1. TL;DR

Simple’s 2025 data shows a measurable shift in digital maturity. More family offices are running multi-system stacks, and integration and data quality have overtaken visual reporting as top priorities. The conversation has moved from adoption to outcomes. After years of experimentation and fragmented adoption, digitalisation has accelerated — family offices are no longer passengers in the technology journey; they’re becoming its architects. The systems they design now, built to connect data, automate workflows, and enhance decision-making, will define their operational advantage for years to come. Offices that can integrate, scale, and build trust effectively are likely to set the pace.

This edition draws on insights from 40 vendor surveys, data from more than 11,000 platform users, Simple’s family office polls and mini-surveys, and direct family office calls and workshops.

Sign in to download the TL;DR as a PDF.

What’s Changed Since 2024

AI is shifting from aspiration to infrastructure.

92% of vendors now use AI, with half embedding it in reporting, reconciliation, and onboarding. Voice and agentic interfaces are entering live workflows, and early pilots show that natural-language and voice-based onboarding assistants are reducing manual data entry and improving document accuracy.

Integration remains a major bottleneck.

73% of platforms cite private-market data as their hardest problem. After years of stitching together middleware layers, many family offices now find the upkeep too burdensome, prompting a shift toward more unified platforms that simplify data flows.

Excel reliance is finally falling.

Only 0–25% of potential new clients still use spreadsheets for primary reporting (down from more than 50%), though investment-led teams remain higher at around 50%.

Buyers are becoming more operationally mature.

Next-gen leaders and Heads of Operations now lead structured evaluations focused on fit, governance, and support, bringing a higher level of digital fluency to procurement.

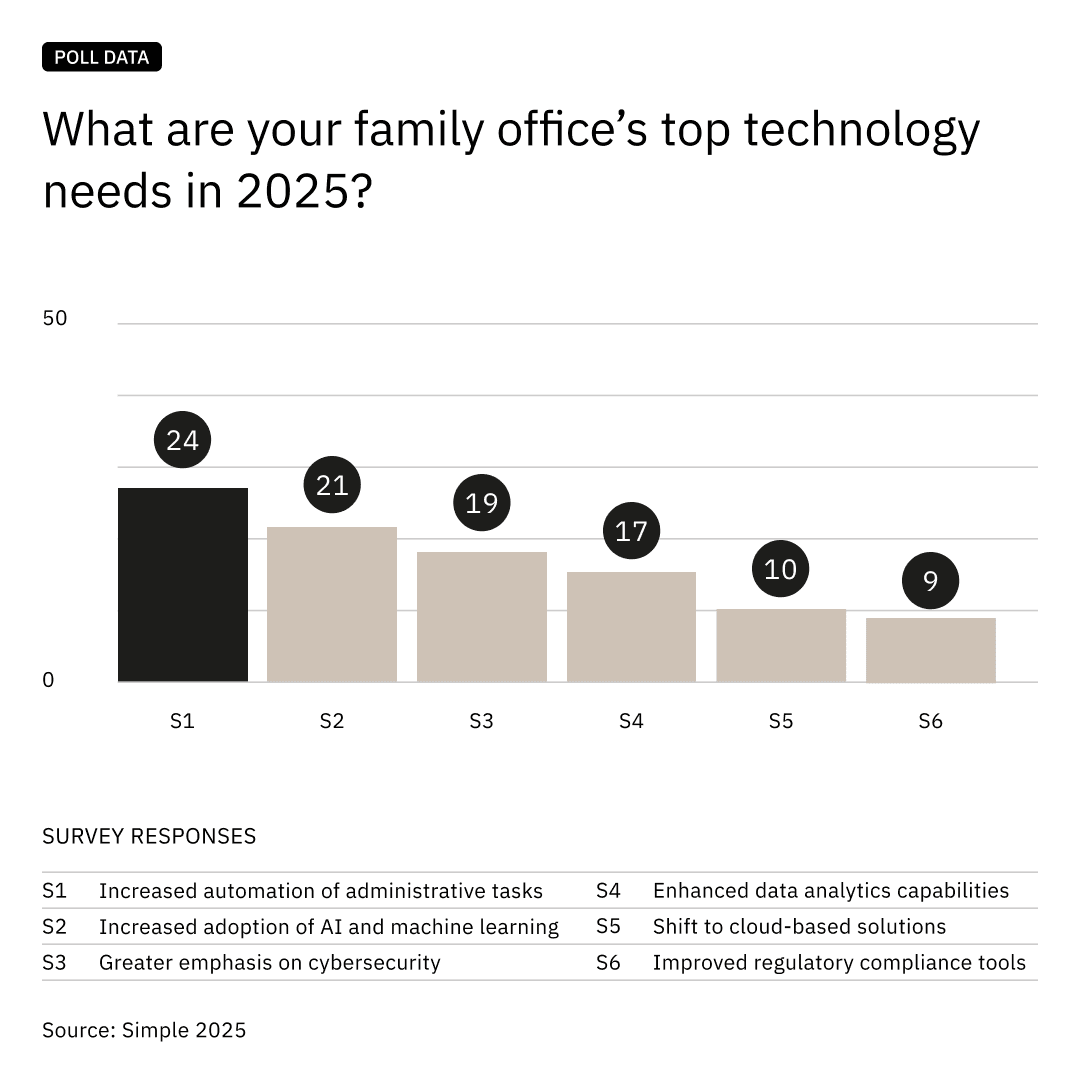

A recent poll indicates that integration, automation, and data consolidation again top family offices’ technology priorities — mirroring the broader shift from tool selection to operational assurance.

Key Market Signals

Trust is increasingly viewed as the new KPI — not time-to-launch, but time-to-trust.

Across all 2025 submissions, ‘trust’ emerged as the most common word, appearing more than ‘AI’ or ‘integration’.

In family-office calls, the same concern surfaced as frustration with inconsistent or duplicated data. The strongest buying signal this year appears to be credible proof of data reliability, rather than new functionality.

Digital maturity appears to be rising fastest in emerging hubs, such as the UAE and Singapore, with Africa showing strong momentum.

Several new offices in these regions launched with cloud-native data fabrics and automated compliance mapping from day one — capabilities many European peers are still retrofitting onto legacy stacks.

Vendor roadmaps are converging on onboarding and modularity.

Providers are redirecting resources from feature releases to implementation speed and time-to-value, responding to more structured buyer expectations.

Family offices want customisation and plug-and-play capability.

Demand is strongest for systems that integrate easily with existing custodians, fund administrators, and accounting tools rather than all-in-one suites that lock users in.

2. Research methodology

The findings in this report draw on extensive data from across the global family office software and technology ecosystem. Insights combine quantitative surveys with qualitative conversations to provide a balanced view of evolving needs, priorities, and adoption patterns.

Our data sources include:

- Direct engagement with family offices: in-depth discussions with more than 100 family offices and principals throughout the year, covering technology selection, optimisation, and implementation.

- Simple platform data: aggregated insights from over 11,000 platform users, roughly half of whom are family offices and principals.

- Structured surveys: a needs-analysis survey of active Simple users and detailed submissions from 40 software vendors.

- Community feedback: weekly polls and mini-surveys capturing live sentiment on emerging trends among platform users.

- Secondary research: publicly available reports and studies used to contextualise findings within the wider global landscape.

A grounded theory approach was applied to identify recurring themes across quantitative and qualitative inputs, which were then explored in greater depth through targeted research and follow-up interviews.

3. Introduction

The digital transformation of family offices has taken another decisive step forward.

In 2024, both clients and service providers were largely reactive — focused on post-pandemic catch-up and tactical digitisation. Complexity, compliance, and cyber risk dominated conversations. Most offices were still asking: “What exists?”

In 2025, the question has shifted to “What fits?” Family offices are now designing their digital architecture for advantage. The new mandate is operational confidence — systems that create clarity and control.

Submissions from the 2025 dataset confirm this shift. Vendors increasingly describe clarity as a measurable outcome — reconciliation accuracy, onboarding speed, and data lineage — rather than a marketing line.

Three shifts define this phase of maturity, centred on execution and clarity as the new markers of leadership.

From adoption to alignment.

Technology strategy is being institutionalised by next-gen leaders and Heads of Operations running structured evaluations focused on fit, interoperability, and governance. Vendors report that procurement teams now arrive with defined success metrics and integration maps, not feature wish lists. Offices are choosing systems that reinforce their operational logic, reporting cadence, and governance frameworks.

“The focus is shifting toward collaboration, automation, and secure data exchange between families, advisors, and institutions.” — Abbove SA

Several leading platforms describe this same evolution, noting that family offices now request integration maps, reconciliation samples, and governance documentation during evaluation — clear signs of a maturing procurement function.

From data overload to data trust.

Nearly every service provider surveyed highlighted that trust has become the defining KPI. The bottleneck is no longer data collection but reconciliation and confidence. As one provider noted, “The best AI is invisible. It’s doing the work without needing a relationship.” The challenge is not deploying technology, but ensuring that what it produces is accurate, auditable, and actionable.

“In 2025, family office technology is no longer a niche concern — it’s a core pillar of operational excellence, strategic agility, and generational resilience.” — Aleta

From dashboards to operations.

Family offices are moving beyond the visual layer. They want closed-loop workflows where insights trigger approvals, tasks, and audit trails. Reporting now sits within an operational context — linked to entities, responsibilities, and policies. The focus is shifting from static outputs to systems that learn and respond.

These developments define the new competitive logic of family-office technology. The offices leading this next phase are building for velocity — designing architectures that convert information into action through reliable, repeatable workflows. Several providers describe rebuilding workflows so that reporting now triggers approvals, reconciliations, or tasks. Their contributions indicate that operationalisation has become the central design goal.

When asked about rollout challenges, family offices most often cited limited internal capacity and resistance to change. Adoption barriers are cultural and resource-based, not financial. This is echoed across vendor data: Multiple platforms highlight limited internal bandwidth and organisational resistance to change as the most common barriers to successful implementation.

4. The State of Family Office Technology in 2025

The family office software ecosystem continues to mature. Across almost every operational function — reporting, accounting, compliance, onboarding, and analytics — multiple technology solutions now exist. The 2025 question is no longer what’s available, but how it all works together.

Family offices have become increasingly digital, but not necessarily more integrated. The ecosystem has matured unevenly: while 85% of audited platforms offer APIs and more than 80% support entity-level reporting, integration remains a persistent blind spot — particularly around private-market data, multi-entity consolidation, and reconciliation.

Integration remains the primary constraint. Contributors to this year’s study emphasise that reconciliation of private-market statements continues to be the slowest and most error-prone process, where automation success depends more on data structure than on AI capability.

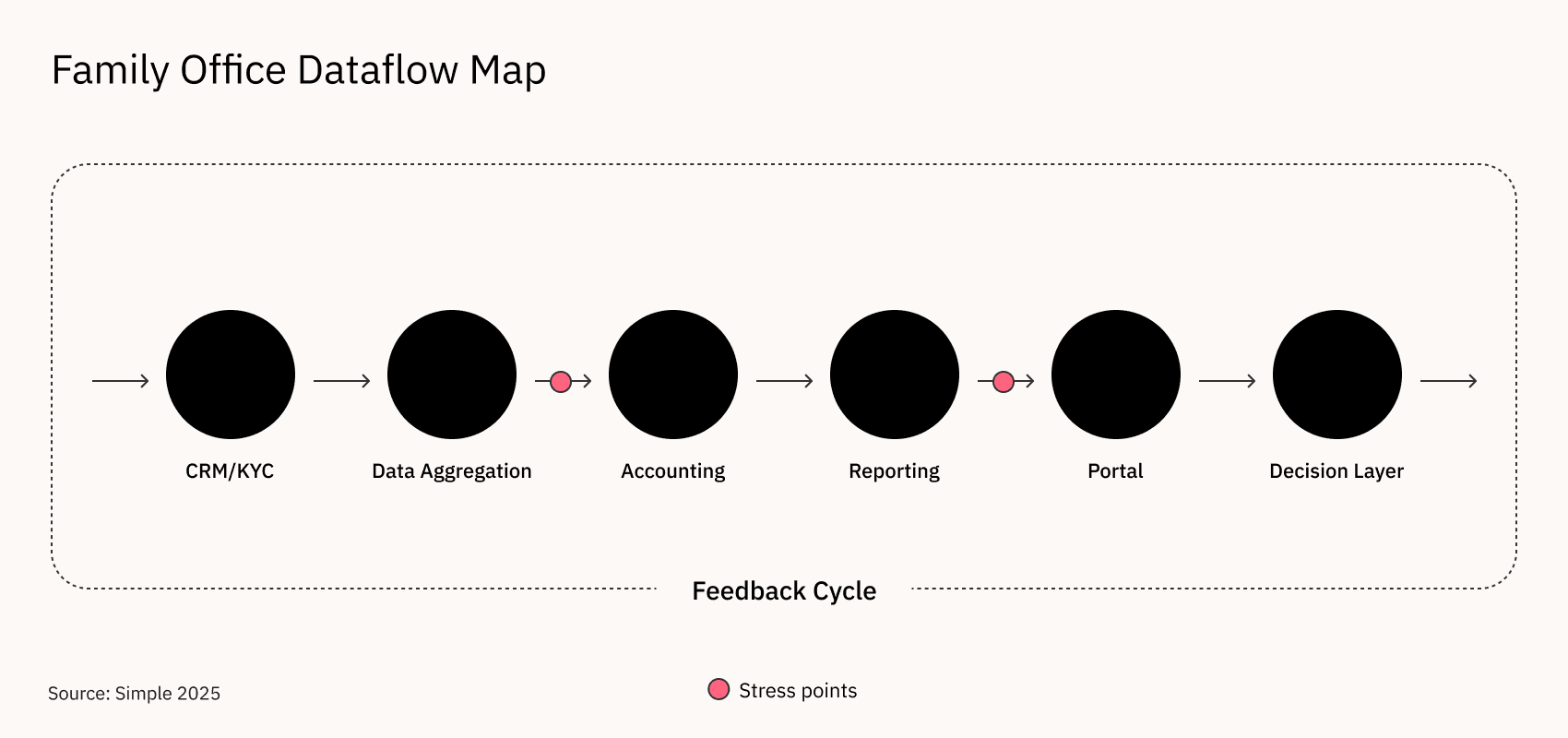

The modern family office data flow remains complex. Integration gaps in reconciliation and reporting continue to be the main points where trust and automation break down.

Integration challenges follow a familiar pattern across the family-office data journey. The most acute friction points occur within private-market workflows: 73% of vendors cite reconciliation as the hardest and slowest process, underscoring that accuracy — not dashboards — now drives buying decisions.

“Most clients still expect magic — they want a unified view of their world, but they don’t yet appreciate what it takes to get there.”

The challenge isn’t purely technical. Several platforms observe that adoption delays often stem from internal readiness — competing workflows, unclear data ownership, and limited project capacity — rather than product limitations. In response, some have begun embedding guided-onboarding frameworks and training modules to help offset these barriers.

Many family offices, especially in mature markets such as the US and Europe, still bolt modern software onto legacy processes.

“We’ve paid for modern tools, but we’re still duct-taping reports together. We need the plumbing — not just the interfaces.”

— Next Gen leader, UK-based MFO

By contrast, newer markets — including the UAE, Singapore, and emerging regions across Africa, Asia, and LATAM — are leapfrogging legacy issues. Onboarding cycles are faster and API adoption higher where infrastructure has been built post-2020. In these regions, integration is embedded in how firms scale, not treated as an afterthought. Similar patterns are visible across the Americas, where open-API frameworks and data-lineage transparency increasingly underpin scalability.

Integration documentation, onboarding timelines, and sample KPIs now matter more than demos, especially for families in transition or growth. Next Gen leaders and Heads of Operations are increasingly initiating evaluations. Their questions reflect a shift from isolated functionality to speed, flexibility, and control across the operating environment.

Although 82% of vendors now offer entity-level and multi-jurisdiction reporting and 63% include ESG or private-market modules, only 34% of buyers actively use these features — a gap tied directly to onboarding quality and client education. Interviews suggest that most bottlenecks are not platform-related but occur at the custodian or administrator level.

“In general we only face challenges when the custodian is not yet ready or provides outdated data feeds.”

— WealthArc

To address this, several data-governance specialists are helping family offices link onboarding discipline with data trust — ensuring that architecture, permissions, and lineage are clearly defined before systems go live.

This reflects a broader pattern: onboarding friction, not product scope, remains the primary cause of stalled adoption. Many offices still revert to Excel mid-implementation or use platforms only for dashboards while keeping core data operations offline.

Operational Signals

- 73% of vendors cite reconciliation and private-market workflows as core integration challenges.

- Digital maturity is rising fastest in the UAE, Singapore, and South Africa.

- Entity-level reporting is standard but underused due to data-quality and onboarding constraints.

- Next Gen and Ops leaders are driving more structured evaluations.

- Platform adoption ≠ full implementation — Excel persists in parallel workflows.

The Simple Take

Features and implementation:

Many platforms now offer powerful capabilities, but few clients activate them. Implementation — not scope — is the limiting factor.

Integration readiness as differentiator:

Families are no longer swayed by dashboards; they want confidence in how systems connect to custodians and fund administrators.

System architecture and support:

Technology evaluations now hinge on interoperability and implementation frameworks. Providers combining strong software with structured onboarding and post-launch support are being treated as long-term infrastructure partners.

Opportunity cost:

Delayed implementation erodes trust, slows reporting, and increases reliance on third-party fixes.

5. From Systems to Friction Points: Why Integration Matters Now

The tools exist, and the buyers are ready — but something keeps breaking. Before analysing platforms, products, or features, we need to address the quiet constraint undermining even the most well-intentioned technology investments: integration.

The average family office today is not short on functionality. Reporting, accounting, CRM, onboarding, and ESG — nearly every operational layer now has digital coverage. Decision-makers, particularly Heads of Operations and next-generation leaders, are entering the market with clearer expectations and structured evaluation playbooks.

So why do so many systems still fail to deliver automation, visibility, or trust? The answer lies in how data moves — or fails to move — between systems. Integration powers everything else. Without it, tools become silos, effort multiplies, and time is lost reconciling what should already align.

The idea of a one-stop shop via an integrated solution is passé — all systems, including ‘all in one’ and the systems within tech stacks, are ‘best of breed.’” — Canoe Intelligence

6. Integration

Across every dataset, call, and vendor conversation this year, one word dominated: integration. It remains the most requested capability — and the most common point of failure. For most family offices, this means not only connecting internal systems but ensuring stable data flows with banks, custodians, and fund administrators.

Integration underpins efficiency and data confidence. A platform may offer dashboards, compliance modules, or ESG overlays, but if underlying systems can’t communicate, the value is constrained — and family offices know it.

“The connectivity challenge is still real, despite various regional initiatives to create standards and open up how banks provide data. This isn’t going away quickly; it’s even tougher as family offices establish themselves in newer hubs like the UAE.” — Altoo

From accounting and banking to portfolio monitoring and legal documentation, the average family office handles data from more than a dozen systems. When these don’t sync, workflows fragment, trust erodes, and teams revert to manual workarounds that undo the promise of automation. “Integration is where all the good intentions fall apart,” noted one European platform lead.

“You can build the cleanest interface, but if the data doesn’t flow right, trust erodes fast.”

More than 70% of vendors cited private-market ingestion and reconciliation as the most underdeveloped part of their stack, though several specialists are narrowing that gap through document-driven data automation. Efforts are increasingly focused on strengthening custodian connectivity, enhancing reconciliation governance, and building automation on clear data lineage and accuracy — ensuring that cross-custodian feeds remain validated and audit-ready.

“Automating accounting and reporting is no longer enough. Family offices are expecting technology to support high-level decisions like risk analytics and scenario modelling.” — Canopy

Many platforms still rely on clients to manage their own connections, integrations, and data formatting. Even where APIs exist, vendor support for setup, testing, and monitoring varies widely.

For smaller or first-generation SFOs, the quickest path to “time-to-trust” often remains a single, cohesive platform covering most operational needs without the complexity of multiple integrations. These integrated environments combine multi-entity reporting, document workflows, and onboarding support within one governed stack.

Many families over-invest in middleware or underuse features they already own. “Middleware fatigue,” cited across interviews, is driving two clear trends: platform consolidation (fewer tools) and specialist augmentation (adopting systems that “play well with others”).

“We’ve got the tools, but not the trust. Everyone’s still cross-checking with spreadsheets.” — a family office COO.

This dysfunction undermines automation, delays decision-making, and erodes ROI. Teams spend valuable time cleaning data instead of generating insight. ESG and impact tracking become reactive rather than real-time, while capital-call and liquidity planning remain unsystematised.

Yet 2025 also brings progress. Several vendors have moved beyond “open-architecture” rhetoric to deliver pre-configured, use-case-driven integration modules. The focus has shifted from building endpoints to shipping workflows.

“The industry is moving from fragmented, spreadsheet-heavy workflows to integrated platforms that unify accounting, reporting, entity management, and compliance in one environment.” — Asseta AI

Several platforms now provide packaged workflows that automate document ingestion, fund reconciliation, and AI-supported reporting — signalling a broader move from generic APIs to tailored integrations. Examples include:

- Real-estate integrations linking document vaults, valuation models, and performance dashboards.

- Capital-call automations synchronising legal documentation, wire instructions, and cash-flow schedules.

- ESG overlays ingesting custodial data, fund metrics, and public impact benchmarks in real time.

“We realised we can’t just expose endpoints; we need to package working workflows,” said a US-based product lead.

At platform level, integration is now treated not as plumbing but as a strategic product tier. Leading teams are:

- Partnering with custodians on native data pipes.

- Co-designing onboarding journeys with clients around reconciliation.

- Embedding governance controls to validate ingested data before it reaches dashboards.

Some platforms now design onboarding around reconciliation logic, aligning governance, permissions, and data hygiene before launch. Others contribute on the governance side, linking onboarding discipline with ongoing reconciliation audits to maintain trust in automated workflows.

In interviews, many family offices cited integration readiness as their single most important selection criterion. They were no longer asking about features but about fit:

“How does this work with our custodian?” “Can we integrate our private-equity ledger?” “Who handles data hygiene during onboarding?”

The next frontier in family-office technology is about connection — not just to data sources, but to context, workflows, and client capacity.

Integration Insights

- 70% of vendors report that private-market reconciliation remains the biggest integration gap.

- Private-market data is still difficult to automate: administrators deliver statements in varied formats — PDFs, CSVs, and emails — with inconsistent fields, valuation lags, and unstructured capital-call schedules. This fragmentation explains why reconciliation accuracy, not dashboard design, drives most procurement decisions.

- Middleware fatigue is pushing families toward consolidation or toward specialist tools that “play well with others.”

- Top vendors are delivering pre-configured integration modules tailored to family-office workflows.

- Trust in data has become the baseline expectation, defining what many describe as “the last mile” of operational friction — the step between accurate data and trusted automation.

“The biggest technology risk for family offices is unreliable or fragmented data. When systems can’t consolidate information across custodians, fund portals, and private investments, blind spots emerge that undermine decision-making and security.” — Vyzer

The Simple Take

Connections now set the benchmark:

Integrations must be native, tested, and supported for the office’s stack.

Integration is now a product in itself:

Vendors that treat it as such will earn trust and client loyalty.

Modular specificity matters:

Generic APIs no longer suffice. Platforms that solve defined pain points through reliable, packaged connectors will stand out.

7. AI in the Workplace

In 2024, AI was mostly hype — talked about more than used. Most vendors were still prototyping; most family offices remained sceptical.

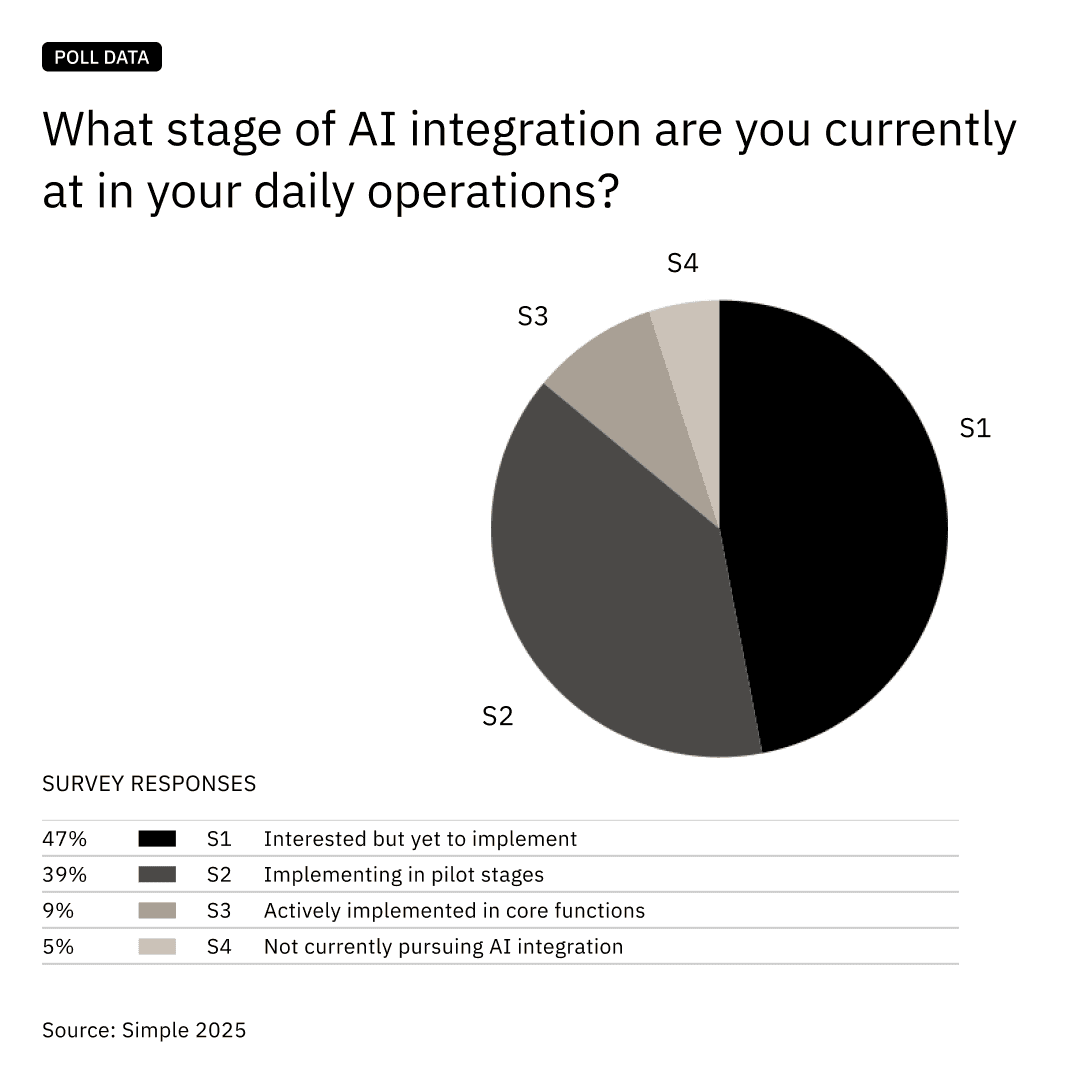

A poll early this year revealed that most family offices remain in early AI adoption stages, with the majority either exploring or piloting implementations rather than embedding AI into core workflows.

While MFOs lead in scale and governance, SFOs continue to prioritise privacy, bespoke control, and minimal vendor exposure — two routes toward the same goal of operational alpha. SFOs voiced concern about vendor longevity, while MFOs emphasised speed of integration and shared standards.

By 2025, the focus has shifted. AI is becoming part of family-office infrastructure: powering classification engines, surfacing anomalies, tagging transactions, parsing documents, and personalising user experiences. A growing number of platforms are embedding AI within reconciliation and reporting workflows, while others are applying machine-learning techniques to enhance onboarding and data validation. “The best AI is invisible,” one provider told us. “It’s doing the work without needing a relationship.”

Not every automation succeeds. Poorly scoped projects can add complexity rather than reduce it — especially when staff aren’t trained to interpret or override incorrect outputs. Still, cautious adoption is reshaping both platform strategy and client expectations. Many vendors now report AI embedded across core workflows — a notable increase from 2023.

The significance lies not in the tech, but in how providers deploy it. Over half of those with live AI report use in reconciliation, reporting, onboarding, forecasting, and client communications — bringing tangible efficiency gains.

Several platforms illustrate how AI can reduce operational drag, from detecting anomalies across multi-custodian feeds to triggering automatic alerts when fund data deviates from reconciliation norms.

What’s changed?

Family offices have matured in how they evaluate AI. Where 2023 buyers asked “Do you use AI?”, 2025 buyers ask:

- “What does it do, and where in the workflow?”

- “Can I see how it reduces time to insight?”

- “What’s your validation and error-testing protocol?”

- “Who is accountable for data quality and output accuracy?”

“What matters isn’t whether it’s AI… it’s whether it’s accurate,” — Head of Operations at a large MFO.

These sharper questions are changing vendor roadmaps. Marketing language is giving way to technical proofs, ModelOps protocols, and client-specific tuning.

Stand-out use cases include:

- AI onboarding assistants that extract key fields from legal documents and generate draft client profiles.

- Generative copilots trained on firm-specific data for internal Q&A and dashboard navigation.

- Anomaly-detection overlays flagging stale or inconsistent fund data.

- Natural-language portfolio queries such as “Show me unrealised gains by entity over the past 12 months.”

- Forecasting models surfacing future liquidity gaps or distribution schedules.

These capabilities are no longer experimental. Several platforms confirm live deployments automating classification, reconciliation, and document parsing at scale. Yet results remain uneven: automation is easy to announce, but harder to sustain in complex family-office environments.

Some vendors now offer modular AI components that plug into compliance alerts, reporting triggers, or entity-structure audits — functional rather than flashy, which is precisely the aim.

“We’re building a firewall around our models. No client data touches public endpoints,” — a platform lead.

That stance is echoed across the cohort, with most favouring private-cloud hosting and auditable model governance. AI is welcome — but only when it aligns with governance expectations.

“Family offices should focus on their wealth strategies and personal priorities while outsourcing technical functions to trusted partners. For smaller offices, building in-house data or cybersecurity teams can prove prohibitively costly.” — Greenlock

By late 2024, most offices were still in pilot phases. The main blockers remain fragmented data, unclear ROI, and security concerns — proof that awareness now outpaces execution.

Governance: The Missing Half of the Equation

As AI becomes more embedded, risk management grows increasingly urgent. Concerns are shifting from “What can it do?” to “What happens when it fails?” Resilience has become part of governance itself. Several contributors note that many offices still lack tested continuity frameworks, while those that rehearse scenarios tend to recover fastest.

Emerging governance themes include:

- Explainability and auditability: demand for a clear chain of logic, particularly in tax and compliance outputs.

- ModelOps discipline: alerts, version control, and human-in-the-loop overrides.

- Data privacy and residency: acute in Europe and the Middle East, where clients ask, “Where is the model hosted, and who can see what?”

Contributors report rising demand for documented AI-governance protocols that outline ownership, override controls, and decision logs. Many family offices now outpace their vendors in caution, insisting on contractual boundaries, local hosting, or off-by-default AI modules. In some cases, firms have even conducted internal “AI audits” before approving deployment.

“The real hurdle is foundational — many lack the clean, centralised data and internal governance needed to use AI effectively and responsibly.” — Aleta

Talent Is Adapting Too

AI is reshaping both tools and teams. Some family offices now hire AI product leads or train analysts in prompt engineering. From Australia to Zurich, a new class of hybrid professionals is emerging — domain-literate, tech-comfortable, and fluent in both stewardship and synthesis.

From analyst to architect. From reconciler to interpreter. From system user to insight curator.

These are not just digital upgrades but organisational shifts, requiring new roles, new questions, and new levels of comfort with automation.

AI at Work

- 92% of vendors use or are developing AI.

- More than 50% say AI is embedded in critical workflows, not just surface UX.

- Most common uses: classification, data cleaning, document parsing, forecasting.

- Generative AI is not standalone — it’s woven into product layers.

- Governance concerns are rising: hallucination, explainability, auditability, data residency.

- Talent shifts are underway — the rise of domain-aware AI practitioners in family-office roles.

The Simple Take

The new baseline:

AI is moving from front-page hype to quiet infrastructure. It’s becoming the logic behind decision-making, not a standalone feature, however its long-term impact on family-office operations is still taking shape.

Governance as design challenge:

As AI becomes more embedded, governance must keep pace. Offices are beginning to build practical safeguards — defining ownership, approval rights, and model-override protocols — to ensure outputs remain explainable and aligned with client policy.

People must evolve:

AI doesn’t replace judgement; it requires it. Family-office teams need to understand, guide, and challenge algorithmic logic — not just operate the tools. Upskilling is becoming a core part of resilience.

8. Innovation & Roadmaps

Family-office software has never been busier, or more uneven. From AI copilots to modular compliance dashboards, vendors are racing to differentiate. Yet product maturity and delivery speed vary widely. Some platforms are already shipping AI-native workflows; others are still refining basic reconciliation.

Across vendor submissions and demo sessions, one clear pattern emerged: roadmap clarity now signals market maturity. It is no longer about which features exist, but how well they solve real-world friction. Three innovation themes define 2025, shaping both buyer expectations and provider strategy.

1. Embedded Intelligence

AI has moved beyond static tagging and chatbot interfaces. The leading platforms are integrating it directly into core functionality — often invisibly.

Examples include:

- Smart entity mapping that detects cross-holdings, ownership chains, and legal dependencies.

- Predictive reconciliation engines that flag mismatches before reports are generated.

- Behavioural prompts based on user habits, such as: “You regularly review quarterly FX exposure — here’s a new variance you may have missed.”

Several platforms exemplify this direction, embedding machine learning into document parsing, reconciliation, and workflow automation so users interact with cleaner data, not algorithms. Others are extending this approach through contextual alerts and liquidity forecasts, making AI part of the process rather than a visible feature.

“The most transformative opportunities for family offices lie in predictive and preventive intelligence across complex wealth structures by forecasting cash flows, understanding overall asset allocation in the context of overarching entity frameworks, and tracking outliers in risk and performance.” — Asset Vantage

AI is shifting from tool to integrated collaborator, reducing friction, anticipating needs, and building trust in daily work. Results remain mixed, with some automations adding steps before efficiencies appear. “If AI isn’t saving time or improving accuracy, it’s just noise,” said one Head of Product at a Swiss platform.

“We stopped pitching it. We embedded it.”

2. Friction Reduction

Onboarding still defines user experience, despite technical progress. Over 60% of vendors are simplifying onboarding through:

- Guided onboarding flows tailored by role, region, or asset class.

- White-glove integration teams that establish live API links to banks, custodians, and administrators.

- Data-migration tools that intelligently map Excel files to structured formats.

Several platforms are pairing automation with human guidance to accelerate time-to-value. Direct custodian connections have helped shorten onboarding times significantly — evidence that user experience and data quality are inseparable.

One vendor recorded a 25% rise in NPS after launching an onboarding wizard with reconciliation checklists and real-time data validation. This is less about novelty and more about product discipline: if clients cannot implement, they cannot benefit.

3. Modularity Over Monoliths

Perhaps the biggest shift this year is the rise of “composable architecture”. Buyers no longer want sprawling, all-in-one platforms. They prefer targeted modules that deploy quickly, integrate cleanly, and scale over time.

Practical examples include:

- À-la-carte access to ESG, liquidity, CRM, tax, or cash-flow tools.

- Middleware-friendly design with shared data layers.

- SSO and OAuth links to accounting, legal, or analytics systems.

- Embeddable widgets within a family office’s own portal.

“Families want to orchestrate their stack — not be boxed in by it,” said one US platform lead. “We don’t sell a walled garden. We sell building blocks.”

Some platforms exemplify this modular approach, offering lightweight components that integrate easily with existing accounting or reporting systems.

When asked to rate what they value most post-demo, buyers highlighted:

- “Flexibility to add or remove features without starting over.”

- “Integration discipline — do they play well with our stack?”

- “Post-onboarding support that’s not just ticket-based.”

These priorities echo the broader operational frustrations captured in recent Simple polls.

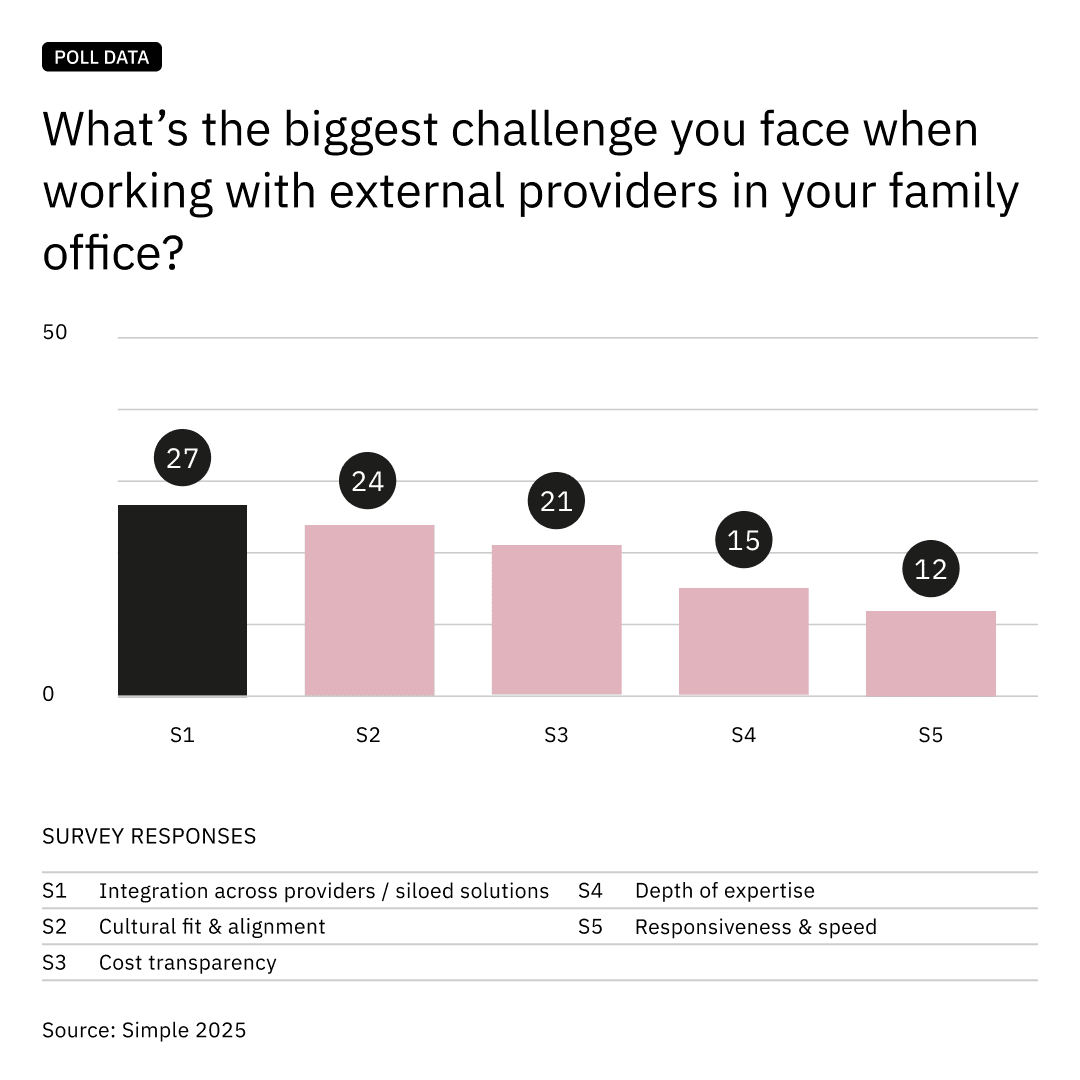

Integration and cultural fit continue to outweigh pricing or speed when family offices assess external providers — proof that partnership and interoperability drive long-term satisfaction.

Where Innovation Slows

Many vendors were candid about what is not moving as quickly:

- AI explainability remains a challenge when teams lack in-house data-science capacity.

- Regulatory alignment delays product updates, particularly around SFDR, US data-residency, and GDPR-adjacent rules.

- Small-team constraints force trade-offs between releasing new features and refining core performance.

“We didn’t release ten new things this year, but we fixed the two that were costing clients hours every week.” — a vendor CTO.

Buyers notice. Several decision-makers said they are more impressed by friction reduction than feature counts. In a market defined by complexity, focus has become credibility. Data from family office surveys also show that interoperability and partnership mindset now outweigh pricing in vendor selection.

Signals & Shifts

- AI is moving into core workflows: reconciliation, forecasting, entity tagging.

- Friction-first onboarding tools are becoming standard.

- Modular, composable design is overtaking all-in-one promises.

- Roadmaps are judged by relevance and follow-through, not volume.

- Transparency wins: vendors that admit delays often gain greater trust.

The Simple Take

Innovation is narrowing to utility:

The arms race is over; success now depends on how deeply a feature improves the client experience.

Integration is the new scale:

Buyers now seek orchestration, not obligation. The ability to plug into existing ecosystems is as important as native features.

Roadmaps as risk filters:

Buyers increasingly disqualify vendors for weak execution in onboarding, integration, or AI maturity — not for lacking features.

9. Buyer Behaviour & Decision Dynamics

Over the past 18 months, the technology buying process inside family offices has evolved quietly but significantly. Buying conversations are more structured, even if purchase volumes haven’t grown. Advisors report that decision-making is widening beyond principals, even as many family offices still learn what they need only after exploring solutions.

Family offices now institutionalise fit, not just choose tools. Technology decisions now reflect governance, risk, and strategic alignment with the organisation’s direction. Insights from our mini survey, platform data, and family office calls reveal a consistent trend: decision-making is no longer concentrated at the top.

Key stakeholders now include:

- Heads of Operations, who manage processes and data flows.

- Next-generation family members, who bring digital fluency and long-term perspective.

- External advisors, often tasked with assessing integration, compliance, and security.

- Internal analysts, who know exactly where reconciliation fails or reporting slows.

These participants bring sharper questions, greater technical scrutiny, and a stronger sense of ownership.

“You can’t just be a good-looking tool anymore. We’re asking: Will this work with our processes, with our people?” — COO, European SFO

This shift is reflected in how procurement itself is formalising. Evaluation no longer ends with a demo; it now includes:

- Sandbox pilots simulating real-world scenarios.

- Role-based walkthroughs tailored to entities, stakeholders, and approval chains.

- Security reviews covering audit logs, ModelOps, and access controls.

- Support queries to test responsiveness and clarity.

- Custom scorecards ranking vendors on integration quality, support posture, and data governance.

Vendors attest to this shift: evaluations now begin with governance frameworks and end with support testing. Buyers want proof of controls and responsiveness, not just feature breadth.

Among buyers on the Simple platform in 2025, more than 65% described their selection process as structured or formalised — a 40% rise since 2023. This reflects the broader professionalisation of the sector. As family offices build resilience, technology decisions are increasingly viewed not as IT purchases, but as long-term alignment choices.

The questions driving 2025 procurement are practical and outcome-focused:

- “How fast can we move from demo to value?”

- “When something breaks, who owns the fix?”

- “What’s the paper trail — and how auditable is it?”

- “Is this actually saving us time, or adding another layer of noise?”

- “Can our operations team run this, or do we need new hires?”

Vendors report that buyers increasingly request sandbox testing and onboarding templates before signing contracts — a clear sign that time-to-trust now outweighs time-to-launch.

A common theme emerged across family office calls: even the most polished platforms lose credibility if they fail during onboarding or lack responsive support.

“A glossy interface with no roadmap is a liability. We’re investing in systems, not screenshots.” — Next Gen buyer, Asia-based MFO

Other contributors echo this sentiment, noting that buyers now treat integration reliability as a proxy for vendor longevity: if the data doesn’t stay connected, neither does the relationship.

Vendor discovery is shifting too. Events, SEO, and outreach still play a role, but peer referrals and advisor introductions now drive the strongest leads. A vendor noted that most new prospects arrive through client-network introductions rather than digital campaigns, with referred leads converting at three times the rate of cold inquiries. Credibility, in short, is now network-driven.

“What’s shifting is the recognition that the family office extends well beyond portfolio reporting.” — Nines

And while spreadsheet reliance is finally receding, it hasn’t disappeared. Several families still use platforms for dashboards while maintaining reconciliation in Excel — a reminder that implementation, not selection, is often the weak link. Increasingly, buyers are asking not just “Can this platform work?” but:

“What will break?” “Who will fix it?” “And how do we exit if it doesn’t fit?”

Ultimately, governance exists to manage that risk — not eliminate it. In 2025, governance is being built directly into every technology decision a family office makes.

“Family offices are very prepared to spend top money for expert advice on structuring, wealth transfer, and tax; however, they remain reluctant to invest appropriately to enable an effective operationalisation of this advice.” — Eton Solutions

Market Dynamics

- 65% of buyers now use structured procurement processes with formal committees.

- Heads of Operations and next-generation leaders are driving platform selection.

- Top evaluation metrics: onboarding speed, support reliability, and integration quality.

- Peer referrals and advisor networks outperform traditional discovery channels.

- “Time-to-trust” has overtaken time-to-launch as the defining KPI.

“Vendors who can combine institutional-grade robustness with consumer-level simplicity will capture the most growth.” — Swimbird

The Simple Take

Platform selection is now a governance act:

Offices evaluate vendors like capital allocations — against risk limits, test results, and accountability metrics.

Buyers are mapping fit, not features:

Success depends on how well a solution embeds into existing teams, workflows, and reporting architecture. Implementation success is as much about change management as platform design. Several providers note that projects with structured onboarding and migration templates reach steady-state usage nearly twice as fast as unstructured rollouts.

Trust has become the product:

The platforms that succeed will be those that can earn — and continuously prove — reliability across onboarding, integration, and long-term support.

10. Vendor Landscape & Product Patterns

By 2025, the family-office software scene isn’t expanding; it’s crystallising. What began as scattered point tools is now forming clear patterns. Instead of consolidating into one or two dominant systems, the market is segmenting into layers, modules, and interoperable ecosystems.

Across platform contributions and family-office interviews, clear trade-offs are emerging. Data-focused systems emphasise reconciliation lineage and accuracy; workflow-driven platforms prioritise orchestration and automation; while governance-led solutions compete on auditability and control.

From this year’s data, six distinct vendor postures have emerged — each representing a different philosophy on how platforms create trust, time, or intelligence for family offices. These postures cut across six primary functional clusters, defining how vendors position themselves and how capabilities overlap.

This evolution is being shaped by four forces:

- New capital inflows enabling vendors to expand product scope.

- Client pressure for deeper functionality and faster delivery.

- Intensifying competition requiring rapid iteration.

- Cheaper, more accessible development tools that simplify integration.

Using aggregated vendor input and platform data, six product clusters define today’s market:

Reporting & Consolidation, Operations & Workflow, Accounting, CRM & Relationship Management, Analytics & Planning, and Niche & Specialist Tools.

Most platforms now straddle multiple categories, and those gaining traction are the ones building bridges across them. Some have extended beyond reconciliation into workflow orchestration; others combine data feeds, accounting logic, and analytics. Reporting-first tools increasingly include document vaults and CRM functions, while portfolio trackers embed expense workflows or ESG overlays. Category lines matter less now — platform posture is shifting.

From Dashboard to Operating System

Across calls and submissions, one defining pattern stands out: platforms no longer aim to be dashboards. They are evolving into operating systems — the daily backbone for decision-making, entity tracking, document sharing, and reconciled insight. Several leading systems exemplify this transition, evolving from reporting-first tools into full operational suites with embedded accounting and collaboration capabilities.

“We realised our clients were logging in twice a week. Our goal now is daily relevance,” said one vendor.

This ambition is being met with sharper scrutiny. As buyer maturity increases, survivability and reliability have become core trust markers, especially in a crowded space where tools often look similar. “We’re no longer comparing dashboards — we’re comparing postures,” said one FO tech advisor.

“Fit is about roadmap realism, integration humility, and whether a platform can grow with the family.”

Platform Moves: What’s Actually Happening?

This year’s submissions and audit data highlight several clear trends among top-performing vendors:

Vertical Deepening

Platforms are expanding into adjacent functions such as entity registers, capital calls, and tax packs. Many now offer pre-configured integrations with custodians and fund administrators, alongside proprietary modules for private-market workflows, impact reporting, and FX management.

These developments mark a shift toward unified operational environments where accounting, reporting, and compliance intersect seamlessly.

AI Infrastructure

AI has moved from experimental pilots to embedded infrastructure. Most systems now feature AI for reconciliation, classification, and anomaly detection. Predictive search, auto-tagging, and contextual filtering are improving daily usability, while new agentic tools can automatically build entity trees or parse fund documentation.

The direction of travel is clear: intelligence is becoming invisible — embedded within data quality and workflow assurance, not presented as a front-end feature.

Onboarding Playbooks

Structured onboarding has become standard practice, with vendors offering pre-mapped workflows, sample datasets, and trial dashboards. Support is increasingly tailored to organisational type — whether single-family, multi-family, or hybrid setups — helping teams reach operational confidence faster and with fewer implementation risks.

Transparent Architecture

Transparency has become a mark of maturity. Leading providers now publish live integration dashboards, compliance documentation, and data-residency details. Families and advisors increasingly request visibility into roadmaps, uptime metrics, and API governance as part of their due diligence. Reliability has overtaken visual design as the primary purchase driver.

Buyer Lens

Procurement questions have grown more sophisticated, focusing on platform sustainability and governance:

- Is the system part of a broader stack or a standalone company?

- What is the funding model — bootstrapped, private equity, or venture-backed?

- How are version control and API governance managed?

By 2025, “middleware fatigue” appeared more often than “mobile UX” in interviews and submissions. Family offices are prioritising durability, compliance, and continuity over aesthetic novelty.

The biggest growth opportunities for technology vendors lie in private markets, emerging wealth regions, and next-generation wealth transfer.” — Alwy

Segment Snapshots: Where Vendors Fit and Who They Serve

Reporting & Consolidation

- Covers asset visibility, bank feeds, and portfolio reconciliation.

- Primary users: single family offices, multi-bank families, and teams migrating off spreadsheets.

- Current focus: reconciled, multi-custodian reporting with stronger data validation and cross-account visibility.

Operations & Workflow

- Centres on entity management, expense tracking, audit preparation, and approvals.

- Primary users: multi-family offices and operational leads managing complex governance structures.

- Current focus: linking operational control with compliance automation and internal approvals.

Accounting

- Handles ledger management, journal entries, and tax-ready exports.

- Primary users: firms internalising finance functions within regulatory-heavy jurisdictions.

- Current focus: bridging accounting, portfolio, and entity-level views under a single data model.

CRM & Relationship Management

- Includes family trees, contact notes, KYC, and pipeline tracking.

- Primary users: advisors, succession planners, and external-facing family offices.

- Current focus: embedding governance workflows and multi-generational visibility into CRM environments.

Analytics & Planning

- Encompasses scenario modelling, liquidity forecasting, and visualised holdings.

- Primary users: CIOs, family councils, and investment committees.

- Current focus: integrating predictive analytics and planning tools directly within portfolio dashboards.

Niche & Specialist Tools

- Spans capital-call orchestration, philanthropy dashboards, and collectibles management.

- Primary users: mission-led families and impact-oriented portfolios.

- Current focus: providing targeted functionality for alternative, purpose-driven, or illiquid assets.

Each category is expanding, but interoperability remains the defining factor. While most vendors claim to “integrate,” fewer can demonstrate validated, high-uptime connectors. Some standouts allow prospects to test integrations in sandboxes before contract signature or publish detailed AI usage matrices mapping workflows, risk levels, and model types.

“We’re not a software company — we’re an operations partner,” said one vendor. “We know clients can leave. Our job is to make staying better than starting over.”

Landscape Highlights

- The strongest vendors are expanding vertically (deeper functionality) and horizontally (broader coverage).

- Buyers favour transparency, roadmap clarity, and integration honesty.

- AI is being embedded quietly rather than marketed loudly.

- Vendor durability — funding model and roadmap stability — is a key evaluation factor.

- Family-office workflows are driving modular, role-based design over monolithic systems.

The Simple Take

Vendor maps matter more than feature lists:

Family offices want to understand each platform’s role in their stack — and whether it can evolve with them.

Product depth isn’t enough:

Families now prioritise reliability and fit across onboarding, integration, and support.

Ecosystem strength now defines success:

— interoperability and adaptability beat standalone features. The most trusted platforms don’t just offer features; they connect, adapt, and stay aligned.

11. What We’ve Learned from 2025

The 2025 landscape reveals a technology ecosystem that is no longer fragmented — but still far from frictionless. Progress is tangible: buyers are more structured, platforms are more interoperable, and AI has moved from hype to infrastructure.

Yet real transformation doesn’t happen at the feature level. It happens in the connections — between systems, workflows, teams, and outcomes.

This year’s research surfaced five lessons that define the state of play:

1. Integration is both the constraint and the catalyst.

Seventy-three percent of vendors still report reconciliation and private-market data ingestion as their biggest pain point — but also the area attracting the most investment.

2. AI is being embedded — not just marketed.

Ninety-two percent of platforms now have live or developing AI capabilities, but adoption depends on governance, explainability, and measurable outcomes.

3. Excel is finally losing its grip.

Fewer than 25% of new prospects rely on spreadsheets as their primary tool — a clear sign of maturity and infrastructure readiness.

4. Buyers are more operationally fluent.

Heads of Operations and next-generation leaders now lead structured evaluations, asking sharper questions, demanding proof, and pushing vendors to go deeper.

5. The best vendors are systems thinkers.

Success is no longer about modules — it’s about momentum. The vendors gaining ground are those building workflows that align with onboarding needs and stay relevant over time.

“Each decision, each integration, each onboarding success becomes part of a system families can trust.”

12. Strategic Outlook 2026

2025 marked a shift from resilience to clarity. In 2026, forward-looking family offices will focus on building lasting, strategic trust.

Trust now extends to the systems, decisions, and connections that hold everything together. It’s trust that the technology stack — data, AI, reporting, and governance — will adapt, scale, and still make sense a year from now.

“It’s no longer about finding the most features. It’s about knowing the whole system can adapt, scale, and still make sense a year from now.” — Head of Operations, hybrid family office

Family offices are entering a new phase of digital maturity — often called FO 3.0. This is not about adopting technology for its own sake; it’s about embedding clarity into every layer of decision-making and aligning people, processes, and platforms with long-term objectives.

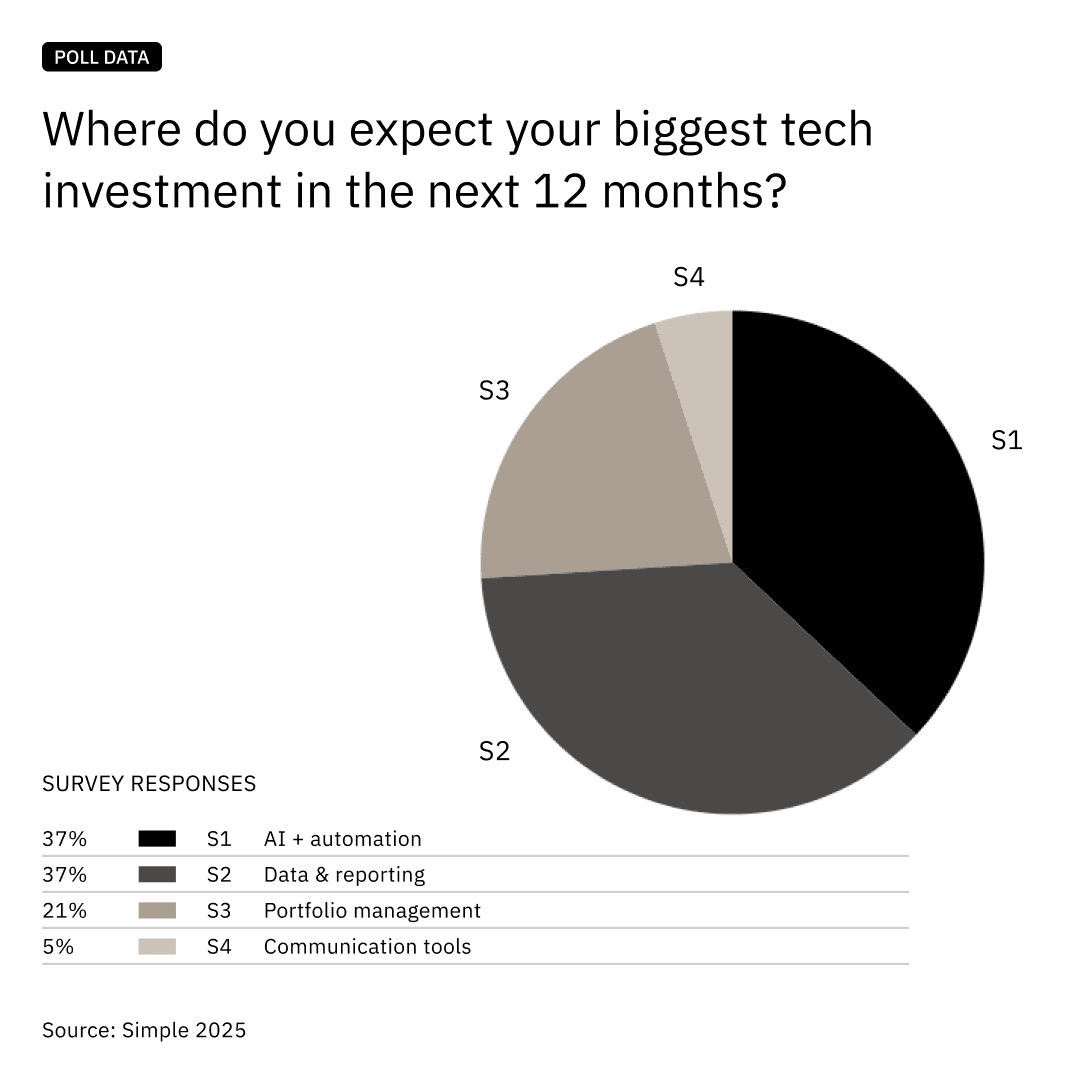

When asked where they plan to invest most heavily in 2026, family offices split their priorities evenly between AI and automation and data and reporting — a clear indication that efficiency and data trust now carry equal weight. Portfolio-management and communication tools ranked lower, underscoring a shift away from surface features toward foundational performance.

AI and data trust define 2026 tech budgets, showing that efficiency and clarity now carry equal weight in family-office strategy.

From Platforms to Infrastructure

What began as fragmented solutions has evolved into layered architecture. Many family offices now manage up to 10–15 vendor relationships across accounting, compliance, reporting, entity management, and communication — a model sustainable only when integration is built in.

Across the market, 2026 roadmaps emphasise modular APIs, transparent data lineage, and interoperability by design. The year ahead will bring a clearer divide between open ecosystems and closed platforms, with API maturity and traceability becoming core evaluation criteria. Vendors face growing pressure to deliver not just outputs but explainability within workflows.

“We can’t afford systems that don’t talk to each other. The conversation is now about clarity and control, not just capability.” — CEO, MFO

AI isn’t the disruptor — alignment increasingly is

AI will continue to expand functionality, but its success now depends on fit, governance, and transparency — not novelty. Emerging frameworks are making automation explainable and auditable, showing how alignment has overtaken experimentation as the true measure of maturity.

In 2026, expect to see agentic interfaces embedded within dashboards, expanded AI-governance models across legal, ESG, and compliance workflows, and the rise of hybrid operator roles that blend domain expertise with AI oversight.

AI is no longer the edge — it’s the expectation. The distinction between followers and leaders will hinge on how well they govern, scale, and adapt it.

Contributors highlight emerging AI-governance frameworks and agentic workflows with clear auditability — showing how alignment has overtaken experimentation as the measure of maturity.

Onboarding ≠ Implementation

One of 2026’s most overlooked risks, onboarding remains the most consequential. Nearly half of vendors cite duration and complexity as their biggest product–market gap. Projects with structured migration templates and training frameworks reach steady-state usage almost twice as fast as ad hoc rollouts, making onboarding clarity a new trust metric.

For family offices, the pain points are familiar: migrations remain largely manual, reconciliations often require rework post-launch, and internal capabilities lag behind product complexity. The result is both a reputational risk for vendors and a deal-breaker for buyers.

“No matter how good the demo is, if onboarding feels like a black box, we walk away.” — Next Gen Lead, SFO

Four Priorities for 2026

Leading family offices are already preparing for 2026 by shifting mindset — from tactical procurement to architectural design. What sets them apart is clarity: knowing what they need, how to achieve it, and who within the team must evolve.

These are already taking shape:

- Governance over hype — documented AI decisions, accountable ownership, and explainability models are becoming standard.

- Interoperability by design — modular tools that share data language and context are replacing one-off integrations, as co-developed connectors and data pipelines become the norm.

- Capability building from within — upskilling analysts, operations teams, and IT specialists sustains implementation and reduces reversion cycles.

- Data as strategy — disciplined data stewardship, trusted lineage, and long-term governance now underpin every outcome.

These imperatives mark a turning point. Interoperability, explainability, and onboarding clarity have become strategic differentiators. The shift from tools to infrastructure has become operational reality, and the new benchmark is alignment — across teams, systems, and outcomes.

Designing Technology Families Can Trust

The next phase isn’t about adopting more tools — it’s about designing systems families can trust and evolve. Success in 2026 won’t depend on who has the most features, but on how effectively technology aligns with structure, values, and ambition.

AI will continue to enable, but it won’t decide. The real advantage belongs to those who treat technology not as a service, but as an operational foundation — governed, integrated, and built for change.

Family offices are no longer passengers in the technology journey. They are architects, and the infrastructure they design now will define their advantage for years to come.

13. Appendix: Wealthtech Market Movers

The wealthtech market continues to mature, signaled by significant capital raises for later-stage firms and start-ups. This activity marks a turnaround from a slump in mergers and acquisitions activity in the sector over the last two years. Additionally, there is a longer trend of difficult fundraising for wealthtech firms developing products servicing family offices because many VC firms lack experience in the sector and find it difficult to gauge its size. Perhaps the activity this year indicates a broader market shift. We will see in the coming years.

Many of the companies with successful capital raises provide solutions for or adjacent to private investments, which could explain their success, owing to the boom in private investments in general. Many of the firms that have raised funds position themselves as tools to navigate complex needs and complex structures. AI thus is being used to handle the processing of documents / emails related to managing such complex structures.

Later-stage companies target complex structures

Addepar, a leading provider of data aggregation and portfolio management software, raised $230 million in May 2025 at a $3.25 billion valuation, in a round co-led by Vitruvian Partners and WestCap with participation from 8VC, Valor Equity Partners, and Singapore’s EDBI. Supporting over $7 trillion in assets, Addepar’s platform enables asset managers to consolidate and analyze data across accounts and asset classes, including alternative investments. The capital will provide liquidity to employees and early investors through a tender offer, while also fueling R&D and product expansion. The company later strengthened its AI capabilities with the acquisition of Arcus, a firm specializing in AI-driven data processing, in May.

In another example of dealmaking in the space, SEI’s Archway Family Office business was sold to Aquiline Capital Partners for $120 million. Archway provides technology infrastructure for ultra-high-net-worth family offices and private wealth management firms, supporting $723 billion in assets across the U.S. Its platform caters to complex multi-entity family structures with capabilities in investment data aggregation, accounting, and financial reporting. Aquiline’s acquisition signals its intent to capture the growing demand from sophisticated family offices seeking more integrated and scalable platforms to manage their wealth operations.

Adding to this momentum, Eton Solutions secured $58 million in Series C funding in July 2025, led by Navis Capital Partners, to scale its AtlasFive ERP platform, which supports over $1.3 trillion in assets. The platform integrates accounting, workflow management, and reporting functions into one system, positioning Eton as a key player in bridging family office management with institutional-grade technology. The proceeds will also accelerate development of EtonAI, an emerging product line designed to deliver automation across wealth operations and portfolio management.

At the larger end of the market, iCapital raised over $820 million in July 2025 at a valuation exceeding $7.5 billion, led by accounts advised by T. Rowe Price and SurgoCap Partners. iCapital provides the underlying infrastructure for alternative investments, structured products, and annuities, serving more than 3,000 wealth firms and facilitating operations on $945 billion in assets. The latest round will support M&A activity aimed at improving advisor and client experiences and driving global expansion.

Emerging companies show focus on illiquid investments

Within earlier-stage companies, Asseta (formerly Prismatic) raised $4.15 million in October 2025, following a $1.5 million pre-seed round earlier in the year. Asseta is building a modular, AI-powered platform for family offices that integrates accounting, investment, and banking data. Asseta is expanding into bill pay, budgeting, and document storage features while investing heavily in sales capacity.

Similarly, Arch, which provides data infrastructure for private market investing, closed a $53 million Series B led by Oak HC/FT and joined by Menlo Ventures and Craft Ventures. Arch focuses on streamlining documentation and workflows related to private investments and is now launching Arch Pay, an infrastructure layer for automating capital calls and fund transactions, a critical pain point in managing alternative investment.

Arch’s competitor, Canoe Intelligence, raised $36 million in its Series C in mid-2024, led by Goldman Sachs, tripling its valuation from the prior year. Canoe automates the extraction and normalization of data from alternative investment documents for LPs, wealth managers, and family offices. The new funding will be used for global expansion and enhance its AI-driven parsing technology to meet surging demand for timely, accurate alts data.

In Europe, QPLIX, a German wealth management software firm, raised €25 million in November 2024 from Partech, with Deutsche Bank remaining a key shareholder. QPLIX provides integrated portfolio management, data consolidation, and analytics across liquid and illiquid assets for family offices, private banks, and portfolio managers. The new capital will develop its end-to-end wealth platform, reflecting growing cross-border appetite for next-gen digital infrastructure in private wealth.

WealthTechs operate on the intersection of supporting and executing investments

Finally, the convergence of technology and advisory models remains a defining trend in WealthTech. In 2024, Range secured $28 million in late 2024 to expand its AI-powered wealth management engine “Rai,” which integrates planning, tax, and estate workflows into a single platform.

Similarly, Farther, a hybrid digital RIA platform that connects clients with advisors and custodians, raised $72 million (Series C) in October 2024 from CapitalG and Viewpoint after surpassing $5 billion in AUM. Most notably, Altruist raised $152 million, in a round led by the GIC. The company, whose core business is custody, also recently expanded into fixed-income trading and tax management. All the companies represent the growing “tech-enabled advisor” model, combining an asset management and trading platform with tax and legal services.

14. Acknowledgements

We extend our thanks to the many stakeholders across the Simple community — our advisors, experts, and growing user base — as well as the family offices who shared their experiences through in-depth conversations. A special thank you to the service providers who contributed to this year’s survey, representing a cross-section of this diverse and burgeoning landscape.

- Abbove

- Aleta

- Altoo

- Alwy

- Asora Technologies

- Asset Vantage

- Asseta AI

- Auria

- Canopy

- CFO Family Reporting

- Copia Wealth Studios

- DAPM

- Daysium

- Dilitrust

- DoLand

- Elysys

- Eton Solutions

- Etops

- Flanks

- Fundcount

- Greenlock

- Hatcher+

- Hemonto

- Infront

- IQ-EQ

- Landytech

- Mantle

- Masttro

- MyFO

- Nines

- Northern Trust FO Technology

- PetakSys

- Sage

- SumIt

- Swimbird

- Trusted Family

- Vyzer

- Wealth Spectrum

- WealthArc

- WIZE by TeamWork

- Addepar

- Arch

- Automated Data

- Canoe Intelligence

- Clade

- Clockwork

- Collation AI

- KeeSystem

- ORCA

- Point

- Qplix

- Tamarix

- WMS-Technology