Apliqo

Have a question regarding Apliqo?

Contact Apliqo directly, or opt for discretion with our private exploration option and take advantage of a free 20-minute consultation with the Simple team to thoroughly explore your service requirements.

What sets Apliqo apart?

"We focus on the Private Markets investments because we believe it's the most attractive asset class."

Martin Zahner

Product

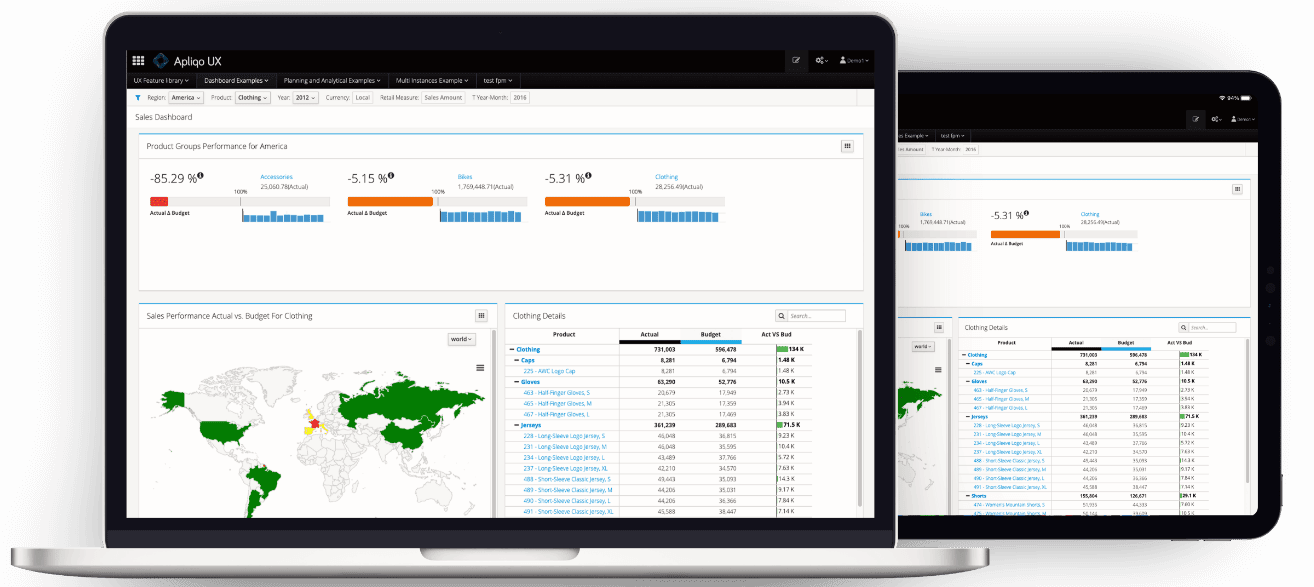

Get an overview of what Apliqo does.

Main Tasks

Portfolio Management

Data Aggregation

Portfolio Construction & Rebalancing

Investment Due Diligence

Investment Performance Analysis

Performance Reporting

Data aggregation & management

Assets supported

Direct Private Equity

Venture Capital

Private Debt

Private Equity

Private Equity & Direct Investments

Private Equity Funds

Whitelabel

Yes

Type Of Software

SAAS

Integrations

MS Excel, Canoe Intelligence

Mobile App

No

Type of data

Transaction level

Accuracy

Automated data integration, Health Check reports

Multi-currency

Users can separate holding level gain/loss from currency gain/loss, Based on holding/position data

Rates

Average SFO: € 100’000 (25 PE/VC/PD funds, 5 users)

Cost structure

Seat based (per named user)

Feature based

AUM based

Key Company Information

Have a look at the company, clients, and references to learn whether this is a match for you.

Employees

50-100

Founded

2013

Locations

Zürich, Hyderabad

Top 5 Markets

Germany, Switzerland

Total AUM

N.A

Ownership

Owned by management, External investors (neither clients nor staff)

Focus

Single family offices

Secondary focus

Fund managers

Can not disclose

Request ReferencesSupport & Services

Learn what support and services you can expect

Added Services

Software development

Bespoke development

Analytical thought processing, data integration and aggregation, custom benchmarking

Support options

General contact mail or phone

Pricing of support

Based on SLA

Onboarding

2-8 weeks

Apliqo Reviews

Sign in to read or leave reviews for Apliqo

Gain insight from real user feedback to guide your decisions or share your experiences and help shape the future of Apliqo.

Read ReviewsLeave Review

We also reviewed some other Portfolio Management Providers