Newest Insights about Operations

Simple Expert Christian Schiede offers insightful advice on leadership transitions in family businesses and seven best practices for family office boards to maintain operational excellence.

All Insights about Operations

Using Human Rights and a rights-based approach for investor engagement

PsychodynamicsA rights-based approach is a conscious and systematic integration of human rights and rights...

What can ultra-affluent clients learn from the origins of a multi-family office?

OperationsBy understanding the origin of a multi-family office, clients can gain some unique insight into the...

The history of family office regulation

LegalThe collapse of Archegos Capital Management heightened calls for regulation of an untamed industry...

Level up your operations with family office technology

SoftwareTechnology is crucial for family offices in order to automate and optimise data, which can help...

An introduction to fiduciary holding structures

OperationsFiduciary holding structures can be useful to wealthy families. Here’s a brief overview of these...

How family office reports can meet decision-making needs

OperationsUsing the right kind of family office report can help streamline decision-making. We’ve rounded...

Impact: Investing in sustainable life below water

ImpactThe 14th SDG, as set out by the UN, aims to conserve and encourage the sustainable use of the...

How to create multi-generational wealth

OperationsCreating multi-generational wealth isn't only about finances and investments to last across...

How wealth management is adopting digital financial services

DigitalAs family offices become more comfortable with digital business transactions, advisers are...

What you need to understand about trusts

OperationsTrusts in common law countries are commonly used as a tool for private wealth structuring and...

A family office strategy for navigating the new normal

OperationsThe second year of a pandemic has meant shifting from survival mode to re-establishing a new...

Next-generation transition: how to prepare to pass the family business on

GovernancePreparing the next generation to take over the family business requires some thought, but it...

The case for interdependence in a family business

GovernanceInterdependence, where there is mutual reliance on other family members, signifies that there is an...

The philosophy and principles of family governance

GovernanceA successful family is measured by more than its wealth. Following three simple guiding principles...

The ownership advantage

OperationsWhile operational involvement in a family business has declined in some cases, there's been an...

Swiss family offices and Sparks: what the SIX segment means

InvestmentsSIX recently introduced Sparks, a new SME-focused segment on the stock exchange that appeals to...

How family offices can deal with death in the family

GovernanceThe hardest part of dealing with death is realising that all you have are memories of yesterday and...

Managing conflict within a family business

ForesightConflict and turbulence within a family – and a family business – are nothing new. If not...

Family office running costs are rising – and why that’s a good thing

DigitalIn 2020, the costs of running a family office rose, with most of these attributed to staffing and...

An introduction to emerging market investment in Eastern Europe

OperationsIt has been 32 years since the transition began in post-communist countries. Despite this...

Why conscious ownership is critical for future-focused family enterprises.

OwnershipIn order to transition their enterprises beyond generations, family businesses must embrace what is...

The impact of matriarchal and patriarchal roles in family business

Next GenerationMost families have an anchor, often identified as a matriarchal or patriarchal figure. A dominant...

The unique governance challenge of mixed culture families

GovernanceGlobalisation has seen the world become a global village. In this global village, a new complexity...

The future of the family office wealth advisor

LeadershipFamily offices come in many shapes and sizes, as do the advisors who serve them. Increased...

Successful on and off the stock exchange – governance practices in family firms

GovernanceThe stock exchange and family firms – two irreconcilable terms upon first glance. Going public...

Seven governance risks that could impact your family office

GovernanceThe need for privacy and more control over wealth and assets has seen the number of family offices...

Made in Germany: five best practices of German family offices

JurisdictionsWhat made family offices in Germany successful and how are they resetting for the new normal? We...

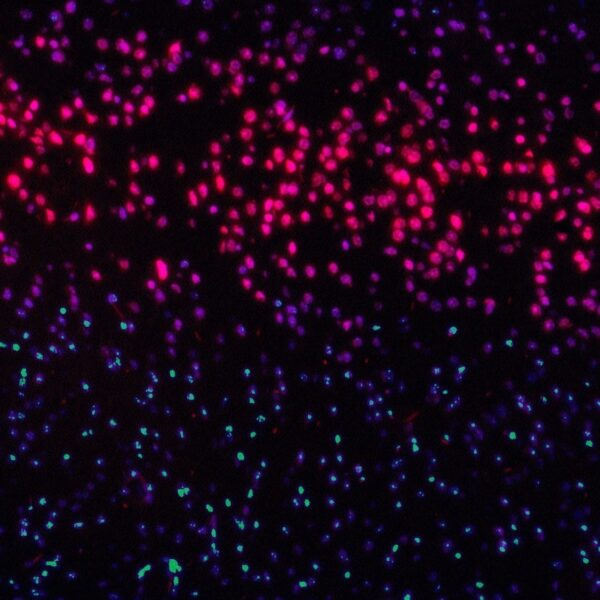

Genomics and epigenetics: new tools for promoting family legacy

GenomicsImagine a seemingly healthy 35-year-old family member assumes the CEO position of a core global...

How to gain a birds-eye view by understanding family office services

OperationsFamily offices rarely think about their operating costs in basis points – surprising when such a...

What family offices should know before setting up in Singapore

JurisdictionsSingapore might be the answer for many Western family offices looking to bridge family values and...

Women on board: enhancing leadership in family firms

OwnershipOver the past 5-10 years, there has been an increasing focus on the importance of women in...

How service design can transform the family office structure

OperationsRalph Waldo Emerson once said, “Every great institution is the lengthened shadow of a single man...

How psychodynamics can drive better decision making in family businesses

OwnershipA changing set of realities, norms and values are underway in the face of an accelerating climate...

How to overcome technological stalemate in Australian family offices

JurisdictionsThough the family office market in Australia continues to go from strength to strength, it is a...

Why emotional intelligence is the key to intergenerational succession

Next GenerationIntergenerational succession represents a significant challenge to family business. Though a common...

Emerging risks in the family office sector

OperationsToday’s business leaders have to navigate an increasingly complex risk environment. Although not...

Using life stages to professionalise the family business

OwnershipMany businesses with humble beginnings have been able to weather change and grow into empires....

How Asian family businesses respond to four global challenges

JurisdictionsAlthough certain business challenges are universal to family offices across the globe, the way in...

5 lessons for family offices from HBO's Succession

CommunicationHBO’s mega-series Succession follows the decaying empire of a dysfunctional media family - a...

Legacy and succession planning trends and advice

Next GenerationOnly 3% of family-owned businesses survive until the fourth generation and beyond. There appears to...

Opportunities & obstacles for African family offices

JurisdictionsAfrica marches to her own rhythm. Besides her unrivalled natural beauty, the continent is blessed...