1. Finding Software is a Pain

“If we could automate getting a glass of water, we would automate that.”

Family Office in India

Family Offices all around the globe are busy retooling their operations in order to power their services. While statements like the one above show how big the need for the right family office software solutions is, finding them is a pain for family offices.

Why? We believe the answer lies in the industry’s most popular phrase:

“If you have seen one Family office, you have seen one family office”.

The market of family offices is hyper fragmented.

The fragmentation of family office structures translates into fragmentation of their needs, which leads to fragmentation of family office software providers that try to fulfil these needs.

Therefore, finding family office technology is not about finding the software which is the best ‘on paper’, but finding the one that is the best possible match.

Finding good matches is crucial because selecting family office technology is loaded with risk factors. Some examples:

- Reporting on wrong data can lead to embarrassing moments with principals, and can get a family office sued

- Depending on the complexity of the software, onboarding can take several months, which will be sunk costs if it turns out that the provider was the wrong match

- Some solutions might be a good fit for the time being, but not for the future – therefore there is a need for flexible solutions that can grow with family offices’ needs in order to avoid switching costs

With the goal of facilitating this matchmaking process and in order to reduce risk for family offices, we screened more than 250 software providers and collected in-depth data from 34 providers.

The outcome of this research is divided into three parts:

- A company finder that allows you to identify a growing number of family office software providers that meet your requirements with in-depth data on their solution profiles (click here)

- Qualitative insights from our conversations with both family offices and family office technology providers (keep on reading)

- Quantitative insights about software providers (click here)

Who is this report for?

We conducted this research not only with the archetypal family office in mind, but more widely for those who engage with family wealth, no matter the legal, geographical or physical set up.

You might:.

- … represent an SFO or MFO that is sourcing modern software solutions

- … work within the family wealth arm of a private bank

- … be a wealth owner yourself or work for UHNWIs looking into setting up a family office

- … be a financial advisor consulting on family wealth

- … be curious to learn more about this space in general

Welcome to the Simple 2020 Family Office Software review. This report is for you.

2. Methodology

At Simple, we frequently receive requests for our opinion on which software providers to choose. We believe, however, that choosing software for family office should not be a matter of opinion but a matter of fit.

In order to be able to compare solutions based on the most important parameters, we designed a standardised survey to collate the responses of all participating software providers. We realised that there is a terminological gap between providers and users of software. While family office software providers put significant emphasis on features and technological aspects, users more often ask questions related to use cases.

With the goal of designing a survey to bridge the gap between providers and users, we conducted 38 co-creation interviews before beginning the survey design. These co-creation interviews were conducted with family office technology providers on the one hand, and with family wealth professionals on the other. During these interviews we gave software users the opportunity to highlight the biggest challenges they experience when sourcing and using family office software. On the contrary, we asked software providers questions such as “what question can we include in the survey so that you can stand out.” This way the providers had a chance to contribute to a survey that helps their customers to understand their unique propositions.

The results of these co-creation interviews was a standardised survey with a hybrid approach of fixed categories on the one hand, and open ended questions on the other.

Additionally, in order to provide the readers a better understanding of what family office managers deal with when it comes to software, we derived insights from these conversations. These co-creation interviews provided us with qualitative insights on the challenges family office managers. We use this data in line with Stratus & Glaser’s Grounded Theory methodology, which enables hypothesis creation through qualitative data by starting with open-ended conversations with the target audience. Accordingly, quotes from the conversation participants can be regarded as primary data, while insights derived from these should be read as working hypotheses.

3. Understanding family offices

To gain a deeper understanding of family office software providers, it’s helpful to first look at what the providers work with on a daily basis: the family office environment, their software problems, and what matters to them.

The context

The context in which family offices operate impacts their use of software. Our co-creation interviews brought forward four key factors that affect software choice: multi-generational needs, a diversity of assets, market fragmentation and the technological frontier.

Multi-generational needs

Today we are in the midst of the biggest transfer of wealth in the history of mankind. The COVIID-19 pandemic has most likely accelerated this transfer, as matriarchs and patriarchs see that now more than ever is the time to ‘go digital’. The wealth of knowledge of how to do so, ultimately lies with the next generation: their children and grandchildren.

Whether this wealth transfer has truly accelerated within recent months remains to be seen. Family office software providers are already tasked with juggling the increasingly diverse needs of multi-generational family offices, as one Swiss family office described. Younger family members who have grown up with technology might be looking for software that can provide personalised at-a-glance updates, and be less interested in the nuts and bolts of the core business. On the other hand, the older generations who are run daily operations might be looking for deeper insights to inform long term strategy and decision-making. This multi generation setup starts a chain reaction. Multi-generational family offices face divergent and at times conflicting needs from the families they serve, which is then pushed to the software providers, who end up chasing their tail trying to satisfy multi-generations within the same family.

Diversity of assets

Families diversify their assets into multiple sources. Not a single family office interviewee mentioned that they would only manage traditional asset classes like stocks and currencies. Family offices that are closely tied to a family’s operational business have an especially strong focus on PE and VC, to the point where we find some family offices focus only on early stage startups. On the other hand, families hold a substantial amount of their wealth in luxury goods such as yachts or real estate. The mix of liquid and non-liquid assets is a challenge to providers who need to integrate multiple sets of data, each with their own idiosyncratic format. For example, where stock data on liquid assets is available at a moments notice. The data on non-liquid assets such as a yacht is much harder to place on demand.

Market fragmentation

“No one in this market has more than 2-5% of market share” states the head of a MFO in the US. This of course depends on how we define the market. The market of family offices is nonetheless hyper fragmented, as the saying goes ‘no two family offices are alike’. Whilst this is at times presented in matter-of-fact fashion, there are of course underlying reasons behind this fragmentation. We have identified two key factors we believe to be driving fragmentation: culture and regulation.

This point about culture becomes obvious when we compare the activities of different family offices. For example, we listened to stories from family office managers describing how tightly married they are to a family’s affairs. Their job is to handle situations that are just as personal and chaotic as one would expect in a “regular” family setting. Another family office manager told us: “Sometimes they just stop by for a coffee and to get a hug.” Relationships between family offices and their clients can indeed be this close. On the other hand, we find that some family office managers are far removed from the families they serve. The families want nothing more and nothing less than a hyper focused investment arm.

Looking at the different cultures within these families, it is no wonder that the family office market resembles more of a Caribbean treasure trove than a Swiss vault.

Regulation is another driver in market fragmentation. Despite the rising trend of digital offices, for many families it’s important to stay in close proximity of their offices. This often results in choosing locations that are geographically close to them. Occasionally geographic proximity is traded in for locations that provide tax or other benefits. Within these scenarios, it makes sense for family offices to choose providers that understand and operate in their specific setup. During a co-creation interview a French MFO highlighted that it was important for them to have a French supplier so they could discuss specific regulations at eye level.

The technological frontier

As digitalisation disrupts industry after industry and technological solutions become increasingly sophisticated, the software selection process for family offices grows evermore complex. The changing landscape poses a huge challenge for those family offices who are still at the beginning of their journey to become digital.

One family office manager stated, “I think nowadays you need at least one tech savvy partner in-house – it’s not possible to outsource that knowledge.” They continued “One provider once offered a fully outsourced tech support. But that backfired. If I have a problem with my report I don’t want to call them and be a ticket number”.

We encounter a broad range of digital competencies in our conversations with family offices. On some occasions, the family office has had one tech-savvy member on board. In others, a member with a business background spent months educating themselves within technological solutions in order to put together the right tech stack for their organisation. Others who run primarily on Excel have some micro-services for the time being, but are nonetheless aware that excel won’t work forever. Regardless of which tech a family office has chosen, as the landscape of tech solutions continues to evolve family offices must understand and capitalise upon a growing number of family office technology providers.

Software pains

When initiating this research we knew that for many family offices finding the right family office tech stack is a pain. Yet through the process we uncovered more and more specific challenges that they faced. Here, we outline these specific challenges and what you, as a software purchaser, should also look out for.

Lack of transparency

The biggest challenge our interviewees struggle with is the lack of transparency in the market. One interviewee who manages assets for UHNWIs at a global bank stated: “It’s difficult to compare their features. Their marketing material only ever highlights their strengths”. A US family office likewise added that they struggle with getting a clear idea of what a software can actually deliver before entering a commercial agreement: “Until you sign, you don’t know what the gaps are”.

The challenge with transparency is not restricted to select features. It extends to a lack of clarity on the A-Z of the user journey when working with the software providers. From their perspective, there is a lack of clarity on the buying process, a lack of clarity on the onboarding process and a general uncertainty on how a long term collaboration will play out. (This is why many of the Simple company profiles feature user journeys.)

‘Demo Dance’ was a frequent term that popped in our conversations. One family office commented: “When you are setting up [a technology for your family office] you gotta do the demo dance for about two months”. Another commented that “I had hoped that they were not so opaque. Not so many demos. They should not hold their software so tight. I need to be able to see it! Even just getting sandbox is impossible”.

It should be like testing social media, where you log in and check it out if it works for you. Easy and transparent

Some found the purchasing process tedious and ultimately a deal-breaker. One UK based family office that ran operations mostly from spreadsheets commented: “I would like to upgrade our setup. But to be honest, I can’t stand getting in touch with providers. Their sales team haunts me for weeks”. Even an office that was willing to commit the time and energy to select the best possible provider mentioned how difficult it was to make such a long-term decision: “I wanted someone who will be a long-term partner. But how can I test that? Ultimately, I had to follow my gut. There is always a leap of faith at the beginning.”

Pricing is another aspect that makes it hard for family offices to evaluate services. Many providers don’t disclose upfront how much their software costs. This lack of transparency over pricing has multiple reasons.

First of all, not all software is SaaS which is the easiest software to price. Many software providers sell a hybrid model of SaaS plus additional services. When discussing the price point for additional services, family offices are often met with responses such as ‘it’s based on complexity’. This of course makes sense when you consider that no two family offices are alike and that providers must handle the needs of multiple generations, diverse assets, and varying digital fluency. Whilst this may be the case, there could also be another underlying reason. As one manager of an international bank pointed out: “Pricing is opaque because the industry is not transparent in general.”

Usability

A major concern for family offices in their selection of family office software is usability. As one offshore family office member stated when showing us their software: “These solutions are not user friendly. Look at this. I can see it’s a lot of tech. In theory I could send emails with our solution. But I’m not doing that. It’s too complicated […] Do you know Hubspot? I want a Hubspot for family offices”. In this case, we can see that the Family Offices members are digitally literate in their reference to HubSpot. The problem then is the lack of easy-to-use applications that can scale across users’ demands and devices. Usability for family office software often starts with data. One family office that was satisfied with their family office technology solution stated that they like their reporting software because of the ease of pulling data.

Once the software has good functionality for pulling data, the next consideration to address is who sees what. Family offices often serve multiple stakeholders within single families, but only a few members should have full oversight. Others are on a need-to-know basis. Others should not have access to specific data. The better adept the software is prepared to handle such cases, the easier it will be for family members and other stakeholders to slice and dice the data. One Swiss MFO attested to this, stating: “Getting insights flexibly to clients is a major challenge.”

Finally the presentation of data is the final challenge for family office software providers. When speaking with an Indian family office who had chosen to build their own app on top of their existing family office technology solution, they stated: “I cringed when I saw the software providers mobile app. That’s not something I can put in front of a billionaire client. The next generation are digital natives. They grew up with smartphones. I think many providers have not yet realised that.” A US family office representative echoed this usability issue, stating: “The number one challenge is getting the data out into a simple format – into a mobile phone format”.

Data quality

In the world of family offices, data is king. Not only in terms of quantity, but especially quality. One MFO manager described how issues with data is his personal nightmare. They stated: “The data needs to be right! That’s the worst thing ever. Sitting in front of a client with wrong data. That puts our credibility at risk.”

Guaranteeing accurate data becomes increasingly difficult when a family has a range of assets that need consolidating. Different assets create different types of data. Whilst that may seem intuitive, what is not intuitive is managing the differing data standards that are needed across custodians. This makes it even more challenging to deliver “the right” data to a family. One US family office posed an important question: “Too often the data language is different within the industry. But why is this the case?”. This variation in data language puts additional strain on fulfilling regulatory requirements. As a manager at a global bank remarked, “Data quality is often poor which gives us a hard time.”

Most importantly, at the end of the day clients care less whether Goldman and Merrill Lynch serve different data formats – and more that the data is right.

What really matters

So far we learned about the contextual challenges and pains of family offices when it comes to software. Let’s now turn to the factors that we’ve identified that could tip the scale in the provider selection process.

Location

As paradoxical as it might sound when discussing the world of family office technology, location matters. Two important elements related to location are face-to-face interaction and regulation.

When discussing the rationales behind their family office technology provider selection, a Swiss MFO stated: “I wanted someone I could talk with in person and I wanted someone who is available.” Going to Geneva to meet face-to-face and forge a relationship was an important part of the alignment process for this MFO. He further added:”They speak the same language. We share the same values. That was important to us […] Now, we sit with them at least 2 times per year to give feedback. They are there, and they listen.”

Some had a preference for face-to-face interaction, others stressed the importance of location for regulation purposes. Even though the world today is hyperconnected, many types of investments require legal setups that are only available in certain countries, or are easier due to a country’s regulation. For example a UK family office we interviewed used a Swiss reporting software as they were looking for a provider that is knowledgeable about Swiss regulation. Likewise an offshore family office told us that they used a French provider as their family office is set up under French law which means that the provider needs to set up and sign all documents in accordance with French regulation.

Feelings over Features

“This business is based on trust. One potential client ended setting up their own SFO – instead of working with us – because of a lack of trust, not because of financial gain.” – MFO manager

Families need to trust their offices. Offices need to trust their providers. Many offices foster relationships with their clients for decades and longer. It is no wonder that they demand a personal relationship from their partners also. Many interviewees mentioned how important it was for them to feel they have partners they can count on. One MFO manager commented: “Actual onboarding takes one year. You need a strong partner to do that. They are there to help us and develop with us. Before we bought from them I met with them in person and had my list of questions with me. And they answered all of them for two hours.” They further added: “Xyz software actually had the best tool. But I was just a number for them. So I wasn’t feeling it. You don’t need software. You need people and a company that supports you”. Another family office made a case along the same lines, stating that trust is the main currency in the Family Office business. But “trust”, they commented, “is not built into software”.

Security

If trust was the single most recurring word in our conversations, security was the second. Security comes in many flavours. Below are some examples:

“The software gives us security so that we don’t overlook something.”

“Access to data needs to be secure. It’s very sensitive information.”

“If there is an audit we need to justify our security.”

“We need the right partners that can carry the risk for securing the data.”

“What we liked was that the solution was secure.”

“We need to ensure the security of our firm. If there is a leak, we could get sued.”

These insights sum up the family office perspective on security: their clients’ security is their own security.

Simplicity

Some family offices find that the software in the family office space is way behind the curve in comparison to other industries. One US family office commented: “There is no enterprise grade tool – there are only apps.” They further commented: “The tech is there! But why is there no software that can do it all?” In essence, what family offices are looking for is simplicity. Simplicity is one of the topics that struck a nerve with many of our informants. One commented: “We want ONE system. That means less work, less risk, no data scattered around: the same information everywhere. Otherwise you get crazy.” Another manager, by contrast, described how they like that they can do so many things with their family office technology. From getting documents from clients, signing them in line with regulation, linking different people in the family, organising which consultant has done what for which client, sending invoices, to linking companies owned by the families. Comprehensive solutions are needed, but they should always be easy to use.

4. Provider insights

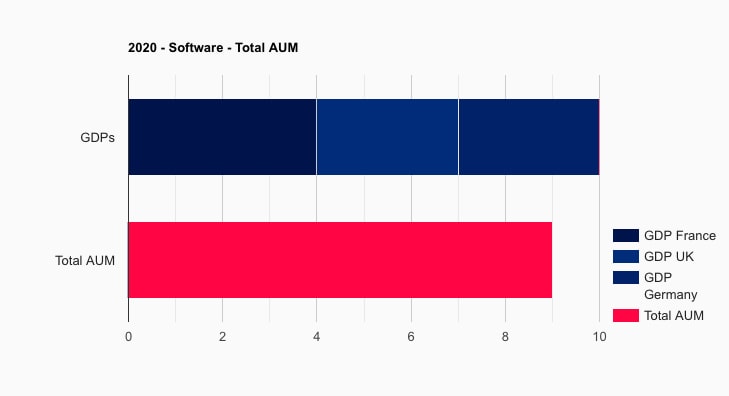

Now that we’ve taken a deeper look into the needs of family offices when it comes to software, let’s turn to providers of family office software. Having screened more than 250 family office technology providers, 34 participated in the survey submitting detailed data. Those providers report to manage more than 8.5 Trillion USD. This is almost the combined GDP of Germany, France and the UK from 2019.

Reporting first

The providers focus on one or more of the following tasks:

- Consolidated Reporting (82.4%)

- Data Aggregation (85.3%)

- Portfolio Management (70.6%)

- Accounting (61.8%)

- Compliance (55.9%)

- Risk Management (58.8%)

- Governance (41.2%)

- CRM (38.2%)

- Impact/ESG Reporting (32.4%)

- Trading (orders only) (23.5%)

- Trading (execution on platform) (11.8)

Of course, this distribution is biased by our sampling as most of the family office technology on the market focuses on reporting. Yet this sampling itself tells a story, namely that reporting is the key function that any manager of family wealth has to deal with. No matter whether the family needs updates by week, by month or by quarter, having a bird’s eye view of their wealth is fundamental. Without it, it becomes difficult to engage in investments or other capital intensive activities like philanthropy. You need to know what the total sum is before you can decide what to do with it.

Portfolio management and accounting are closely tied to reporting. The need for this is represented accordingly in the data. We find it interesting to learn that reporting on impact investment is done by a third of all participants. This is in line with the feedback we received from family office managers stating that the role of impact is becoming increasingly important – one manager even mentioned that in their opinion ESGs are over-invested compared to other assets.

Family office technology that facilitates deal-flow trades is rare in our dataset. We see two reasons for that: either trading is outsourced by the office, or trading is executed via specialised family office software.

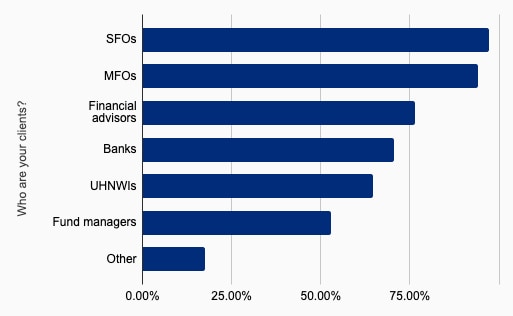

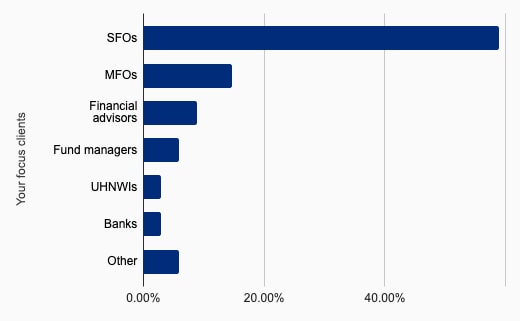

SFOs first

SFOs are the main client group for the providers surveyed. Whilst SFOs and MFOs lead the field, we also received many responses stating their clients were also financial advisors such as RIAs or IFAs, individual wealth owners and banks.

Yet, when we asked respondents to highlight their top client segment SFO’s stood out by far. Banks were highlighted as clients by more than 60% of the providers in the multiple choice questions, but only one respondent placed them as their top client segment.

Small companies for big money

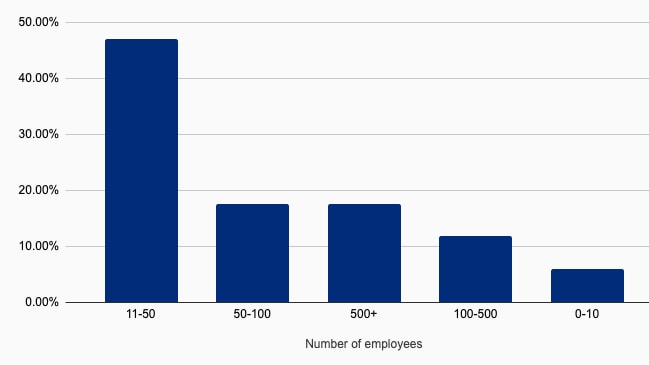

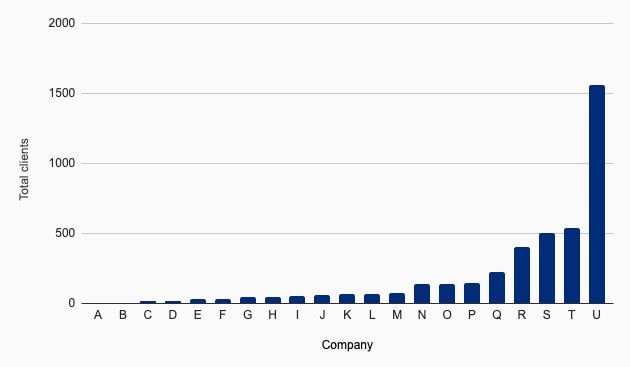

Around half of the family office technology providers surveyed are small companies with 11-50 employees. Few providers have managed to build businesses that are able serve many audiences and fulfil the shared needs of a fragmented market. But on the flipside of this coin, there are many service providers who are specialists in niche areas and who are able to meet specific needs – which is a good news for users. This point is further supported by the fact that even the leading solution in terms of client numbers has about 1500 clients, while 80% have less than 200 clients.

Centres of wealth

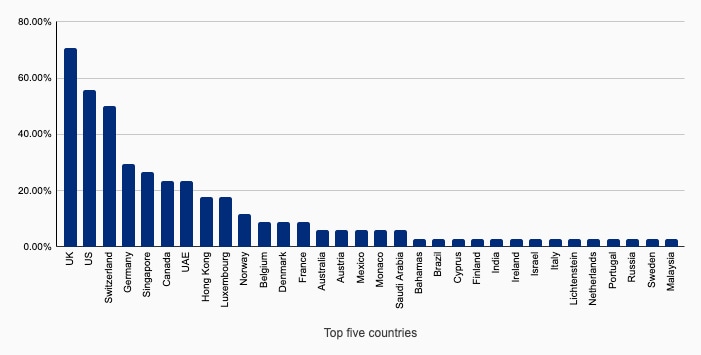

The top five markets for the family office software providers are the UK, the US, Switzerland, Germany and Singapore. However, there is a large geographical distribution, telling us that there are many providers that specialise in many different geographical regions.

Special business models for a special market

Almost all of the family office technology providers surveyed deliver value through a Software as a Service (SaaS) business model. About 50% of all providers offer Saas plus additional Services as their key offering, while a few provide fully standalone software, meaning that these softwares can be hosted on the clients’ proprietary side. This proprietary model may seem strange in many industries, but it is to be expected in an industry where data is particularly sensitive. Some families prefer hosting the data on their own servers.

Transaction VS. holdings

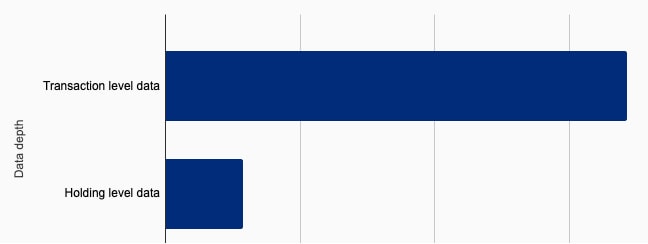

During our co-creation interviews, family office technology providers pitched that they reported based on transaction level data. Transaction-level reporting is when each and every transaction is documented compared to simply reporting the current holdings. This enables detailed auditing, reporting and attribution. As such, we asked providers whether they used transaction or holding level data. We found that an overwhelming majority of providers report on transaction level, however we also learned that transaction level data can come at a cost. Considering that some of the major players in the market provide holding level data, it is worth for buyers reflecting on whether transaction level data is needed for their use case. Also, the ubiquity of transaction level data questions further calls into question whether this is still a unique value proposition users should look out for.

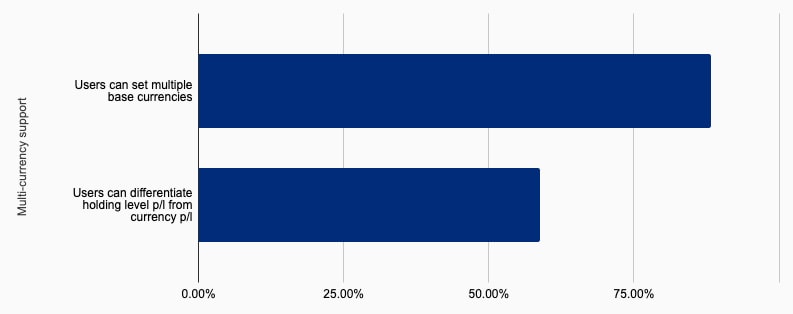

With regards to data depth, it is perhaps more interesting to see how providers handle multi-currency. Setting multiple base currency is quite standard, whilst being able to differentiate between position vs. currency profit is less common. In short, users should ask themselves whether it’s important for them to know whether, for example, the value of a portfolio increased due to the underlying assets or due to changes in currency value.

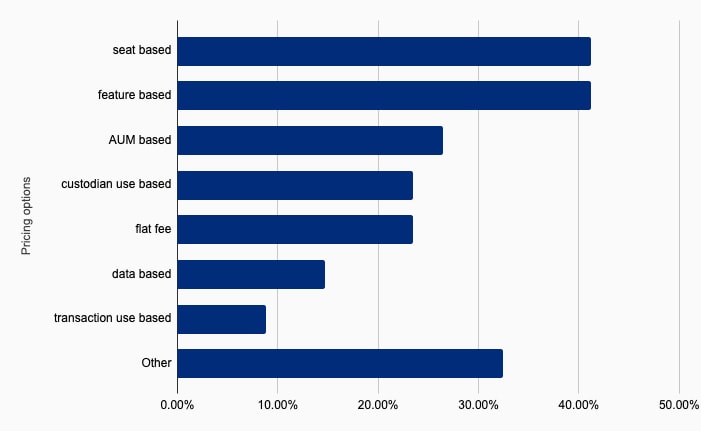

Pricing models

The majority of family office technology providers charge based on features and number of users. While pricing by AUM is native to the finance industry, charging per user or per feature is the norm within the family office software industry.

“Other” was chosen by a third of the respondents. The most common answer to pricing within the “Other” category was “based on complexity”. This response sums up the headache that exists for buyers and providers alike. Users need to provide an overview of their assets and their plans, which allows to estimate the pricing based on their bespoke needs. Often this happens after “demo dance” has taken place. If the complexity based offer does not prove to be a good fit for either party, resources are burned on both sides. The ubiquity of this complexity based pricing provides an important point for reflection. Although there is a clear need for digital solutions within the family wealth space, reporting and managing wealth is a complex task. It can’t be tackled with generic Silicon Valley style SaaS pricing à la basic to professional to enterprise.

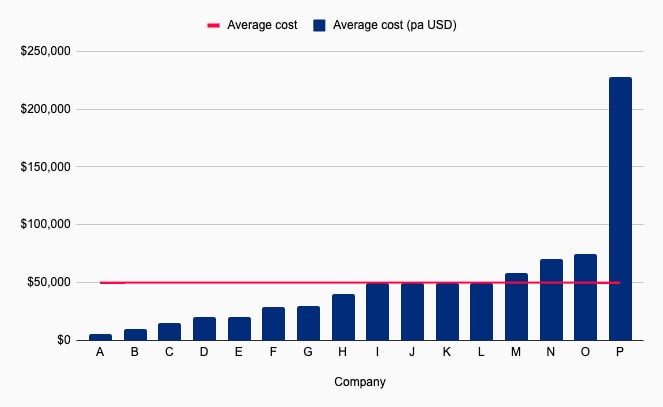

How much do you have to pay?

Though pricing is a challenging topic to get clarity on, enough providers submitted these responses to sketch a rough picture of the going rates. There are some high-end providers whose average customers pay around $200,000, but the average is around $50,000 per year.

This data should be treated with caution as it shows averages per family office technology provider across customer segments. In the case of some providers, this skews the picture because some segments pay much higher prices than individual users, for example banks.

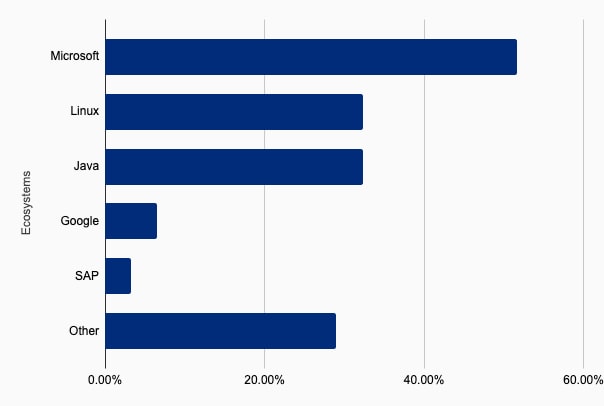

Microsoft dominance

More than half of the family office technology providers build their software around Microsoft. One third build around Java, another third around Linux. The dominance of Microsoft makes sense when considering that the majority of commercial software setups run on Microsoft.

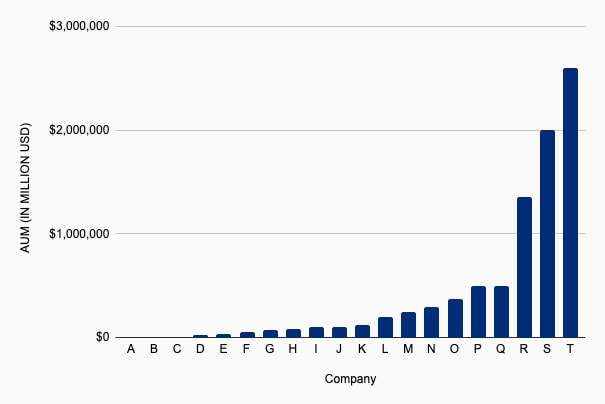

The two groups of AUM

Most of the family office software providers manage or report on less than $500M in AUM. Interestingly we see how providers are split into two groups on this front. Those who take the pole positions in terms of AUM, have more than double the AUM, starting from 1.3T and more.

Connecting behind the scenes

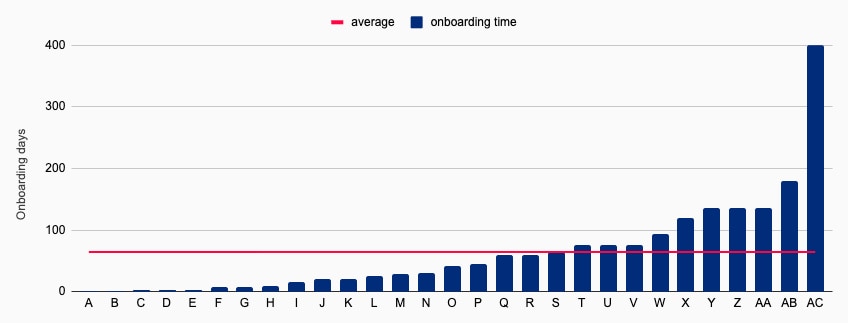

Onboarding is a definitive moment for the success of a long term relationship. The data above shows that most of the family office technology providers estimate that onboarding takes less than three months. Yet, we also see an outlier who estimates that onboarding takes on average 400 days. Why is that so?

First of all, there are differences inherent in the type of family office software that providers offer. For example, Governance software that focuses on sharing documents, requires less technical setup than a portfolio management system that focuses on communication between brokers and accountants

We also expect that onboarding means different things to different people. During our co-creation interviews, we saw that tech oriented managers often defined onboarding as providing connectivity between different applications, whereas engagement managers tended to view onboarding as a longer and holistic process. We recommend users to ask providers what they define as onboarding, and what kind of functionality can be expected before and after onboarding is complete.

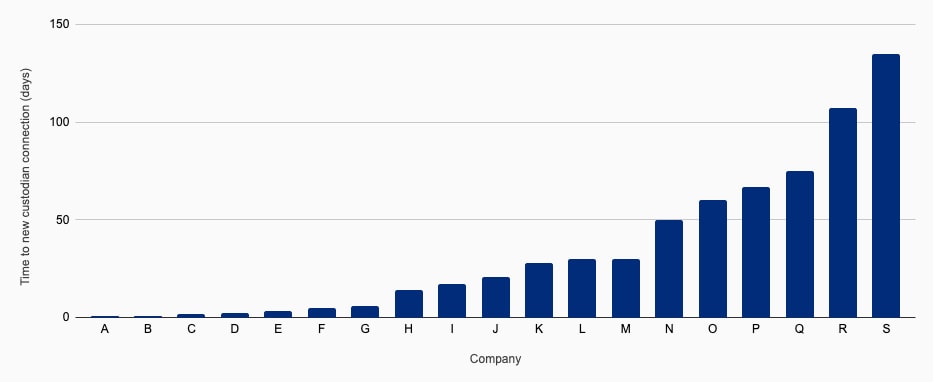

When looking at the time it takes for providers to connect with new custodians, we saw a similar picture. The variety within these responses is immense. Some respond 1 day, others respond up to 3 months. We recommend asking the provider you talk with whether relevant custodians are already connected, and if not the average time it takes to integrate with them. Some providers stressed that connections to custodians are made free of charge, or on a continuing basis to meet market demands.

5. Tips for building your tech stack

As you read this report you may be in the process of retooling your family office with new family office technology. Are you imagining what the perfect set up looks like? The bad news is, that in reality there is no one-size-fits-all set-up. Because – you guessed it – no two family offices are alike. Your stack will look completely different, depending on the kind of family office you are and the contextual factors that we outlined in the beginning.

However, the good news is that we’ve compiled a list of top tips and best practices for building your tech stack

Start with the major tasks: Do you need consolidated Reporting? Portfolio management? Accounting? CRM? Governance? Compliance? Portfolio Management? Trading? Data Aggregation? Risk Management? Impact/ESG Reporting?

Check location: Depending on your preferred service level and the necessary regulatory setup, the location of the provider matters.

Choose someone who grows with you: “We were not aware at the beginning what we needed. That’s why we need flexibility from your service provider.” Operationalising flexibility is challenging. We recommend asking yourself what kind of flexibility matters to you right now, and in the future. Does a standard solution do the job? Do you need customisation? Or do you need bespoke development? Then feed this back to the provider. (Or speak to us.)

Get a feel for pricing early: No one enjoys the demo dance. It’s a headache for both providers and users. We recommend getting an idea of the commercial factors as soon as possible, so that precious time and resources are not wasted. On many of our profiles you can find information on how providers structure pricing.

Own the process: Buying, onboarding and ongoing engagement. Often there’s a lack of clarity around these processes, until it’s too late. Ask providers for use cases on how this customer process works in practice. To make this decision easier for you, we have included graphical User Journeys on many of our provider profiles.

6. The future of family office software

The role of offline

We can already see today how more and more services for family wealth are moving online. Through our co-creation interviews, however, we nonetheless see the importance of face-to-face service during the set-up phase of the provider-user relationship.

Many of these family office software products are the turnkey solution for multi billion dollar operations. Even though it is in theory possible for providers and to go 100% online, we’re not expecting face-to-face interaction to vanish completely. Those who value offline engagement will most likely continue to see the need for more personal relationships.

Beyond the need for interpersonal connection, the regulation aspect is an important factor. Some offices demand certain legal and regulatory setups. It is unlikely that countries such as the UK or Switzerland will introduce digital citizenship overnight, therefore for the time being we expect geographical location to play an important role in the decision making of family offices.

Trustless tech

As one MFO stated: “What can’t be built into software, is trust”. Trust is a fundamental part of the family office arena. Without trust, it is impossible to allow someone to manage their billions.

Engineers around the world are working hard to create the technologies which will safeguard trust and transparency. Distributed ledger technology (DLT) is specifically aimed to create trust in a system as it is not solely dependent on human decision making. Bitcoin – the first successful application of DLT – works based on peer-to-peer networks meaning that users are not relying on the trustworthiness of a third party like a central bank. This is made possible through encryption meaning that access is only granted to an authorized entity who has the right “key”.

Some respondents were already familiar with this trend, stating that they can’t see their clients data such as their AUM due to encryption. As the tech frontier accelerates within the family office space, family office technology will enable and automate more and more “trust-jobs”.

All-in-one vs micro-services

Family offices come in many kinds of flavours. There was a high percentage of young professionals in some of the family offices that we interviewed, who used applications that are commonly known in the startup world. For example, they used Slack for day-to-day operations and Box for document storage. These apps are not marketed to the family wealth segment, but select family offices learned to repurpose them for their use cases.

In a similar DIY (do-it-yourself) fashion some tech savvy offices decided to dive deep to build their custom stack around general ledgers, communication tools, deal flow platforms, custom mobile apps and more.

Even though many offices wish they had the all-in-one solution, we don’t expect this to come on the market too soon due to fragmentation of user needs and regulation. Instead we anticipate a range of turnkey applications at the centre of family office operations with an ever evolving ecosystem of micro-services catering to niches of families – of which no two are alike.

7. Top Family Office Software Providers

Here is our shortlist of some of the best family office software providers who participated in this year’s survey and their unique selling points related to family offices and their advisors.

Multi-functional family office software solutions

These systems offer family office technology with various features and may include combinations of consolidated reporting, CRM, document management, governance, compliance (e.g., AML, KYC, regulatory reporting), portfolio management, data aggregation, and Impact/ESG Reporting solutions.

Based in the United States of America, Addepar is a wealth management platform that infuses transparency into complex financial information across functions and reporting. Connecting data, family office technology and people, it is designed to assist in achieving multi-generational family objectives by facilitating informed decisions through actionable insights and tailored reporting.

Developed and hosted in Switzerland, Altoo prides itself on Swiss precision in intuitive wealth data aggregation and monitoring. Altoo’s offering encompasses consolidated reporting, governance, data aggregation, risk management, document management, task management, and secure communication solutions that provide simplicity and control to private wealth owners and family offices.

USA-based Allvue is a flexible and customizable accounting, monitoring and reporting family office technology solution. It is designed to support family offices of any size or structure and is employed by some of the world’s most prominent families.

Serving global single- and multi-family offices and CPA firms, USA-based Asset Vantage offers an intelligent family office technology platform that boasts integrated performance reporting and general ledger technology. It is designed to provide a consolidated view of the family office’s entire net worth. Its functionality affords families comprehensive overviews and insights into their sophisticated wealth data.

Singapore-based Canopy is a private & anonymous wealth account aggregation, portfolio analytics and client reporting platform for High Net-Worth Individuals and their Wealth Managers. Offering a turnkey service and full customization, family offices simply submit their data, and Canopy does the rest. Covering all asset classes in all markets and any currency with reporting in the format of the family office’s choice,

German-based CORYX iO is an investment management platform tailored to the needs of single- and multi-family offices, asset and wealth managers, funds, foundations and banks. Covering all bankable and non-bankable assets for the family offices, CORYX provides comprehensive evaluation with a high level of individualization, risk monitoring, accurate accounting and corporate actions and a high degree of automation.

American company Diligend offers a flexible platform streamlines due diligence and monitoring processes across all asset classes through digitization and automation. It also facilitates time-saving analysis, collaboration and the structuring and centralization of data.

Developed by the Monaco-based company that pioneered Microsoft’s next-generation ERP applications in the financial services sector, Elysys is designed to serve global, mid-market treasury and investment management professionals working under several regulatory and compliance frameworks. It is a secure, cost-effective, scalable and integrated enterprise software for financial services organizations.

USA-based Eton Solution’s platform, AtlasFive, was built by a family office for the family office market and is the only fully integrated single source of truth platform in the UHNW market today.

Designed to solve the most common industry problems, inefficiency and lack of timely, accurate data, AtlasFive leverages technology and processes for efficient transaction processing, data collection and reporting. A fully integrated CRM, Document Management, Data Aggregation, General Ledger, Portfolio Reporting, Partnership and Trust Accounting, and Payments engine, powered by risk-mitigating workflows and A.I., create a virtual family office generating daily reporting and insights not previously possible.

Denmark-based Hemonto delivers state-of-the-art consolidated financial reporting with trusted data that forms the basis for financial decisions. Their professional reporting platform is supported by a permanent team of experts to ensure data accuracy and services can be tailored to customized reporting needs without compromising data integrity.

iPaladin’s Digital Family Office is a USA-based blockchain platform designed specifically for family office professionals to orchestrate people, services, documents and activity. It offers a single, centralized source of truth for the modern family office that affords a bird’s eye view to track the past, understand the present and prepare for the future in a way that saves time, money and stress at every stage of growing the family’s legacy.

Operating out of Luxembourg, IQ-EQ Cosmos provides an end-to-end bespoke portfolio monitoring solution to institutional and private wealth investors focusing on alternative and luxury assets.

Their solution combines one of the best-in-class accounting systems for closed-end funds or private assets (FIS Investran) and open-ended funds or public securities (Paxus) with leading online visualization technology. With in-house development services, this versatile and flexible solution can be integrated with I.T. systems, data feeds, and open source feeds to create an entirely bespoke online dashboard according to the family office’s needs and portfolios.

With offices in Switzerland, the United States, Mexico and Chile, Masttro is an integrated global wealth family office technology platform delivering comprehensive & interactive views of total net worth, an intuitive, highly customizable client experience, and automated & robust operational efficiencies complete with military-grade security. Its mission is to bring ultimate control, transparency, and peace of mind to wealth owners and the institutions that serve them.

Founded over two decades within one of Scandinavia’s largest banks and now wholly independent, Denmark’s PandaConnect is a full-scale investment administration solution. It covers all asset classes and bankable and non-bankable investments – helping family offices achieve the twin goals of wealth preservation and growth. The solution helps to solve client challenges with transparency and accuracy through complete data aggregation and consolidation across family members, banks, currencies, and managers.

Belgium’s PaxFamilia helps patrimonial advisors to serve their clients with a holistic and structured approach to their global wealth. By facilitating the aggregation of the family office’s global wealth in one secured platform, professionals can work and collaborate more efficiently. Family office clients can then connect to the platform and access a clear overview of their wealth.

America’s PCR combines over two decades of experience and family office technology to help family offices achieve data independence by streamlining how their sensitive investment data is aggregated, managed, and used in reporting and other operations.

Their secure global data-sharing platform is specifically designed to address the challenges of the family office. It offers automated solutions to the many complexities of family wealth management, including hard-to-aggregate illiquid investments, complex family ownership and simplifying how information is transferred to a families’ reporting and accounting systems.

Private Wealth Systems is an American solution that provides the digital infrastructure that powers modern family offices across the world. The unique way the software captures, corrects, calculates and presents actionable information across every asset class (public, private, non-financial) and every currency enables the solution to support even the most complex nested ownership structures.

Located in the USA, RSM offers a family office dashboard that combines state-of-the-art technology and dynamic industry-leading advisors to provide unrivaled insights and value. This information equips family offices with a personal, holistic and integrated view combined with complete ownership and access to their data.

The USA-based Accordia Group’s RUBY levels the playing field by making big-firm technology affordable to family offices of all sizes. It solves the hugely expensive problem of data integration in investment management and tames the complexity inherent in reporting across asset classes, functions and geographies. It provides a customizable family office technology platform that enables business intelligence, risk management and diversification while saving clients time and money and allowing them to focus on strategy. Its modern, cloud-native technology ensures faster servicing of business requests with reduced operational risk.

American SEI’s Archway Platform℠ and outsourced services streamline the accounting, investment data aggregation and reporting operations of family offices and financial institutions.

Designed to help family offices and advisors to wealthy families better serve their ultra-high-net-worth clients, SEI’s platform and high-touch outsourced services efficiently handle complex partnerships, portfolios, and corporate accounting alongside bill payment investment management and multi-asset class data aggregation.

America’s SS&C Private Capital Group eliminates the cost, risk and time of integrating disparate systems. Their family office software delivers fully-integrated multi-currency portfolio management, financial and partnership accounting solutions to single and multi-family offices to serve their complex needs. Their integrated platform and dedicated, seasoned support staff help to simplify the complexity of the family office.

With their head office in Sweden, Swimbird’s Platform, SWIP, is a modern portfolio management solution that offers clients a centralized, holistic view of their total portfolio.

The platform offers real-time aggregation and visualization of portfolio data (assets and liabilities), irrespective of format and data source. It also handles all geographies and instrument types; financial instruments (listed and OTC), private equity and alternative investments. The solution is built on best-of-breed family office technology, can be tailored for individual businesses and is continuously evolving to keep up with future demands.

Multi-functional family office software solutions with trading functionality

With headquarters in the USA, the Black Diamond® Wealth Platform offers a cloud-based solution designed to meet the complex business needs of wealth management professionals and their clients.

Their offering encompasses accounting, consolidated reporting, compliance (e.g., AML, KYC, regulatory reporting), portfolio management, trading (execution on the platform), trading (orders only), and data aggregation. Complete with performance reporting, portfolio rebalancing and an immersive client portal, the platform connects to a vast ecosystem of smart integrations. Proactive, personalized attention from a dedicated service team ensures advisors receive access to an elite combination of family office technology and service.

With headquarters in Finland, FA Solutions is a cloud-based software platform that facilitates the entire Investment Management function via a single platform across devices.

With a modularized approach to various functions including accounting, consolidated Reporting, CRM, governance, compliance, portfolio management, trading execution (orders only), data aggregation, risk management, Impact/ESG Reporting, the platform is scalable, allowing clients to select the feature they need immediately, but with the functional coverage they need to grow as their businesses do.

Finartis Wealth Management is a Swiss Fintech company that offers an integrated suite of financial applications dedicated to Wealth and Fund Management.

For family offices that need to manage their investment activity across all asset classes and produce accurate and timely financial statements, their main product Prospero offers a comprehensive administration solution. It boasts a unique level of investment automation from decision-making to financial statements. Functionality includes accounting, risk and portfolio management, data aggregation, trading (execution on the platform), compliance, CRM, and consolidated reporting tools and solutions.

UK-based Finlight offers a fast, cost-effective solution that makes investment reporting data easy to analyze and integrate with any tool, regardless of a family office’s existing processes and asset mixes.

Covering consolidated reporting, data aggregation, portfolio and risk management, and trading (orders only) Finlight’s family office software automates and standardizes reporting data so that it can be easily uploaded into any tool. It also boasts a peer-enriched reporting dashboard that allows for portfolios’ benchmarking against those of community peers.

QPLIX, based in Germany, offers an all in one next-generation SaaS solution for family and investment offices, banks, wealth and asset managers.

The wealth management software provides solutions across various accounting, consolidated reporting, governance, compliance, risk and portfolio management, trading (orders only), data aggregation and Impact/ESG reporting. It is engineered to handle the full range of asset classes and complex legal entity structures. It optimally supports all internal and external roles involved in asset management to deliver precise results in a challenging and ever-changing environment.

The Swiss company offers portfolio and risk management, compliance, data aggregation, CRM, consolidated reporting and trading (orders only) solutions. It offers flexible interactive performance and risk analytics help you to develop important insights. VISION can be implemented onsite or in the Cloud and automate systematic workflows.

India’s Valuefy offers a digital platform that features accounting, consolidated reporting, CRM, compliance, portfolio and risk management, trading (execution on the platform) and data aggregation solutions.

It’s secure and robust full suite enables families to execute performance analytics, create and benchmark complex model portfolios, compare advisors, and manage rule-based investment mandates and restrictions. Secure communication with other users and advisors and design and manage flexible account structures with the flexibility to slice and dice family investments are also possible.

WIZE by TeamWork is one of the fastest-growing FinTech companies in Switzerland dedicated to External Asset Managers, Family Offices, Banks, Securities Traders, Fund & Asset Management firms.

This Swiss all-in-one Wealth & Asset Management solution offers an integrated data aggregation, CRM, accounting, compliance, governance, risk and portfolio management system, including 100+ custodian automatic feeds for multi-asset, consolidated reporting. It also facilitates orders-only trading. It is a 100% web-integrated platform with 250+ functionalities and is trusted by over 70 clients (representing 3000+ users in 14 different countries). TeamWork focuses on providing an intuitive user experience, rich and performing functionalities, and an easy and transparent pricing model.

Trading Software (with execution on platform)

With headquarters in Cyprus and offices in the UAE, 8 topuz is a trading software solution that employs artificial intelligence and machine learning to offer automated and audited investment solutions that have consistently delivered a 3% ROI average per month since December 2016.

Governance & Operations Software

Belgium’s Trusted Family platform serves global family businesses with a single, secure and centralized governance platform. This enables directors, shareholders, family members and their close advisors to easily connect, communicate and collaborate from anywhere, at any time, on any device.

Founded by two next-generation entrepreneurs from European business families, the company leverages a decade of industry expertise to help multi-generational family businesses thrive and achieve sustainable, long-term success.

Developed in Switzerland, Orca offers a modern governance software that provides a secure, intuitive way to store and share sensitive financial information and reporting that facilitates productive discussions on wealth structuring, tax, compliance, succession planning, family reporting and more.

Operating out of the USA, Way2b1’s mission is to enable high net worth individuals (HNW) and families to better manage their complex lives by providing a secure, private, and efficient operating environment that connects them with their ecosystem service providers and each other.

Their systems help facilitate seamless decision-making, create institutional memory, and ensure information continuity across real-world domains. Dedicated resources are allocated to onboarding, and insights into building alignment among the family, the family office and the professionals involved in daily operations are shared throughout this process.