How to choose a crypto custodian

Cryptocurrency Updated on June 2, 2025Table of Contents

- Why cryptocurrency is becoming mainstream asset

- Family offices to lead with caution

- The role of asset custodians

- Common crypto terms

- How cryptocurrency wallets work

- Hot storage vs cold storage?

- Why custody is so important in the cryptocurrency market

- Custody options for family offices

- Don’t go it alone

- Four key considerations when choosing a crypto custodian

- Importance of digital asset custody

As the crypto industry grows, so does the demand for reliable crypto custodians. While their responsibilities aren’t dissimilar to those of traditional asset custodians, the crypto space is vastly unique in and of itself, with a constant influx of new players and technology. This guide, created in collaboration with Simple Expert Ben Wiener, is designed to assist family offices in choosing the right crypto custodian to engage with the industry confidently and efficiently.

Why cryptocurrency is becoming a mainstream asset

The digital assets market is still considered to be in an early adoption phase. however, the launching of bitcoin ETFs and the recent growth in cryptocurrency market capitalisation to over $2.5 Trillion suggests that it is fast becoming a more mainstream asset class. No longer just the realm of speculative investors, cryptocurrencies and digital assets are receiving increasing attention from institutional investors as well as family offices, raising the possibility of a massive surge in crypto investment in the immediate to long-term horizon.

Family offices to lead with caution

According to a 2023 Goldman Sachs survey, a greater proportion of family offices are now invested in cryptocurrencies — 26% versus 16% in 2021. With significant capital to invest and a long-term horizon, family offices are expected to not only ride the crypto-wave but propel it to new heights as they diversify their assets and look to new stores of wealth. The combination of rising inflation and low interest rates are also contributing factors to this projection.

The role of asset custodians

Asset custodianship has traditionally been associated with capital market financial institutions that are responsible for the safeguarding of investors’ assets as well as providing other services like trade settlement, exchange, clearing, and corporate action execution. These custodians are temporarily entrusted with assets and are expected to minimise the risk of fraud, theft or loss to those assets. In line with accelerating investment into the crypto space, the demand for digital asset custodianship has grown tremendously. However, this has proven to be a space that is vastly different from traditional asset custodianship, hence the plethora of new players and technologies that are emerging all the time.

Like their traditional capital market counterparts, digital asset custodians are also responsible for the safekeeping of a client’s crypto assets, however the difference is that these custodians do not hold the asset itself but are responsible for the custody of the keys to these assets. Through safe key management, digital assets are cryptographically secured and the custodian, therefore, ensures that the asset cannot be accessed by any other party. For a family office to have transactional access to an asset, both a public and private key needs to be used.

“As the regulatory environment continues to take shape, more and more guidance is coming out. There is still a need to proceed with caution, but waiting too long could lead to significant missed opportunities that may never return.” – Ben Wiener.

Common crypto terms

Let’s first define a few common crypto terms that are used in this section:

A public key is a long numeric code that is cryptographically derived from a specific private key and is publicly available. A public key allows you to receive cryptocurrency transactions. Anyone can send transactions to the public key but you need the correct, corresponding private key to “unlock” them and prove that you are the owner of the cryptocurrency received in the transaction.

A private key is a randomly generated binary number that is used to encrypt and decrypt information and is only made available to the originator of the encrypted content. A private key gives you the ability to prove ownership or access the funds associated with your public address.

A cryptocurrency wallet is a device, physical medium, program or service which stores the public and/or private keys for cryptocurrency transactions. In addition to this basic function of storing the keys, a cryptocurrency wallet often also offers the functionality of encrypting and/or signing information.

There are many custody options available to both individual investors and institutional players, falling within three main categories:

Self custody: These include hardware, software or paper wallets in which the digital asset investor independently stores private keys.

Exchange wallets: Control and management of public and private keys are handed over to an exchange, but the investor maintains access via an online wallet.

Third-party custodian: Typically aimed at institutional investors and large family offices, these service providers store digital assets on behalf of customers using institutional grade security and controls to protect investors’ assets.

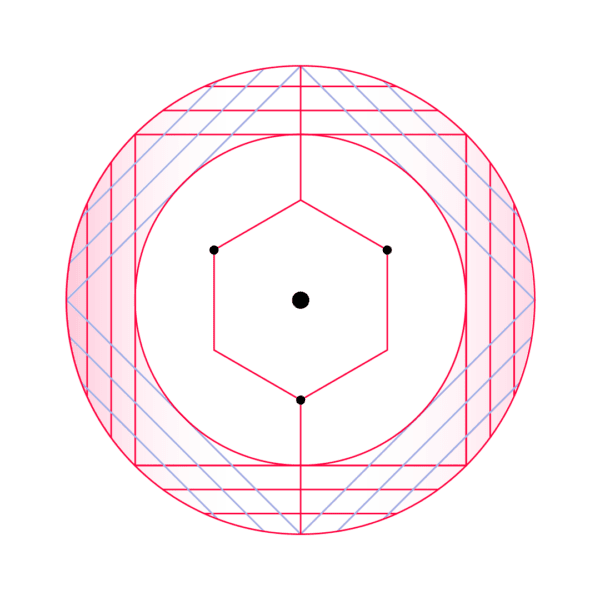

Custodians safeguard digital assets by ensuring that investors’ private keys are maintained securely. This is achieved by either storing the assets online, a method called hot storage, or offline, known as cold storage, or through a multiple approval approach, known as multi-signature and smart contract wallets.

How cryptocurrency wallets work

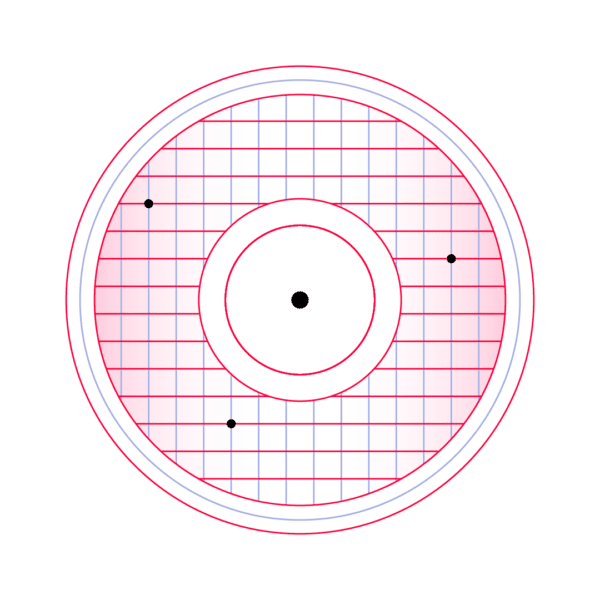

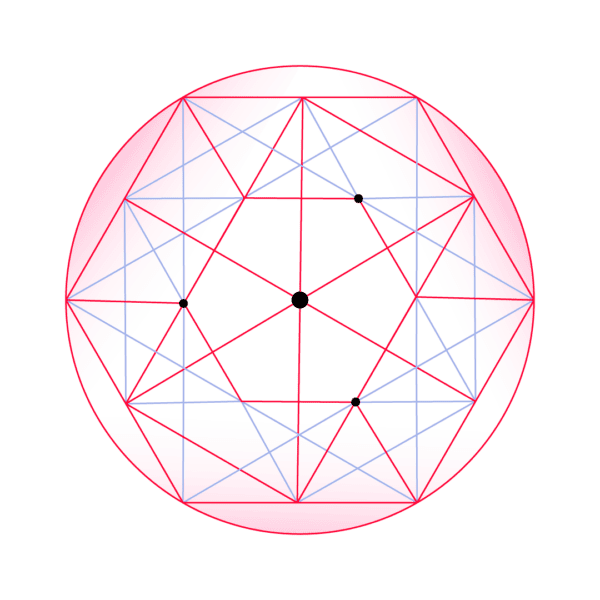

When trying to visualise digital wallets and the custody relationship, imagine a wallet as a condominium building. Each person who lives in one of the individual condos has their own, unique mailing address to receive a package. If someone wants to send something to them, they need to have the correct name and address on the package, the proper delivery fee, and the courier takes care of the rest. See image below:

In a similar way, if someone wants to send crypto to you, they can do so by having the correct deposit address, paying the delivery fees (gas), and having the courier (blockchain ecosystem) take care of the rest.

Wallet address

It’s important to note that different assets live on different blockchains – just like the condo owners live on different floors. For example, if I want to send a package to John J. J. Schmidt, who lives on the 4th floor in unit 4B, all of that information is important to make sure it reaches the proper destination. Crypto is similar in that you need to know the asset you’re sending, the blockchain it’s on, and the corresponding address of the receiver.

“ If you try sending Bitcoin to an Ethereum address, it’s not going to arrive, and unlike traditional mail, it’s not going to get sent back either.” – Ben Wiener.

Private keys

Receiving packages, and crypto for that matter, doesn’t require much more than providing the correct address. Sending something, however, is a different story. If someone wanted to send an item from the condo, they would need to have the keys to get in the condo first. If they didn’t have the keys, in theory, they wouldn’t be able to control the asset to be able to ship it. Similarly, when sending cryptocurrency, one can’t send assets without the private keys. Once you have the private keys, however, you can send assets within a matter of seconds.

While this example might provide a helpful illustration, it comes up a little short in that a digital wallet doesn’t actually store any of the assets like a condo would. It only stores the keys that are needed to move the assets. The assets themselves are all stored (live) on the blockchain.

Not your keys, not your coins

A crypto wallet, then, is a program that allows you to send, store and receive digital assets by managing the keys. Furthermore, custody is the act of storing and securing those private keys. You may have heard the phrase, “Not your keys, not your coins.” That phrase is in reference to not having control (or custody) of the private keys to your assets.

It is never a good idea to rely solely on the exchange to protect your assets. Remember, whoever holds the keys is in control of the assets and can move them anywhere they want in a matter of seconds, so it’s imperative to understand the storage and security of the private keys to keep your assets safe. That process is referred to as custody and there are several ways to go about it.

Hot storage vs cold storage?

The difference between hot storage and cold storage depends entirely on whether or not the private keys have internet connectivity. Hot storage does have connectivity, while cold does not. Going back to the example of the condominium, think of hot storage as leaving your condo unlocked. It certainly makes coming and going a lot quicker and easier, but it also exposes you to a heightened degree of theft. Cold storage, on the other hand, would be the equivalent of closing off access to your condo altogether from outside parties.

Cold storage holds keys offline, which maximises security but does not provide an efficient user experience. Using a self-custody hardware device, such as Ledger or Trezor, is a popular solution that blends the two fairly well. Using a device that can easily connect and disconnect from your computer enables you to transact when you need to and unplug when you’re done.

Why custody is so important in the cryptocurrency market

Asset security and transaction efficiency are common requirements for most investors, whether they be single investors, family offices or large institutions. Crypto custodians play a vital role in achieving both of these objectives. With the amount of value beginning to accumulate in the digital asset space, the safeguarding of this wealth begins to take on a new priority. It should also not be forgotten that digital assets are, by nature, more vulnerable, which means that crypto custodians play a key role in limiting the associated risks. Over the past few years, family offices have been increasingly targeted by cybercriminals so it would make sense for this sector to consider the services of a third-party custodian when exploring crypto investment.

Custody options for family offices

Self-custody refers to when the owner of the asset(s) holds their own cryptocurrency by securing the private keys themselves. This allows the owner to have complete control over the assets and greater privacy with no third-party custody risk. The downside to self-custody is the risk of losing the private keys, and it does require a bit of technical skill and security knowledge to minimise the risk of those keys being stolen.

Most who are seasoned in the sector will advocate for this selection and as an individual, it’s an excellent choice. As a family office, however, you may find a number of challenges due to the likely trustee relationship and the potential regulatory challenges of holding assets in a trust, etc.

Multi-signature custody is an area that has seen a significant amount of development over the last 12-18 months. Multi-sig as it’s commonly referred to involves multiple people or devices in order to authorise a transaction. Instead of needing one set of private keys for a transaction, this process requires multiple private keys to ‘agree’ in order for a transaction to take place. This removes some of the self-custody risks of losing the keys. However, it usually takes quite a bit of time to set up and coordinate at the time of transaction.

This type of custody is most often used in businesses, investment groups, or if the asset is being held as collateral. The most significant downside to multi-sig is if one of the signatories isn’t available or refuses to ‘agree’, transactions can be delayed or blocked altogether. If you have an actively managed part of your portfolio, multi-sig can be an excellent form of risk management as both you and the manager would need to be in agreement before assets were ever moved.

Qualified custody is the solution that most resembles the custody of traditional assets, using a service provided by institutions that are subject to a significant level of regulatory audit and oversight to manage your private keys. While each custodian has their own unique approach, it typically involves the separating of the private keys into pieces and storing those in separate military or institutional grade vaults spread out geographically. Using a qualified custodian generally means that your assets are in a bankruptcy-remote position and likely have some insurance protection should anything happen.

Due to the regulatory compliance these institutions must maintain, this is most likely the solution that you’ll find yourself facing as a family office. While this solution comes with ease and peace of mind, there can be some disadvantages when it comes to transaction speed and cost. Using a knowledgeable broker like Benaiah Custody Solutions will enable you to navigate through the selection process in a quicker way and will likely save you considerable costs in the process. The combination of security and preference by regulators make qualified custody a strong consideration – especially with the allocation you intend to hold long-term.

Don’t go it alone

Digital asset custodians are currently leading and shaping the crypto landscape and represent a significant disruption to the traditional financial services sector. However, it is likely that the traditional asset custodians start playing a greater role in how this investment category grows and evolves. Either way, projections indicate a significant increase in family office investment in cryptocurrency over the next few years and appropriate measures need to be taken by the family office to ensure adequate risk management.

“Consulting with a reputable service provider before you dive in can save you considerable tuition in time and money,” says Ben Wiener. Remember that the digital asset space is still quite new and is certainly very volatile. Partnering with the right crypto custodian is paramount before you take the plunge, and enlisting a brokerage to help is certainly advised.

Four things to consider when choosing a crypto custodian

Selecting the right custodian is not an easy decision and should not be taken lightly. Here are some important questions that need to be asked when choosing a crypto custodian:

Does the custodian have the right credentials and is it governed by regulation?

Trust is a hugely important consideration. Your custodian needs to provide solid credentials and confirm their compliance with appropriate regulations. For example, is the custodian having to comply with a regulator that is a FATF member and therefore having to comply with the highest standards of AML, KYC and CTF?

What level of technical expertise does the custodian have?

A technical review of a potential custodian is always recommended. Certain standards need to be in place and adhered to by a custodian in order to demonstrate technical expertise. Systems need to be reliable and aligned to best-practice cryptographic standards. Systems and processes should be audited and stress-tested.

What unique service and system requirements do you have?

Consider the unique needs of your family office. What specific service requirements do you have? What customisation might you need to ensure that a custodian’s ‘product’ is an appropriate fit for your family office?

Is the custodian focused on individual or institutional investors?

Many crypto custodians are not geared to service family offices or larger institutional investors. Ensure that a custodian’s product offering is one that has the necessary level of sophistication and integration capability to suit your family office requirements.

Key reasons why digital asset custody is becoming so important:

1. Safer than exchanges

Storing digital assets on an exchange carries a greater risk of loss due to the susceptibility of exchanges to going bankrupt, being shut down or successfully targeted by hackers.

2. Recourse for investors

If investors choose to hold assets privately or with unlicensed custodians they carry a significant risk of loss from hacking or other events. However, licensed custodians are more likely to have access to trusted insurers and therefore provide some recourse and security in the event of a loss.

3. Reduced complexity

Potential investors in digital assets are often discouraged by the perceived complexity involved. However, custodians can leverage their technology and regulatory expertise to provide investors with a greater sense of comfort and improved ease of use.

4. Increased security

Due to the online nature of digital assets, the security risk associated with hackers and other cyber-crime is quite high. Custodians should have the necessary technology and resources to minimise these risks, providing investors with a more secure and regulated storage option for their digital assets.

What is cryptocurrency?

Cryptocurrency, or simply crypto, is a type of currency that exists digitally or virtually. It is secured by cryptography, which makes it almost impossible to double-spend or counterfeit it. To verify the transaction, cryptocurrency uses encryption, which is where its name is derived from.

How to buy cryptocurrency?

First, you need to choose a broker or crypto exchange. After you create and verify your profile, in order to buy crypto, you need to make sure that you have funds in your new account. Then, choose your desired cryptocurrency (Bitcoin, Ethereum, DOGE, etc.) and place your order. Finally, store your cryptocurrency, either by using digital wallets or leaving it on the exchange platform.

How does cryptocurrency work?

Cryptocurrency is a digital currency created by a process called mining. All transactions are recorded and verified by encryption and are secured by cryptography to prevent counterfeits or double-spends.

Further Reading

A Simple guide to NFTs

CryptocurrencyNow that you've got to grips with cryptocurrency, it's time to understand NFTs. This is a comprehensive guide to everything you ever wanted to know about NFTs but didn't want to ask. From the origin of NFTs, and their rise to prominence, as well as how to buy and sell them, we're covering all the aspects of this trending digital asset.

A Family Office Guide on Governance Pitfalls

GovernanceGovernance has become the cornerstone of effective family office strategy. As complexity and expectations grow, families are moving beyond informal arrangements to adopt structured, transparent frameworks. The focus is now on accountability, adaptability, and long-term continuity—ensuring the office remains aligned with both legacy and future vision.

A Simple guide to family office service design

OperationsThis guide to family office service design explores the essential elements of design thinking for family offices, offering a comprehensive approach to enhancing their efficiency and impact.

A Simple guide to family office recruitment

RecruitmentThis guide provides a deep dive into the unique aspects of recruiting for family offices. Drawing on insights from Simple’s experts and online research surveys, it suggests actionable tips and proven methods to navigate the recruitment process. With the purpose of providing an overview of the landscape, it covers all the basics, starting from identifying specific talent needs to implementing effective onboarding and retention strategies.