Shaun Parkin

My central philosophy is that of a Sherpa. I believe in acting as interpreter, educator, assessor, and advocate for family offices – whilst still being independent.

East Asia, Oceania

Perth, Australia

Investments,

Technology

Infrastructure advisory,

Technology advisory

With over 20 years of financial services experience, Shaun is the founder and principal consultant at Hall Road Investments. Prior to establishing Hall Road, Shaun spent seven years at Boston-based asset manager, State Street Global Advisors where he had numerous roles including Australian Head of Exchange Traded Funds (ETFs) and national head of relationships for Insurance, Endowment, and Family Office clients.

He also held roles in capital markets and middle office with Lonsec, Shaw Stockbroking in Sydney and GLG Partners and JP Morgan in London. He also had a small Mongolian detour which is worth having a chat about.

Insights Shaun Parkin has written

How family offices can ensure successful adoption of technology changes

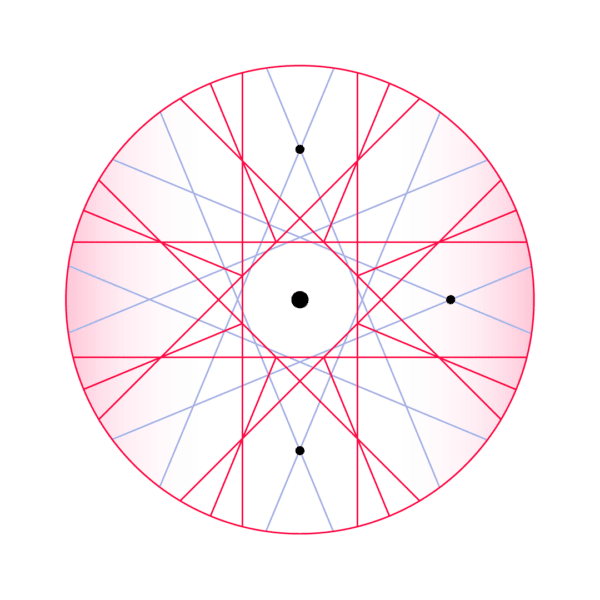

SoftwareAn illustration of the potential decision bottlenecks, managing the onboarding process, discuss the drivers of change in how family offices are utilising new investment technology and how to manage the current office dynamics for a new regime.

6 steps to selecting family office technology

SoftwareTraversing the sometimes confusing and time-consuming task of family office technological improvement is a challenge that needs a process. Here are the six stages you can use as a guide to help make this determination, circumvent analysis paralyses, and make impactful improvements.

How wealth management is adopting digital financial services

DigitalAs family offices become more comfortable with digital business transactions, advisers are utilising new technology to provide advice quicker and more profitably than ever before. Wealth platforms that were forced to upgrade allow for increased mobility for those providing advice to families, who can use this infrastructure as part of a new breed of family office services.

Family office running costs are rising – and why that’s a good thing

DigitalIn 2020, the costs of running a family office rose, with most of these attributed to staffing and IT costs. In this case, this isn't necessarily bad news, as these costs signify a new era for family office technology.

The future of the family office wealth advisor

LeadershipFamily offices come in many shapes and sizes, as do the advisors who serve them. Increased competition, technological changes, and an increasing desire for niche investment opportunities are changing the way that family offices work with wealth advisors. We explore what the future might hold for this market.

How to gain a birds-eye view by understanding family office services

OperationsFamily offices rarely think about their operating costs in basis points – surprising when such a measurement is a common component of determining expense vs value when comparing investments. Navigating your supplier universe can help you gain a much-needed system overview.

How to overcome technological stalemate in Australian family offices

JurisdictionsThough the family office market in Australia continues to go from strength to strength, it is a challenge for software providers to see the value in expanding to a vast country with a highly idiosyncratic financial system. At the same time, there are also challenges to helping established Australian family offices to invest in a high-performing tech stack. We explore solutions to this technological stalemate.

Shaun Parkin is an expert in