“As a general rule, the more complicated the financial product, the worse the deal for the investor.” — David Swensen, Unconventional Success: A Fundamental Approach to Personal Investment (2005).

At Greenlock, our team holds diverse perspectives on the strategies of David Swensen, the renowned Yale endowment manager. However, his insight resonates widely among us. This guide builds on his principle: as a rule, the more complex and intricate the agreement between an investor and a financial intermediary, the greater the likelihood of encountering hidden and indirect fees.

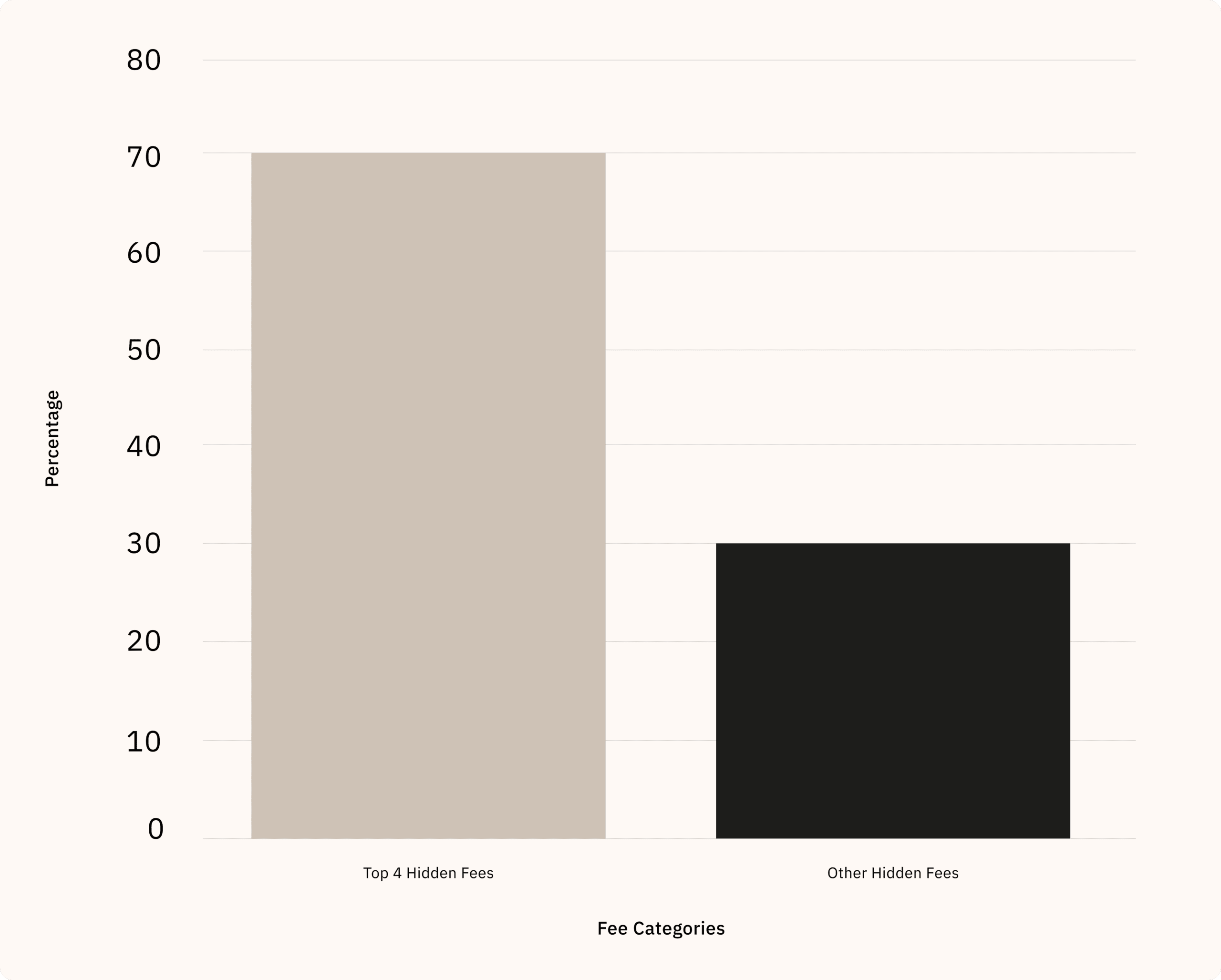

In 2025, a European family office managing over $1 billion believed its costs were well-contained. A fee audit told another story: silent leakages compounding into millions over a single generation. Across the dozens of families we analyzed, four categories consistently drove the hidden cost burden:

- Cash drag – below-market deposit rates and overpriced margin loans.

- FX spreads – hidden mark-ups of 50–150 bps on currency transactions.

- Retrocessions – undisclosed commissions flowing to intermediaries, often reclaimable

- Complex instruments – funds, notes, and PE vehicles with embedded costs beyond visible fees.

Cash opportunity cost

One of the most common mistakes family offices make is neglecting robust treasury control. Banks often exploit this by offering uncompetitive rates on account balances, deposits, or marginal loans. Here are some practical tips to address this:

- Monitor overnight rates: Familiarize yourself with overnight rates for key currencies, such as SOFR (Secured Overnight Financing Rate for USD), ESTR (Euro Short-Term Rate for EUR), and SONIA (Sterling Overnight Index Average for GBP). Ensure the rates on your account balances align closely with these benchmarks to minimize losses to uncompetitive bank rates.

- Avoid deposit fees: Confirm that your bank does not charge fees for opening or closing deposits. Many banks, especially regional ones, impose such fees. Always compare the yield on bank-offered deposits with government bonds of similar maturities. It may be more cost-effective to purchase government bonds directly, as the market for short-term bonds in major reserve currencies is deep, with minimal transaction costs.

- Negotiate marginal loans: When securing a marginal loan, aim to tie the rate to a benchmark like SOFR, ESTR, or SONIA, plus a fixed bank premium. This premium typically ranges from a few dozen basis points, depending on your terms.

FX fees and hidden spreads

The second most overlooked area for financial leakage is foreign exchange (FX) transactions. Depending on the jurisdiction and bank size, key areas to monitor vary, but two universal rules apply:

- Compare quotes across providers: Even in deep markets like the U.S., FX spot transactions are over-the-counter (OTC), as they are in the EU. For large volumes, execute FX trades, forwards, or swaps with major banks, which typically offer tighter spreads. Alternatively, consider reputable brokers or fintech providers like Interactive Brokers, Schwab, or Revolut, which usually provide transparent pricing and narrower spreads for major currency conversions, reducing transaction costs for investors.

- Scrutinize FX Fees: If you haven’t analyzed your FX transaction costs, you might be facing a fee pyramid—charges as high as 1.50% for transactions up to $50,000, gradually decreasing with higher volumes. You can successfully negotiate fees down to just a few dozen basis points per transaction if you do your homework and compare FX fees with competitors.

Retrocessions and rebates

Retrocessions are hidden commissions that financial intermediaries, such as banks, receive from asset managers, investment funds, or other providers for distributing their products. These payments, often undisclosed, are funded by client assets. Such fees draw criticism for incentivizing banks to promote products that maximize commissions over those best aligned with client interests.

This creates a risk of biased recommendations driven by the bank’s profit motive. Many jurisdictions have deemed retrocessions illegal, and investors may be entitled to compensation.

For instance, in Switzerland, the Swiss Federal Supreme Court (FSC) ruled in 2024 that clients are entitled to reclaim retrocessions unless the bank obtained a valid, informed waiver from the client. The statute of limitations for such claims is 10 years from the date the bank received the retrocessions. Claims not filed within this period may be dismissed due to expiration.

Instrument-level fees

Returning to Swensen’s opening quote, it’s a universal truth: the more complex the financial product, the greater the due diligence required from the investor compared to vanilla instruments. While we won’t delve into the pros and cons of complex financial products here, we’ll outline the cost components of some standard instruments:

| Instrument | Explicit Fees | Range | Hidden Fees | Range |

|---|---|---|---|---|

| Mutual Fund | Entry/Subscription Fee; Ongoing Mgmt Fee (TER/OCF); Custody Fee; Performance Fee | Entry: 0–5%; TER/OCF: 0.2–2% p.a.; Custody: 0.05–0.3% p.a.; Perf.: 10–20% of profits | Retrocessions/Trailer Fees; Transaction Costs; Dealer Spreads | Retro: 0.25–1% p.a.; Transactions: 0.1–0.5% AuM; Spreads: 0.05–0.3% per trade |

| Structured Note | Structuring Fee; Placement/Arrangement Fee; Custody Fee; Early Redemption Penalty | Structuring: 0.5–2% upfront; Placement: 0.5–3%; Custody: 0.05–0.3% p.a.; Penalty: up to 5% | Distribution/Retrocessions; Hidden Markup in Derivatives; Hedging Costs | Retro: 0.5–2%; Markup: 1–3% notional; Hedging: 0.1–0.5% p.a. |

| PE Fund | Management Fee; Performance Fee/Carried Interest; Subscription Fee | Mgmt Fee: 1–2% p.a.; Carry: 20–30% of profits; Subscription: 0.5–2% | Monitoring Fees; Transaction Fees for M&A; Admin and Legal Costs; Due Diligence Costs; Placement Fees | Monitoring: 0.5–1% p.a.; Transaction: 1–2% deal size; Admin/Legal: 0.2–0.5% AuM |

These fees are layered on top of advisory, management, or custody fees charged by the bank holding these instruments.

Conclusion

Controlling the total cost of investments—whether FX fees, spreads, instrument-level costs, cash opportunity losses, or retrocessions—is a complex and multifaceted process. It requires a deep understanding of financial mechanisms, regulatory requirements, and diligent oversight, alongside continuous monitoring of both explicit and hidden costs. By addressing the four key areas outlined above, investors can significantly enhance their financial outcomes. To start, conduct a fee audit with your team, compare provider quotes, and consult legal experts to identify and reclaim undisclosed retrocessions. This approach saves time, minimizes errors, and preserves portfolio returns through cost optimization.