A new kind of legacy

Legacy is more than the transfer of wealth. In a world shaped by climate risk, technological disruption, and social upheaval, family offices are navigating uncertainty while redefining what it means to leave a lasting mark.

While institutional investors dominate headlines, family offices are quietly driving a values-led shift in impact investing. With patient capital, deep networks, and strategic independence, they often move early, act decisively, and back what others overlook.

We rounded up a few companies that you might find interesting.

Capital: Smaller, faster, bolder

Institutional investors manage trillions with rigid mandates and regulatory oversight. Family offices, by contrast, operate with leaner structures. While they may appear unconstrained, their capital is often guided by values, legacy, and relationships rather than mandates.

According to Deloitte, there were over 8,000 single-family offices globally in 2024, managing $3.1 trillion in assets. By 2030, that number could approach 11,000, with $5.4 trillion under management. Their scale is rising, and so is their relevance.

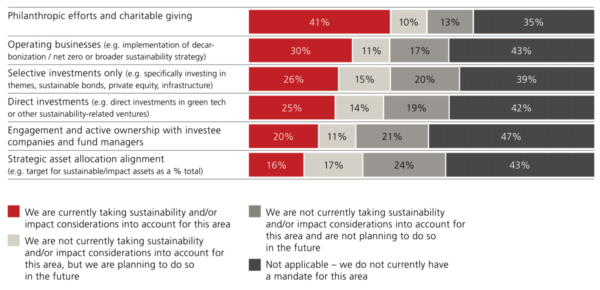

Figure 1: Channels Where Family Offices Integrate Sustainability and Impact (Source: UBS Report on Family Offices & Sustainability Integration)

PwC estimates that 53% of global family offices are backing impact deals, spanning sectors such as health, education, climate, and regenerative agriculture. UBS adds that 46% of family offices now embed sustainability into their investment strategy, a number expected to rise.

“This is part of a clear shift across the global family office community away from traditional investments and toward impact investments.” – Jonathan Flack, Family Office Leader, PwC.

Strategic flexibility: From grant to growth

These are turbulent times for impact investing. Where “climate tech” dominated the conversation, today’s narrative is shifting from decarbonisation to resilience. Yet, beneath this change in language, persistent funding gaps remain. Series B and C rounds are under growing strain. Startups that surged during the 2021–2022 boom now face a tougher, leaner funding climate.

Essentially, the “valley of death” is widening. First-of-a-kind (FOAK) funding is drying up, projects that develop and implement the first commercial facility for a startup, leaving a stubborn gap between pilots and commercial deployment. The leap to scale remains the most underfunded and riskiest stage, and is now further threatened by potential cuts to DOE support under a possible Trump return.

Amidst the growing gap between pilots and scale, family offices offer rare flexibility. Sitting at the intersection of philanthropy and venture capital, they can back high-risk, high-impact ventures that institutional capital won’t touch.

Unlike traditional investors constrained by mandates and return thresholds, family offices can adopt bespoke structures, aligning mission with outcomes on their own terms. Their participation is optional, but when they act, they can have systemic outcomes.

This includes:

Flexible capital structures:

Builders Vision is pioneering tools like blended finance, recoverable grants, milestone-triggered tranches, and revenue-based finance. These models recycle capital when goals are met, blend philanthropic aims with investment discipline, and unlock future funding without relying on early exits.

Values over valuation:

Armonia prioritises long-term impact over fast growth. Instead of chasing unicorns, they invest in regenerative agriculture and place-based enterprises, backing founders aligned with systemic change, not short-term multiples.

Backing the frontier:

In high-risk, underfunded sectors, like carbon removal, rural infrastructure, and nature-based solutions, family offices step in where others won’t. KIRKBI invests in carbon removal tech; Ceniarth channels capital to underserved communities. Both support ventures with unclear exits but undeniable relevance to future systems.

This isn’t flexibility for convenience, it’s a market-shaping force that lays the groundwork for industries critical to long-term planetary and societal health.

Activating family office capital

Start by aligning opportunities with their mission and legacy, not just returns. Family offices respond to clear narratives of impact and long-term value.

Structurally, offer co-investment rights, milestone-based tranches, or shared-risk models that reflect their flexibility. Build trust through peer networks and private deal flow, not public pitches. And just as importantly, support them in building internal capacity: from governance models to impact frameworks and due diligence tools. When family offices are equipped and engaged early as partners, not just funders, they step up.

Most institutional investors still hesitate at investing in “missing middle,” too early to scale, yet too risky to justify conservative capital. Yet, Builders Vision has made this gap its sweet spot. Family offices are uniquely positioned to fund this gap, not just by writing cheques, but also by shaping the systems around them: enabling capital guarantees, co-founding ventures, and working across philanthropy and investment.

“My ambition is to be generative with my capital,” – Lukas Walton, Founder & CEO of Builders Vision, remarked to the Financial Times.

Lukas has demonstrated through Builders Vision that family offices can use patient capital not only to de-risk innovation, but to systemically shift entire sectors. Nowhere is this clearer than in their ocean portfolio: beyond direct startup investments, Builders Vision has committed over $260M to 158 partners. In doing so, the firm demonstrates what becomes possible when values are embedded in strategy, where profit remains the motive, yet the outcomes generate unexpected philanthropic gains.

Not every family office needs to go as far as Builders Vision. The real question isn’t how much capital you allocate, but how intentionally you do it. Whether it’s investing earlier, backing mission-led managers, or structuring capital with flexibility, the key is making it their own.

This is more than flexibility, it’s a catalytic force. Used with intent, capital conviction from family offices can unlock markets, de-risks innovation, and builds what others overlook.

Influence beyond capital

Family offices may deploy smaller tickets, but their influence is outsized. Family offices often anchor first-time funds, validate new strategies, and open overlooked opportunities. Trusted within private wealth networks, they help shift attention and resources toward underserved sectors.

Through research, storytelling, and early adoption of new metrics, especially in nascent fields like adaptation finance or ocean innovation, they shape the discourse that larger institutions eventually follow. Their influence is quiet, fast-moving, and foundational, often shaping the discourse and setting the stage for paradigms others will later claim.

Many operate as trusted nodes in global networks of private wealth, quietly directing attention and capital toward underfunded opportunities. From adaptation finance to ocean innovation, family offices play a formative role in shaping discourse, building the credibility of new sectors, and opening the doors for larger follow-on capital.

Their actions often go unpublicised, but they set precedents that others follow. When family offices move, they help define the market, long before institutions arrive.

Blind spots: Agility without structure

The same agility that enables family offices to act boldly can also expose underlying weaknesses. Many remain under-professionalised, lacking dedicated impact talent, formal due diligence processes, or robust measurement systems.

Without the institutional networks of larger investors, their access to quality dealflow is often narrow, and their impact measurement practices remain inconsistent or informal.

Unlike institutional investors, they often operate without the benefit of expansive networks, curated deal flow, or established benchmarking tools. Impact strategies may be guided by intent but executed with limited structure.

As Mireille Abujawdeh, Head of Family Offices, Endowments, and Foundations for BlackRock in EMEA, notes:

“They need tailored solutions, data-driven insights, deal sourcing and due diligence support, particularly in private markets where over half of respondents recognize gaps in internal expertise.”

Discretion, a defining trait of many family offices, can also lead to isolation, limiting access to opportunities or shared learnings from peers. Unfortunately, many remain impact-curious rather than impact-capable, lacking the tools or confidence to move from intention to action.

But this is changing. Next-generation leaders, stronger data infrastructure, and growing global networks are accelerating professionalisation. More family offices are hiring impact specialists, developing internal frameworks, and joining collaborative platforms.

What was once fragmented is becoming more strategic. Family offices are starting to move beyond good intentions toward disciplined, values-aligned capital that can ensure strong returns and meaningfully shape markets.

Actionable takeaways:

- Fund Managers: Structure your offerings to reflect family office dynamics, flexible tranches, co-investment rights, and blended finance. Share your learning curves. Helping them build capability builds trust and traction.

- Founders: Focus on aligned family offices and build long-term relationships. Strategise early. Less outreach, more relevance. No need to spray and pray.

- Family Offices: Invest in internal capacity, frameworks, networks, and tools to move from curiosity to capability. Outsource if needed. Paying more now is often cheaper than costly missteps later.

Conclusion: Catalysts, not followers

Family offices are not trying to replace institutional investors, nor should they. Their influence lies in strategy, not scale. They move early, take risks, and inject values into markets long before benchmarks catch up, shaping what later becomes mainstream.

However, vision without rigour won’t shift systems. To lead the next chapter, family offices must evolve from bold actors into disciplined stewards. The question is no longer whether they can drive change but how they move from curiosity to conviction to shape the future of impact investing. But whether they even will.

Family offices don’t need to overhaul their portfolios overnight. But they do need to stop seeing impact as “over there” or a dirty word, as it’s already here, defining our collective future.