pitfall 5: Stagnant Governance and Over-Centralisation

The Challenge: Governance does not evolve; founders dominate decisions.

Why It Matters: Bottlenecks, lack of next-gen engagement, resistance to change.

Strategic Response: Schedule governance reviews, build shadow committees, and transition authority gradually. Introduce innovation forums for fresh input. Use sunset clauses for founder privileges and set term limits for key roles. Plan succession as a cultural shift, not just a transaction.

Pitfall 6: Talent Management Challenges

The Challenge: Difficulty attracting and retaining skilled professionals, and aligning on culture.

Why It Matters: Expertise gaps, high turnover, missed strategic goals.

Strategic Response: Build a holistic talent strategy with competitive pay, purpose-driven roles, and career paths. Launch mentorship schemes, peer-learning groups, and speaker sessions. Track retention and development metrics. Invest in employer branding that reflects the family’s values.

Pitfall 7: Weak Security and Risk Management

The Challenge: Inadequate systems to protect data, assets, and operations.

Why It Matters: Financial loss, reputational damage, legal exposure.

Strategic Response: Create a formal risk taxonomy and assign internal owners. Implement strong cybersecurity, conduct annual audits, and simulate crisis scenarios. Establish AI oversight and third-party monitoring. Regularly review insurance and compliance needs.

Key Principles of Good Governance

Effective governance relies on a clear but comprehensive set of principles:

Clarity: Every role, responsibility, and decision path should be well defined. Without clarity, accountability falters, and strategic focus is diluted.

Accountability and Measurement: Responsibilities must be measurable. Tie roles to clear performance indicators and review outcomes regularly to ensure follow-through and course correction.

Transparency: Open, timely communication is critical. It builds trust between staff, family members, and stakeholders, and reduces the chance of misalignment or conflict.

Professionalism: Operate with integrity. Adhere to ethical standards, remain compliant with regulations, and invest in the continuous education of the team.

Adaptability: Governance must evolve. Family dynamics, markets, and external risks shift—your governance framework should too.

Alignment and Continuity: Ensure all activities are consistent with family values and the long-term vision. This includes succession planning and knowledge transfer.

Participation: Encourage meaningful involvement from multiple generations. Shared ownership leads to better engagement, resilience, and cohesion.

Implementation in Practice

While strategy and structure are essential, successful governance ultimately depends on thoughtful execution. Building strong governance requires a phased and deliberate approach:

Assess your current state: Conduct a baseline audit of governance strengths and gaps. Include third-party input where possible.

Define values and objectives: Anchor governance in clearly articulated purpose statements and vision.

Create a governance charter: Formalise the operating model—who decides what, how, and when.

Set policies and procedures: Document and review protocols for finance, risk, succession, and disputes.

Establish communication protocols: Standardise reporting lines, meetings, and escalation channels.

Schedule reviews: Use calendar milestones (e.g. fiscal year-end, family gatherings) to revisit structure.

Seek outside expertise: Periodically bring in neutral advisors to challenge assumptions and offer perspective.

Codify cultural norms: Document informal behaviours and conflict resolution practices.

Integrate governance into daily tools: Use task managers and CRMs to operationalise policies.

Audit for voice diversity: Rotate responsibilities, invite anonymous input, and track equity of participation.

Looking Ahead: A Dynamic Landscape

Family offices in the next decade will not only be asset managers but also data stewards, venture partners, and value custodians. The push for digital transformation will demand that governance keeps pace with the technology it seeks to regulate. AI systems, for example, will need ethical oversight, especially when automating decisions in finance or HR.

Meanwhile, family values are shifting. Sustainability is no longer an optional add-on but a reputational pillar. Offices that lack a strong ESG governance overlay may fall behind. At the same time, geopolitical volatility and regulatory tightening require nimbleness. Scenario planning, dynamic charters, and risk resilience frameworks are no longer best practice—they are essential.

Finally, engagement with the next generation will define success. Offices that treat governance as static risk alienating the future stewards of wealth. Inclusive structures that recognise new forms of leadership, transparency, and co-creation will be best positioned to thrive.

Building a Robust Governance Structure

Building a robust governance structure is not a checklist; it’s an evolving process grounded in reflection, alignment, and implementation. Below are the key components grouped into three stages:

Diagnose and Define

- Assess your current state: Conduct a governance audit. Include input from internal stakeholders and external advisors.

- Define values and objectives: Clarify the family’s purpose and vision. Let these drive all strategic decisions.

- Codify cultural norms: Document shared beliefs and informal practices that shape how the family works together.

Design and Document

- Create a governance charter: Outline the operating model, including who decides what, when, and how.

- Set policies and procedures: Focus on financial oversight, investment governance, succession planning, and risk protocols.

- Establish communication protocols: Define meeting rhythms, reporting structures, and escalation procedures.

Operationalise and Adapt

- Integrate governance into daily tools: Use CRMs, task managers, and dashboards to bring policies to life.

- Schedule reviews: Align governance reviews with major family or fiscal milestones.

- Audit for voice diversity: Rotate participation, solicit feedback, and ensure inclusive engagement across generations.

- Seek outside expertise: Engage independent advisors periodically to validate structure, offer fresh insights, and stress-test assumptions.

Conclusion: A Long-Term Commitment

Governance is not a one-off task. It is a continuous discipline and a strategic pillar. By addressing key pitfalls and embedding core principles, family offices can establish a resilient operating model that protects values, engages the next generation, and adapts to change. Good governance ensures the family office remains not only functional but purposeful—able to navigate uncertainty, embrace innovation, and uphold its legacy for generations to come.

What does governance mean in the context of a family office?

Governance refers to the systems, structures, and processes that define how a family office makes decisions, manages risk, and aligns family members with long-term objectives. It covers areas like ownership, succession, reporting, and accountability.

Why is governance so important for family offices?

Good governance provides clarity, reduces conflict, and ensures continuity across generations. Poor governance often leads to disputes, mismanagement, and reputational or financial risk.

What are the most common governance pitfalls family offices face?

Typical pitfalls include lack of defined roles and responsibilities, weak succession planning, poor communication, and insufficient oversight of advisors or external partners.

How can family offices avoid governance breakdowns?

By creating clear decision-making frameworks, formalising succession plans, establishing reporting standards, and conducting regular reviews. Many also bring in independent advisors or non-family board members for balance.

What role does technology play in family office governance?

Technology can streamline reporting, improve transparency, and enhance decision-making. However, without proper governance structures in place, technology alone cannot solve alignment or accountability issues.

How often should governance structures be reviewed?

Best practice is to review governance frameworks every few years, or sooner if there are major shifts such as new generations joining, significant asset acquisitions, or changes in family priorities.

Further Reading

A Simple guide to family office structure

StrategyFamily office structures have evolved significantly over the past few decades, becoming far more sophisticated and efficient. Changes in organisational, legal and governance structures reflect the ambition of modern families to manage their own destiny and thrive into the future, despite complex regulatory environments and emerging risks.

How to evaluate your family office banking provider

StrategyTo ensure family offices are getting the support and service they need, it's crucial to assess their banking providers regularly. This guide aims to assist family offices utilising the services of a private bank and who want to take a structured approach to evaluate their banking partner.

How to choose a family office bank

StrategyThe popularisation of the family office has caused an outflow of assets from the private banking space. However, banks have responded by significantly improving their family office service offering and are becoming more customer-centric in their approach. When choosing a banking partner, the key is to strike the right balance between the capabilities that are employed in the family office and the offerings that are sourced from your bank.